#97 - Ramblings Sep2023

Last updated: Apr 30, 2024

Instead of trying to guess whether a stock price will go up or down, figure out the intrinsic value of a business, and only buy the stock when the price is significantly below that.

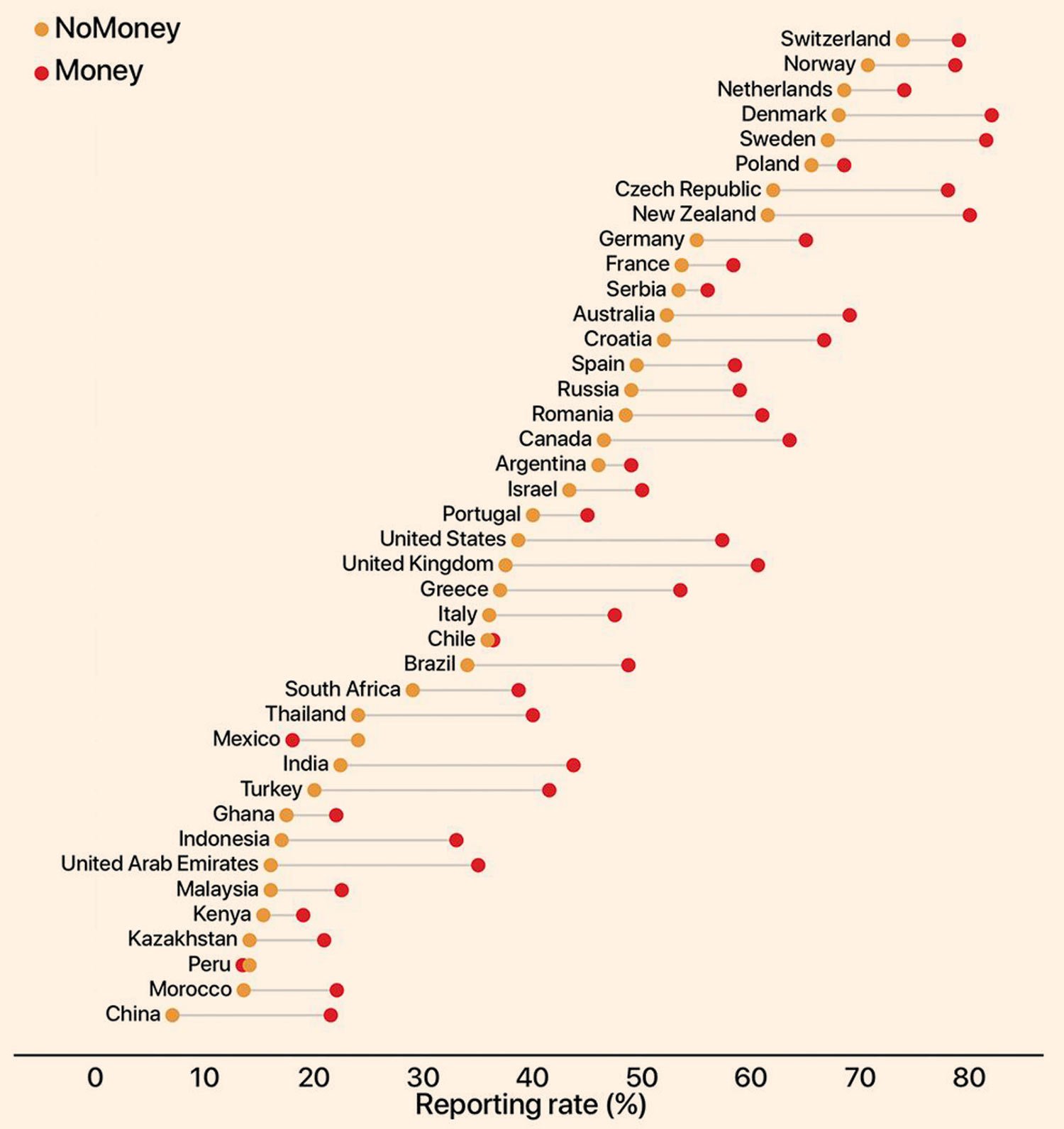

There was a superb study of honesty around the world in 2019.Leave 17,000 wallets (with contact email) containing various sums of money in 355 cities across 40 countries. Would finders email the owner?

Link: thread

An article shared by Firm Returns in the his weekly update.

Takeaways from the article:

- whishlists/follower ratio for unreleased games: 5x to 14x (median 9.6x)

- 1st week sales/whishlists ratio: median 0.2, average 0.36, but with a VERY wide range (research article)

- For Steam games launched into Early access, the sales/whishlist ratios are: median 0.16, average 0.29

- 1st year to 1st week of sales on Steam: 2x to 5x

For a good background on what wishlists are and why they’re important, see this article.

Turning our attention to Punch Club 2 in particular, here’s an article from Alex Nichiprochki. The game was developped by Lazy Bear Games.

I think this article shows the scrappiness of this team. The game was not getting any traction, until they introduced “Twitch Plays Punch Club”, where twich users were playing the game through chat commands, and the company vowed to only release the game once twitch users beat it.

As per the article:

Everyone started talking about it. The hype was real and all over, and we generated over $1m in sales in the first couple of weeks.

On July 20 2023 the company launched Punch Club 2: Fast Forward on PC, Xbox, PlayStation, and Switch.

The game was launched with 100k fresh (i.e. recent) whishlists and seems to have converted well, 35% ahead of of the original. Some interesting stats:

- $1.4m gross in 18 days

- peaked at 5.5k concurrent players 2 days after launch

- User rating: 80% (1,200 user reviews)

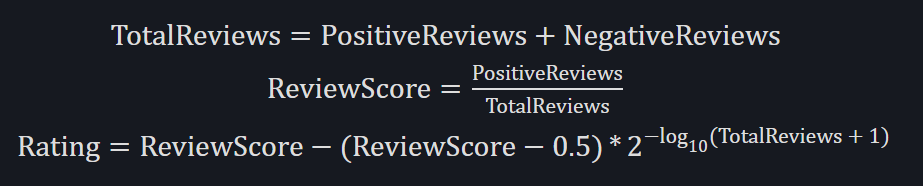

Side note: I found this description of the Steamdb rating formula quite fascinating. Here’s the formula:

Basically, we take the raw score and nudge it back towards the average (0.5) by a quantity that depends on the number of total reviews (divides by two when then number of total reviews 10x).

