#85 - Ramblings, March 2023

Last updated: Jun 17, 2023

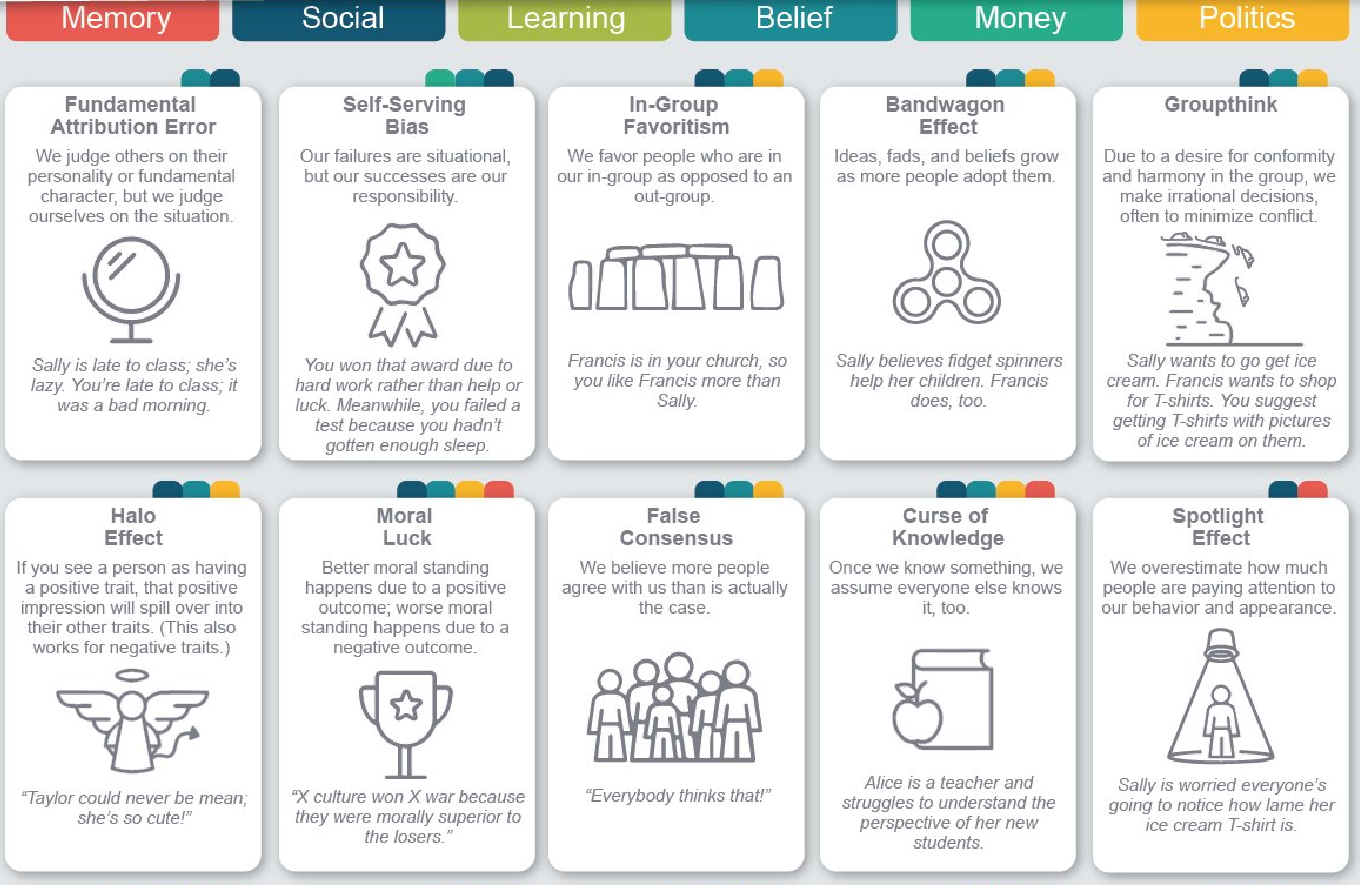

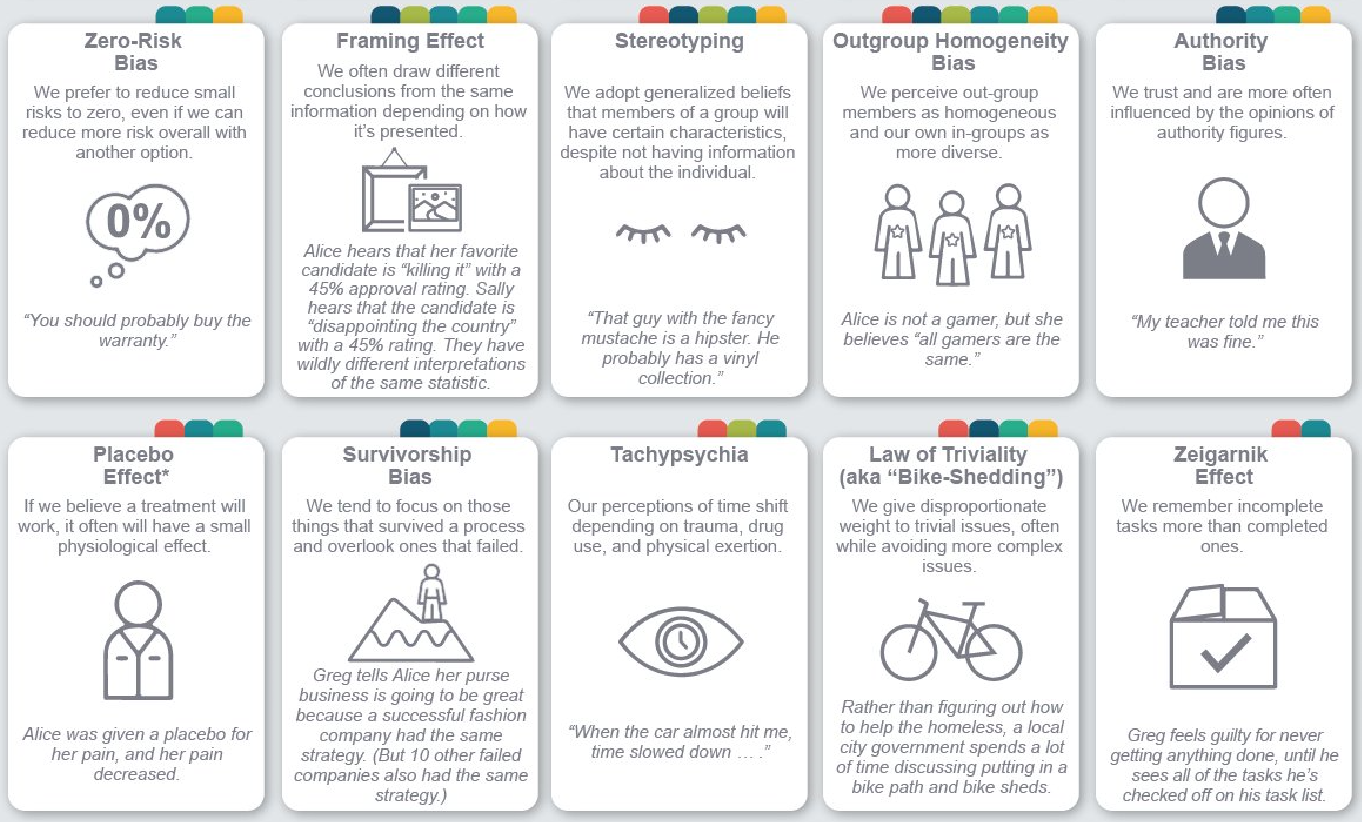

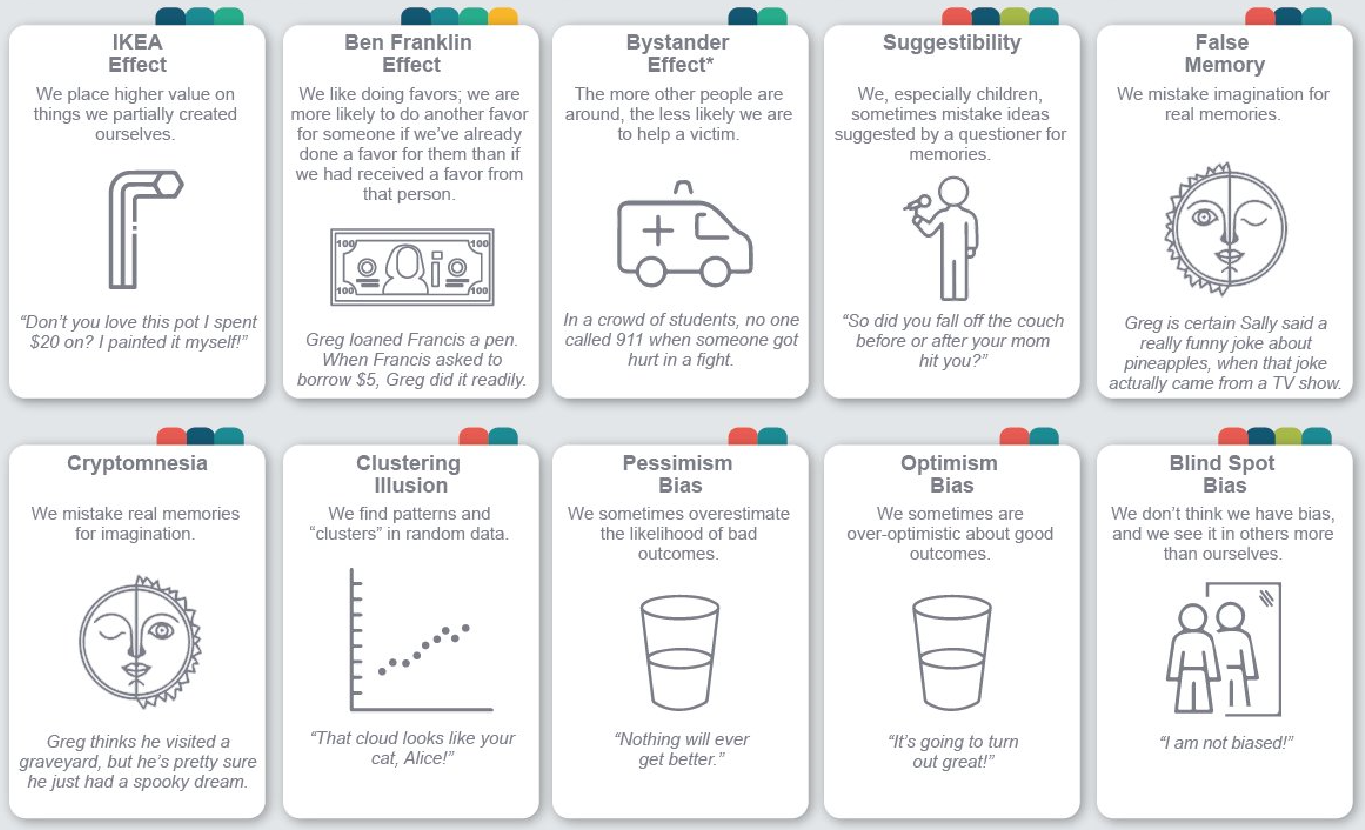

A list of 50 biases, from this tweet:

But 50 is a way too many to remember, at least for me.

So here’s a better mental framework, from the following tweet:

Psychologists have posited hundreds of cognitive biases over the years. A new paper argues that they all boil down to one of a handful of fundamental beliefs coupled with confirmation bias. https://t.co/bDDmNftq7M pic.twitter.com/6jEgsYp9CA

— Steve Stewart-Williams (@SteveStuWill) March 18, 2023

I archived the research article here.

