#87 - Ramblings, April 2023

Last updated: Mar 21, 2024

I’m very impressed with their 7-year CAGR (17.5%), despite an abysmal 2022 (-43%).

In this letter, Artem lays out his thesis on Crocs. I remember dismissing this idea as a simple Covid work-from-home retail winner, but I (along with most of the market), confused causation (one thing causing another) with coincidence (two things happening at the same time):

The pandemic was gasoline thrown into the fire that was already nicely burning.

Good lesson to keep in mind. Errors of omission don’t show up in the numbers, but they can be huge.

There’s saying no because the numbers don’t add up - and there’s saying no because of unjustified or superficial bias.

Scott Management wrote a foundational piece about serial acquirers.

Studying Serial Acquirers, Exploring Context substack.

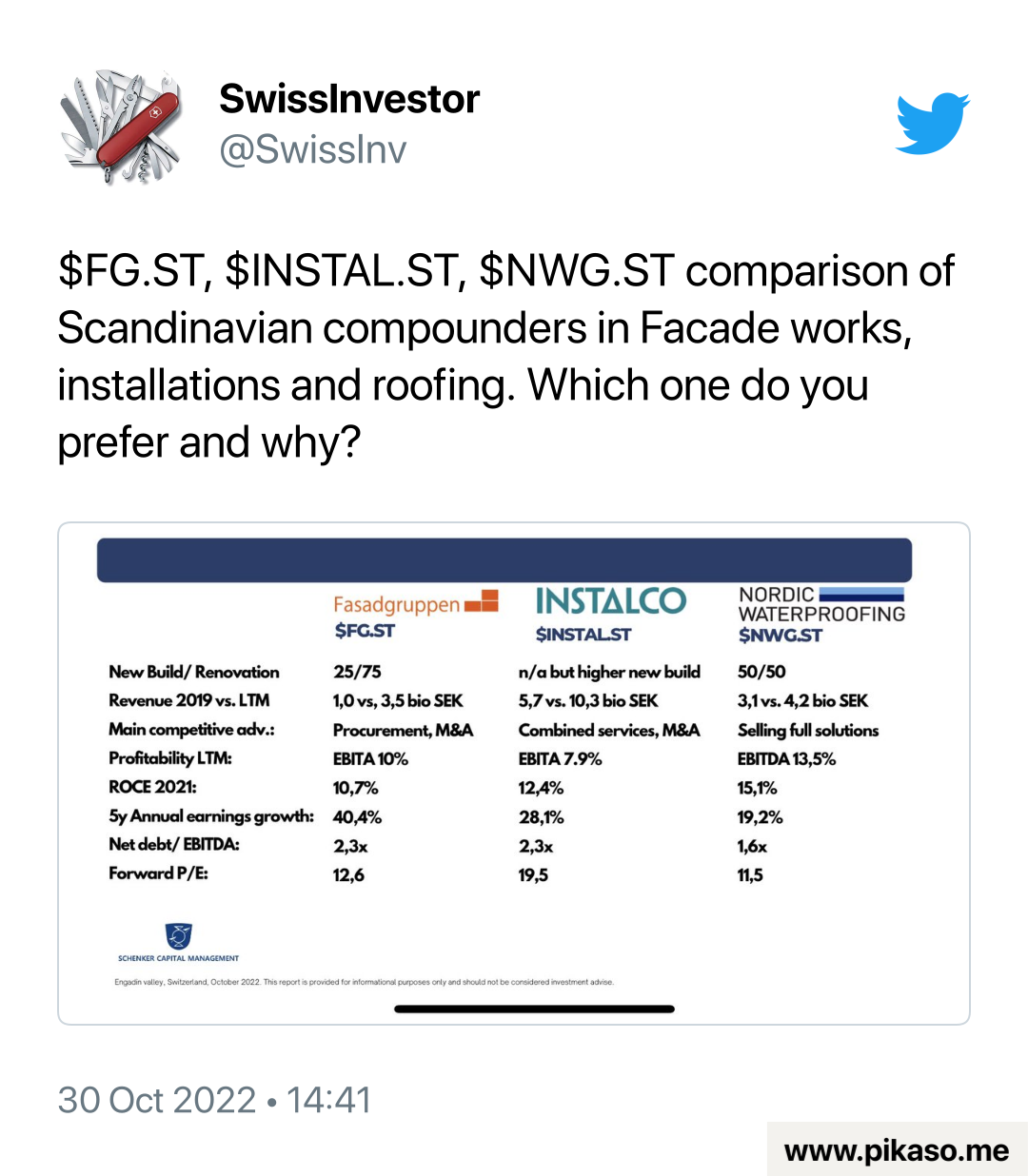

Redeye provides its Q4 2022 sector update for Swedish serial acquirers.

