#83 - Ramblings, February 2023

Last updated: Feb 3, 2024

A great post from Rachel Zimmer on entreprneurship. Reproduced without permission, original here.

1/ ambition & urgency trump. Anything is learnable to those that have a crazy growth mindset, relentless ambition and an attitude of inevitability. Additionally, a healthy dose of naivety, paired with smarts & intellectual curiousity, can go a long way. cc Matt Clifford

2/ identify + advise + invest. To be an effective Talent Investor, there are three critical competencies including identifying, advising and investing. Know your spike(s) and where you need to fill in the gaps. cc Alice Bentinck

3/ distribution > ideas. As a founder, you really need to have an unfair advantage to build your business which often comes in the form of better distribution vs your competitors. cc Jack Abraham

4/ go after a really, really big market. All things being equal, building in a big, hot market stacks the odds in your favour. Despite this being a truism in VC, it’s surprising how many folks don’t really lean into this! cc Don Valentine (Sequoia Capital)

5/ team > idea. Trust and respect are the underpinning of a high performing team. Trust = [ credibility + reliability + intimacy ] / self-orientation. cc David Au-Yeung & Tom Shinner

6/ change is hard but inevitable. Effective change takes exceptional org alignment via = vision + skills + incentives + resources + action plan. cc James Chiswell

7/ VC is only one path to build. Though it has the potential to be a great path, it’s a very specific one. You can also build a business that creates massive value and brings you a ton of happiness in other strategic ways. cc Bram Warshafsky

8/ regardless of the path, the hardest part is to just KEEP GOING. Shout out to Matt & Alice for their relentlessness in building Entrepreneur First. You’ve been at it for over a decade and your impact continues to compound, building an institution with a portfolio worth over $10B (and counting!).

I have none.

Not only that, I finally feel like I understand what Buffett means when he says that he doesn’t care about macro.

It doesn’t matter. What matters is finding great companies at good prices. Macro concerns are irrelevant to those.

“De minimis non curat lex” <- the law doesn’t concern itself with trifles.

Hallelujah!

From a twitter account that is into value investing and fitness:

Factors that lead to success:

-

An average level of commitment and personal fortitude. A baseline level of discipline and general enjoyment in being active.

-

A social, work and family life that allows for manageable stress. Not a time factor. We all have the time. But we don’t all manage stress the same.

-

An understanding that there will be trade-offs to make. How many and how intense will depend on your goals.

-

The ability to communicate effectively.

-

Ability to think long-term. This is hard for humans. We rationalize problems with short-term solutions.

-

Elaborate on 5. Consistent and sustained application. Long-term thinking flushes out bad days.

-

Acquiring knowledge before results. Asking questions and understanding the why.

-

Find staple meals you like and ride the shit out of them.9. A healthy relationship with alcohol.

-

If less motivated, a defined goal that is beyond monetary commitment.

This is just too funny, I couldn’t resist saving it 😂:

Lyrics: link (Italian + English)

I interpret these lyrics with a stoic angle: discipline is the fight, distractions are the invader, death is saying NO.

What do you see—an old woman or a young woman?

Hint: The old woman’s nose, mouth, and eye are, respectively, the young woman’s chin, necklace, and ear.

Mind-sets are quick to form but resistant to change. The amount of information necessary to invalidate a hypothesis is considerably greater than the amount of information required to make an initial interpretation.

This perceptual bias is reinforced by organizational pressures favoring consistent interpretation; once the analyst is committed in writing, both the analyst and the organization have a vested interest in maintaining the original assessment.

Source: Psychology of Intelligence Analysis

From wikipedia: “Morita therapy seeks to have patients learn to accept fluctuations of thoughts and feelings and ground their behavior in reality.”

This is contrast to the typical Western reflex of trying to supress unwanted feelings or thoughts - or at least I can say that it is a reflex of mine.

Cure is not defined by the alleviation of discomfort (which the philosophy of this approach opposes), but by taking action in one's life to not be ruled by one's emotional state.

People don’t have ideas. Ideas have people.

The problem with people who read a little bit but not enough is that they might think some of their ideas are their own.

Ideas are like viruses. They find a host, make themselves at home in their mind, and multiply in their brain until the victim believes these ideas are the product of their brain.

Reading a lot allows one to know what big ideas have been circulating for decades, if not centuries or millenia. And instead of reinventing the wheel, we can instead stand on the shoulders of giants and take their ideas slightly further.

