#98 - Portfolio Update Sep2023

Last updated: Oct 17, 2023

TL;DR

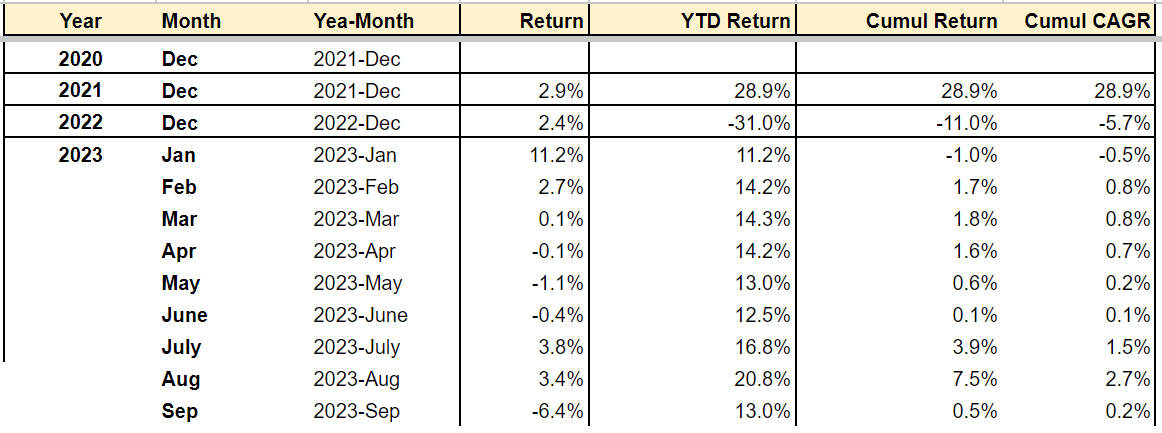

Toughest month of the year so far, down 6.4%.

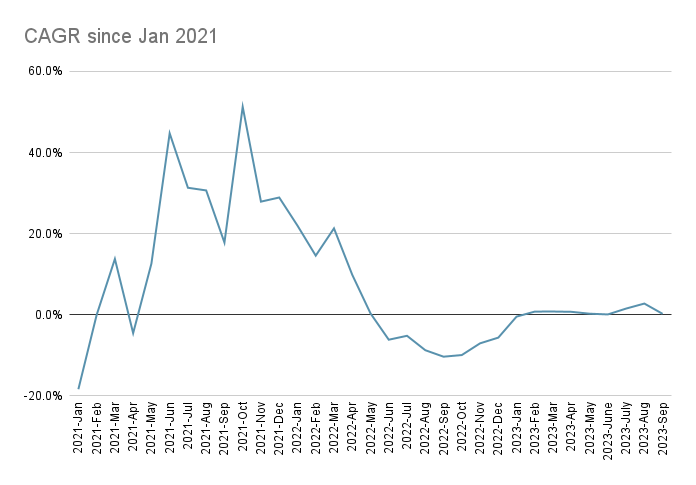

Performance update

Exchange rate contribution: -0.11%

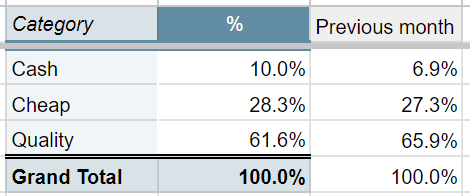

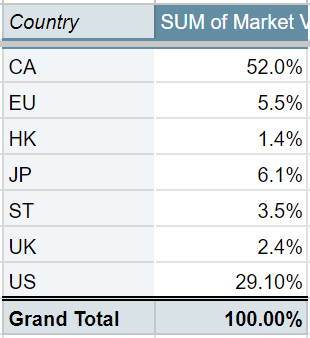

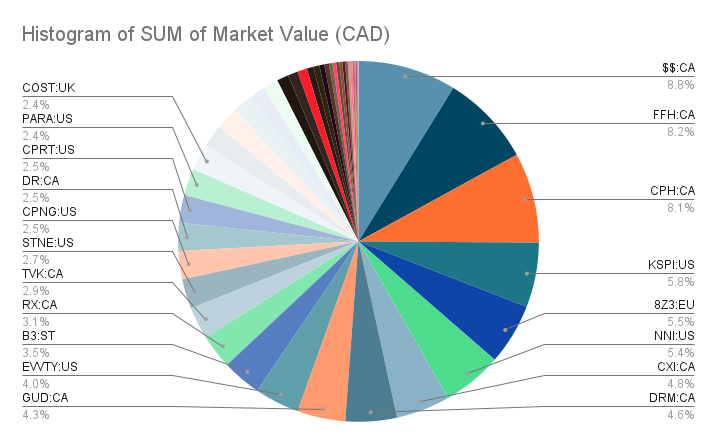

Holdings

Highlights

Top contributors:

- $CPH.TO: the Approval for MOB-015 in the European Union has finally made its way into the stock price.

