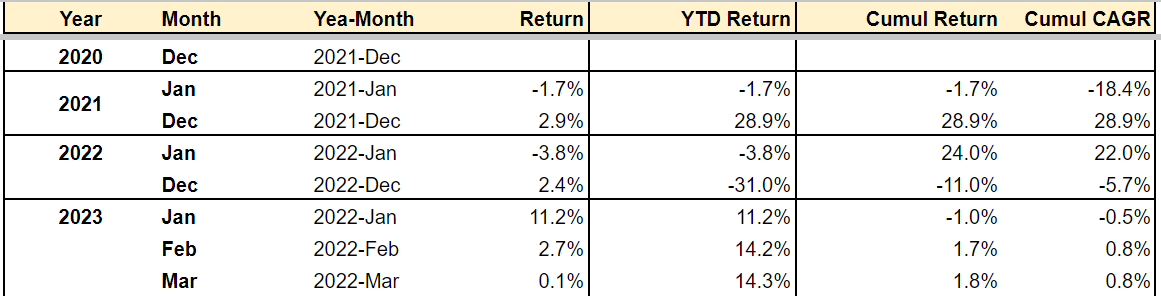

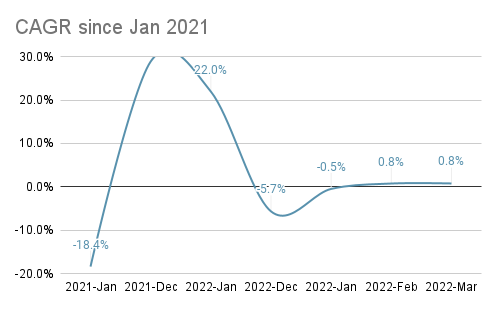

#86 - Portfolio Update, March 2023

Publish date: Mar 28, 2023

Last updated: May 16, 2023

Last updated: May 16, 2023

A tranquil month. I added to positions that I consider cheap (low P/B or low FCF/EV yield).

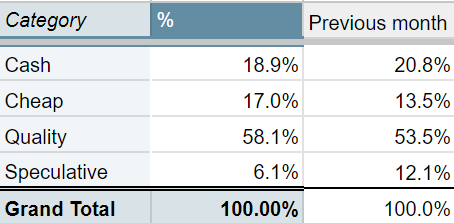

More quality stocks, more cheap stocks, and less speculative crap. Good.

Biggest positive contributors:

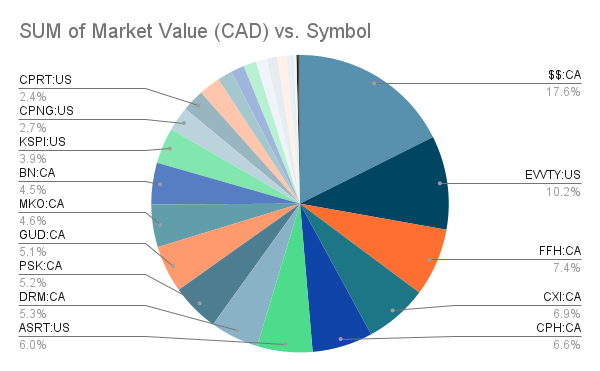

- $EVVTY: currently trading at EV/EBIT~28.5. Not cheap.

- $ASRT: EV/EBIT~6. Listening to the latest earnings call, and despite the recent run-up, this one could still have legs.

- N/A

Biggest negative contributors:

- $CPH.TO: not sure the underperformance is for any specific reason. Still trading at EV/EBIT~3.

- $GUD.TO: disappointing guide for next year. EV/GP~2.9. Not terribly cheap, not terribly expensive.

- $DRM.TO: maybe interest rates remaining higher for longer will put a cap on the upside. We’ll see.

- New:

- $NNI: still some work to do on this one. See my monthly ramblings.

- $6038.HK: very cheap. Wrote it up in my rambling as well.

- Added:

- $CPH.TO: still cheap

- $ASRT: still cheap

- $DRM.TO: still cheap

- $GUD.TO: got cheaper

- Trimmed:

- $MKO.V: I’m trying to get out of the mining business.

- $EMO.V: see above.

- Exited:

- $PROSY. Questionable capital allocation in the past. Not interested in the food delivery businesses.

Disqus comments are disabled.