#99 - Ramblings Oct2023

Last updated: Aug 5, 2024

Buffett, the GOAT

Potentially my favorite clip of all time: audio, video.

A Gaming Investor

Interesting profile: link.

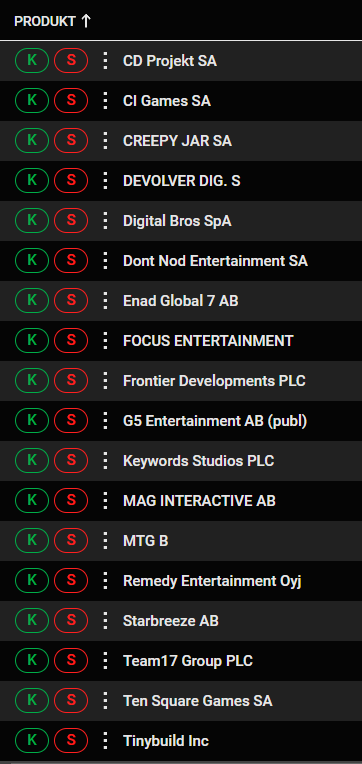

Here’s his portfolio:

Ugly Politics

I browsed the twitter accounts of some Canadian liberals, one of which left an answer to a comment I made on liberals.

I went from her profile to a few others in her sphere.

What I found made me feel…bad. I did not realize that there could so many people with values so at such odds with mine.

It’s as if I had discovered a world full of crazy evil people.

But they must think the same of me.

The reality is, the initial commenter doesn’t strike me as someone I wouldn’t want to have a conversation with in real life. Yet my initial comment made it so that it would be hard for us to have a respectful conversation online.

I shall steer away from holding and posting extreme and naive political views in the future.

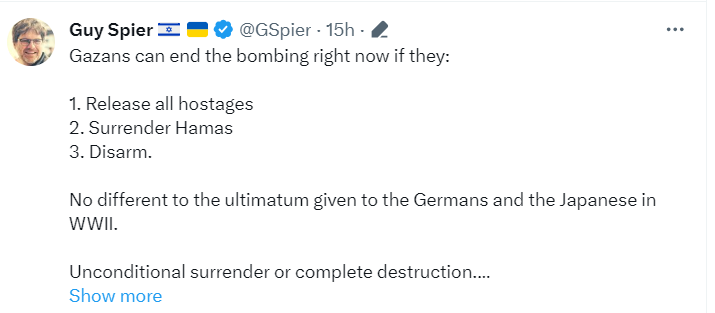

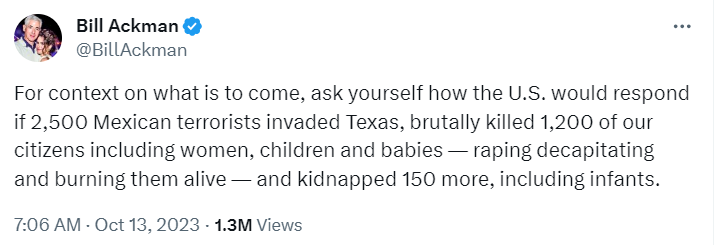

Today, everyone on X has been posting on Israel and Palestine, following the horrific attacks by Hamas. This has only confirmed my distate for political posts, no matter how just or obvious they seem.

It’s all useless.

I will focus on myself, my health, my wealth, my family, and my work.

You started it, they started it.

My safety matters, yours doesn’t.

My children matter, yours don’t.

I’m righteous, you’re not.

I’m defending, you’re attacking.

I’ll kill you, I’ll kill all of you.

I’m vengeful, I’m righteous.

I believe it was the President of Israel that recently said the following:

I will tell you, about the civilians, no more civilians […] I don’t care about [them] anymore. Before, I cared about children and women from the other side; no more! (link).

(link)

It turns out the whole George Floyd story was a lie.

By Tucker Carlson. Worth a watch: here.

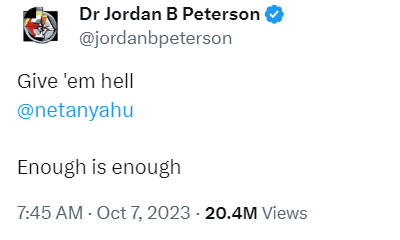

Give’em hell

I know Dr Peterson has gone through a lot of hardships in his life, but this is not the way. It makes me sad.

I’m going back to Nietzsche.

Barry Sternlicht on interest rates

Worth a listen: tweet (archive).

Turning stocks

$CARD.L

A cheap stock (double digit FCF yield). Not sure about the margin prospects.

Thesis found on Iggy’s Substack.

$PLCE

Another Youtube pitch (David Bastian):

The thesis is as simple as: a business that has done $100M of FCF consistenly, currently trading at $300M market cap. $200M of debt that will be brought down to 1x EBITDA. Consistently buying back shares since 2009.

$LDB.MI

Interview of the CEO on The Mikro Kap substack, archived here.

$B3.ST

Another thesis on the company from Black Wolf Capital. Nothing new here for me, but might be worth browsing his other writeups.

A very thorough note on $B3.ST, archived here.

Despite the short-term headwinds, the lower bound of the fair estimate range remainds around SEK$130. We are WAY below that now at SEK$81.50.

That being said, it can always get worse than the forecast.

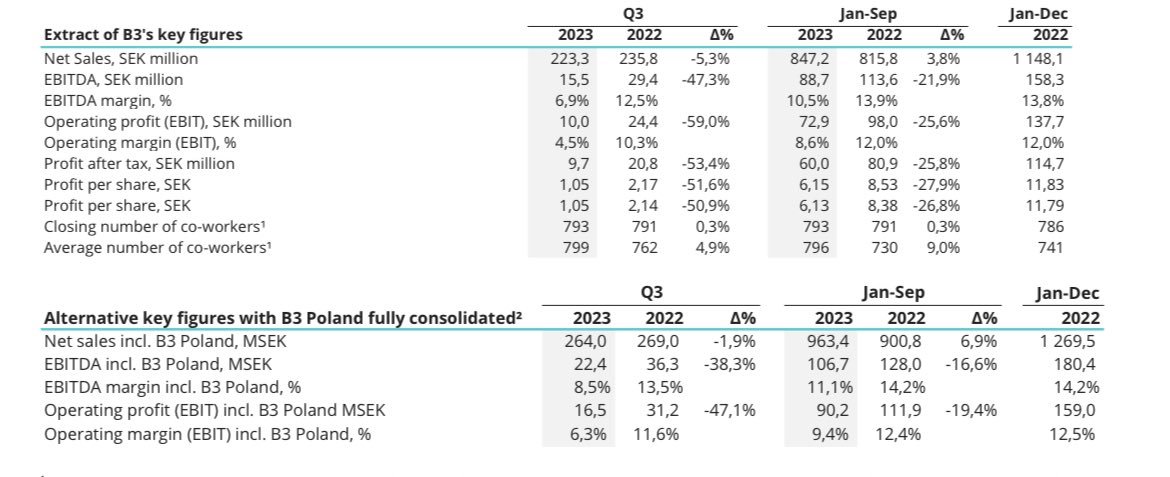

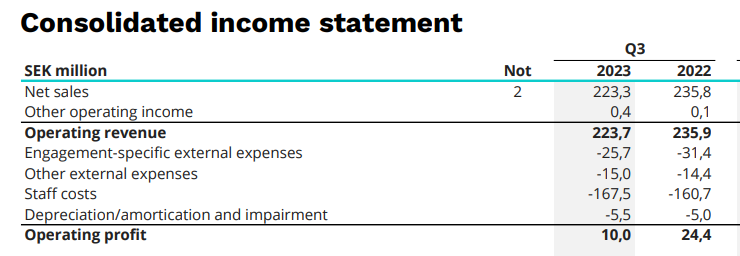

Q3'23 results are out. Pretty ugly:

Surprising decline in profit margin. I did not expect this much of a drop, to say the least.