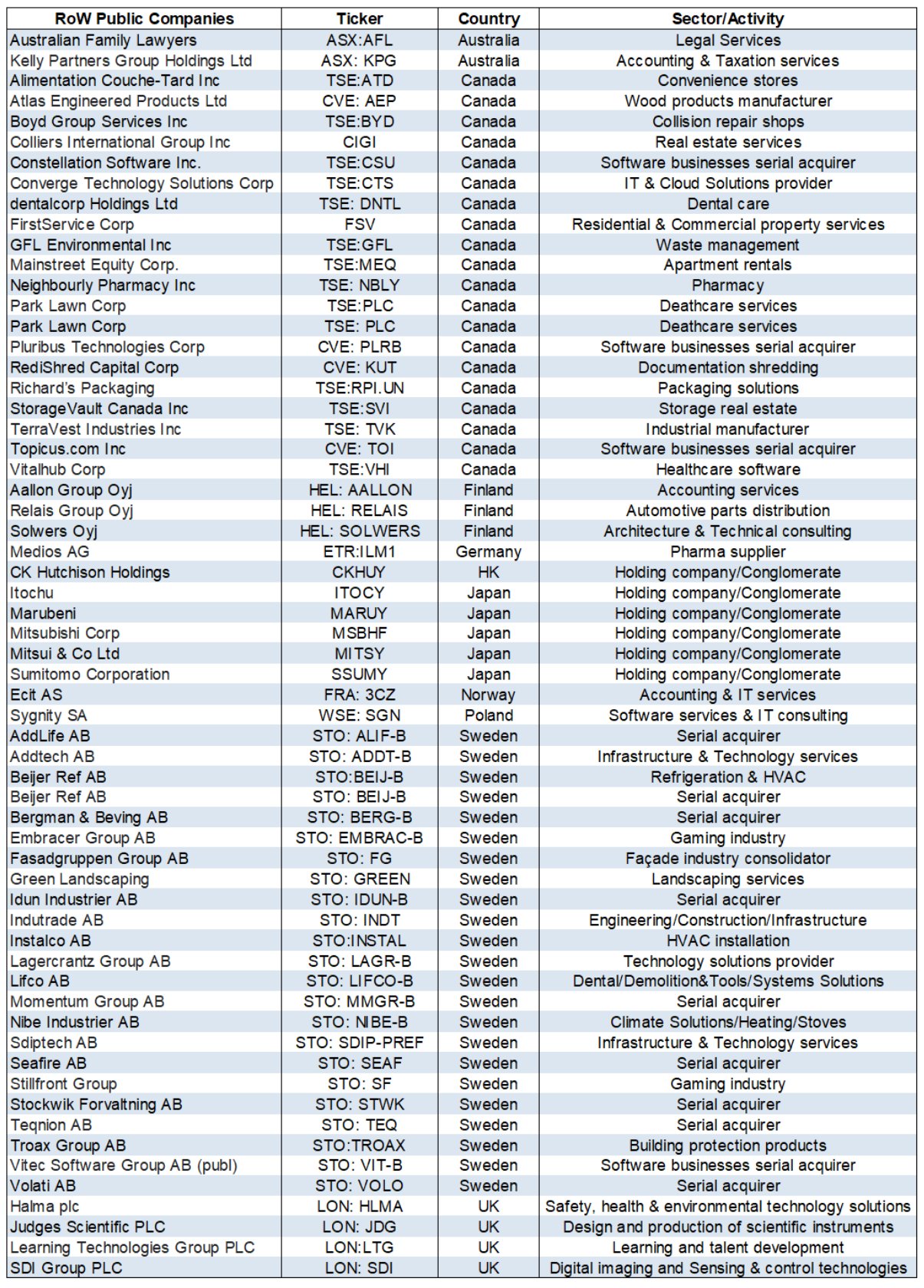

More serial acquirers:

Redeye investment philosophy: link.

From Epoch Investment Partners (arhived here).

From this list of links on valuation: tweet.

These were kindly shared by random strangers on Twitter. Deeply emotional music.

A comprehensive list of resources on this God-like investor compiled by @Paul: thread.

-

Podcasts:

-

YouTube:

-

Class notes:

How Long Term Investors Beat The Market | NYSE:GIL Stock Example.

My take-away: build a watchlist of strong companies and wait for a short-term random event that freaks out the paper hands.

British oil producer Hurricane Energy surges on acquisition deal with Prax.

2.5 pence-per-share offer, including:

- firm proceeds of 4.5 pence a share worth about 83 million pounds

- special payout of up to 1.87 pence per share in cash

- deferred consideration unit of up to 6.48 pence per share in cash

I have no idea what unlocks the “up to” portion nor do I know anything about the players involved.

PASS.