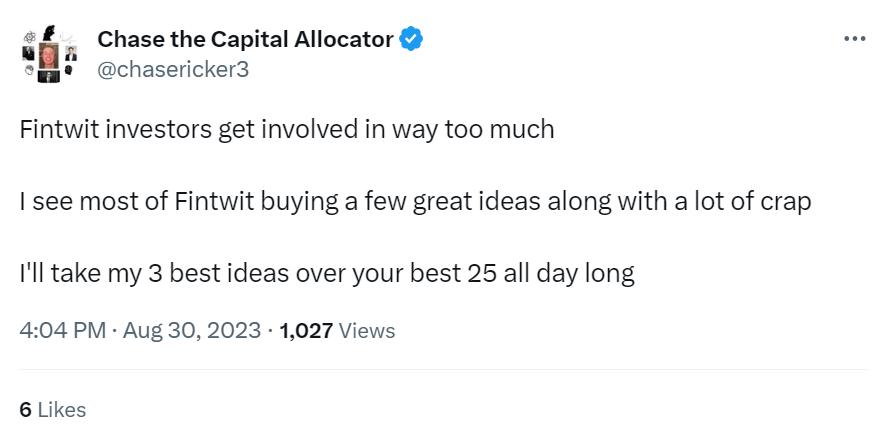

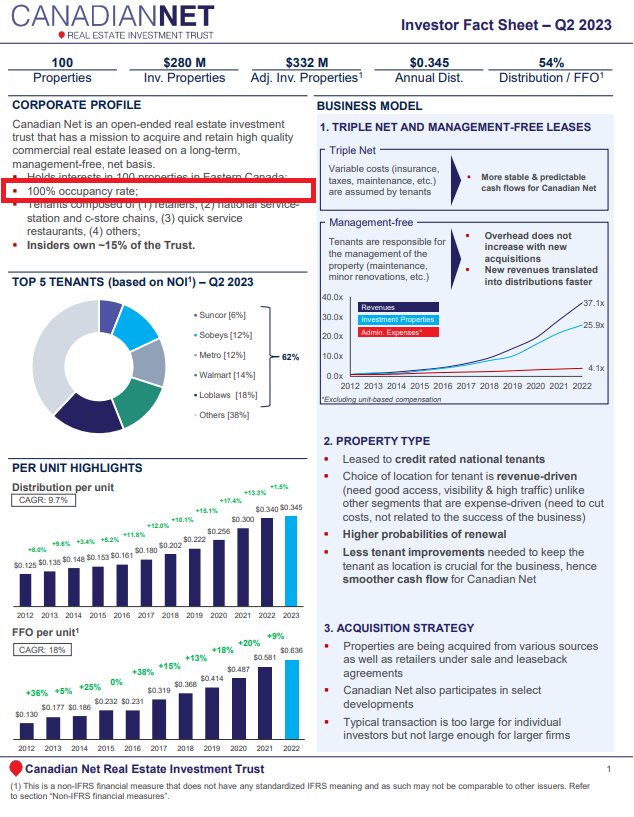

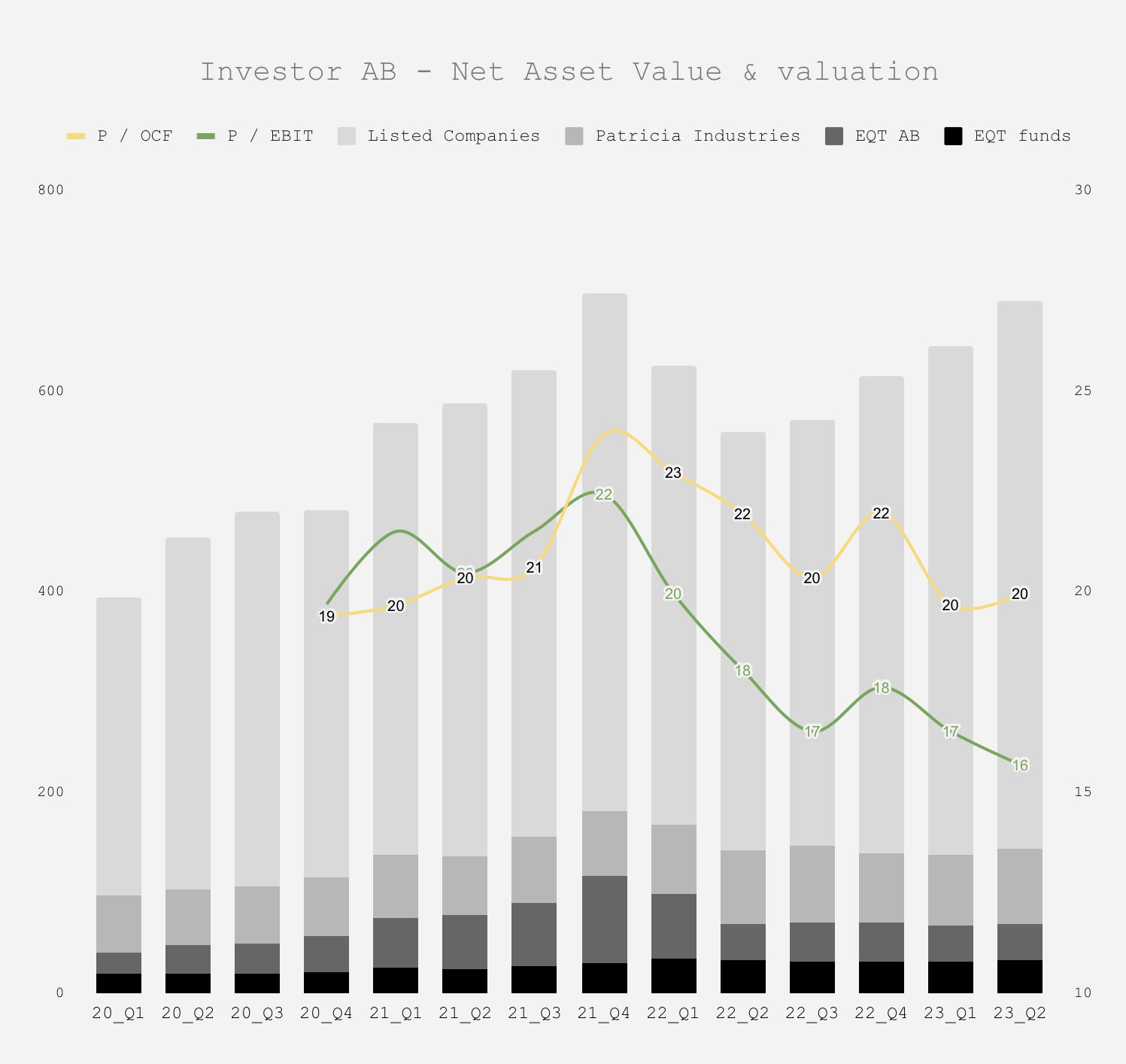

I was intrigued by this post:

He owns $JRSH $NAII and $JCTCF: see the theses in this video.

I will be curious to compare our future performances.

On 2nd thought, I’m actually curious about these holdings.

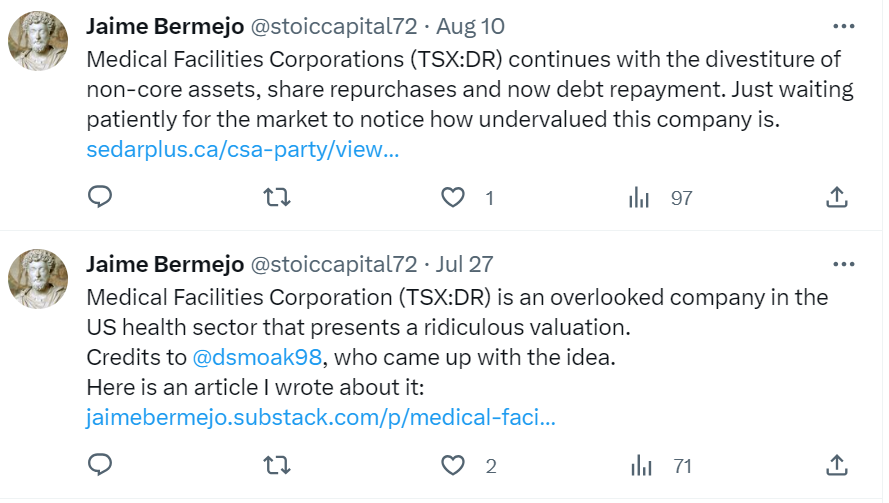

Two tweets from @stoiccapital72 caught my attention:

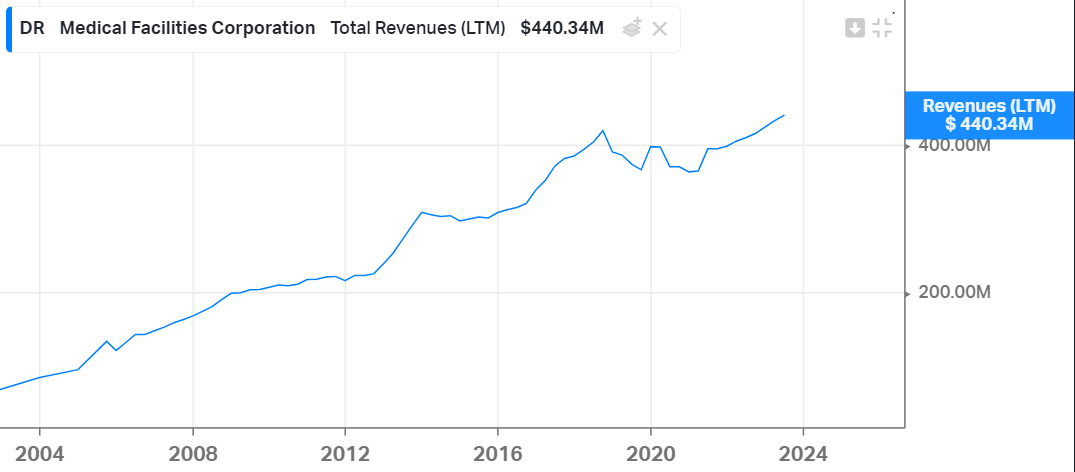

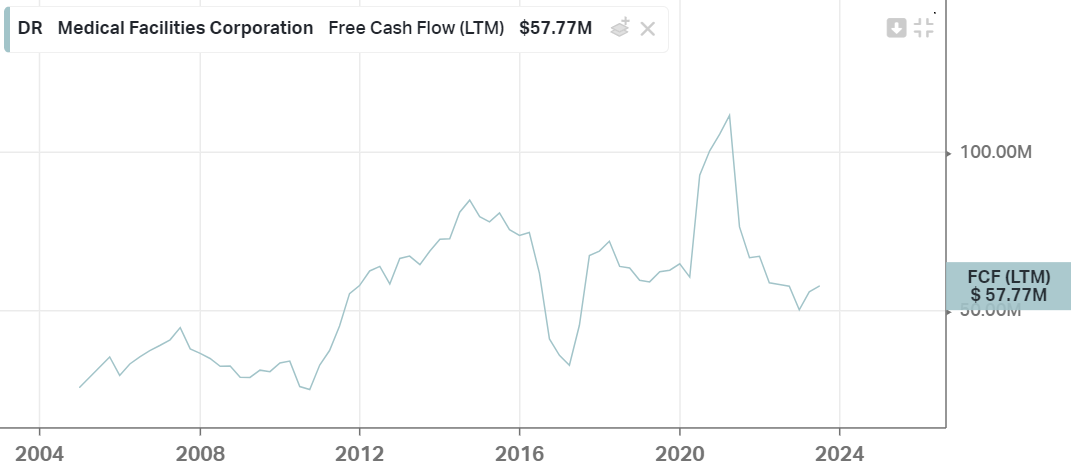

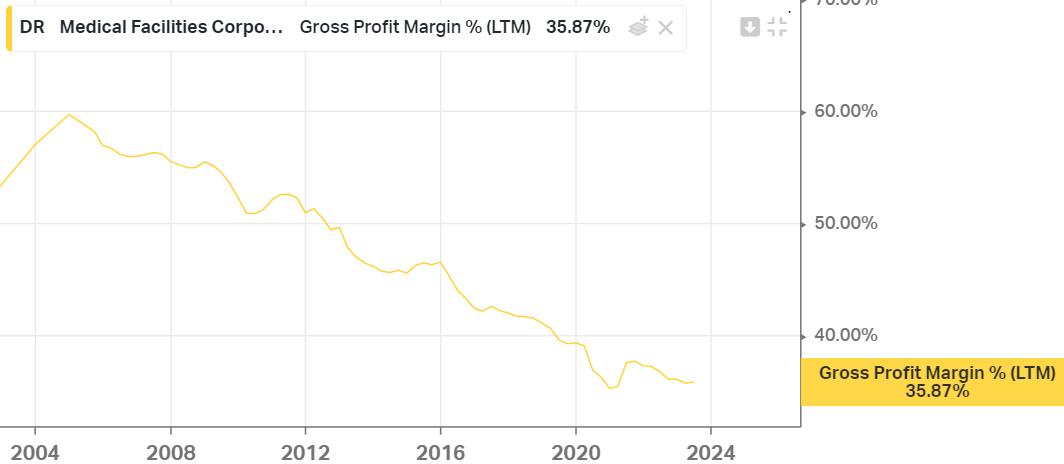

Over on Koyfin, I see this:

Wtf is going on here?!

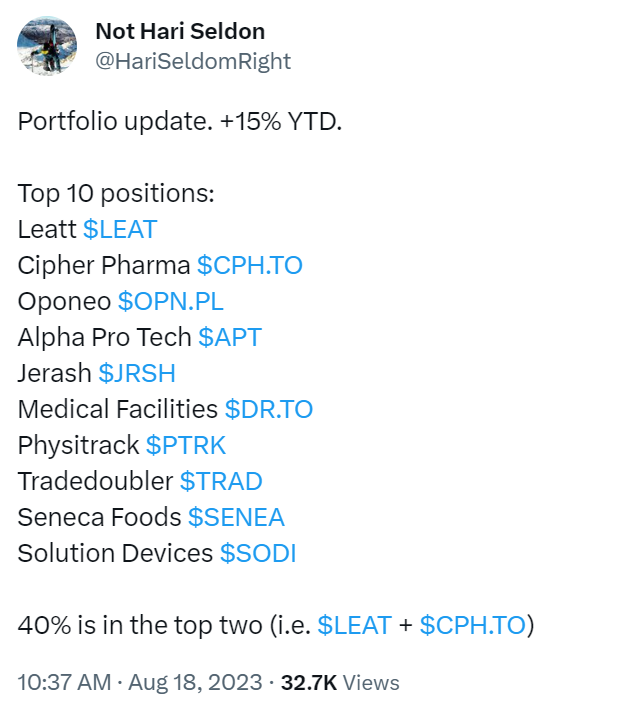

These guys own it as well:

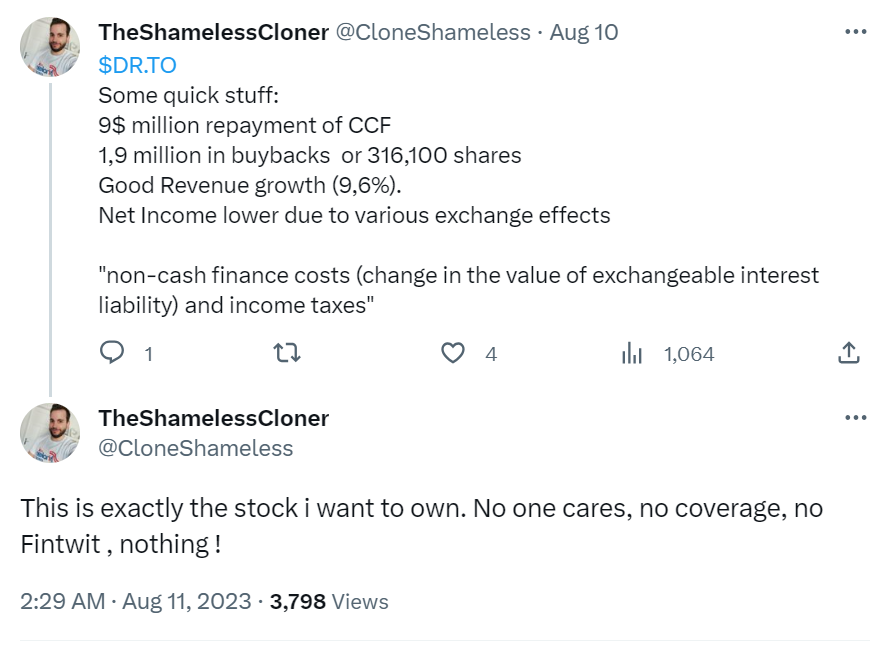

I think I mentioned Smoak Capital in the past. They mention $DR.TO in their 2023Q2 letter (archived here).

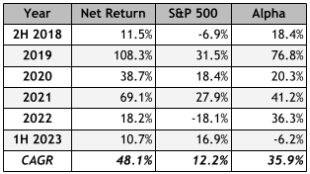

A reminder on Daniel Smoak’s performance:

Found another writeup (archived here).