Link.

I only have 1 stock in common with this investor ($EVVTY).

What I found more interesting is their VC investments in the March portfolio update.

In particular, I was intrigued by Asaak.

In another issue, there’s a decent list of stock writeups.

https://www.meetmax.com/sched/event_92581/conference_presentations.html?bank_access=0&event_id=92581

https://www.woodlockhousefamilycapital.com/post/footnotes-to-phelps-100-to-1

A few quotes that resonated with me:

From a customer of Old Dominion:

When I have a problem with Old Dominion, I can pick up the phone and I can immediately get a manager on the phone at almost any place in the country, and they will do everything they possibly can to solve my problem right then. If I call [competitor], I'm lucky if I get anybody, but one one of the regional dispatchers to talk to me. And usually, their answer is there's nothing I can do about it.

From Chris Mayer:

If you spend a lot of time studying businesses all over the world, you would think your circle of competence would widen over time and you would find more ideas. However, it doesn't work that way [...]. Over time, you get pickier. Your checklist grows longer. And so naturally the list of companies that hit all those boxes starts to get shorter.

I couldn’t resist a third one - possibly my favorite of the three quotes:

Pickiness is good for the long haul investor. If you buy something you are not all that enthusiastic about, you are unlikely to hold it for long. You'll be too quick to chase the next shiny spinner that dances across your view. Worse, you'll probably sell what you have at a bad time.

And the final combo:

Buffett: The weeds wither away in significance as the flowers bloom. Over time, it just takes a fe wwinners to work wonders.

C. Mayer: Remember, you don’t get to see the flowers if you keep pulling them before they bloom.

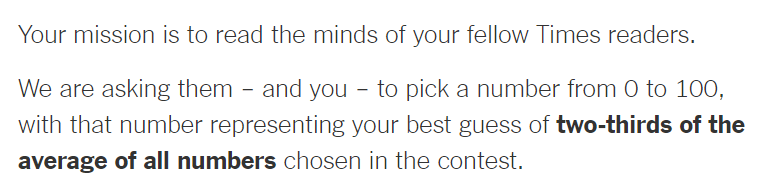

This is from the author of the UndervaluedJapan substack, inspired by the following New York Times puzzle:

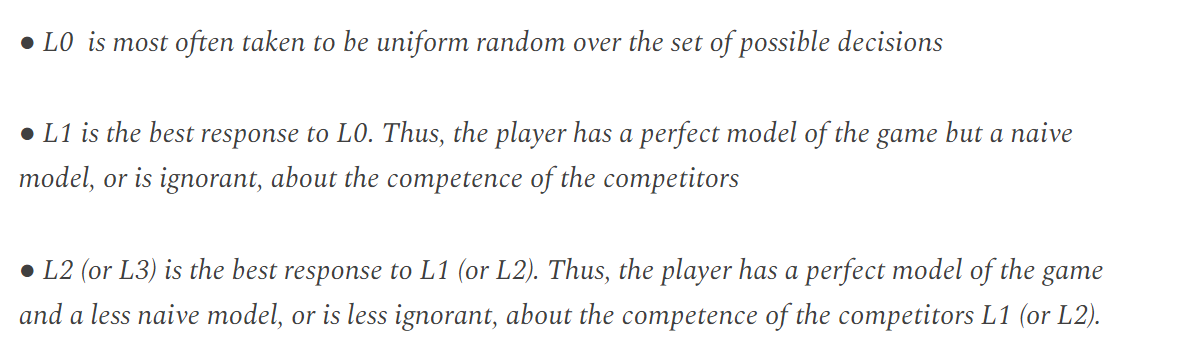

One way to approach this puzzle is to try and figure out at which level the other players are thinking:

What’s interesting is that the average of all guesses is 28, which is roughly halfway between the first order answer (33) and the second order answer (22).

This is probably a good rule of thumb, to be somewhere between L1 and L2. Especially, as the author of the substack argues, if we can pick a game where most people are at L0 (i.e. very cheap stocks).

A big collection of small-cap company interviews: link.

Can’t say that it’s my favorite way of finding ideas (I prefer to start from an existing thesis or from the numbers), but it’s better than watching random clips on YouTube.

A thesis from Nitor Capital here, archived pdf here.

The thesis conclusion:

Using conservative assumptions, one can come up with over $800 million of value that is not present on the balance sheet. Adding in this value implies over $2 billion of equity value for Dream.

Current market cap: $976M.

A quick excerpt from the letter, about Nitor Capital’s approach:

When we look at our investments, we constantly think about how they will impact our net-worth in five, ten, and even twenty years from now, rather than how they will impact our standing with our investors at years end.

Also, a new meandering post from Tyler: link.

I have a tiny position here. I’m out of $USD and The CAD->USD exchange rate kinda sucks at the moment so it might be a while before I can add to it. In the meantime, here are some links worth going over:

-

Why we owned Nelnet from the guys over at ChitChatMoney, archived here.

-

Nelnet shows some skin from the MinsetValue substack.

-

yet another Substack post.

Link with Boston Omaha:

- Adam Peterson is on the board of $NNI.

- $NNI is Magniolia Group’s (the investment fund of Adam Peterson) largest investment.

Anecdotal piece of news: Nelnet is collaborating with fintech company 8B Education Investments to provide up to US$30 million in loans to help African students afford an international degree link.

Full tweet:

#Costain interesting one, strong update today. Profitability 33% ahead of consensus and factoring in the Feb 22 settlement, £72.9m free cash inflow FY. Market cap of £132m. Net cash of c£124m, average month-end net cash of £99.2m. No borrowings. Operating margin expansion ahead

— Baron Investments (@baroninvestment) March 14, 2023

The Wonderful World of Banks - Punch Card Investing: YouTube clip.