The joys of negative operating leverage:

Updated long-term financial targets: SEK 1.5b and 10% EBIT margin (2023 Jan-Sep: SEK 847m and 8.6%).

The stock opened around SEK 76.0, or ~16x Q3-annualized EBIT.

$OGUN-B.ST

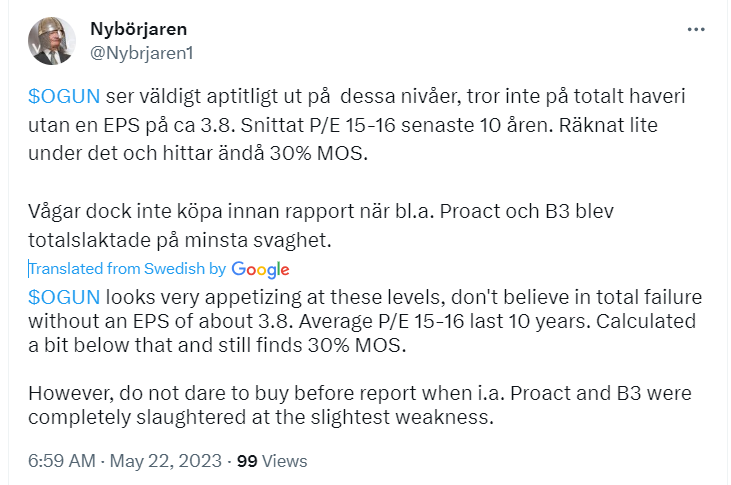

Also in Sweden, here’s another seemingly cheap company: Ogunsen.

Ogunsen is a staffing and recruitment company focused on providing mainly specialists and managers to companies in Finance, IT, HR and Supply Chain. In general, Ogunsen has a larger share of recruitment than traditional staffing companies. It was founded by Per Ogunro in 1993 with the aim of finding employment for bankers in the Swedish bank crisis. Many of Ogunsen’s recruiters and sales personnel have experience in their respective focus areas.

This guy seems to think their revenues are sticky:

Their investor relations page is here.

A longer form writeup can be found in this substack, archived here.

$0833.HK

Found through a screener.

Seems ridiculously cheap!

EV/GP ~ 0.5x EV/EBITDA ~ 0.7x EV/EBIT ~ 0.8x FCF/EV yield ~ 195% !! FCF/MC yield ~ 117% !! Div yield ~ 7% P/TBD ~ 0.4x

Low but relatively stable gross profit margin. Negative net debt.

Couldn’t find anything about them on Twitter. Their IR page is here.

Found a few weird flags in their financial statements.

$DRR-UN.TO

Watching Capital Mindset pitch Kilroy Realty here.

Someone mentioned $HOM-UN.TO in the comments. Seeking Alpha thesis here.

On Twitter, @NestBetter mentioned that he prefers $DRR-UN.TO, which is…Dream Residential.

$MNTR

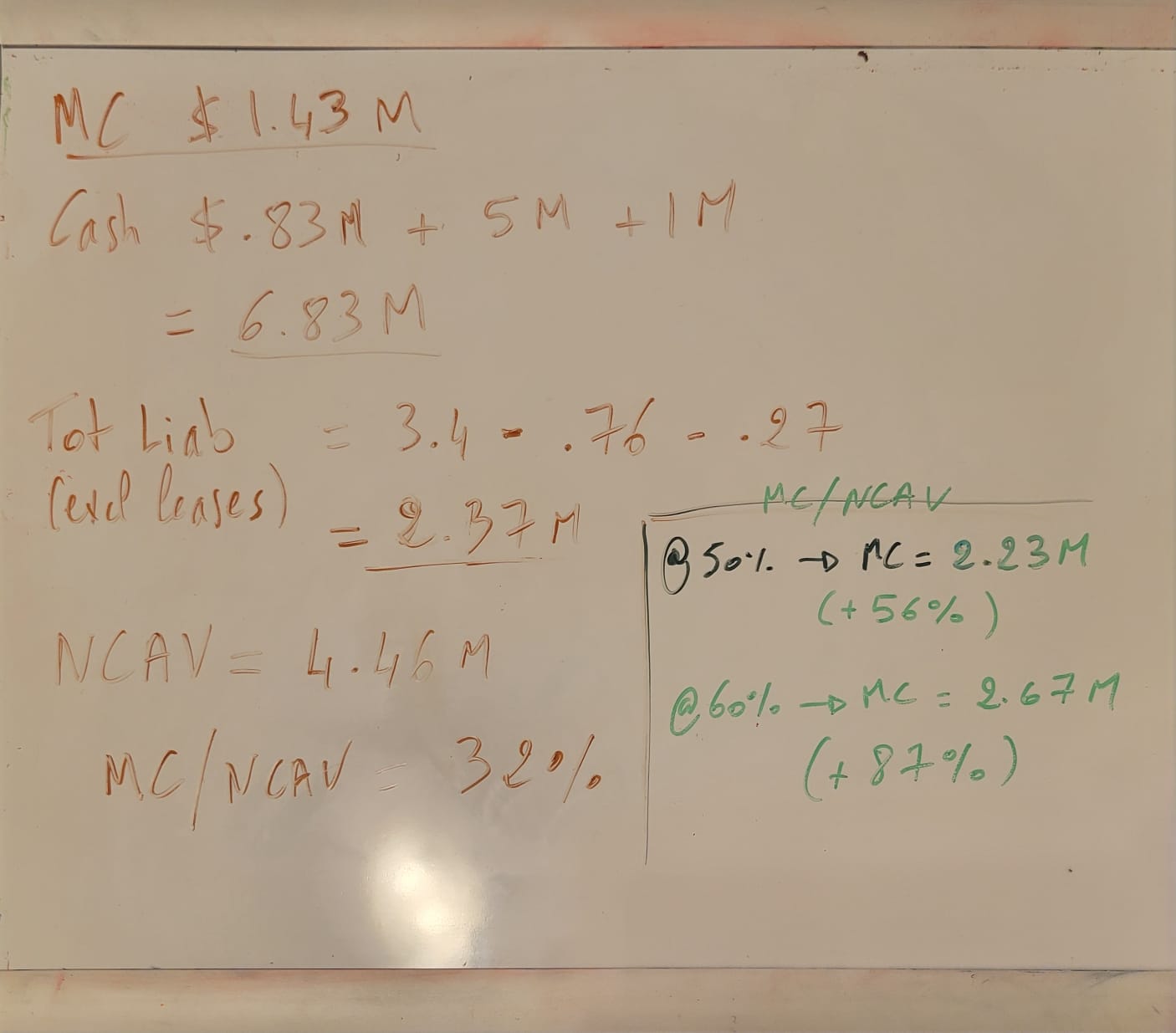

I bought a small stake in this one.