Apparently, there were 4 big philophical streams in the times of Plato:

- cynics: those are useless assholes

- skeptics: not assholes, but with limited usefulness

- epicureans: useless but fun

- stoics: useful, but limited fun

Out these four, the only philosophy of life I find interesting to study deeper is stoicism. Many stoics are highly successful people - that’s almost by design. Disciplined, willful, efficient.

But I’m not a stoic, although I’m open to stealing some of their ideas.

I’m more of an existentialist - more specifically the Camus version. I found this excellent article/video on the subject: link.

Freedom and love are the two core values in this philosophy. Love is the missing part from stoicism, which makes it too “dry” for my taste.

Charlie Munger:

“I regard Alibaba as one of the BIGGEST MISTAKES I ever made. In thinking about Alibaba, I got charmed by their position in the Chinese internet and didn’t stop to realize, ’they’re still a gawd-damned retailer.’”

Link to audio.

I wrote about it last month. I didn’t act on it. It doubled in less than a month (+26% just today) 🤦🏻♂️.

Lack of discipline leads to lack of energy. Lack of energy leads to lack of deciciveness. Lack of deciciveness leads to missed opportunities.

From this SA writeup

“a self-induced turnaround after abandoning an unforced merger”

“complete failure to have a sponsor bank agreement in place just in case the merger didn’t go through”

“they would have to extend their current sponsor bank arrangement at unfavorable terms simply to cover the reality that they did not have another option in place”

“As rates changed the world, so it seems they changed Luvleen’s opinion. And the people surrounding her.”

Not an outsider-type management.

Despite looking cheap, this is a PASS for me.

$CPP.L CPP Group

Left for dead. Going through a turn-around (remember what Buffett said about these: they seldom do).

Still, could have some potential - but will take some time.

**PASS**

Casinos in Portugal. Seems too good to be true, but I can’t buy it on IBKR!!!

INTERESTING

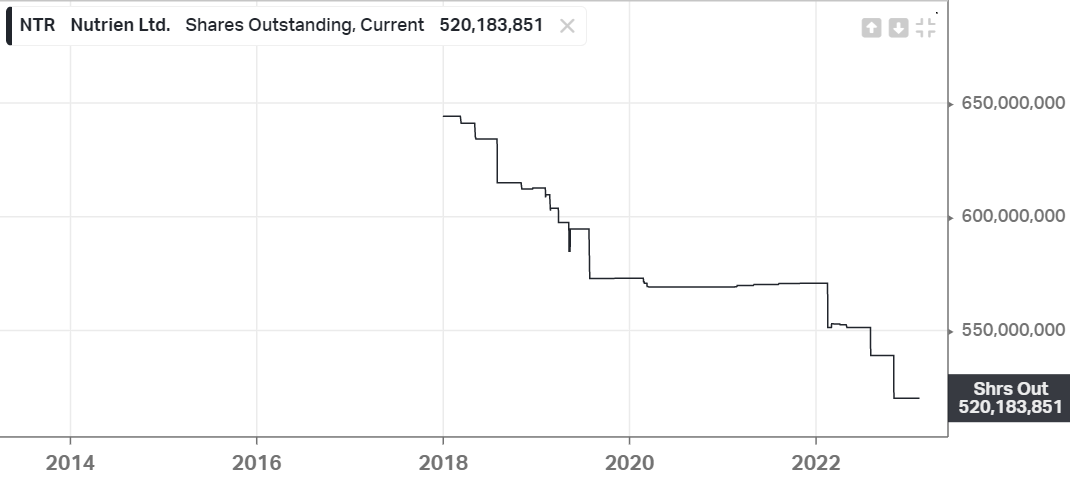

Brought to my attention by this tweet.