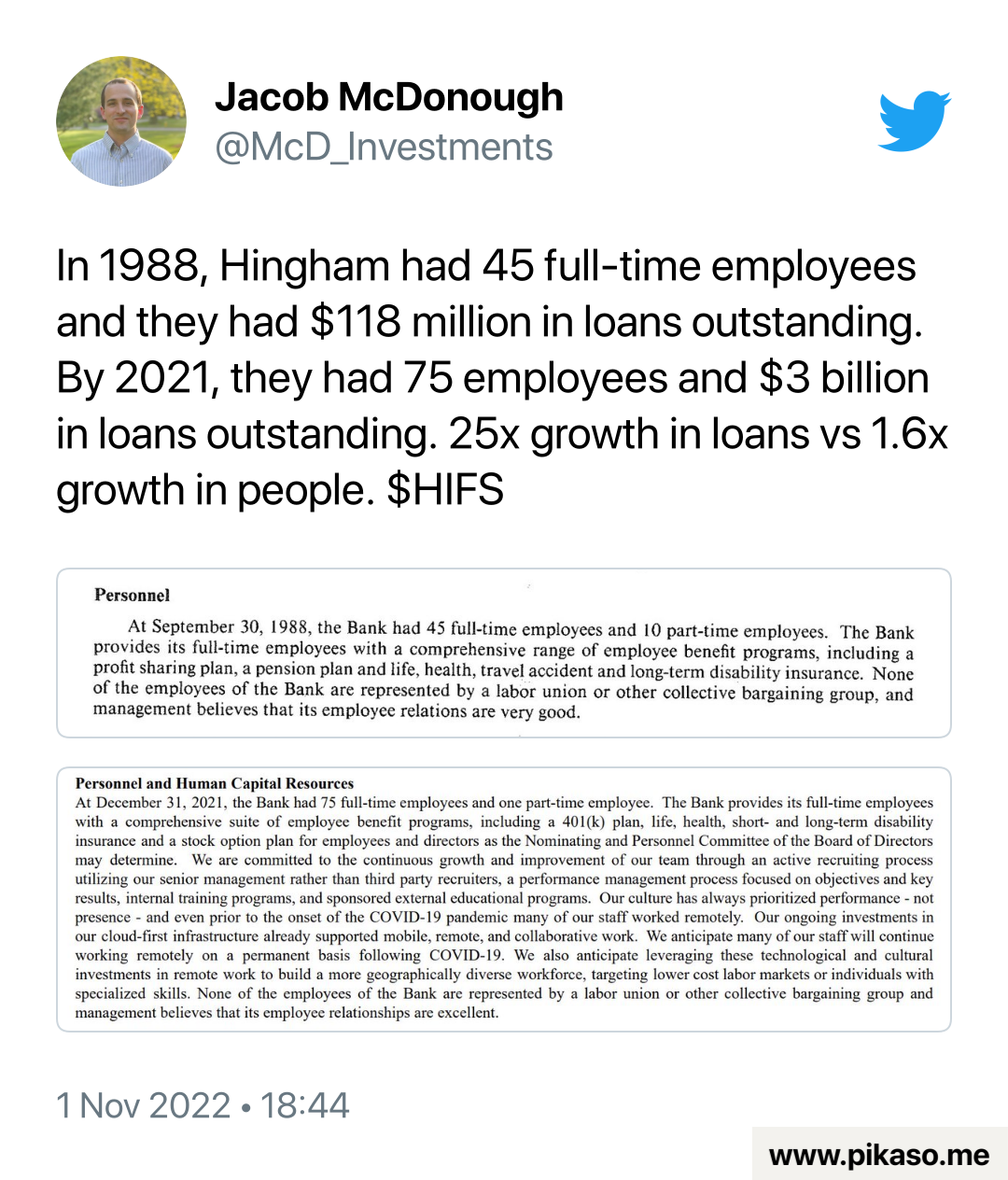

$HIFS looks somewhat cheap, but not crazy cheap either:

Here’s their 2022 annual report and the one from the year prior.

The reason why $HIFS is interesting is the simplicity of their loan book. According to Investing with Tom, they only do residential and commercial real-estate loans.

Here’s a deep dive on the company.

And here is their 2022 annual meeting.

Finally, fun fact: Hingham has infinite deposit insurance.

Another fun fact:

A mention from Colarion LLC, who follows the US banking sector closely: link.

Finally, another writeup title The Bank that Stood the Test of Time and Tides from @findingmoats.

Big buys in the open market by the CEO and the CFO.

Just filed. CEO of Capri buys $240,000 shares worth ~$10m, adding to his $87m position. $CPRI

— Sean D. Emory (@_SeanDavid) March 21, 2023

CFO also buys on the open market. pic.twitter.com/I1Kl1T1b48

Unfortunately, this is a retailer (women’s clothing), and I don’t understand / am not attracted to that industry.

Long and detailed writeup: link and archived pdf.