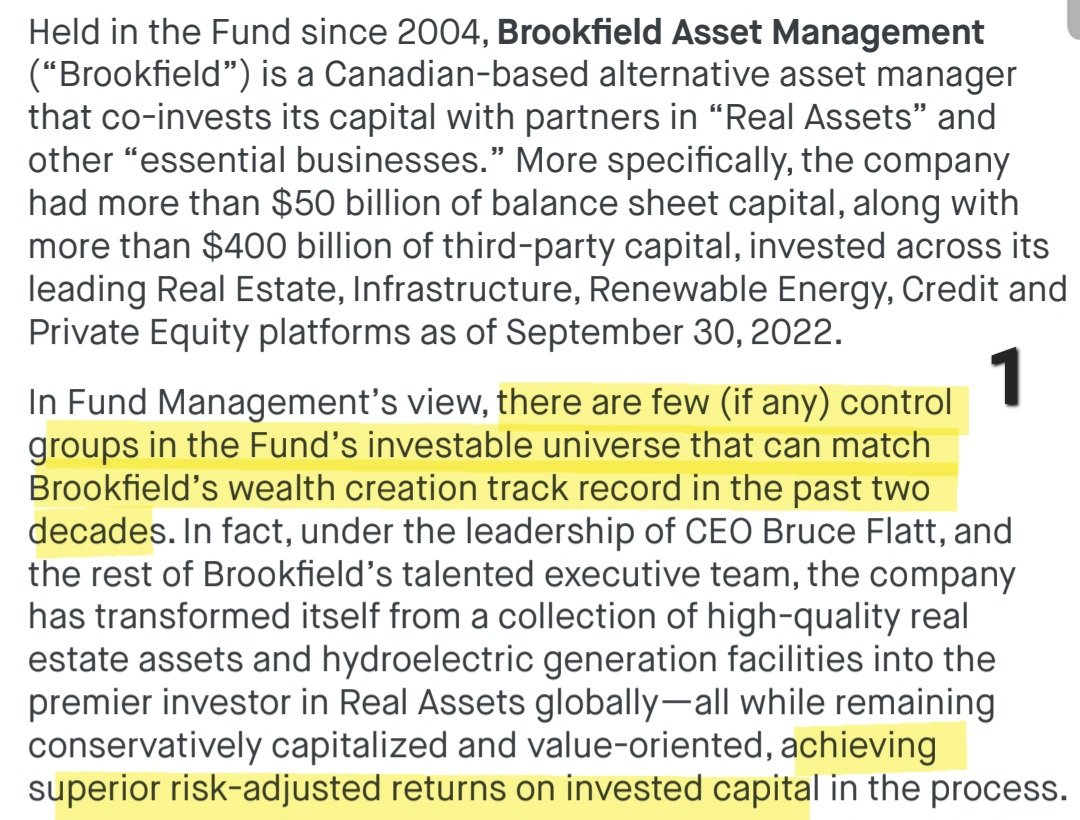

From this 3rd Avenue RE Value Fund letter of Dec 2022 (retweet here):

in Dec22:

I like Brookfield here.

BUY

Youtube video: The Legend of Zelda: Tears of the Kingdom – Mr. Aonuma Gameplay Demonstration. I’m a shareholder (small position) but I found this preview underwhelming. The game doesn’t seem that much fun to me…but then again, I’m not the target demographic.

From Kingswell:

AN UNLIKELY BENEFICIARY: The biggest winner in all of this, oddly enough, might be Nintendo.As Microsoft raced around trying to placate regulators and win approval for its acquisition of Activision Blizzard, it signed binding 10-year contracts with most of its rivals to bring Call of Duty to these platforms “day and date” and with “full feature and content parity” to the Xbox versions.

Which, for Nintendo, isn’t so much about preserving the status quo as having one of the biggest game franchises in the world drop into your lap out of nowhere. Activision had not released a Call of Duty game on a Nintendo system in over ten years — but now will be contractually obligated to do so for the foreseeable future.

-

What Sets Nintendo Apart From Sony and Microsoft? | The Economics Of | WSJ

-

A very long thesis on Nintendo from Crossroads Capital, archived here

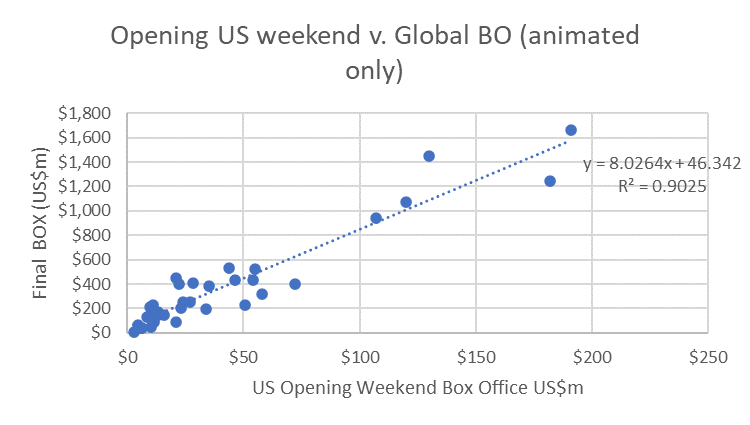

Here’s a nice regression to project final BO revenue (source), putting forecasted revenue for this movie around US$1.2B.

