#84 - Portfolio Update, February 2023

Last updated: Apr 28, 2023

Cruising…

- Three new entrants (Coupang, Kaspi, and Nintendo).

- Less oil in the portfolio.

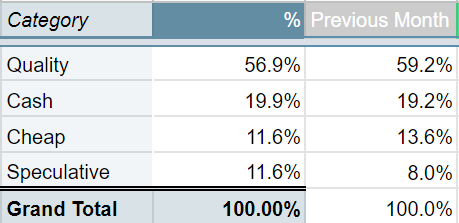

Portfolio composition:

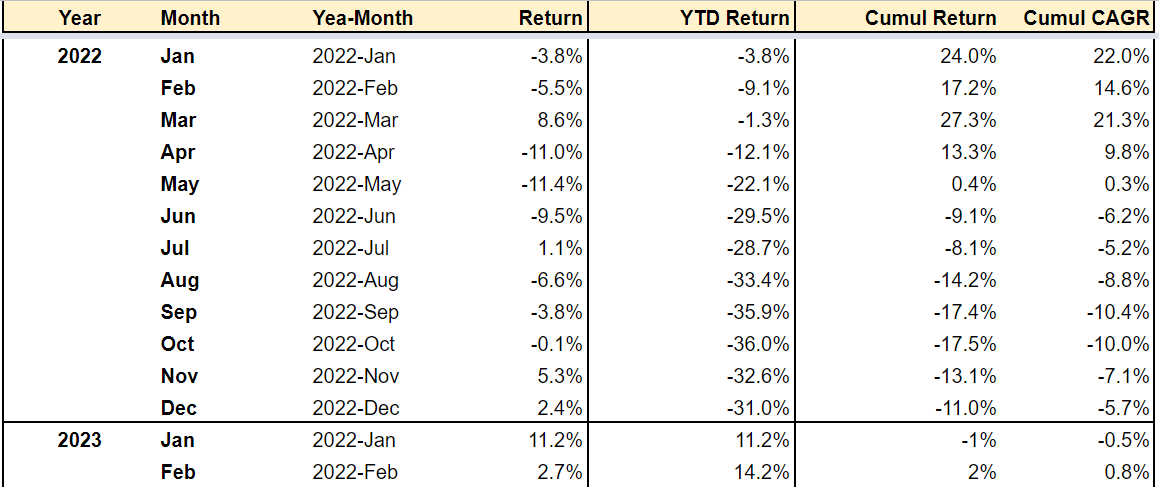

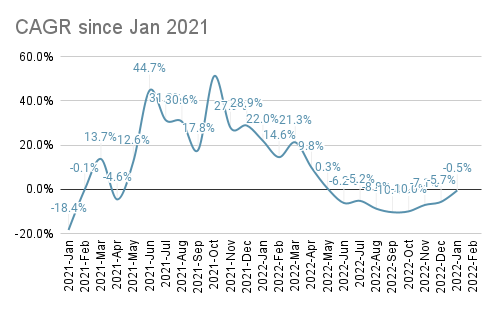

note: CAGR is time-weighted, not dollar weighted.

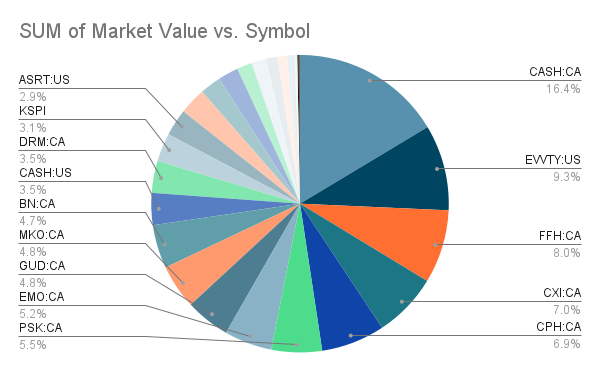

Biggest positive contributors:

- $ASRT: still cheap imo

- $EMO.V: not really sure whether I should keep this one or sell it…

- $FFH.TO: lots of good things materializing over there

Biggest negative contributors:

- $BN.TO: I’m willing to ride this one out onto the sunset

- $MKO.V: temporary underperformance I think

- $PROSY: I should do an update on this business

- New:

- $KSPI.IL

- $CPNG

- $7974 (Nintendo)

- Added:

- $CPH.TO

- Trimmed:

- $PSK.TO

- Exited:

- $TPL

- I trimmed $PSK.TO as it was getting rather big compared and not exactly cheap either. I used the proceeds (and some) to add to $CPH.TO, for the following reasons:

- No debt, net cash ($27.5M as of 2022Q3, probably closer to $30M now)

- The FCF yield to EV is 40% (yield to MC is 17%)

- Revenue seems stable

- There is some optionality in the product pipeline

- CEO is actively looking for an acquisition at the right price (doesn’t want to repeat the mistakes of the past)

- $KSPI.IL is a new position for me. I wish I bought it much earlier, but I wasn’t familiar enough with my broker’s user interface to do so (the stock is listed on the London International Order Book). I’m very happy to finally have this company in my portfolio!

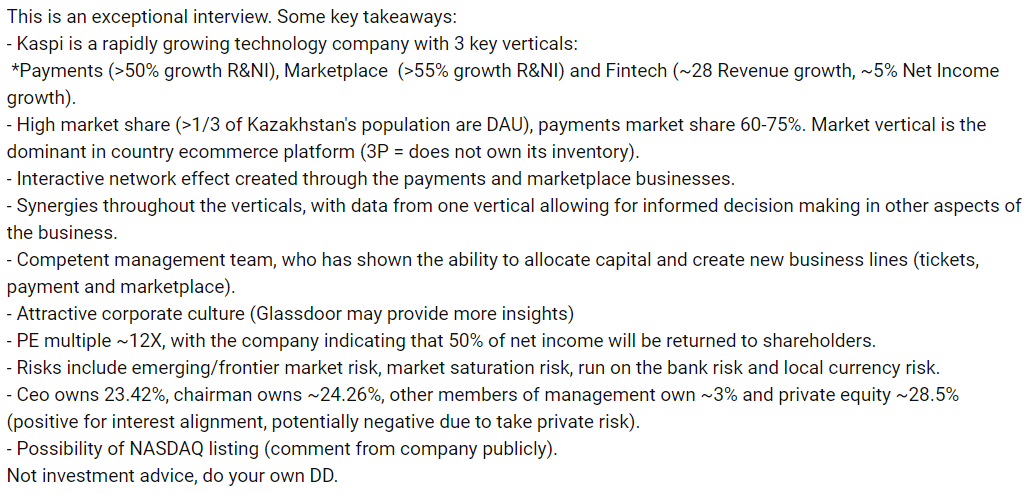

Here’s a summary of the thesis, taken from a comment under this YAVB interview with Artem Fokin:

Also of interest, here’s the presentation by Mikhail Lomtadze at the international forum Digital Almaty 2023.

I completely exited $TPL. I could have done it earlier as well. It’s not cheap, and management is not just misaligned with shareholders - they are ANTI shareholders. I’ll be happy to re-enter if it gets cheaper and management is changed.

I purchased a small stake in $CPNG Coupang. This looks like an exceptional company, led by an outsider-level CEO, at a reasonable price (1.x EV/Sales).

Maybe the timing is wrong but…I don’t do that shit anymore. Zero fucks given to macro and timing. Winners win.

Here’s some praise for this company:

Yet another deep dive into the company comes from The Generalist.

Disqus comments are disabled.