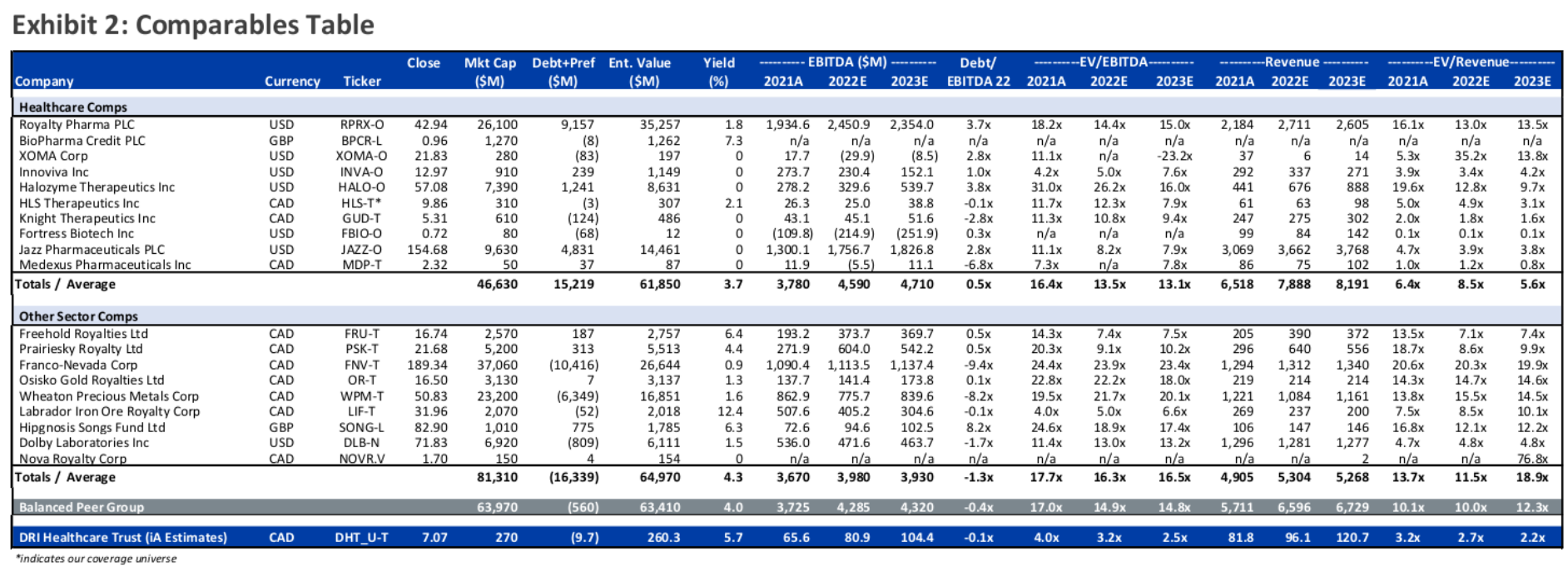

I might take a second look at some point, but I’m already quite heavy on healthcare-related stocks, and the numbers didn’t jump out at me.

https://twitter.com/Picolinie/status/1595104854711873537

A writeup on the company on Picoline Capital substack (@Bastiaan on twitter), archived here.

I like the business model but at EV/EBIT~17, it’s slightly expensive. Would love it below 15.

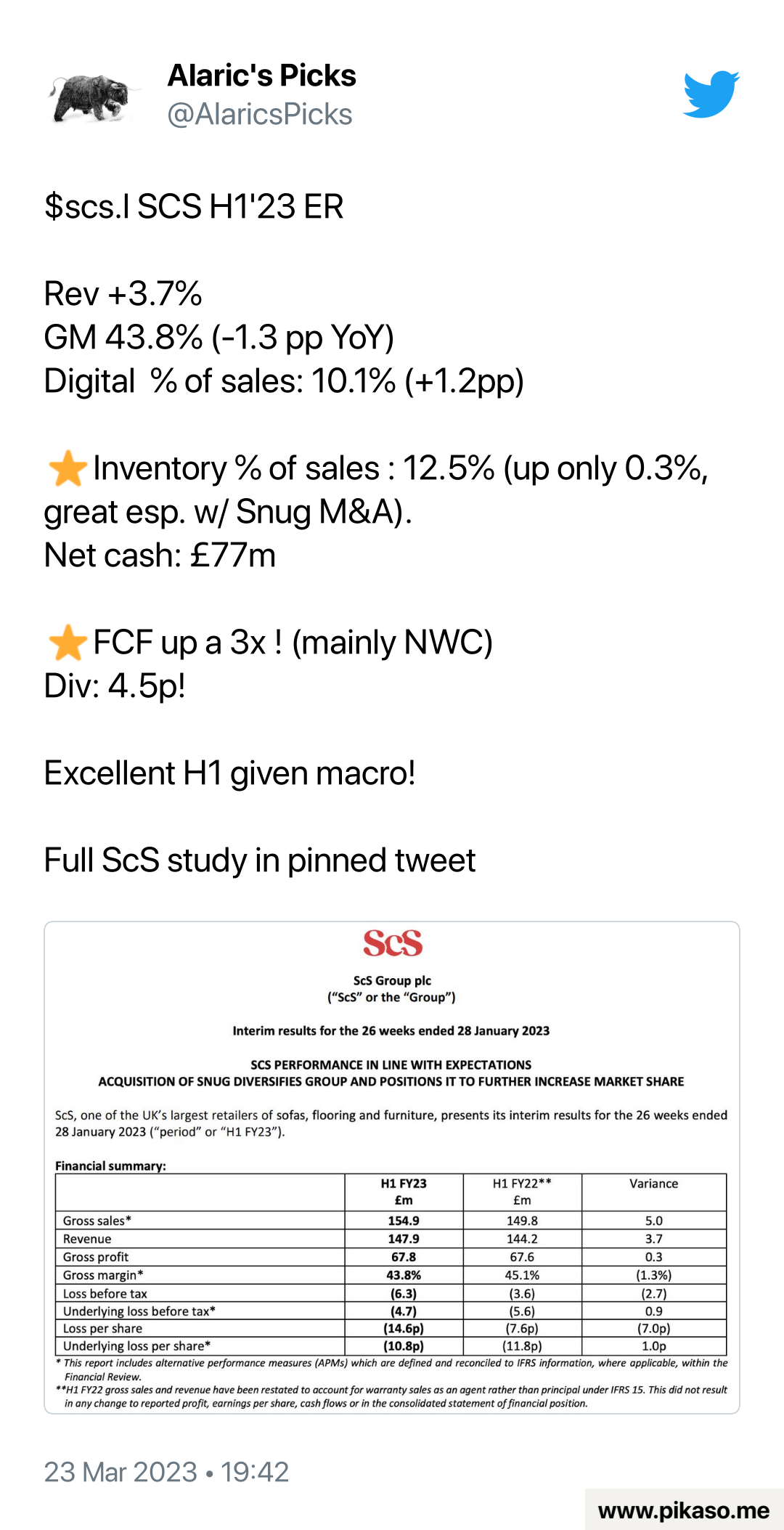

This tweet caught my attention:

From Yahoo Finance:

ScS Group plc, together with its subsidiaries, engages in the retail of upholstered furniture, flooring, and related products in the United Kingdom. Its stores offer various furniture products; and flooring products, such as carpets, rugs, wood, and laminate and vinyl tiling products. The company provides sofa products under the La-Z-Boy, G Plan, SiSi Italia, Celebrity, and Endurance brands, as well as third party brands. It operates through a network of 98 stores. The company also sells its products online through its Website, scs.co.uk.