Dude @finance_schmidt also shared a deep dive on YouTube, albiet in German and it’s difficult to follow with the CC:

Maybe this explains the share price destruction:

I ended up buying some, but I can’t say I’m super excited by this one. Probably not a bad bet, but (I think) unlikely to be a great one.

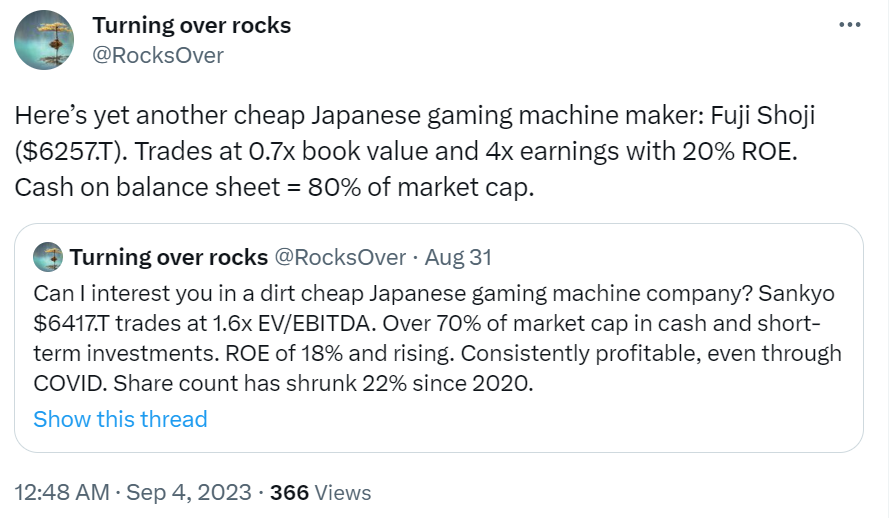

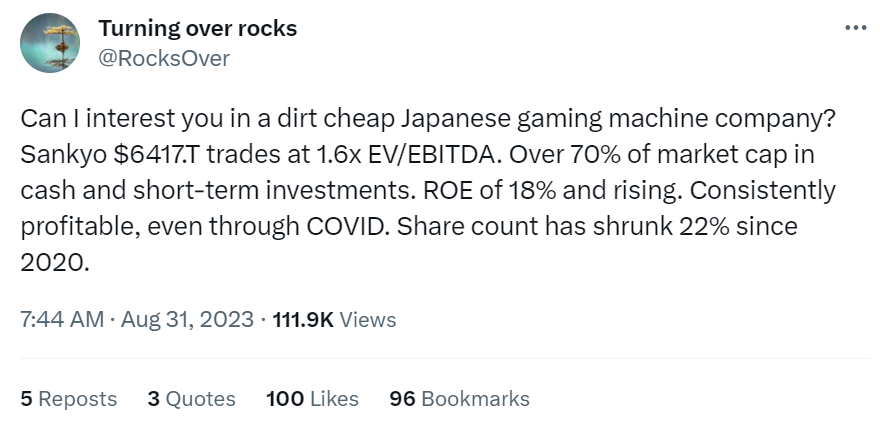

Two other cheap Japanese stocks I want to look into:

(tweet)

Note on $6257.T:

Unlike Sankyo it’s not so shareholder friendly. Like many Japanese companies, seems ripe for activism. I’ll be taking a look at several of these pachinko game machine makers in a future post on the site that shall not be named.

Another (deeper) perspective on Sankyo $6417.T:

The best article from Firm Returns on $TBLD.L I’ve read so far is this one, from Jul 18 2023: link (archived here). It’s quite a detailed walkthrough.

Peers: Frontier Developments (FDEV:AIM) and Team17 (TM17:AIM)

Analysts at Berenberg said:

Ultimately, we believe much of the remaining value in the business is in the broader expertise and platform that has been developed, rather than in the near-term financial delivery, with much attention on the rebuild plans of the new CFO.

Tinybuild’s portfolio (not comprehensive):

- 2023:

- Punch Club 2

- Black Skyland

- Rhythm Sprout

- Farworld Pioneers

- The Bookwalker: Thief of Tales

- I Am Future (independent studio Mandragora)

- 2022 and older:

- Hello Neighbor 2

- Not For Broadcast

- Despot’s Game

- Cartel Tycoon

- Potion Craft

- Future releases:

- Streets of Rogue 2

- Broken Roads

- RAWMEN

- Stray Souls

- Pigeon Simulator

- Critter Cove

- Slime 3K

- Kill it with Fire 2

- FEROCIOUS

- Level Zero and Sand

Acquisitions:

- 2022:

- Bossa Studios (UK): Surgeon Simulator, I Am Bread

- Konfa Games

- 2021:

- Versus Evil

- Red Cerberus

- Animal: Rawmen

- Bad Pixel

- DogHelm

- Moon Moose

- Hungry Couch Games

- We’re Five Games

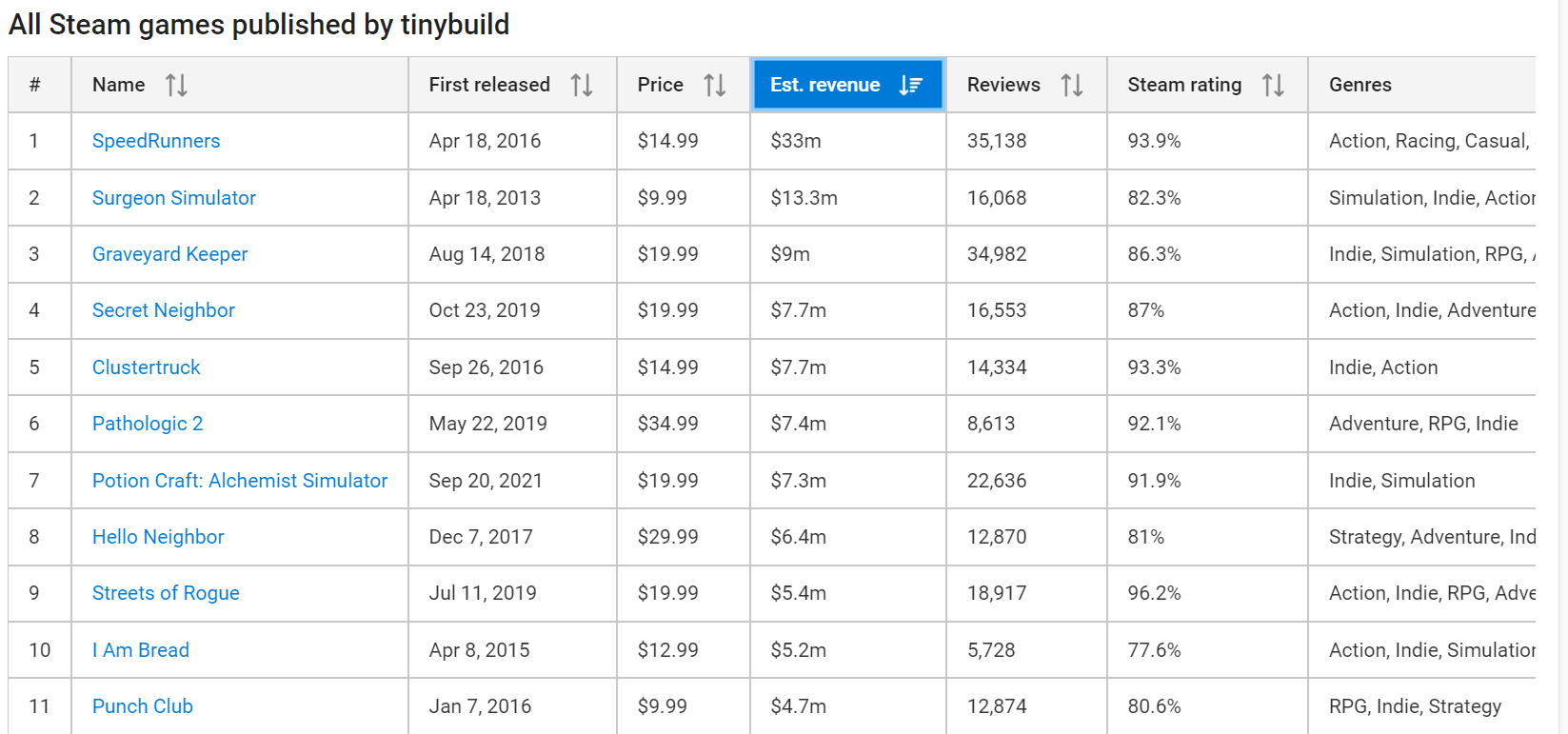

List of games pubilshed by tinybuild, with estimated Steam revenues:

