#78 - November 2022 Ramblings

Last updated: Dec 1, 2023

https://investmentmanagementinsights.substack.com/p/graham-and-dodd-annual-breakfast (pdf)

You can have a great business, but it doesn’t mean it will be better in five years. Charlie Munger: less than 2% of the S&P businesses would be a “better business” in five years.

The most important question: is the moat getting wider or narrower?

The worst business grows and needs infinite capital with declining returns. The best business grows exponentially with no capital.

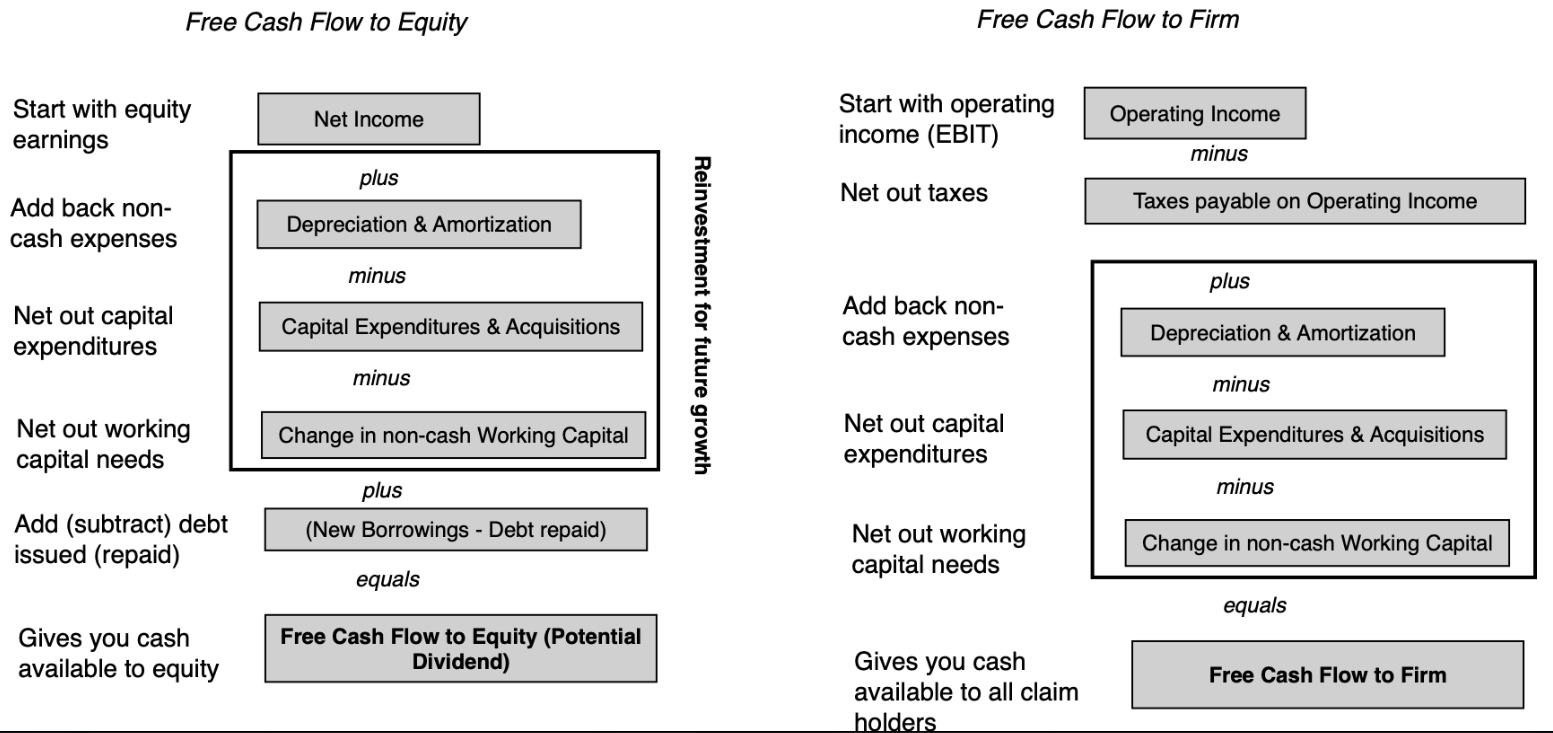

Focus on: owner’s earnings (a) reported earnings

- (b) depreciation, depletion, amortization and certain other noncash charges

- (c) the average annual amount of CapEx for plant and equipment, etc., that the business requires to fully maintain its long-term competitive position and its unit volume.

*If the business requires additional working capital to maintain its competitive position and unit volume, the incremental spending should also be included in section (c)

https://academiccommons.columbia.edu/doi/10.7916/d8-8deb-kf24 (pdf)

The median firm recognizes 25% lower D&A expense compared to the estimated level of maintenance capex.