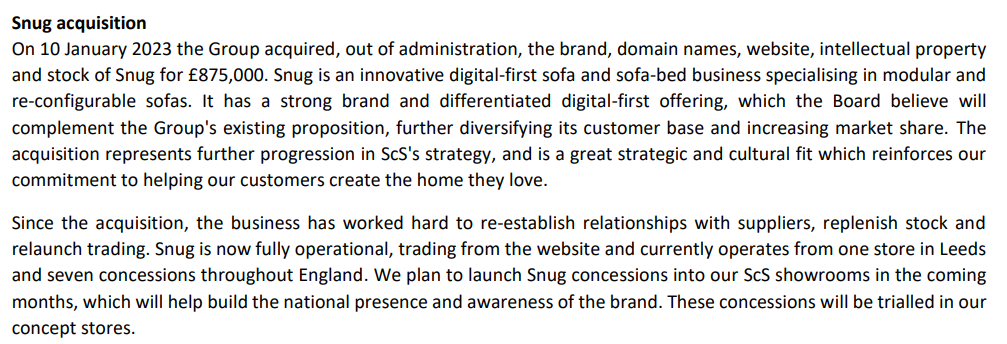

Their latest interm results are here and a full thesis has been written up here.

Interesting acquisition:

A few numbers:

- EV/GP ~ 0.6

- P/B ~ 1.6

- Div yield ~ 8%

- EV/EBIT ~ 5

- Avg ROE ~ 28%

Interesting business model (from the writeup above):

SCS runs a negative working capital model, paying its suppliers up to 2 months after a product was shipped to its distribution warehouses; while receiving down payments right after a sale from customers who do not use financing options.

Also positive:

Stock-based compensation is very low, at around 0.2% of sales with a maximum of 0.5% in FY 2021. Finally, over half of management remuneration is linked to a long term incentive plan paid out in shares, measured by EPS results, aligning management with clear shareholder incentives.

Unfortunately:

Yet, executives hold less than 1% of total shares.

I’d much rather be invested alongside insiders. The upside is also not mind-blowing (100M fair value according to the writeup, vs 64M currently).

PASS.

https://www.reddit.com/r/pennystocks/comments/r0di5c/deep_dive_into_dri_healthcare_trust_dhtun_dhtu/

A decent deep-dive from Fairway Research but I couldn’t get excited for this one.

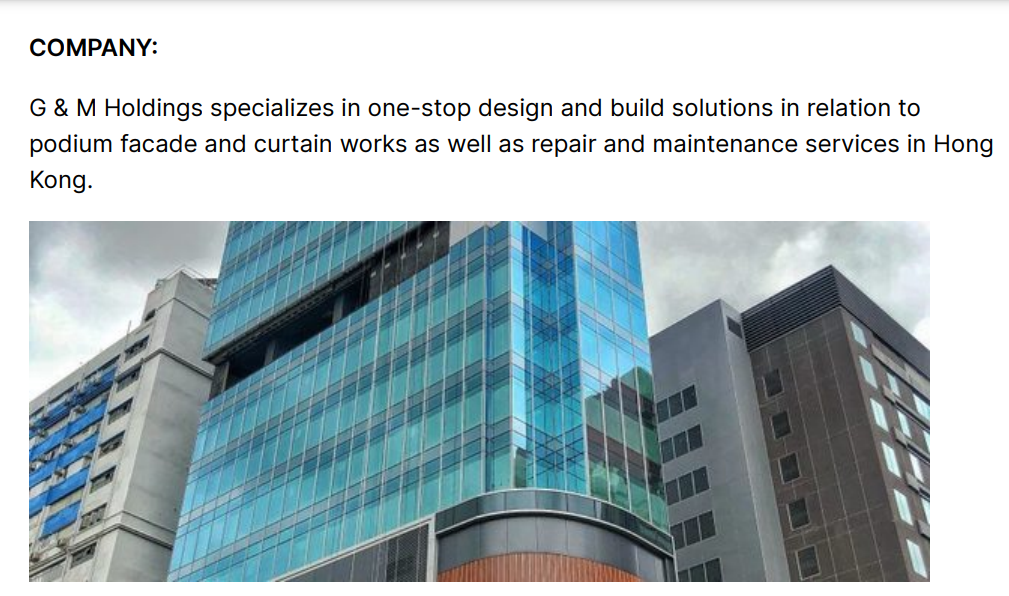

Revenue is from podium facade (mainly), curtain walls, and repair and maintenance services.

Podium façade generally refers to the exterior of the podium section of a building, which is usually supported by metal frames and other structural materials fixed onto the concrete part of the building. The system and design involved in podium façade works are usually more complex and irregular and different kinds of materials are usually applied. Common materials used in podium façade works include glass, granite, aluminium, steel and other cladding materials.

A curtain wall is an outer covering of a building in which the outer walls are non-structural, designed only to keep the weather out and the people in. Because the curtain wall façade carries no structural load beyond its own dead load weight, it can be made of lightweight materials (wikipedia).