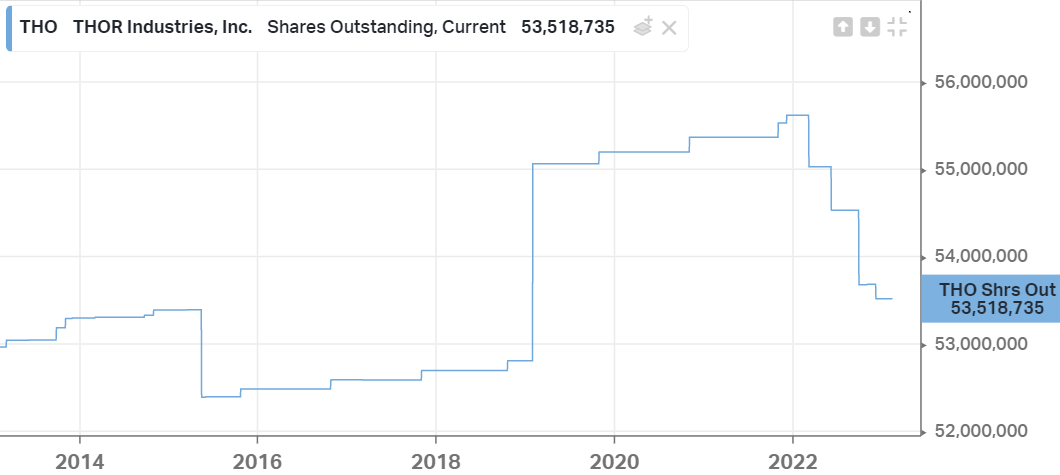

Aggressive buybacks:

I have a hard time getting excited about these commodity stocks, but who knows…

INTERESTING

Price just got smashed after reporting revenue and earnings declines.

I just don’t know if I can understand this business/industry.

PASS

A compounder at a reasonable price?

Quick take here.

Then again…it’s a $100B market cap…

INTERESTING

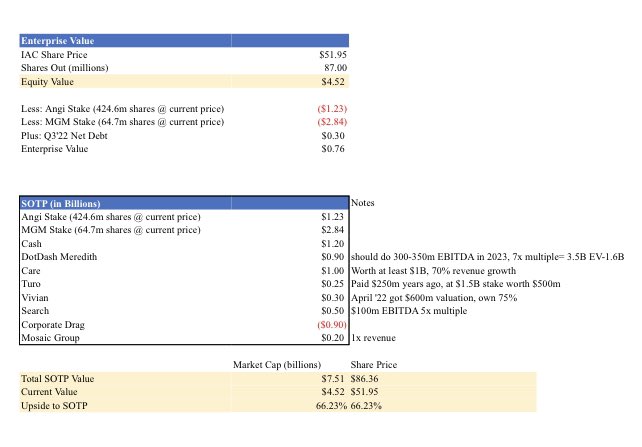

A 100+ page investment thesis from crossroadscap: link.

For what it’s worth, I find 100-page investment thesis borderline crazy. Still, the stock is really cheap. I nibbled.

On VIC: another writeup

BUY

Insider buying: link

Too hard for me. This guy knows.

PASS

https://twitter.com/davidhpolansky/status/1624117691840712704

Quickly looking at some Koyfin stats, doesn’t scream cheap to me.

PASS

I missed the bottom but if it goes into the 70s again, I’m snatching this baby.

Looks pretty INTERESTING…

Found on twitter:

So much complexity for ~60% upside? Meh. I’ll PASS..

Interesting Polish company, market leader of the Polish waste management sector, compounder at a reasonable price.

Found it through this twitter thread.

East Value Research wrote another short overview in early 2021.

Interesting valuation-wise…but potential for growth seems to be limited.

PASS..

Throught the East Value Research website, I stumbled on this other company called Krka.

They are one of the world’s leading generic pharmaceutical companies. Their medicines are used to treat more than 50 million patients every day in over 70 markets.

Their production and R&D facilities are in Slovenia, Croatia, Germany, Poland, the Russian Federation and China.

It’s unfortunate that this is not a company I can easily understand, so I have to pass even though it looks pretty good from a valuation perspective.

PASS.

Looking for the company above, I typed “KRKA” in the search bar of Koyfin, by mistake.

This is a completely different company, called Koç Holding, based in Turkey.

In fact, Koç Holding is Turkey’s leading investment holding company and the Koç Group is Turkey’s largest industrial and services group in terms of revenues, exports, number of employees, taxes paid and market capitalization on Borsa Istanbul.

There are 12 publicly listed companies within the Koç Group, accounting for approximately 85% of its net asset value.

This is a massive company, representing 8% of Turkey total GDP, across many different industries.

Just too hard for me, unfortunately.

PASS..

Here’s a fantastic read from Compounder Fund: link.

Quote from Coupang’s CEO:

If we wanted to provide something that really mattered to customers — 100 times better, exponentially better — we had to go through an enormous amount of change. We had to change our entire technology stack, the way we did business, our business model. I think that was the most difficult, but the choice that I’m most proud of.

This company is very impressive, to say the least.