Here’s the napkin math:

Here’s another net-net that I own:

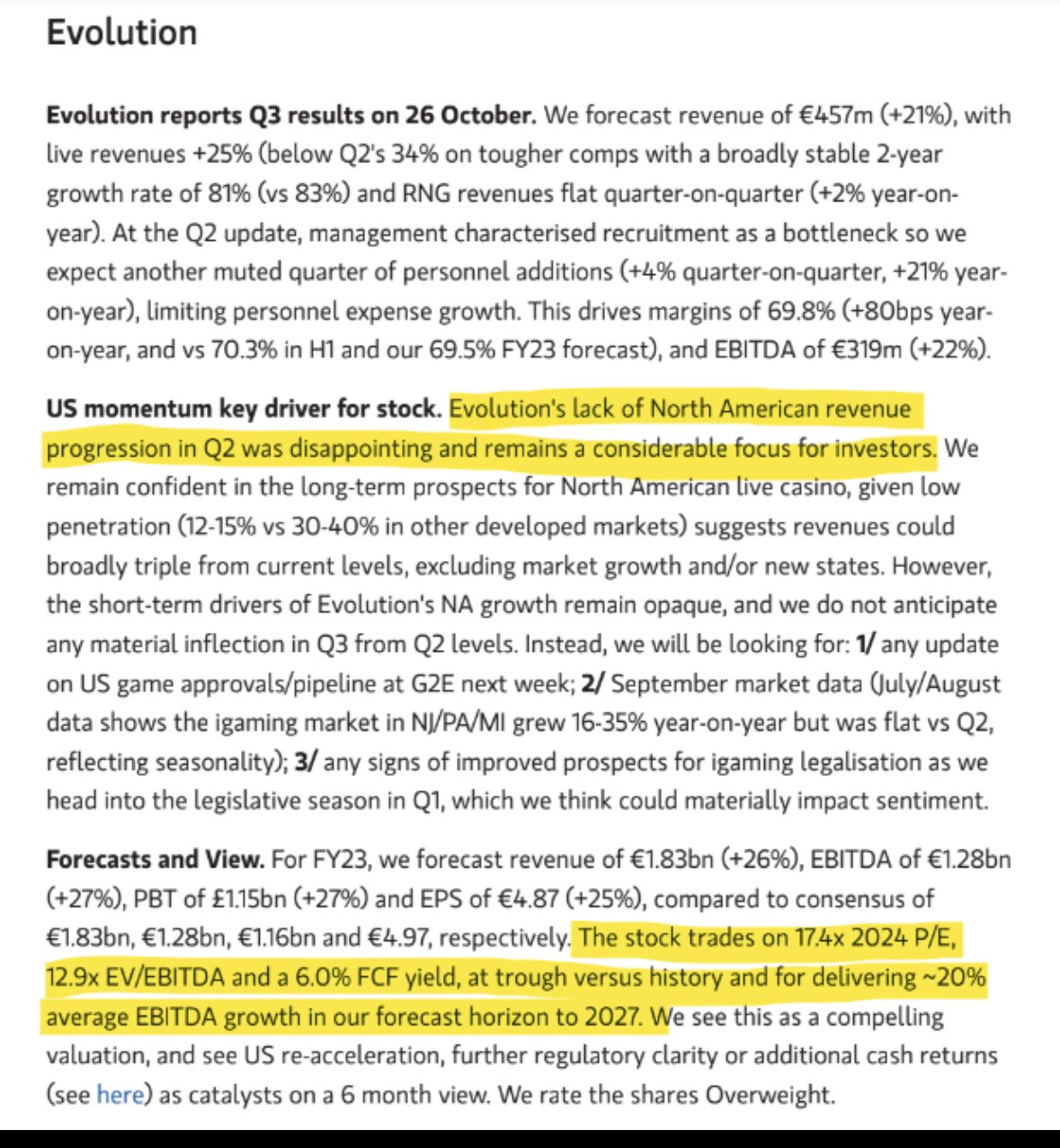

$EVO

(link)

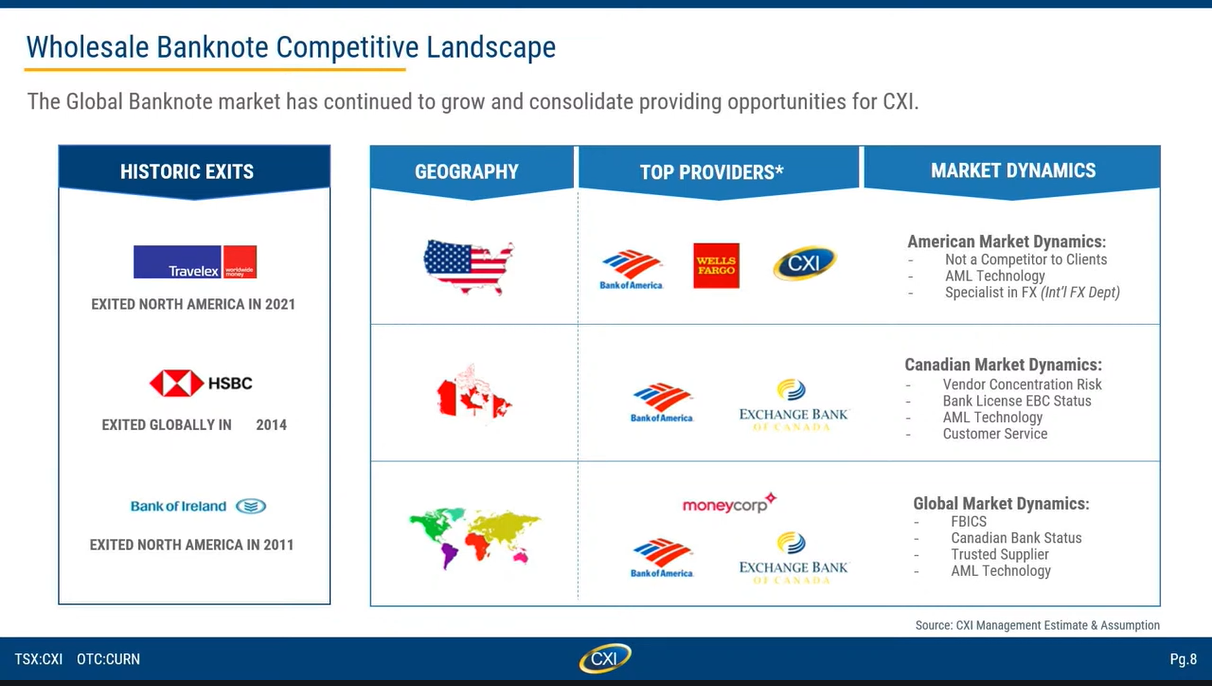

$CXI.TO

I’ve listened again to the last earnings call, and my impression is that the business is doing well.