Full thread:

One of my HK stocks, G&M Holdings (https://t.co/1ltviPgUaM), just published its full year results. This is laughably cheap at current levels: 3.3x PE, negative enterprise value and 12.3% dividend yield https://t.co/f0S71mzHiq

— Generals & Workouts (@gw_investing) March 22, 2023

A simple investment thesis can be found here; credit goes to thewhitetiger.

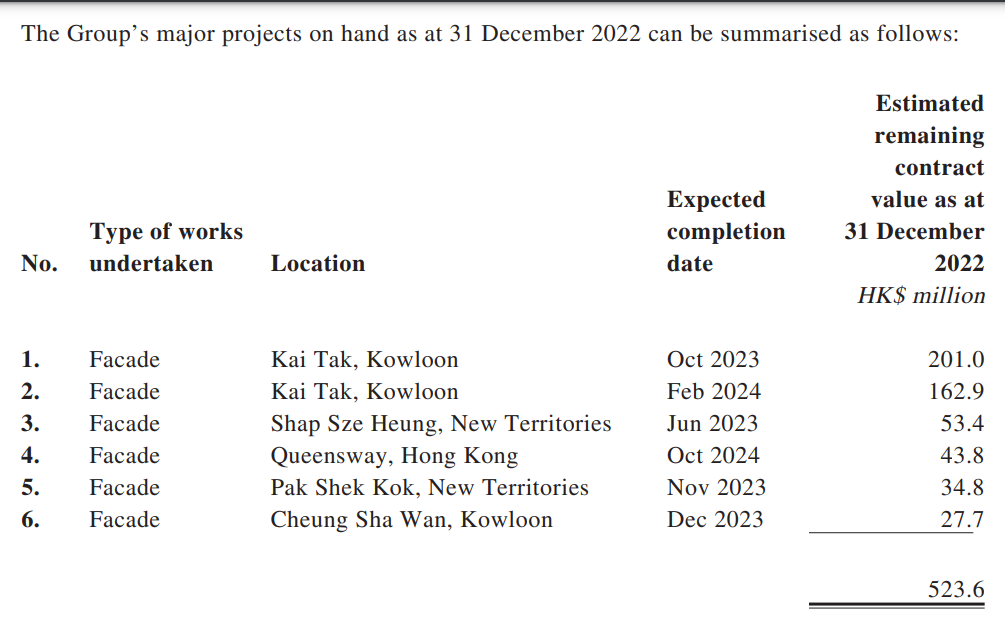

In 2022, revenue was HK$382.8 million and profit was HK$43.4 million (vs HK$403.2 and HK$36.8 in 2021). No debt. Market Cap HK$184M. Enterprise value: close to zero (HK$38.8 million in cash and HK$140.0 million in fixed time deposits that over three months with interest rates ranging from 4% to 5.2% per annum).

Dividend to be paid for Y22: HK1.8 cents per share (~10% yield) or HK$18 million.

From their recent 10K:

The Group’s outstanding contracts on hand as at 31 December 2022 amounted to approximately HK$578.9 million, while the Group has been awarded two podium facade contracts with contract sum of approximately HK$388.1 million in January 2023.

Noteworthy:

The Hong Kong government have promulgated a series of policies and incentives to drive Hong Kong back to a business and tourist destination for the international community.

Intrigued by the whitetiger’s portfolio, I checked this other holdings of theirs.

-

SEK$1102M in the investment portfolio

-

SEK$79.8M in the associated companies

-

SEK$126M in properties (conservative)

-

SEK$9.7 in short-term investments

-

SEK$59.8 in liquid funds

-

SEK$6.2 in LT liabilities

-

SEK$25.2 in ST liabilities

Excluding the real estate, tangible book value should stand around SEK$1.2B.

Current market cap is SEK$1.06B.

I’d like a bigger discount.

Their 2022 year-end report is here (english version [(here)])(https://drive.google.com/file/d/1bJHLFGN9n0Rgvq_qC7U17OaSh3tz79oh/view?usp=sharing)).

Note: there was some insider buying January of this year (link) and throughout the past year.

https://altaycap.substack.com/p/super-cheap-japanese-stocks-42-names

Investing in a statistical fashion doesn’t really do it for me, and I don’t know if I’ll be able to go through all 42 names.

But the link above brought me to this writeup on Nippon Ichi Software NiS $3851:JP. Interesting company, similar to Nihon Falcom $3723:JP in some ways. It trades slightly below book value and around 4x EV/EBIT. The jist of the thesis is that the downside is capped (P/B below 1) while it would only take one big hit to unleash massive upside. There is high insider ownership from the founder who recently came back as president.

Could be interesting, I’d need to get a sense of how the sales of Disgaea 7 are trending and how management is thinking about shareholder returns.

From there, I wandered to this other Japanese-oriented substack, and in particular this thesis on Nitto Kohki, a company with long record of profitability trading at ~0 EV. The problem I have with this one is: I don’t see what the catalyst is to unleash upside. In the previous example, growth was a potential catalyst. In the other cheap name I own ($6038.HK), I don’t really need a catalyst, since dividend yield is already at 10%.

I found this thesis on Yodogawa Steelworks 5451:JP more appealing. This is a Japanese steel company located in Osaka. It’s unfortunate that I didn’t catch this one earlier, as it is up 10% already YTD.

I’ll keep it on the watchlist, just in case.