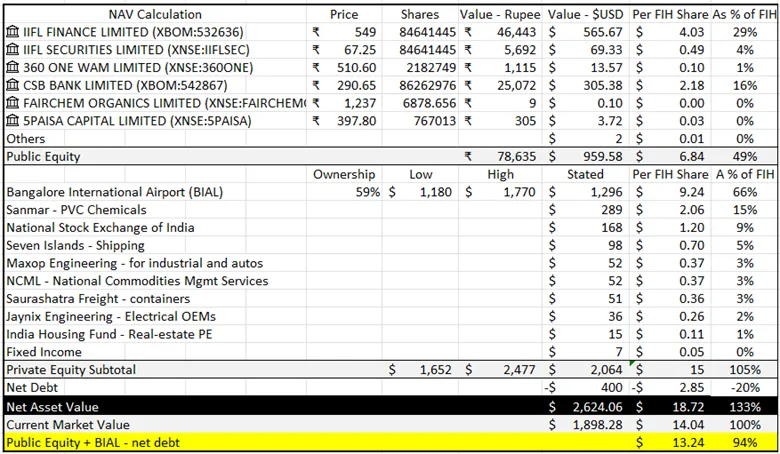

Found in this substack:

- 59% stake in India’s third largest airport (in Bangalore, the supposed “Silicon Valley of India”)

- The airport is irreplaceable and regulated to provide a high teens return

On the negative side:

The company takes 1.5% of book value and 20% of any growth above a 5% hurdle rate (meaning if the company grows book value at 10% annually, they charge 2.5%)

The other stock mentioned in this post and that I want to look into is Fab-Form Industries (FBF), since I screwed up on AEP.V.

A video from the Unrivaled Investing channel:

Quote from the video:

Are they growing because they're unrivaled and their products are exceptional and they don't have to worry about margin pressure (from generics or from customers who can find alternatives)? Is this really an unrivaled company or a marketing company?

Also, an interesting website to track traffic: crunchbase.

A fantastically well written bear case:

Some contrary indicators that I think the bulls are missing on this stock.First, almost no one has noticed that they lose 50% of their new subscribers within 6-9 months. All you have to do is check that chart they publish every year in their presentation showing their marketing payback (the last time was during their 2022-Q4 earning released in February). If you model those numbers out, it’s about a 20% loss of revenue and subscribers every quarter. A lot of people claim that if they simply reduced their marketing they would be profitable right now. The truth is that they need to maintain at least 2/3 of their current market spend just to keep revenue level q/q.

Second, there’s a lot of focus on past growth by the bulls coupled with an assumption that this same growth will continue. The most recent quarter’s q/q growth was 9% and Google Trends suggests the next quarter will be about that or a little less in the current quarter. They are currently trending toward 30-40% annualized growth, which they have been openly signaling for a long time. (That’s still good, but not the 80%+ people keep talking about).

Third, underneath the hood of that slowing growth is a lack of clarity on how they are doing in their new categories, like mental health. It’s no accident that they have been slow to expand into new categories. For a new category to work, there needs to be enough demand to provide a payback on advertising. It looks like most new categories fail to pass this test (they market-test everything, which is good). I suspect that mental health simply isn’t performing as well as ED and hair loss drugs. Obesity drugs might, but that probably depends on them selling some of the newer weight loss drugs.

Fourth, I don’t see HIMS expanding internationally that much. In nearly every country other than the US and New Zealand, DTC advertising on prescription drugs is severely restricted by law.www.ncbi.nlm.nih.gov/…

Finally, I know that folks love the high gross margins, but you need to look at the overall operating expenses. Those expenses are growing significantly faster than they were, which pushes potential profitability further into the future.

My guess is that enough players in the market know about these dynamics, which is why the stock started dropping soon after HIMS began its push into mental health. It could bounce back, of course. At the beginning, HIMS wasn’t that good at selling ED and hair loss drugs either and now that’s their bread and butter. Maybe the same will happen on its newer categories. We will see. But there’s no strong evidence of that yet.

I own a bit here.

Insightful comment found on uk.advfn.com:

Of the current £120m+ cash on the balance sheet approx £60m, iirc, is debt to subbies who are paid a month behind Costain.

Current EV (shown by Koyfin) of £55m should therefore be adjusted up to £115m.

Assuming a sustainable FCF of £20m, that’s still an attractive 17% yield at current prices.

Tweet: link

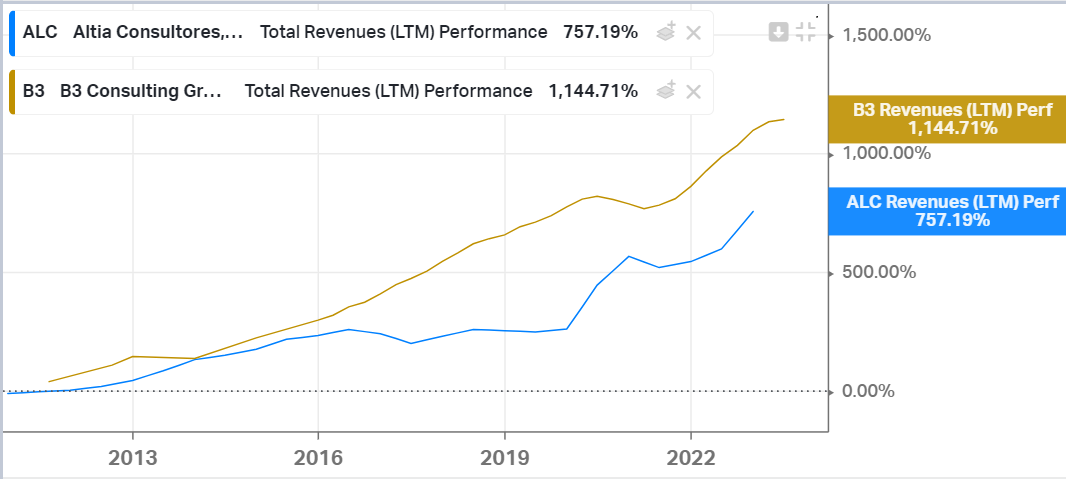

It’s nice but I can get B3.ST at half the price with similar growth profile:

Found an interesting research note.

A nice thread: link.

B3 Consulting Group ($B3): Case threadB3 is a consulting company with a focus on IT and management. The company supports several of Sweden’s leading companies and organizations with digital transformation and business development. The ambition is to be Sweden’s best consulting company.

B3 Group is based on a legal company structure with entrepreneur-driven & collaborative companies, where the parent company is responsible for group-wide areas such as HR and administration. (image below is from YEAR 2022, since then B3 has increased its holdings in Digital Worklife)

Geographically, there are B3 offices in the Swedish cities of Stockholm, Borlänge, Gävle, Gothenburg, Jönköping, Linköping, Malmö, Sundsvall, and Örebro. Via the associated company B3 Poland, B3 also has offices in Krakow and Warsaw.

According to the annual report for 2022, B3 has more than 200 customers. No customer accounts for more than 5% of the revenue. The 10 largest customers account for approximately 25% of the revenue. About half of the income is attributable to sectors with low or moderate cyclical dependence. Image

B3’s most important asset is its employees. Over the years, B3 has built up an award-winning corporate culture. At the end of Q2 2023, B3 had roughly 800 employees in Sweden and roughly 200 in Poland. In 2022, employee satisfaction amounted to a high 90%.