The stock itself is trading cheaply, as far as I can tell:

Management pointed to a stabilization in costs and a few growth levers (e.g. international payments).

Here’s the audio from the recent LDMicro presentation: link.

A description of some parts of the business of CXI (around 6min mark):

Physical cash for digital dollars. They need cash to distribute to their branches. They will wire us US dollars, we ship them cash, and we charge a fee.

CXIFX.com: we buy their foreign currency and give them the dollars (or vice versa), we make a spread.

I have added to my position.

$APN.WA

(link)

11-12% FCF yield, no debt. Looks cheap despite the huge recent run-up.

Interesting!

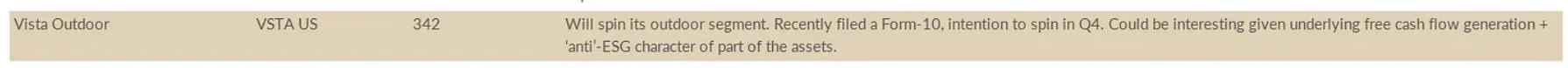

$VSTA

Still from Toff capital:

Looks cheap enough:

Need to look deeper.

$HGBL

Investor deck here, archived here.

Audio presentation from LDMicro here.

Earnings call 2023Q2 transcript here.

I bought a small position. The business currently has momentum, and it seems cheap.

EV/EBITDA(2023) ~ 7-8x

Not sure this is still an amazing opportunity as the stock has tripled since April of last year.

One of the things I really didn’t like about their business model is that they lend money to the customers who buy their portfolios of nonperforming loans, in exchange for interest payments and maybe a piece of the profits. Something about that doesn’t feel right to me.

In the short-term however, the business should do well.

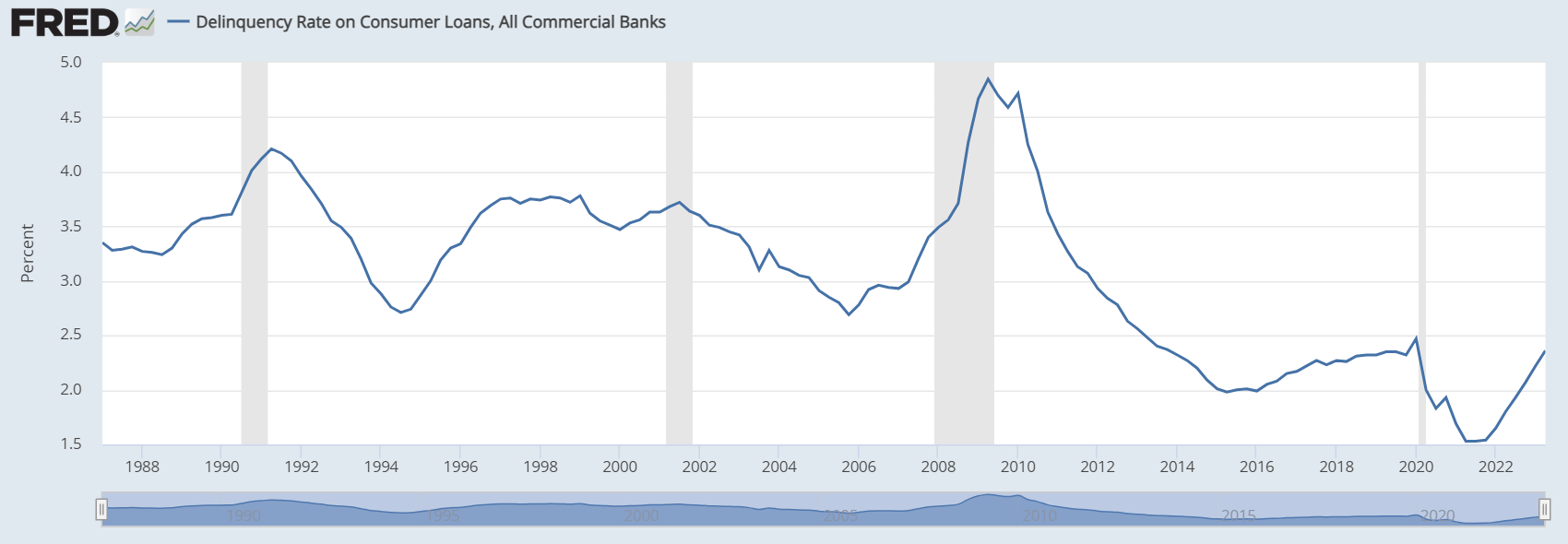

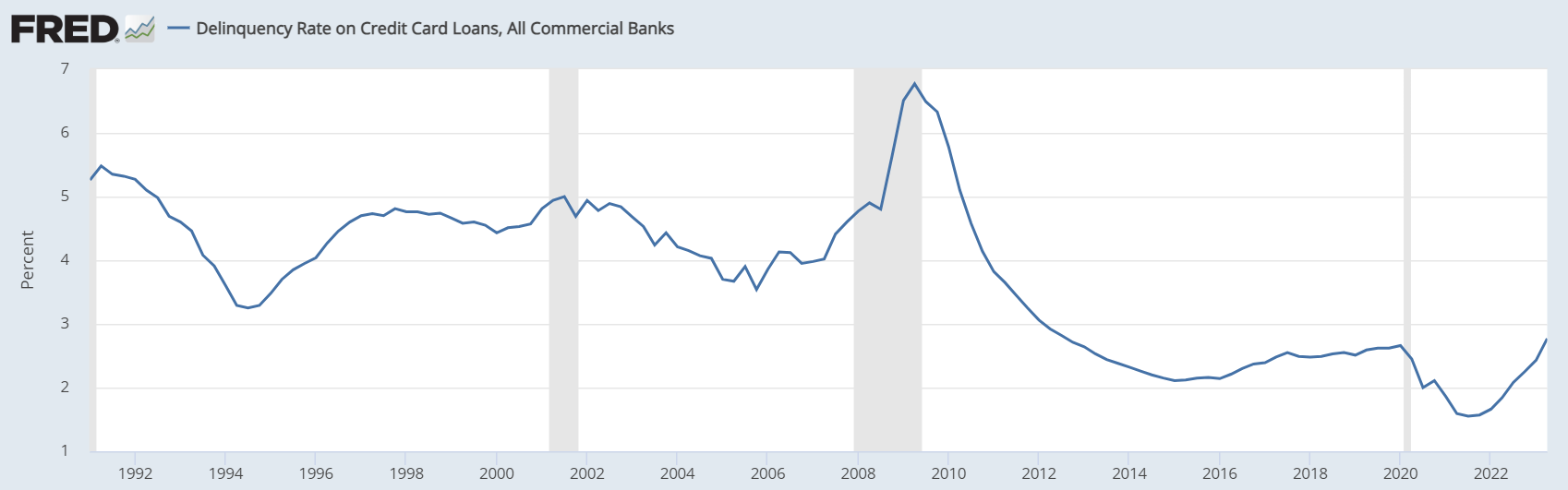

source: link.