This thesis made me realize that the last time I reviewd this company’s P/E, I forgot to exclude net cash.

The other factors that pushed me over the edge are:

- the growth of the licensing revenue

- the management’s stated desire to deploy cash for growth

Another thesis from Blue Tower Asset Management: link.

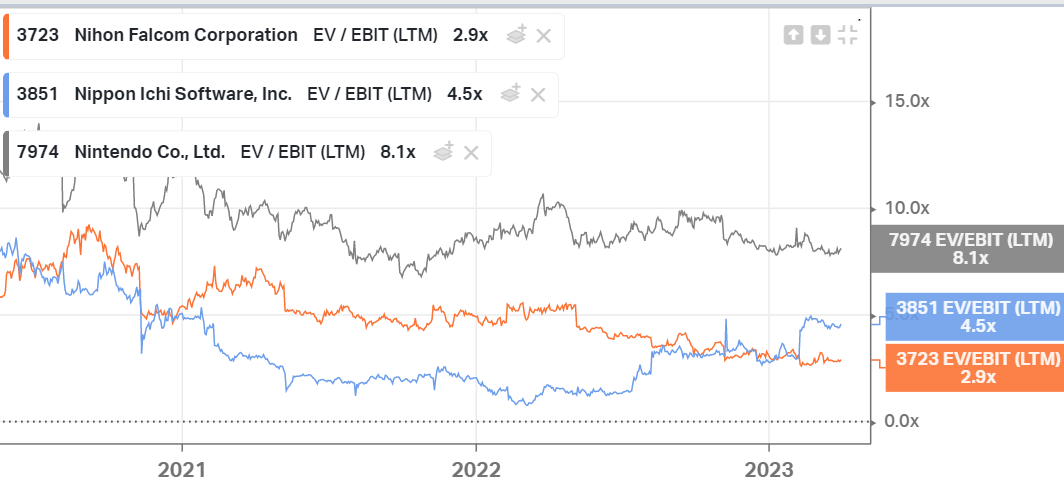

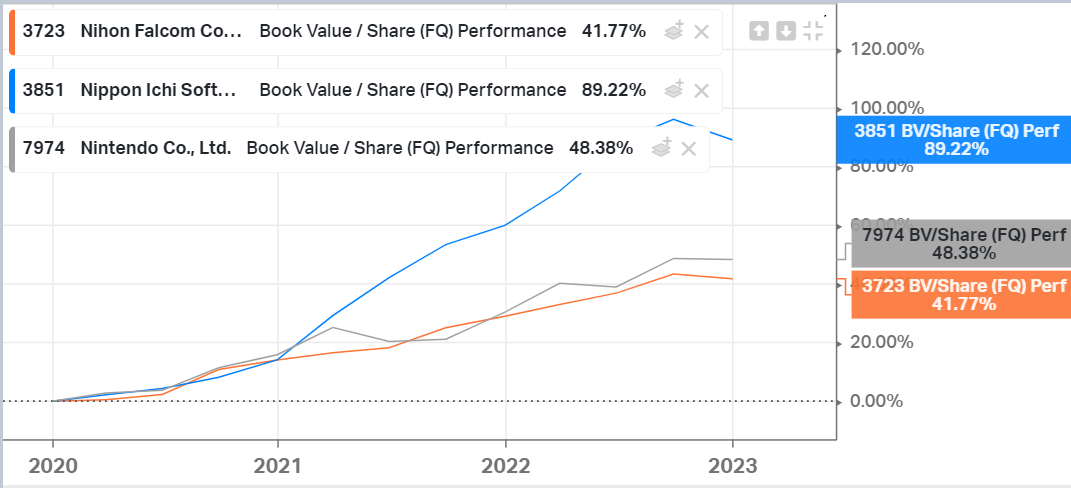

I thought I’d compare Nihon Falcom, Nippon Ichi ($3851:JP) and Nintendo ($7974:JP) with a few charts:

BUY.