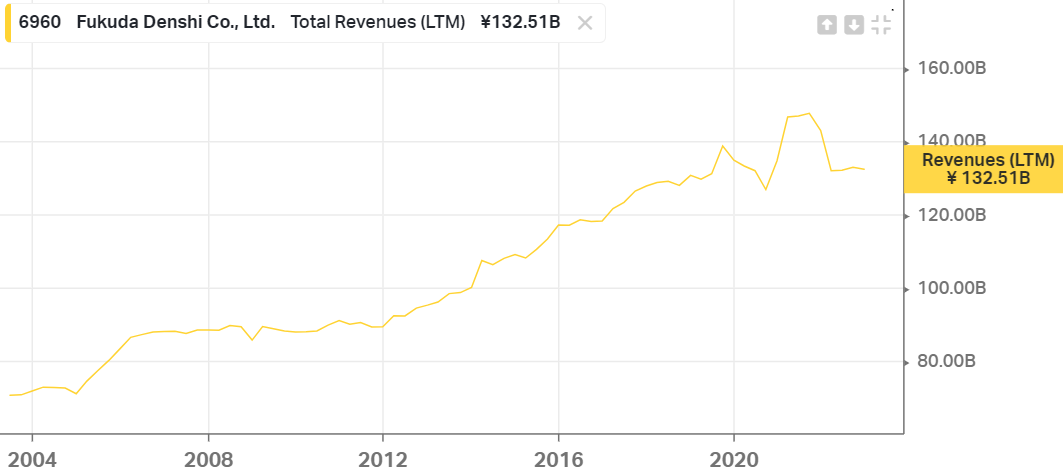

Slightly more interesting was this writeup on Fukuda Denshi, from the same author. This is a well- established and leading Japanese medical device manufacturer, having strength in equipment related to the cardiovascular system.

A few charts from Koyfin will explain what piqued my curiosity:

.png)

.png)

.png)

Some excerpts from the writeup:

From 2000 to 2022 EPS increased by a CAGR of 7% p.a., from ¥ 111 to ¥ 535. Since 2012 the momentum accelerated significantly to 13% p.a.

FCFPS, or owner earnings, increased at 6 % p.a. over a period of 22 years, matching growth in EPS and OCFPS.

Fukuda Denshi has long centered its growth strategy around the home care business, providing rental services for oxygen concentrators, home-use mechanical ventilators and equipment used to treat sleep apnea syndrome.Thus, the company is well positioned to keep profiting from the secular trend “Away from Hospital towards Home Care”.

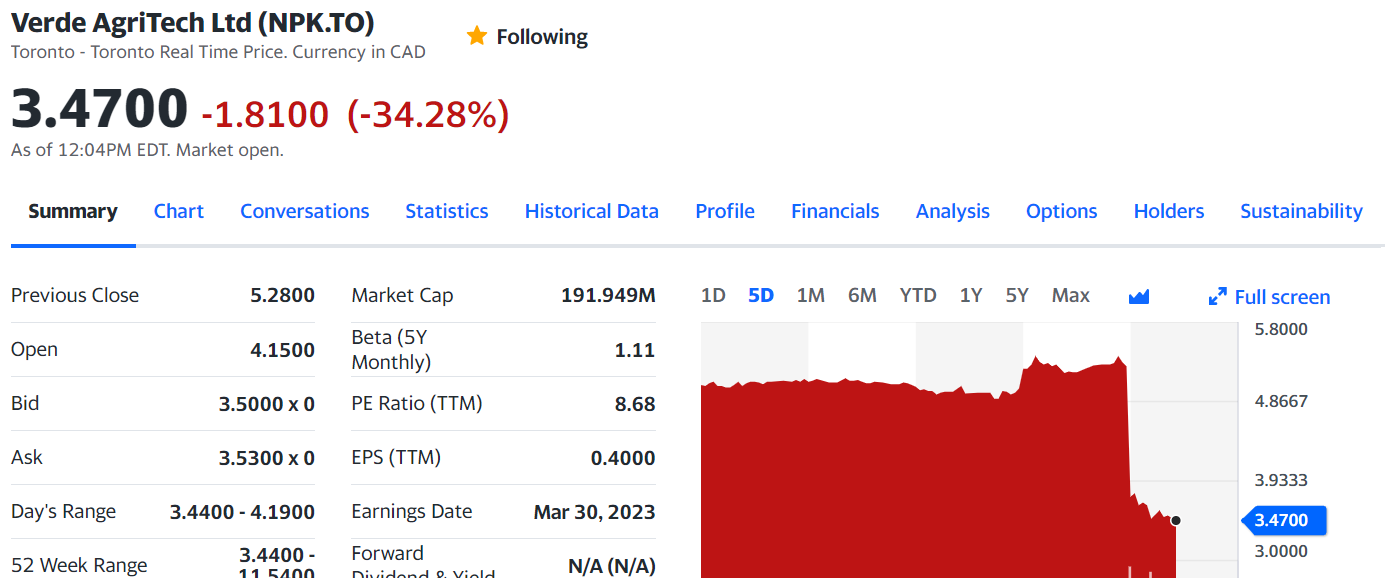

Looks like I dodged a bullet on this one.

Lot of hype, I was tempted, but then again…wtf do I know (or care) about potash.

Detailed notes from a conscientious $EVO shareholder: link.

A new interview: link.

The company is trading slightly below 1 EV/S, but gross margin is mid-teens…

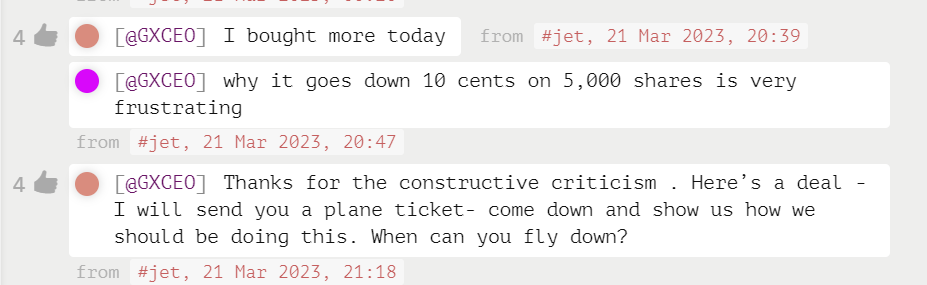

The CEO might not my kind of guy (link):

Disqus comments are disabled.