- $TVK.TO

- $6038.HK

Top detractors:

- $8Z3.F: a temporary blip, hopefully.

- $CXI.TO: a big position at the outset, down significantly.

- $DRM.TO: keeps drifting down.

Changes

Lots of movement this month, a lot of small new positions.

- New:

- $DR.TO: seemed like a cheap one. I initially bought big but trimmed it afterwards. Not super exciting.

- Added:

- $8Z3.F: added big time

- $DRM.TO: added a bit

- $B3.ST: added a bit

- $STNE: sold $PAGS to add here

- Trimmed:

- $WBD: I don’t understand it well and I already own $PARA

- $PSK.TO: probably solid in the long run but won’t make me rich

- Exited:

- $PAGS: $STNE seems to be fairing better and I used the loss on $PAGS to tax harvest

- $LDB.MI: not as cheap as I thought (or as 8Z3.F)

- $FISH.V: I don’t understand what Akiba is doing

Learnings

The market has pockets of stupidity. I shouldn’t have rushed into 8Z3.F.

Outlook

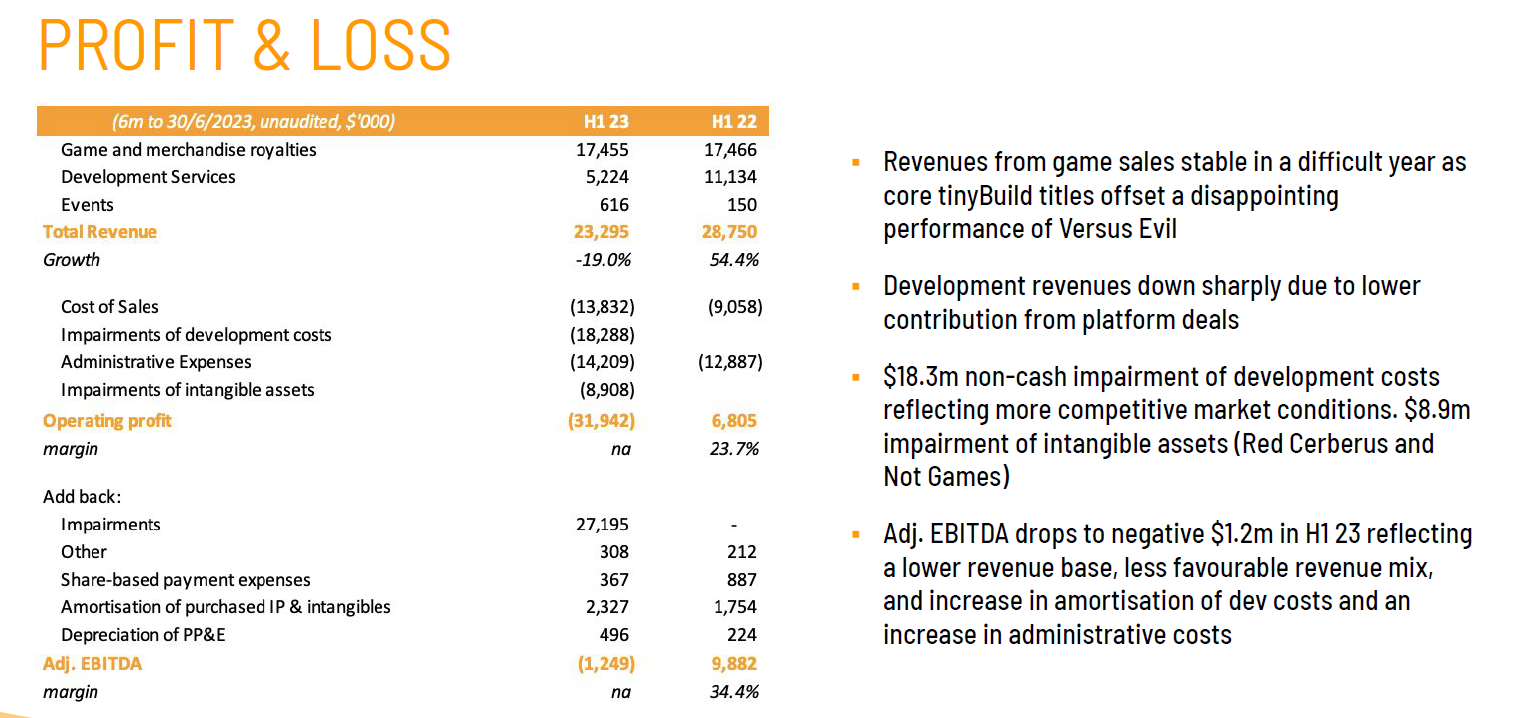

Tinybuild:

- MC: $21.5M

- Cash: $10M (they currently have $14M)

- EV: $11.5M

Assuming annual xGP of $19M, current EV/GP ~ 0.6.

Their investor presentation for 2023H1 is here.

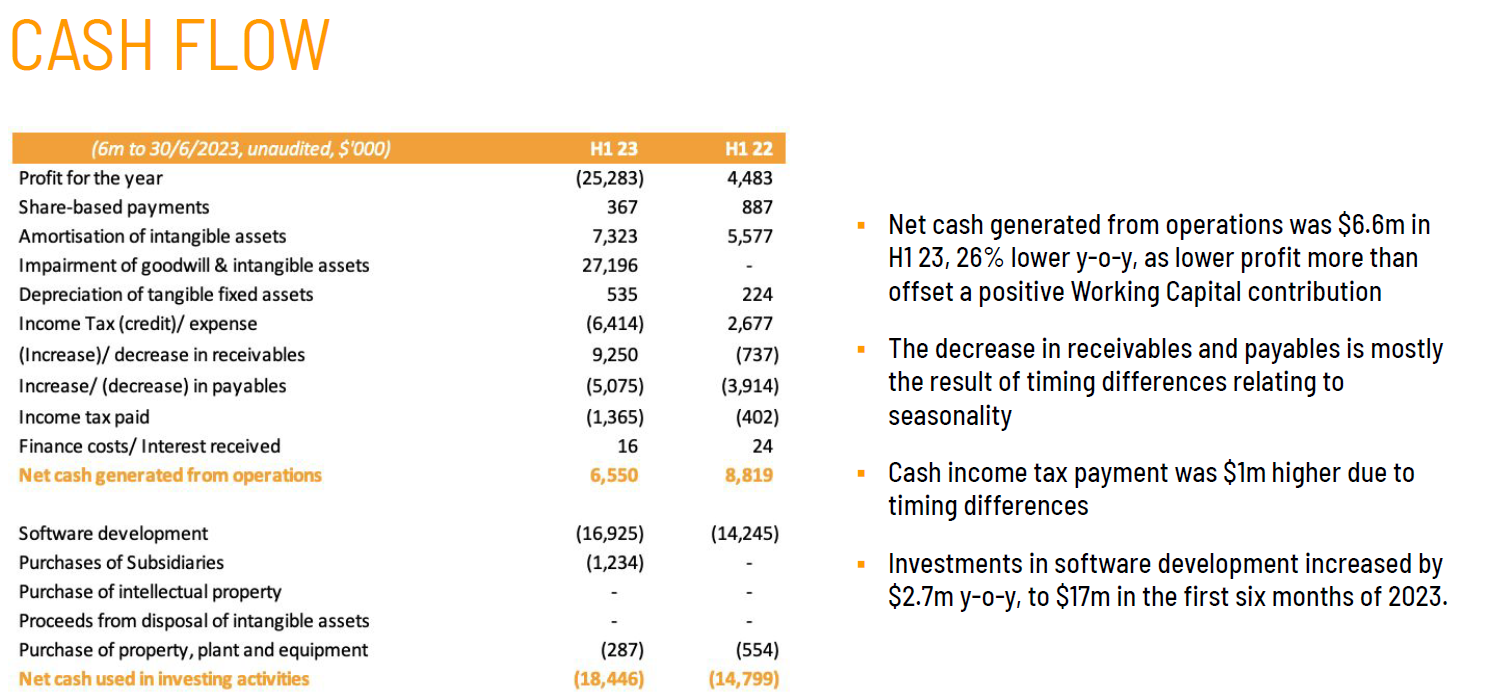

Here’s the P&L and Cash Flow statements:

Cost of sales in H1 23 was $13.8M, out of $23.3M of revenue (gross profit = $9.5M).

Note: the COGS include an amount for the amortization of software development costs of released games, and from the cashflow statement, I think that amount is $7.3M.

For more details, the 2022 financials can be found here.

Exited $RX.V. I don’t know how they will grow in the future.

Disqus comments are disabled.