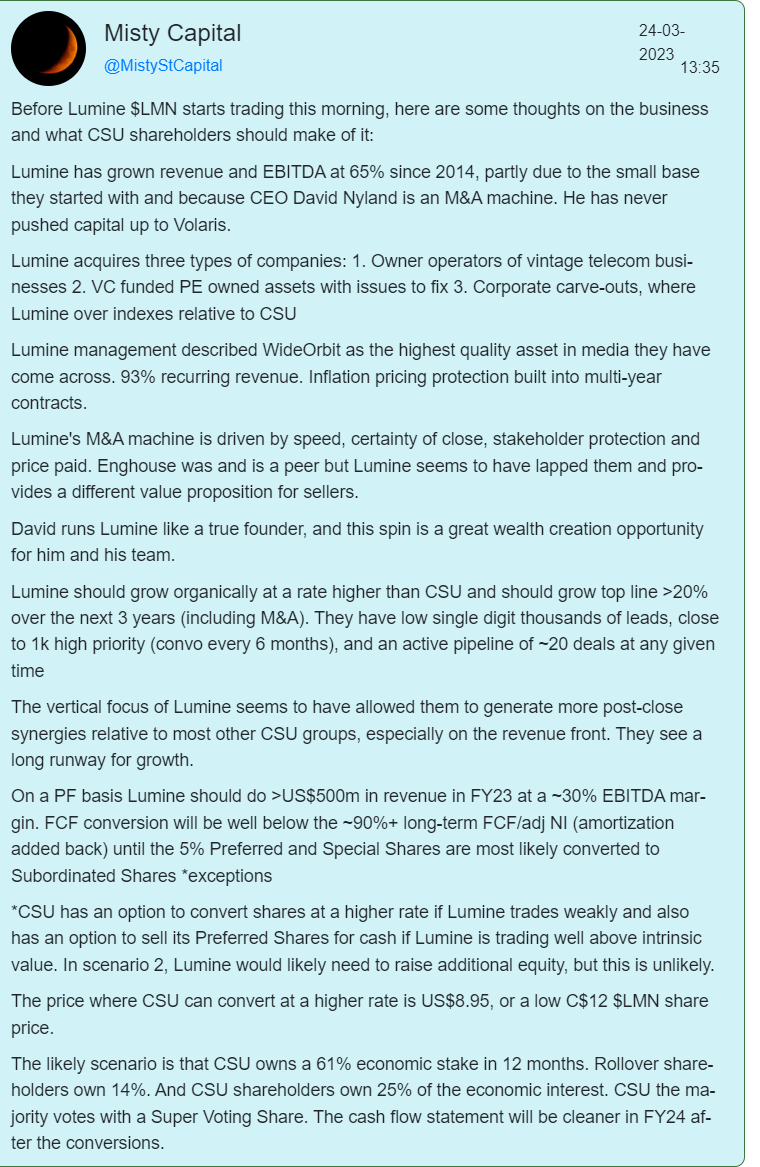

https://twitter.com/MistyStCapital/status/1639259619670278144

Thesis from the10thman.

Last month, I linked to this substack that listed 42 cheap Japanese stocks.

At the time, I said that it was too many for me to go over individually.

I still couldn’t do a deep dive on them, but I decided to build a smaller basket based only on valuation metrics (as reported by Koyfin).

I built my basket selecting the cheapest among the cheapest (P/B, EV/EBIT, FCF/EV), with a reasonable dividend yeld, and stable or increasing revenue.

Here are the tickers (from the initial 42) that made it into my portfolio (in varying proportions):

- $3723 (Nihon Falcom)

- $3851 (Nippon Ichi)

- $3954 (Showa Paxxs)

- $4754 (Tosnet Corp)

- $5078 (CEL Corp)

- $6038 (G & M Holdings) <- this one is not Japanese and not from the initial list

- $6643 (Togami Electric)

- $7539 (Ainavo Holdings)

- $7974 (Nintendo)

- $9780 (Harima B-Stem)

- $9782 (DMS Inc)

- $9845 (Parker Corp)

- $9906 (Fujii Sangyo)

The author of the above substack also mentions that he is overweight the following positions: Lonseal ($4224:JP), Yodogawa Steel ($5451:JP), Nitto Kohki ($6151:JP); and that he recently bought Sonocom Co ($7902:JP). See tweet here. None of these have made it into my portfolio at this time.

A few other tickers/findings that could be interesting to look at:

-

Wakita $8125 could be interesting as well: see this Proposal to unearth the value of Wakita & Co..