Here’s another outsider-like mindset:

In a market where the industry standard is a six-day workweek, we were the first to establish a five-day workweek for our drivers, even as we became the first major service to provide deliveries to customers seven days a week. We also hire our own drivers, Coupang Friends, directly, and provide them with paid time off and full benefits. The vast majority of drivers in the industry receive neither. Additionally, we are planning to grant up to a ₩100 billion, or approximately [US]$90 million, of restricted stock awards to our frontline workers and non-manager employees. We believe we are the first company in Korea to make our frontline employees stockholders.

This SA article explains that at Coupang’s scale (18m active customers out of a TAM of 37m Korean online shoppers), future growth will mainly come from:

- International expansion (Japan or Taiwan)

- Increasing customer adoption and engagement across more offerings

BUY.

I wrote a bit more about this purchase in my monthly ramblings.

The biggest risk I see here is an inability to expand internationally.

A few tweets that recap the story:

$JOB the main problem short term is that management is not aligned with shareholders. From 10Q this is the criteria for future compensations. They want growth in Adjusted EBITDA and revenue, rather than short term stock appreciation. Their compensation is tight to growth only. pic.twitter.com/s17mcDWJcS

— Spanish_investor (@spanish_invst) February 15, 2023

$JOB would prefer to buy other companies at 6-8x EBITDA instead of own stock at 3x EBITDA. Hmmm

— Rational Research (@RationalResear) February 15, 2023

PASS.

Full thesis:

Purely a bet on Adam Peterson's ability on pivoting away from subprime auto loans and creating value elsewhere. Gonna get worse before it gets better. Could turn out nice or end up a nothing burger. $NICK

— Roaring Wolfy ⚡️ (@TheLoneWolf58) February 24, 2023

According to the thread:

- Finance receivables: ~$140mm

- Current stock price: $6.50

- Book value/share = $13.1

- ~$5/share of freed up capital to be reallocated

- Experienced board collectively owns 35% of the company

- Corporate restructuring -> $20mm of opex savings

Adam Peterson is co-CEO of Boston Omaha $BOC.

Potential red flag: compensation at $BOC:

The Boston Omaha co-CEOs are now getting paid an annual salary 6x of Buffett/Munger (and this is before bonuses) $BOC

— Brett (@CCM_Brett) May 25, 2022

Boston Omaha has a market cap well below $1 billion and has dramatically underperformed the index since its inception

The $BOC stoc price has done nothing in the past 5 years:

INTERESTING

This is related to Bostom Omaha through Adam Peterson (co-CEO of $BOC), who sits on the board of Nelnet. Adam also runs the Magnolia fund, where $NNI is the top position (23% of the portfolio).

Here’s a great intro to Nelnet: Arch Capital: Why We Own Nelnet.

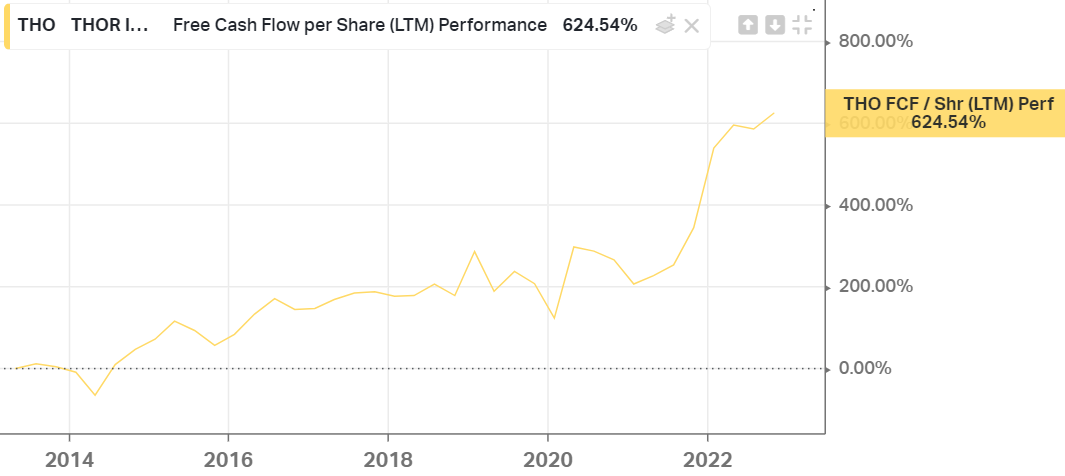

These two charts summarize what I like about this company:

BUY.

Disqus comments are disabled.