The share was listed on Nasdaq First North Premier on June 13, 2016, before the company moved the share to Small Cap on the main list on December 14, 2016. The number of shareholders as of December 30, 2022 was 4,940.

If you look at the group management, the male members (excluding acting CFO) have a perfectly okay or very good share ownership. On the female side, share ownership is non-existent or low. Among the board members, I believe that apart from the major owner Sverre, there is some alibi ownership.

Given the poor development of the share price, I think that several insiders should be able to carry out insider purchases - given that you believe in the company you represent.

B3 was founded in 2003 and has so far shown revenue growth in every single year. So far this year, revenue has increased by 7.6%, mainly driven by more employees and increased hourly rates. Reduced occupancy has hampered revenue development.

If B3 has an impressive revenue history, however, the level of profitability has historically left more to be desired. In order to strengthen profitability, B3 successfully implemented an efficiency program in 2021-2022. Until Q2 2023, B3 had 6 consecutive quarters with an operating margin above 10%.

In the annual report for 2022, B3 wrote that the efficiency measures taken created the conditions to permanently exceed 10% EBIT margin. YEAR was published in April. Thus, it did not even last a quarter before the EBIT margin crashed & came in well below 10%.

The Q2 margin (7.4%) was a negative surprise for me. I would have thought the B3 would hold up better. Adjusted for non-recurring items, the margin landed at 8.4% in Q2. When the economy was in high gear, B3 announced in 2022 that it is launching new financial targets for 2025 (see below) Image

Certainly 12% is something that meets “permanently above 10%”, but it otherwise feels a bit contradictory to write “permanently above 10%” in the annual report when the goal is “over time” to report 12%. It is somewhat typical that new financial goals are launched when everything is moving along incredibly well.

If B3 delivers on its financial targets, in my opinion the share should trade clearly higher than today. The margin target of 12% is not something that comes by itself, even if the target was met in 2022. At R12m, the margin now amounts to 10.9% - a level where the short-term risk is on the downside.

B3’s successful operations in Poland will be consolidated into the group by 2025 at the latest. My hope is that it will happen in Q1 2024. B3 Poland has a better growth rate (+29% in Q2) and profitability (12.5% in Q2) than B3 in general, something that will support the pursuit of financial goals.

B3 has a solid financial position. Excluding IFRS16, B3 has net cash. In 2022, B3 repurchased 3.5% of the outstanding shares at an average price of SEK 166.60 (today’s share price SEK 90.10). I would like to see B3 launch a new buyback program in connection with the publication of the Q3 report.

On the risk side, there are, among other things, continued declining demand, increased competition, price pressure, reduced debit ratio, not attracting and retaining competent staff and write-downs of previous acquisitions.

Examples of triggers for an investment in B3: · Improved debit rate · Launch of new efficiency program · Launch of new buyback program · Continued insider buying by major owner Sverre · Consolidation of the Polish operations · Acquisitions & new start-ups

Conclusion and summary

B3 is a company with an impressive revenue history (CAGR of 18% over the last 10 years). Hopefully, the year 2023 will mark the 20th consecutive year of revenue growth. In terms of profitability, the company needs to be better than what it has performed historically.

Before the Q2 report, my interpretation was that they had now landed at a higher level of profitability. We will see if the Q2 report was a slip-up or if “over time” you can show that profitability is now at a new level.

B3 has announced that it will present a new efficiency program in connection with the Q3 report, which I look forward to.

I would also very much like to see a new buyback program when the stock trades around current price levels.

I am willing to sacrifice my dividend (and other owners’ dividends) if the money is instead used for buybacks. It is also very positive that B3 Poland will soon be consolidated, something I believe some analysts did not include in their estimates.

Assuming that revenues in Q3 and Q4 land at the same level as in 2022 and that the operating margin comes in at 8%, I land on an adjusted profit per share of SEK 8.83. It there a P/E multiple of 10.2. I think that is an attractive valuation.

I think B3 stock is attractively valued today, although there are many challenges at the moment (including selling pressure from some major shareholders so far this year). Hopefully, the consolidation of B3 Poland and the new efficiency program will support profitability.

I own shares in B3. As the share price suggests, I expect challenging quarters to emerge next. My investment in B3 is not made on a quarterly basis. I’m not sure that you deliver 12% margin in 2025 but I hope/believe that over time B3 can perform better than in Q2.

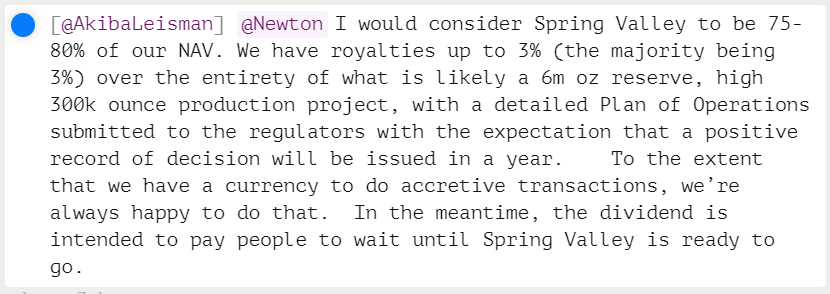

Interesting update from Akiba:

Note: I bought and made a nice little profit then exited when I saw Akiba selling out.

This ticker and the next few ones are from [@Andy]’s tweet: link.

Twin Vee Powercats manufactures boats and is starting to build EV boats. They already got some big orders and just ramp up production. Usually no biz I would touch but it`s a net-net, burning cash slowly and has huge (and I mean huge) upside if everything goes well.

Proto Corp. is a japanese company that mainly operates a distribution plattform for cars. A huge percentage of the income comes from recurring revs from cars sellers and maintenance providers. Midterm goals suggest high growth, RiskReward looks solid at an 4x ev/ebit.

Precia Molen sells and services industrial weighting solutions. Stock did x26 in the last 20yrs. Getting bigger+bigger in their niche. New CEO is turning all the rocks needed (eg closing down country division which make no money). Looks cheap at 10,5x 2023 ev/fcf.

CTAC is a small dutch IT Services provider with a focus on SAP integration. After the CEO went ill and died in 2023 they just creating a new mid-term business plan. Stock looks very cheap with ev/fcf 7, high ROE and a healthy balance sheet.

Spirent provides tests for telecom equipment. RiskReward looks compelling with sub 10x ev/fcf 2024, huge buybacks, big dividend. A niche biz that is just under fintwits radar ;). You find a great writeup from my friends over at Ennismore [here](https://twitter.com/evfcfaddict/status/1691063280112951297?s=20).

Centaur Media is a very interesting british microcap. I discovered it over it Rockwood - an UK microcap fund with a massive track record. They provide different niche services, eg. an online platform with specific information for law firms. Stock trades @ 7,5x ev/fcf.

The greek producer of yoghurt and ice-cream Kri-Kri Milk $KRI.AT has a market cap of 265m€ and an EV of 275m€.In 2022 the price of their biggest cost factor milk went up from 44€ to 59€ for 100kg. They hiked prices slowly but their ebit falls over 75% yoy to just 4m€.

Full pitch: thread

Gay Lussac (french microcap fund with a history of outperformance) says yes, it’s a buy at 7x ebit and a possible takeover target. $ALITL.PA (hard to disagree…)

RCS Media is an italian media company which transformed their business from a traditional media house (print/tv focus) into a more asset light digital subscription focused company. High dividend (~8%), low valuation (ev/fcf ~5)!

Takuma-they are selling and servicing environmental plants. Recurring revenues are growing, midterm plan look promising and the valuation is pretty low at 4x this years ev/ebit. In addition you get @AVIJapan as a great friendly activist for free.