-

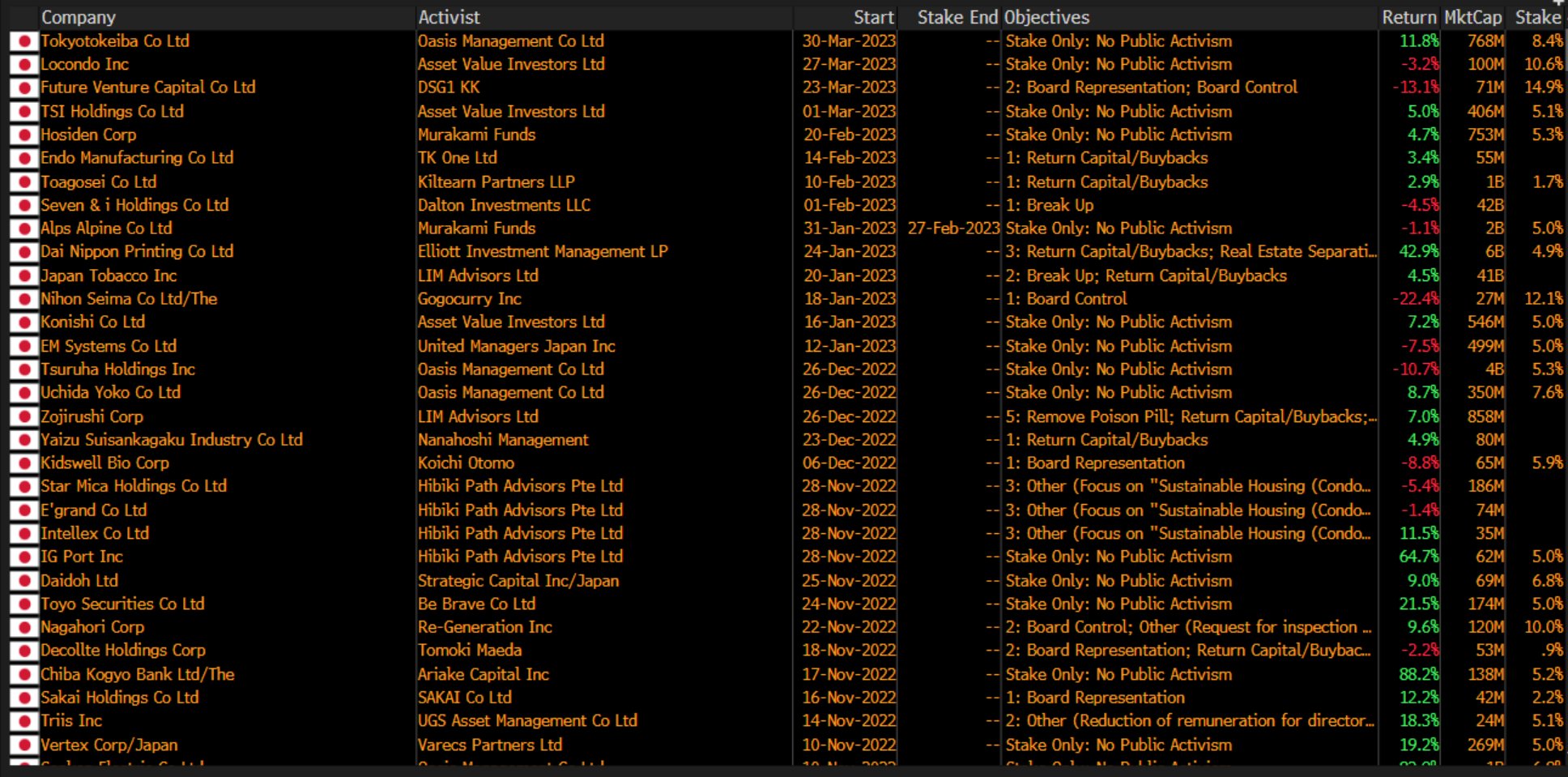

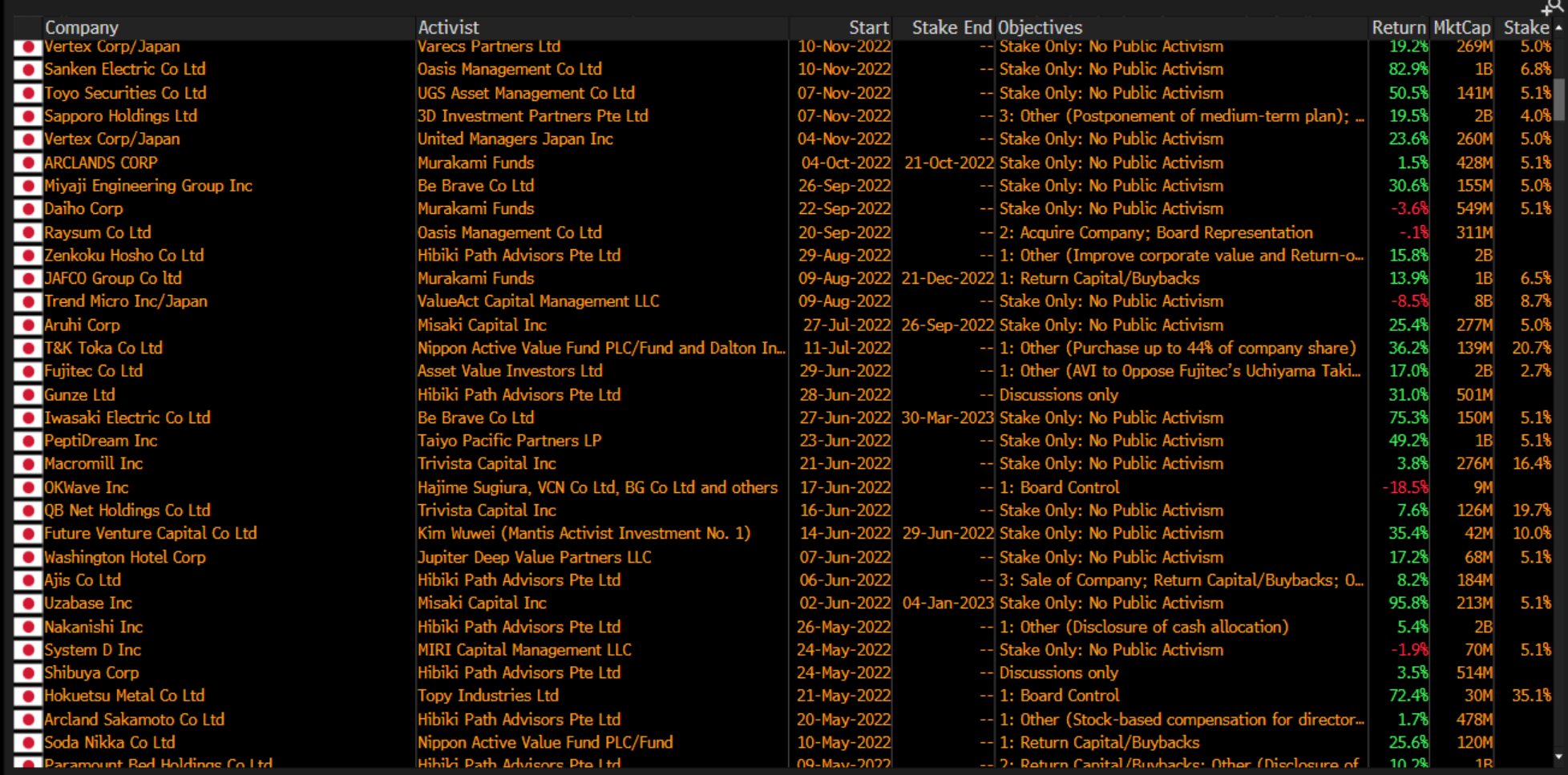

List of Japanese companies with an activist involved (original tweet here):

-

Yet another screen focused on family Murakami’s activism (original tweet from the same author here).

-

Nice thread on Japanese stocks (ROIC, ROE and buybacks): Twitter thread.

-

Comments from Platinum Japan Fund:

A big story in Japanese markets during the quarter was the move by the Tokyo Stock Exchange (TSE) to attempt to push companies to focus more on their cost of capital and stock prices via a ‘name and shame’ approach. This culminated at the end of the quarter with a (non-mandatory) request that companies trading below 1x price-to-book (P/B) should publish detailed plans as soon as possible on how they expect to achieve a 1x level or better and to continue updating those plans each year.

It appears likely that cash distributions from Japanese corporations will continue to increase from current record levels, spurred by growing shareholder activism amid the ongoing push by the TSE, Financial Services Authority, and Ministry of Economy, Trade and Industry for corporates to improve their profitability. In turn, this should