I might not stick around very long.

$KSPI $CGEO.L

A valuation note from Prudent Shrimp on $KSPI can be found here (archived), following a description of the business (archived).

They just released their 2023Q3 earnings: link, taken from VOX Markets. Another blowout quarter.

The other holdings of the author are TBC Bank Group plc ($TBCG.L) - write-up archived here, and Flow Trader archived here.

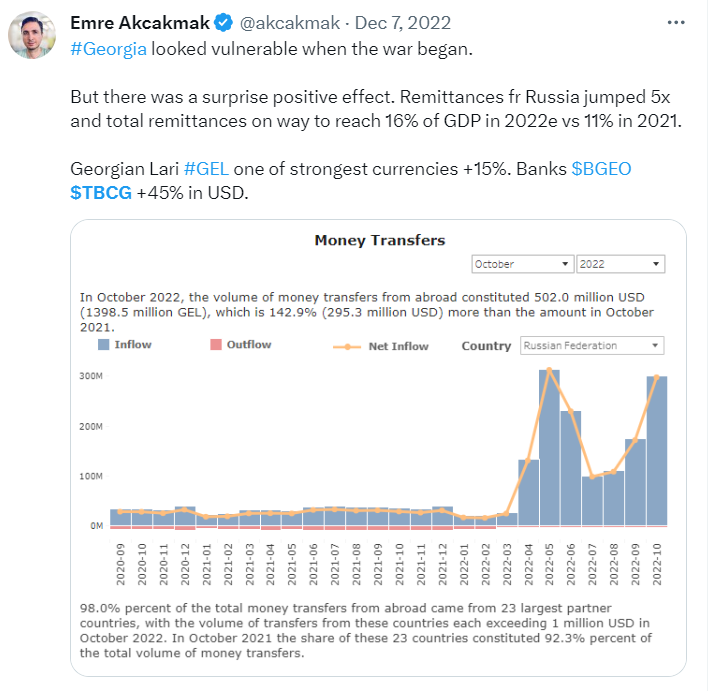

Still in Georgia, there’s $CGEO.L which was highlighed in this thread.

I see a P/E of 1.7 and P/B of 0.4!

Their IR is on twitter.

The 1H23 results can be found here, with details here.

Another description of the business can be found here.

A very thorough writeup from kairoscap, archived here.

Here’s what happened in Georgia:

Found another writeup from Breeley Capital, archived here.

$NCI.V

This tweet prompted me to run a screen of my own:

I used P/E < 5, P/s < 0.5, Revenue CAGR > 25%, EV/EBIT < 25.

NTG Clarity Networks Inc $NCI.V was one of the results.

Revenue growth has been spectacular lately:

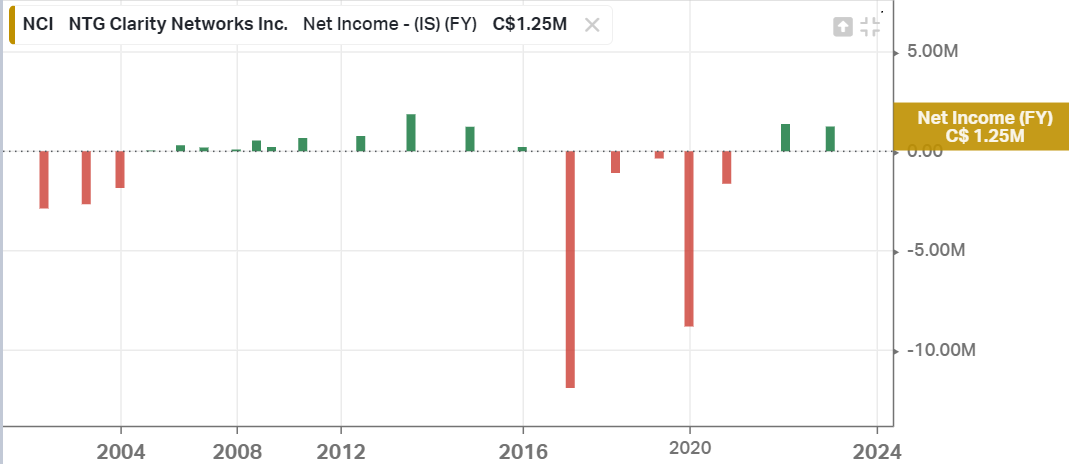

They had some unprofitable years:

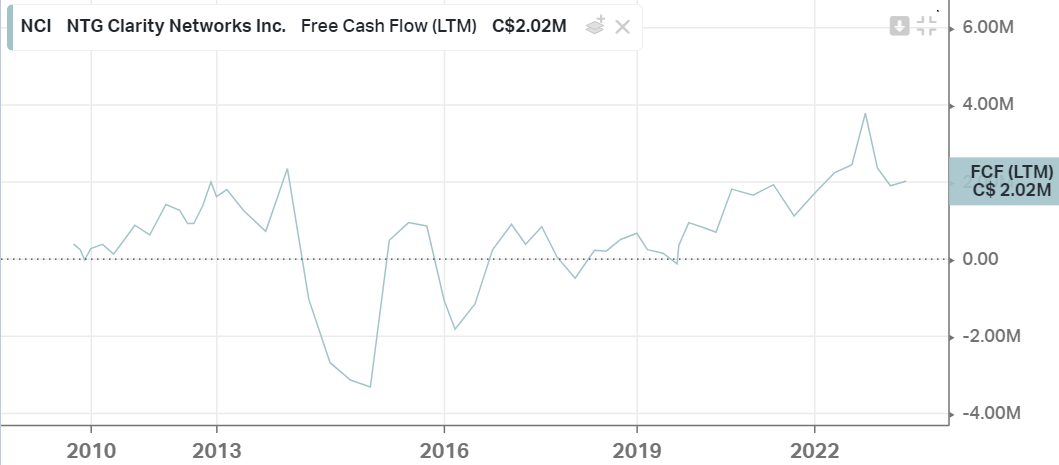

But CFO has been growing steadily:

Here’s the FCF:

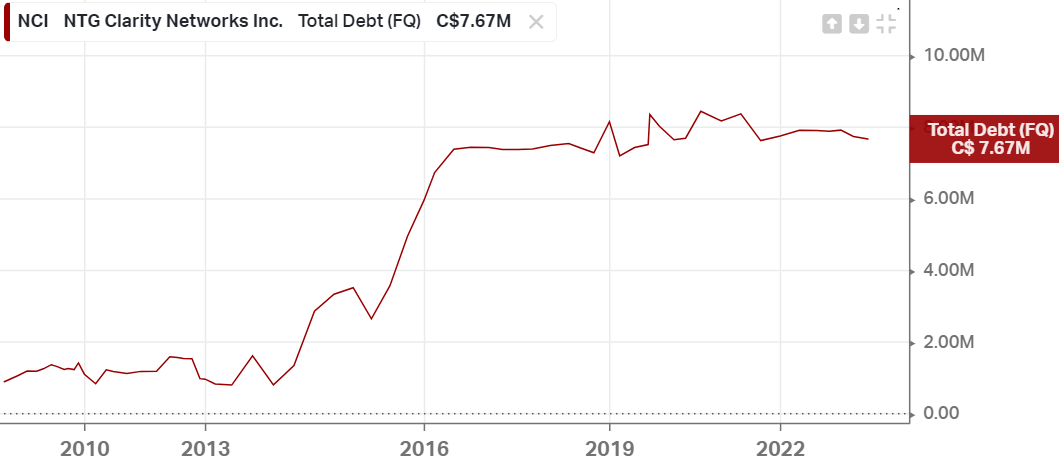

They have a bit of debt:

Their business is not clear to me:

NTG Clarity Networks has an over 20 year history in the delivery of network, telecom, IT and infrastructure solutions to network service providers and enterprises of all sizes. The company maintains a presence in Toronto, Egypt, Saudi Arabia, Qatar and Oman with a staff of over 400 people among the top ranks in the telecom industry.NTG’s suite of solutions spans custom digital app templates, ecommerce, WiFi, Internet of Things, last-mile delivery, and the management of project portfolios, workflows, inventory, assets, and customer and partner relationships.

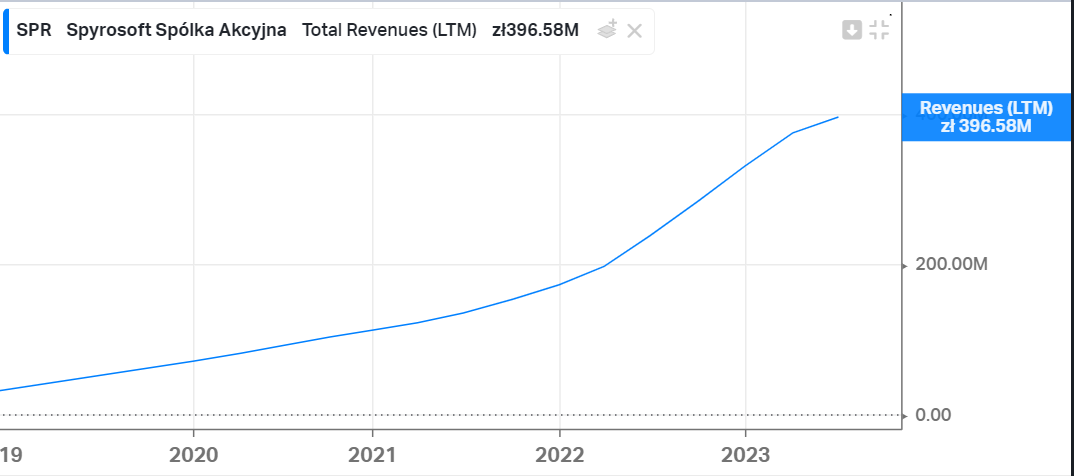

$SPR.WA

Full thesis from Gekko Capital archived here.

A bit of a slowdown in revenue recently:

Relatively cheap at the moment:

Around 5% FCF yield at the moment.

Strong return on capital, but decreasing.

Here’s a recent pitch from the CEO:

Q1FY23 here: link.

Another writeup: link, archived here.

Their earnings reports can be found here.

$SODI

A long-form video from Trey Henninger on X.com: here.

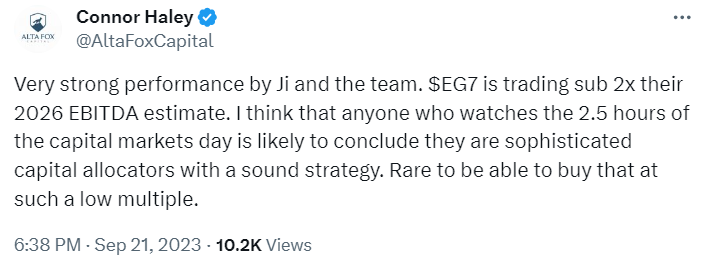

$EG7.ST

A very thorough (60+ pages) write-up from Atai Capital, archived here.

I bought a small position. Management seems very methodic and business-minded.

AltaFox also has a position (archive).

Management guided to a down year in 2024 (vs 2023) so there might be opportunities to buy even cheaper. It’s very cheap already.

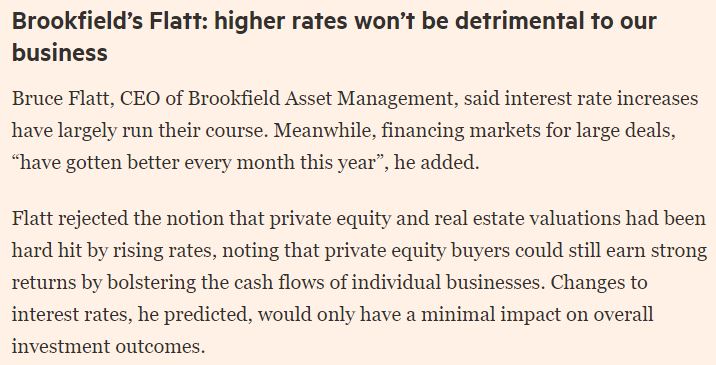

$BN

This tweet reminded me why I sold out of $BN.

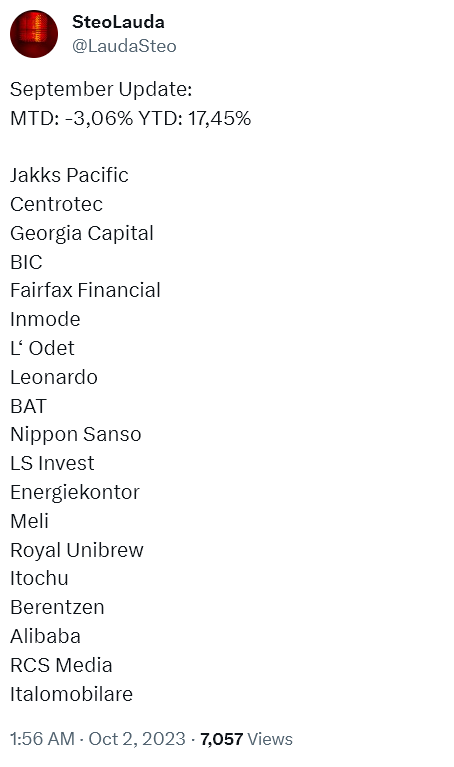

Random names

A few random names from a portfolio that also contains $CGEO.L:

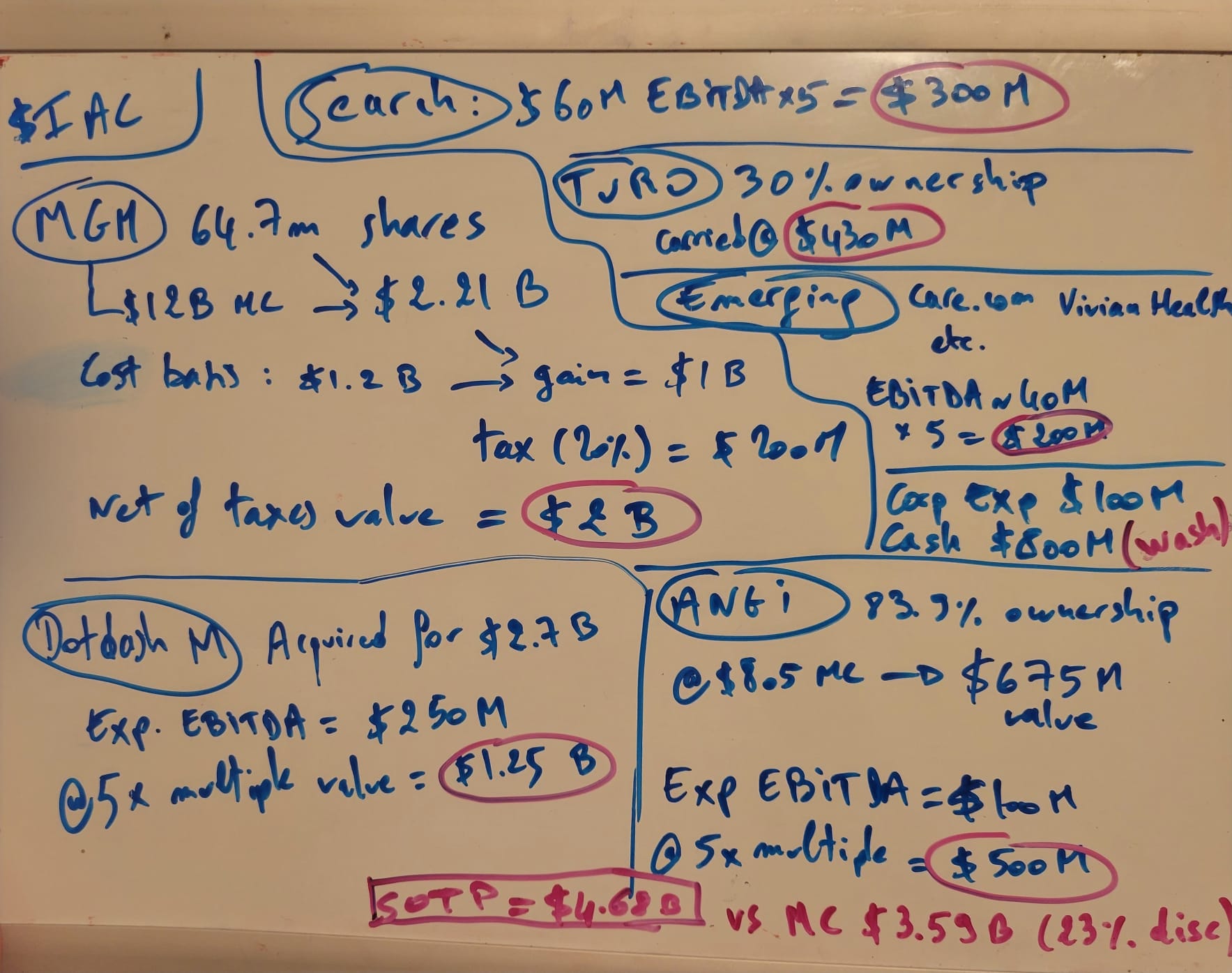

$IAC

Sum of the parts:

I get a 23% discount to the conservative sum of the parts; keeping in mind: these are moving parts.

Here’s MGM’s income statement for 2023Q2:

Assuming Koyfin’s EV of $40B is correct, I see this trading at 11x EV/EBIT (deducing rent in the EBIT calculation and keep the lease liability in the EV calculation).

Koyfin’s FCF (as OCF minus CapEx) of $1.2B seems correct, yielding MC/FCF ~ 10x (12 / 1.2).

I see net debt of:

- -$3.8B cash

- +$3B deferred taxes

- +$2.3B other liabilities

- +$6.7B LT debt

- +$0.5B other LT obligations

= $8.7b

so EV ~ $20.7B (vs $40.6B on Koyfin)

and FCF/EV yield ~ 40.6 / 20.7 * 2.91% (from Koyfin) = 5.7%.

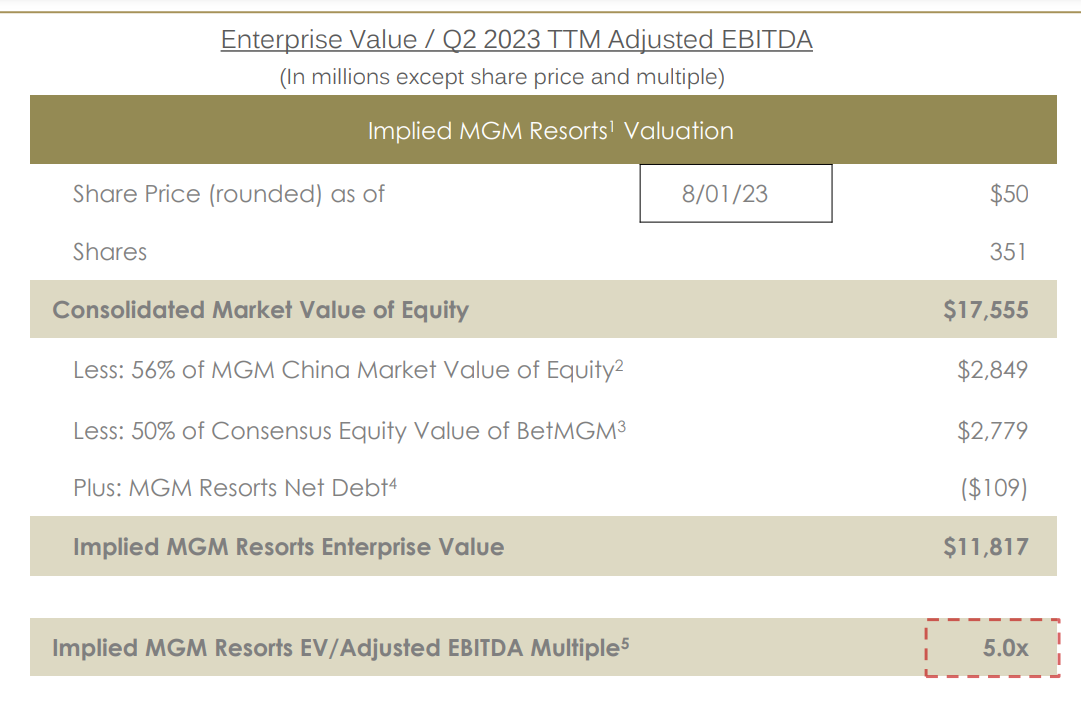

The following slide from their 2023Q2 presentation shows a different approach to come up with the implicit valuation of MGM Resorts:

It shows that MGM owns 56% of MGM China ($2282.HK) which currently has a market cap of US$4.77B, so the 56% stake is worth $2.67B.