International Money Express operates a biz most of you might know from Western Union. You send money from eg US to your family in Mexico. Long story short: $IMXI is best in class, high margins, high growth, temporary margin pressure from an opponent that was taken

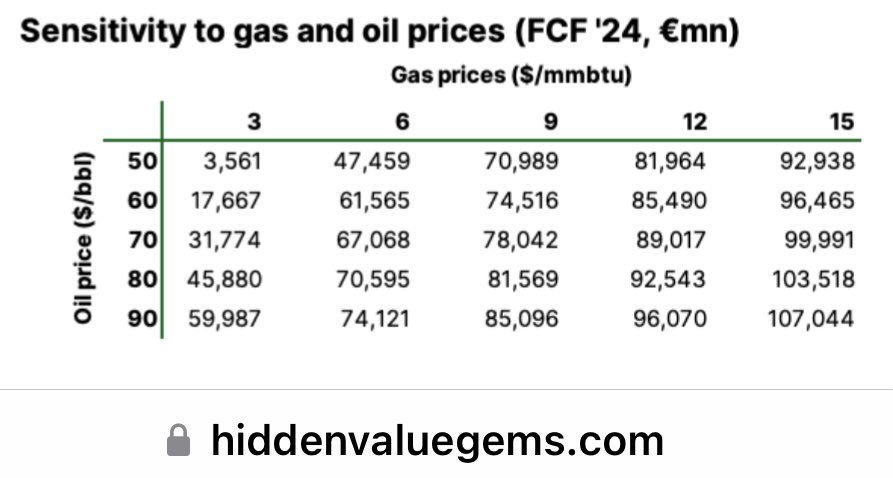

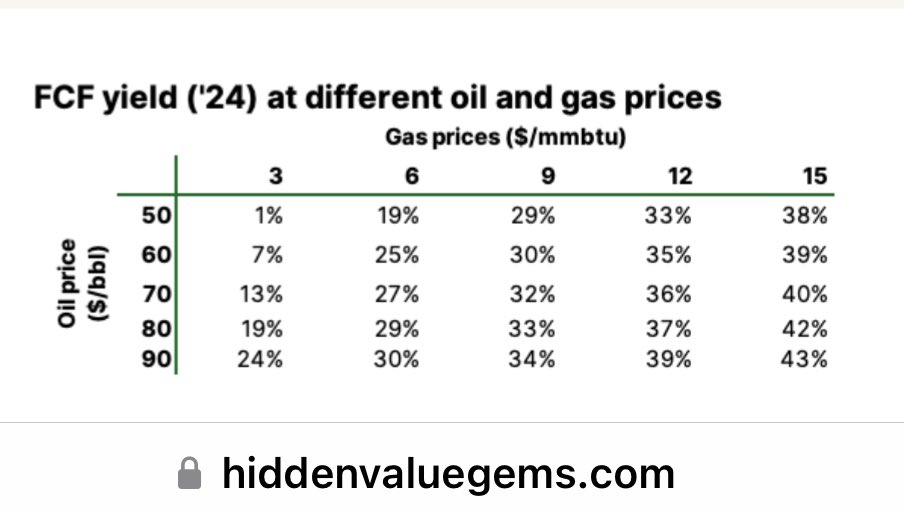

Just flagging that TTF gas prices are up >20% in just two months on possible strikes in Australia and extended force majeure at Nigeria’s LNG. At spot $KIST.L should generate €92.5mn FCF in ’24, 37% FCF yield. The founder and CEO, Andrew Austin, owns a 17.3% stake.

@BreeleyCapital (one of the two twitter accounts that owns and knows a lot about $TBLD.L) also owns it.

Here’s the rest of his portfolio:

Full writeup: link (archived here).

Interesting piece of news, dated July 31st: UK to Grant Over 100 North Sea Oil and Gas Licenses.

The following are from this Twitter thread: link.

Videogame company that owns a controlling share of GRVY, nearly a net/net, heavy buybacks over the last decade.

Natural gas pipelines, seems as predictable and boring as a utility without the wildfire risk.

They own Porsche and VW stock worth ~double the market cap. VW owns a lot of great brands: Audi, Bentley, Lamborghini and Ducati.

Private Prisons trading cheaply now, and stand to benefit as illegal immigration picks up.

Mexico stock exchange, the only risk is a new competing exchange, but that seems like a tough biz to break into - and even the duopoly outcome isn’t that bad.

Airports are particularly predictable monopolies, and $OMAB stands to benefit from near shoring.

Tourism railroads in Switzerland, a predictable monopoly. They have a long runway to expand into more real estate near their routes, and benefit from organic growth in tourism generally.

Builder supplier that escaped a bad balance sheet. Forward earnings might be near peak earnings, after some delay due to higher rates.

Supermarket chain that Publix avoids competing with, they own their real estate.

A high confidence @natstewart5 pick which trades obviously cheaply.

Bank with no duration mismatch, trades very cheap and credit quality seems fine.

Interactive broker, a low cost producer with the widest variety of global exchanges. They could benefit after the old CEO left and the company gradually becomes more user friendly - and able to attract larger funds.

Absurdly cheap toy manufacturer. It’s Hong Kong listed, normally a thesis breaking problem, but in this instance it’s Korean owned and operates out of Vietnam - seems they could list elsewhere if needed.

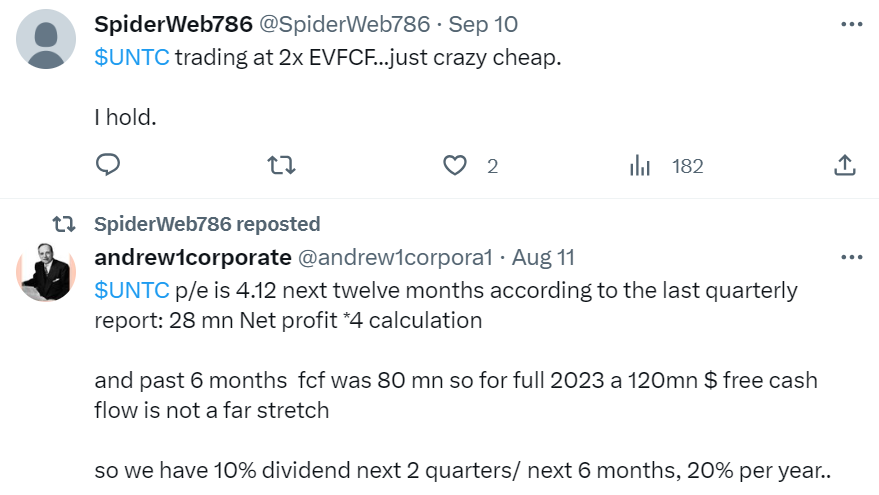

Shared by @SpiderWeb786:

I feel like I’ve come across this ticker before…

Wait, KingdomCapital made an appearance on YAVB to talk about it: link.

Napking math:

Another guy talks about it in this YouTube clip: link.

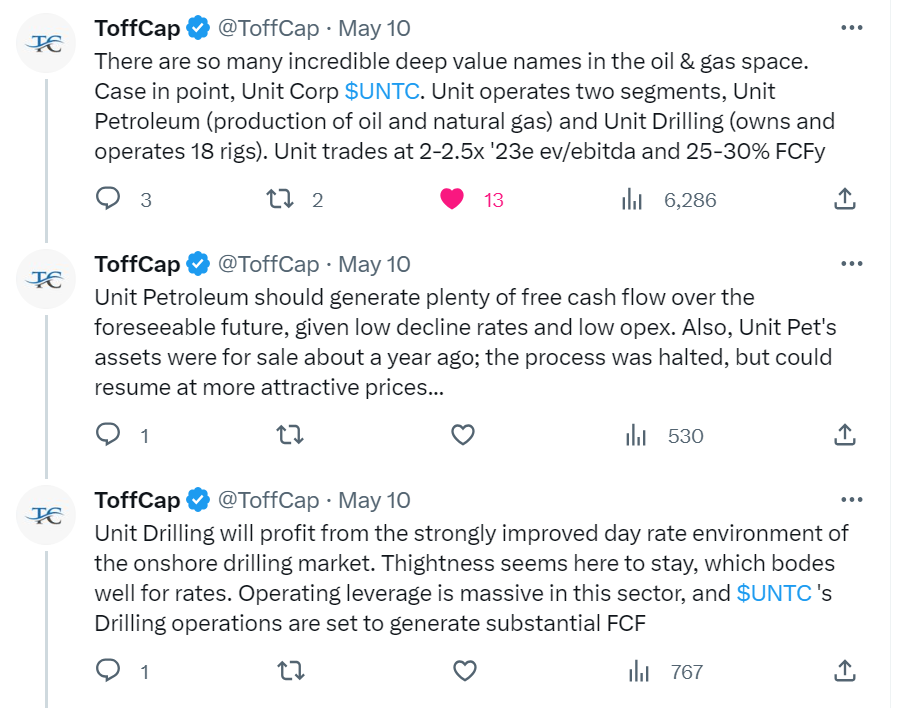

ToffCap also seems to like it (thread):

Shared by Modern-Investing in DMs.