drive an improvement in stock performance for two main reasons. The first reason is that a company buying back stock priced at levels below 1x P/B actually increases its book value per share as a result of the transaction. The second is that a reduction in excess cash holdings leads to an improvement in return on equity (ROE), which tends to increase the valuations at which stocks trade.

We see the outlook for Japanese stocks as very positive. With a starting point of low valuations and a tailwind of rising buybacks and dividends driven by the government and activists pushing to improve profitability, it is relatively easy to envision a golden period for the market going forward.

A cheap-looking stock: thread.

Another super-long thread.

Haven’t gotten around to looking deeper into it.

Original SeekingAlpha writeup, archived here.

I like this company.

BUY.

A short and sweet thesis from HurdleRate substack here.

~15x EV/EBIT, revenue doubling in roughly 3 years since 2020.

5% dividend yield, very high return on capital.

Another one I should look into.

WATCH.

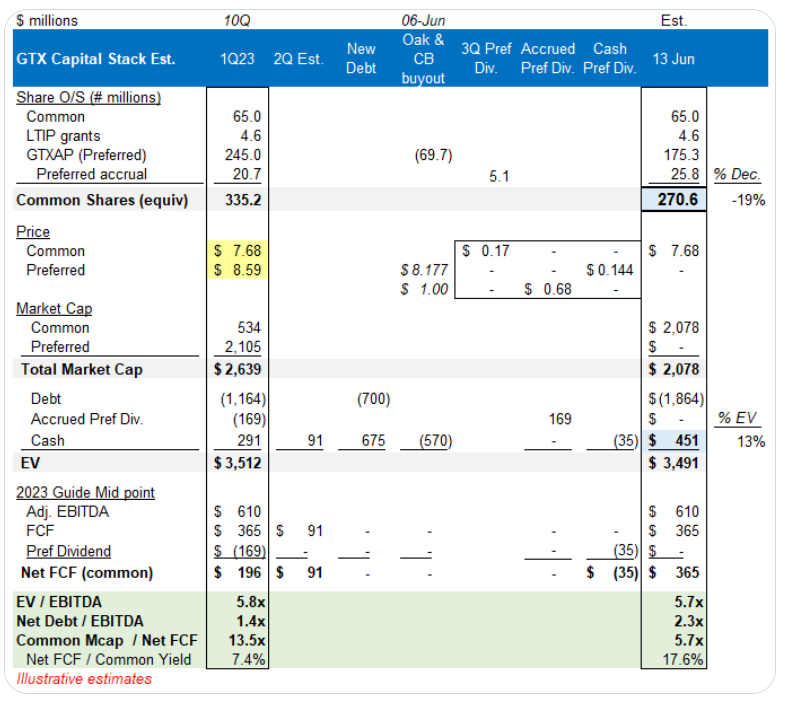

Garrett Motion Simplifies Capital Structure By Converting To Single Class Of Common Stock.