MGM also owns 50% of BetMGM, the other 50% being owned by Entain plc $ENT.L. BetMGM had net revenues of ~$476M in 2023Q1 and $468M in 2023Q2 ($944M in H1'23).

The net debt shown in the slide above includes the $6.7B of debt on MGM’s balance sheet minus $3.5B related to MGM China. The cash is $3.8B minus $0.5B related to MGM china.

6.7 - 3.5 - 3.8 + 0.5 = -$0.1B

However, this calculation ignores $2.4B in other accrued liabilities and $3B in net deferred income taxes.

So my adjusted net debt value is rather $5.3B.

And the recalculated implied MGM resorts EV is:

$12B (MC of MGM) - $2.67B - $1B (~ my conservative value for 50% of BetMGM @ 1x revenue) + $5.3B

EV = $13.63B (vs $11.8B in the slide above)

The implied MGM Resorts EBITDAR in the slide is $2.36B (corresponding to Las Vegas Strip and Regional Operations adjusted Property EBITDAR for the 12 months ending June 30, 2023 adjusted to include corporate expenses and cash rent).

Because cash rent was included, it makes sense to exclude Operating lease liabilities from the EV calculation.

=> MGM Resorts EV/EBITDAR ~ 5.8x

MGM China (IR page here) had adjusted EBITDA of HK$2835M in H1'23 (adding back share-based payments and corporate expenses) or US$362M.

Cash was US$449M. Total debt is US$4.1B => net debt = US$3.65B (Koyfin shows US$2.99B).

EV = $4.77B (MC in USD) + $3.65B = $8.42B

EV / annualized adjusted EBITDA = 8420 / (2 * 362) = 11.6x

This entire exercise makes me feel that MGM is either fairly valued or somewhat overvalued with MGM China @ ~12x EBITDA, BetMGM @ 1x revenue, and MGM Resorts @ 6x EBITDA. I would feel more comfortable with MGM China @ 6x EBITDA.

In Oakmark International Small Cap Fund: Q1 2023 Commentary, they mention selling MGM China during the quarter as its share price approached their estimate of intrinsic value. Current share price is HK$9.8 vs HK$3.2 in Oct 2022 (just a year ago).

This would imply an EV of $4.3B for MGM China and MC of $694M => share of MGM = $388M.

Bottom-up recalculation of MGM EV:

$.388B (China) + $1B (BetMGM) + $11.8B (MGM Resorts)

EV = $13.2B

Fair MGM MC = $13.2B - $5.3B ~ $8B (vs $12B actual)

So the $2B attributable to $IAC turns into $1.2B removing $0.8B from the SOTP.

New SOTP = 4.68 - 0.8 = $3.9B vs MC $3.6B (8% discount).

I’d like a 25% discount, corresponding to a market cap of $2.9B or a share price of $36.25 (80m shares outstanding).

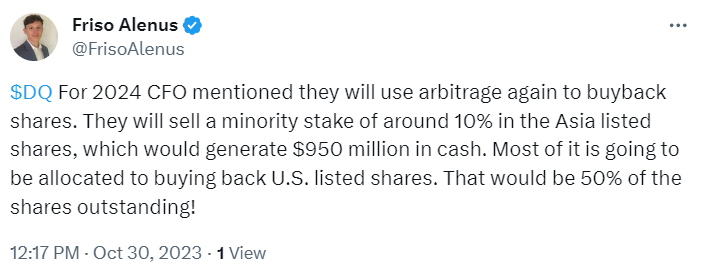

$DQ

I’ve come across this name before…somehow didn’t feel comfortable holding it. Might be worth a revisit, the stock has been pummeled.

A tweet: link.

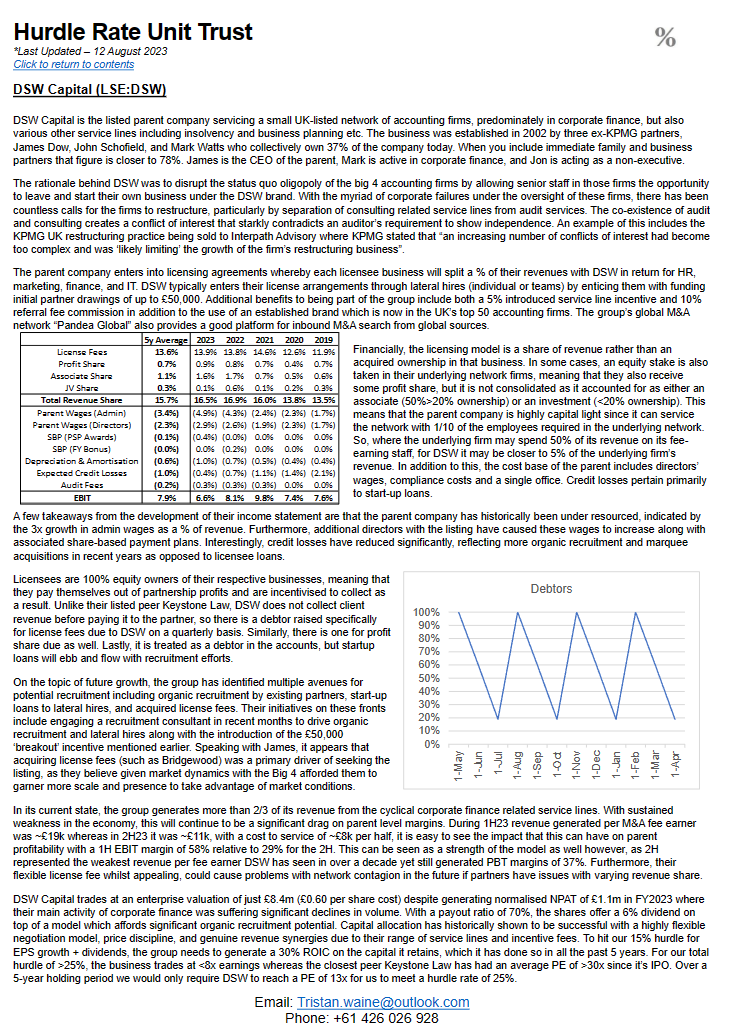

$DSW.L

A writeup from Tristan:

For reference, his Master Doc with all previous letters can be found here (archive).

Disqus comments are disabled.