Polish government controlled coal Producer. 0.5x net cash and 1x earnings.

He also shared some Nordic O&G plays: $VAR (Norway) and $OTL (picks and shovels play at 20% FCF Yield and 60% insider ownership).

I think they produce the POS devices. Not sure they have a moat of any kind.

(link)

From this thread: link.

Seems cheap-is around 8x EV/EBIT.

Hit by Hollywood’s writer strike + fear of AI taking their lunch.

Their main customer (~80% of revenue) is Netflix.

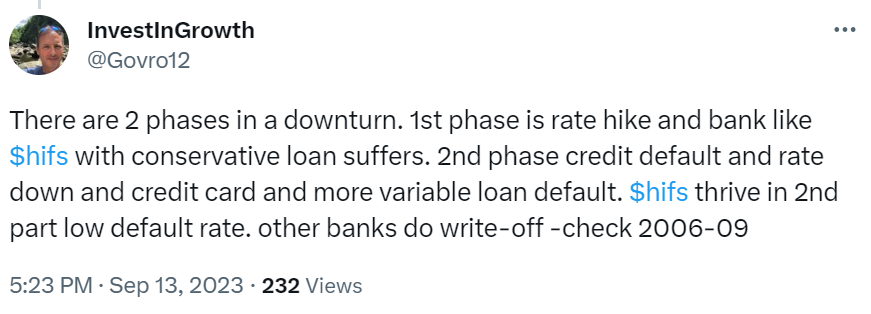

Some back & forth on $HIFS from this thread:

Earnings deck (english starts page 8): link.

According to the 2023Q2 earnings report, IAC owns:

- 83.9% of Angi, currently worth $873M (Angi MC: $1.04B)

- 18.4% of MGM, currently worth $2.4B (MGM MC: $13B)

- Cash: $813M

- Total: $4.08B

Current $IAC market cap: $4.5B

Angi is currently trading for 0.9x EV/GP and 24.8x EV/EBITDA. Angi’s EBITDA has room to grow, I can see a triple in a couple of years.

MGM is trading for 5.8x EV/GP and 9.9x EV/EBITDA. Outlook seems stable.

What do you get for $420M ($4.50B - $4.08B)?

- Dotdash Meredith (2023E adj. EBITDA = $250M)

- Care.dom (2023E adj. EBITDA = $100M)

- Vivian Health

- Stake in Turo (31%). Turo was privately valued at $1B as of July 2019. In 2022, Turo produced Gross Profit of $405M adj EBITDA of $80M, up from $44M and ($92M) in 2019.

- Corporate expenses: ($100M)

However you slice it, a pretty convincing case can be made that you get Turo for free, at the very least - if you assume that Angi and MGM are not currently overvalued.

Thread: link.

Notes:

- their debt is currently very cheap at 3%, will have to be refinanced in 2025. 1/3 of the debt is at 1.5 fixed rate. The other 2/3 are already at 4-5%.

- CAPEX consists of both Maintenance capex (50k/club) and Expansion Capex.

A writeup here from Inbox Alpha.

From this thread: link

NAV calculation: link

This stock was pitched by Chase Rickard in some of his video, on the basis of low price to net tangible assets (currently 0.7).

The main subsidiary of the business is called Jewett-Cameron Company (JCC) which is wholesaler, and a manufacturer and distributor of products that include an array of pet enclosures, kennels, and pet welfare and comfort products, proprietary gate support systems, perimeter fencing, greenhouses, and fencing in-fill products made of wood, metal and composites.

Examples of the Company’s brands include Lucky Dog®, for pet products; Adjust-A-Gate™, Fit-Right®, Perimeter Patrol®, and Lifetime Post™ for gates and fencing; Early Start, Spring Gardner™, Greenline®, and Weatherguard for greenhouses.

On Seeking Alpha, an ex-CFO of the company attributes a value of $4.8M to the 11.7 acre of land on which the secondary seeding business is operating. This value translates into after-tax proceeds of about $1 per share. The seeding business has been losing money consistently.

Valuation of the land: it was acquired in 2000 at a cost of $457,000 for 13 acres or $35,000 per acre. In 2013, 1.3 acres of this land was sold for $410,000 or about $315,000 per acre. Adding a 3% inflation rate brings us to $411,000 per acre in 2022 and $4.8M for the remaining 11.7 acres.

Now, the interesting part is that in their most recent earnings report, the company announced that:

it has decided to close its Jewett-Cameron Seed segment effective August 31, 2023. The wind-down of operations has been proceeding smoothly, and full closure of the facility is expected to be completed by the end of calendar 2023.

One of the issues that stands out to me when looking at the income statement is the declining revenues, with sales of $18.9M vs $20.9M in 2022 and $21.6M in 2021.

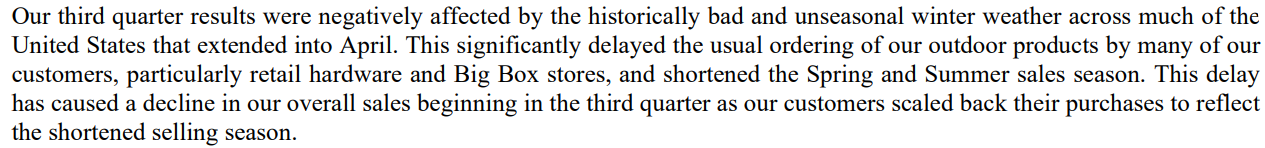

The company somewhat adresses this in their 10Q:

Now on to the balance sheet. There’s $2.7M in cash, $7.5M in accounts receivable and $20.5M in inventory.

I’ll mark down accounts receivable by 25% (to $5.6M) and the inventory by 50% (to $10.2M). Note that my inventory write-down is probably aggressive, as the company records it net of an allowance for potential non-saleable inventory due to excess stock or obsolescence. It is mainly comprised of wood and metal finished products. This excess inventory does not spoil or turn obsolete.

This gives me a total adjusted value of current assets of $18.5M.

Total liabilities are $13.1M, so adjusted NCAV = $5.4M.

To this, I think we should add the value of a potential land sale, now that the seeding business has been terminated. The total land is recorded on the books at a value of $559K. I want to use a conservative $4M value for the after-tax sale proceeds, which brings us NCAV to $9.4M.

NCAV =

- 100% of cash (+2.7)

- 75% of receivables (+5.6)

- 50% of inventory (+10.2)

- after-tax proceeds from land sale (+4)

- total liabitlies (-13.1) = $9.4M

Reminder: current market cap is $16.3M.

Note that if I had marked down inventory by 25% instead of 50%, using $15.4M instead of $10.2M, NCAV would have been: $14.6M.

In other words, using this less aggressive inventory write-down, the stock can be considered a net-net “as is” around $4.17 per share, about 10% lower than the current price of $4.66.

Thread: link.

Write-up: link.

A substack worth reading: Iggy’s Substack.

Crazy story from nonamestocks.

The market cap was $12K a week ago. It is now around $100K. Apparently, the company earned $93K in 2022.

For years, the CEO did everything in his power to avoid disclosing financials.

A nice writeup by Mackie Sander on this net-net. I don’t think Mackie owns it though.

Disqus comments are disabled.