Bunch of tweets:

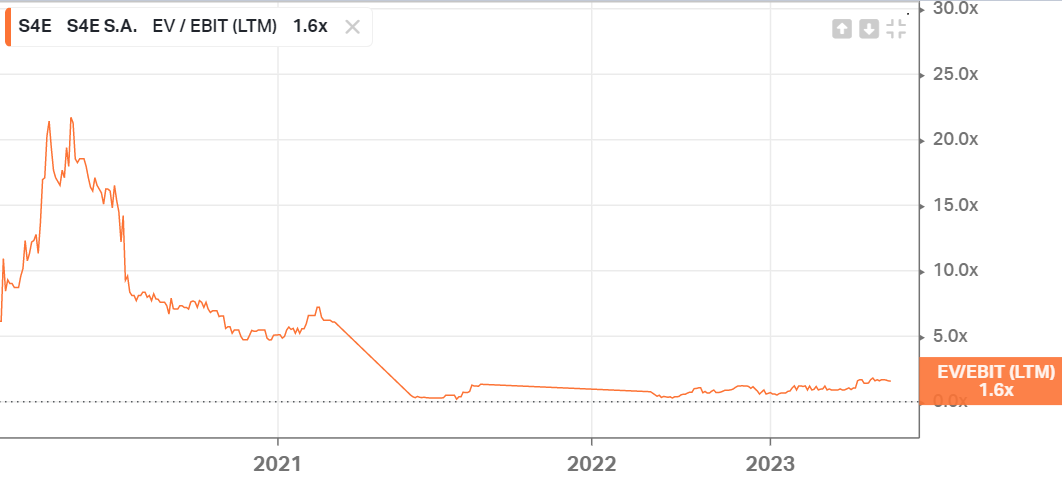

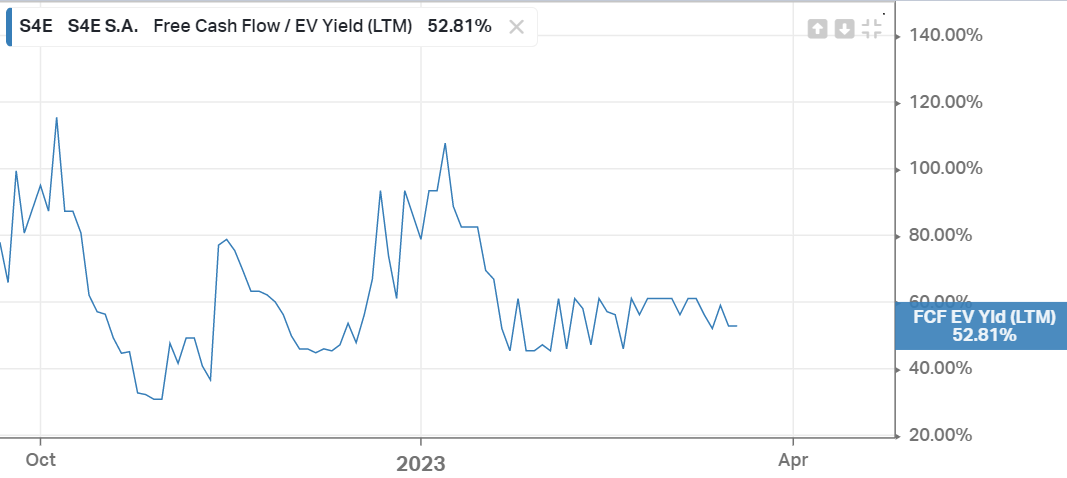

Another seemingly cheap company:

I was slow to move on this one.

Assertio Holdings, Inc. to Acquire Spectrum Pharmaceuticals.

Total acquisition price of approximately $291 million based on Assertio’s stock price on April 24, 2023.

2022-Q4 total revenue of Spectrum: $10M.

Minus $44M in net debt for $SPPI, this puts the acquisition at a 6x EV/Sales multiple. WTF?!

Plus this little gem: “Assertio intends to retain the majority of Spectrum’s commercial team and add operating costs of approximately $60 million annually”.

Needless to say, I’m unhappy. Because I’m stirred up, I can’t act on this news (yet). I’ll wait for more information to come out and I want to see how the fucking ROLVEDON revenues trend.

Apparently the “transaction Expected to Be Accretive to Assertio’s Adjusted EPS and Operating Cash Flow in 2024”. We’ll see about that.

If ROLVEDON doesn’t do $60M+ of revenue in 2023, this is a smelly turd.

Update: I SOLD.. The lack of insider ownership tipped me over the edge.

Disqus comments are disabled.