This is because firms often record depreciation and amortization (D&A) expense that do not capture the effect of technological changes, resulting in misleadingly low D&A expense.

Accounting D&A expense is primarily a method of allocating the historical cost of these assets and does not reflect the economic cost required to operate the firm in its current form.

Firms do not usually change their depreciation/amortization schedules when technological developments shorten the actual useful life of an asset, and instead take one-time impairments and write-downs after the asset has become technologically obsolete.

Proposed solution: sum the reported D&A expense and the write-downs and impairments over a sufficiently long period of time (five years).

Specifically, to estimate an approximate value of maintenance capex required to sustain the firm’s current revenues:

a) compute cumulative capacity cost as the sum of D&A expense, asset write-downs, loss on sale of assets, goodwill, and intangible asset impairments over the last five years (t-4 to t).

b) the cumulative capacity costs are then divided by sales cumulated over the same period resulting in an average firm-specific estimate of the cost of long-term operating assets required to generate a dollar of sale (“Capcost_ratio”).

c) To compute the dollar amount of maintenance capex for the current year, multiply the Capcost_ratio with the current-year sales.

Caveat: Capcost_ratio, computed as described above, may not represent the true economic cost required to sustain current revenues, because both D&A expense and reported impairments might be over or understated. The paper describes a complicated procedure to adjust for this by benchmarking against the firm’s industry.

(pdf)

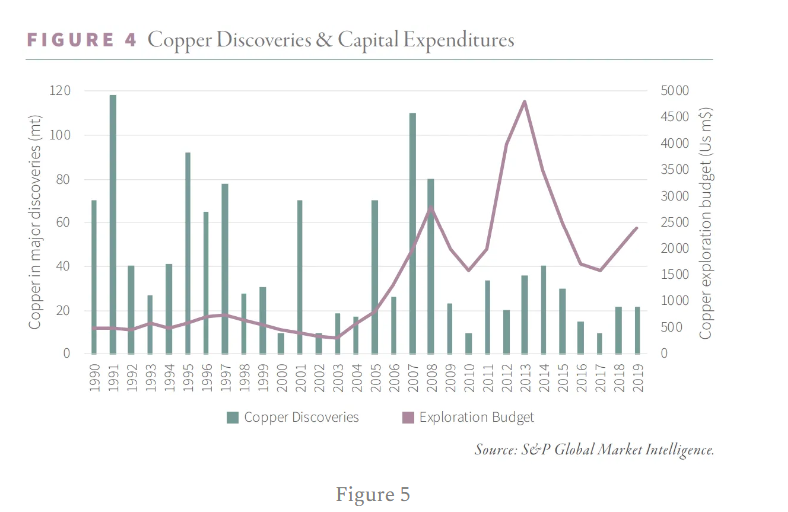

https://zerosummation.substack.com/p/copper-thesis-and-1-idea

Most of the growth in copper reserves over the past 2 decades has not come from new discoveries, but from lowering the cut-off/reclassifying what was originally waste rock into economical ore.

The lack of greenfield exploration has been due to many factors, which seem intractable.

-

Firstly, there are long lead times. The National Mining Association estimates that it takes 7-10 years on average to obtain the permits necessary to bring a mine into operation in the US.

-

Secondly, there is increasing jurisdictional risk. Latin America, which accounts for 40% of global copper production, is increasingly hostile to mining companies. It is unlikely western companies will be exploring in China (8.5% of world production) or Russia (4.3% of world production).

https://www.docdroid.net/1MgHFOK/elliott-letter-pdf (pdf)

I could have copy-pasted every other paragraph, the letter is so good.

Just a few excerpts:

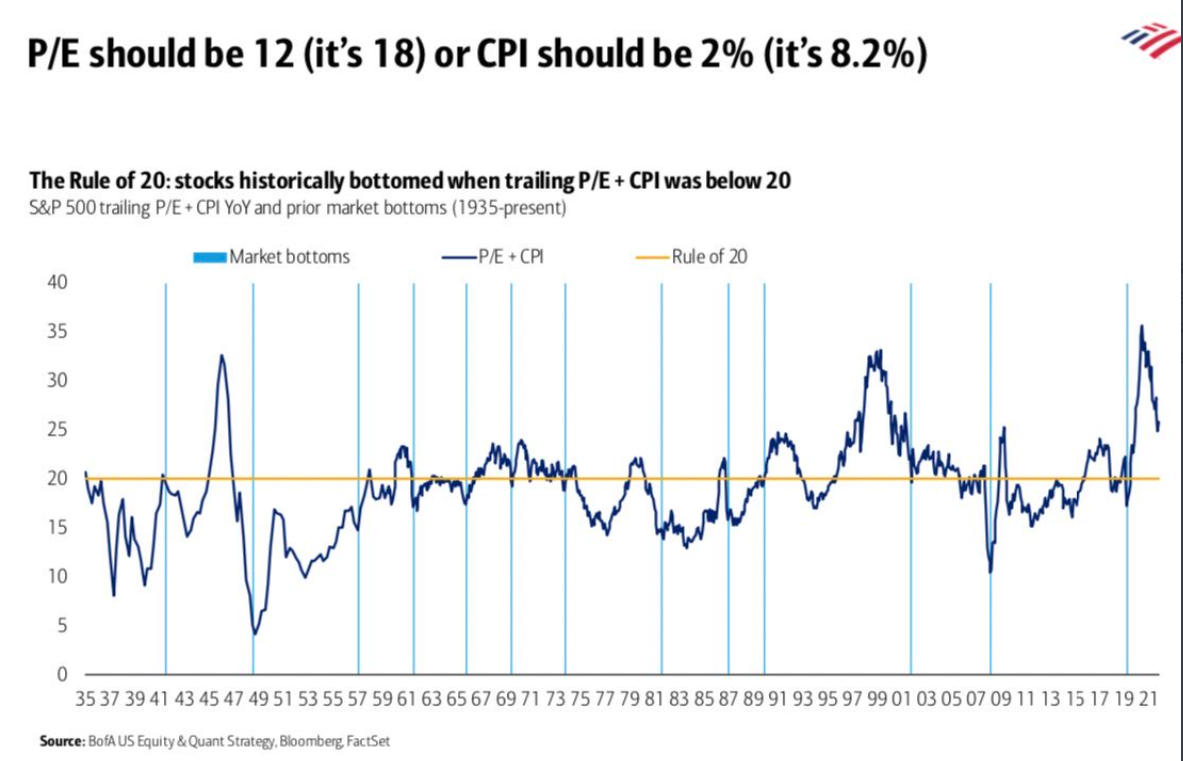

On the Fed, inflation and recession

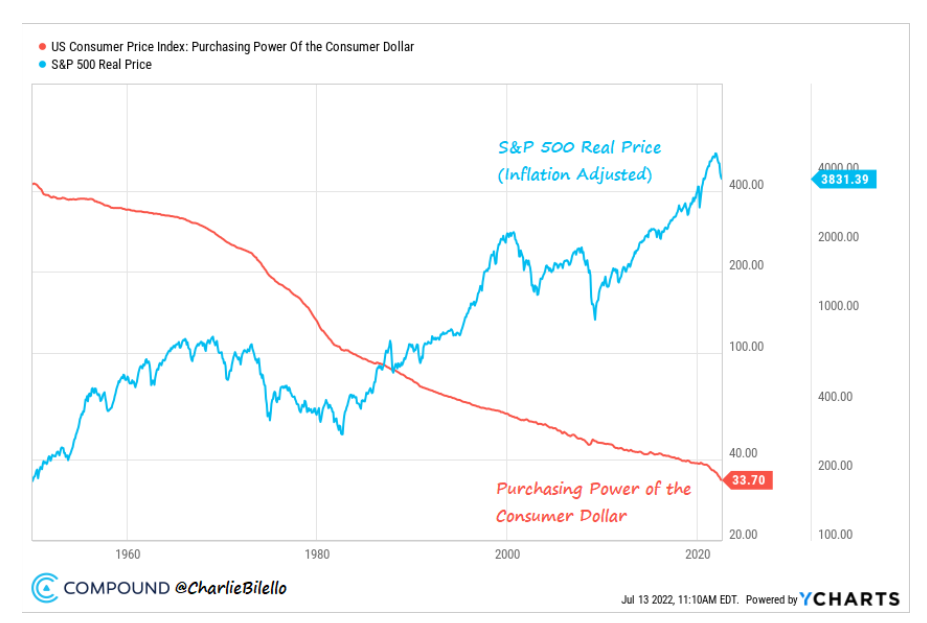

The Fed’s “overarching focus right now” is to bring inflation down to its 2% goal. And that commitment is “unconditional.” Well, here is the “coming attraction” for that unconditional commitment: In the event that the unfolding recession becomes an inescapably present and serious recession (just what exactly is a “technical recession,” anyway?), the “unconditionality” of the Fed’s commitment to fight inflation will melt away under the shouts and pleas of politicians facing political pressure.

A hard landing in the global economy appears to us quite likely, and if this hard landing is a deep recession, a decline in the rate of inflation will probably accompany it. The probable policy response to the recession is likely to cause a new round of even-higher inflation.

On energy

The messages that political leaders are sending to oil, gas and coal producers are both “You are engaged in an activity that is endangering the very planet!” and “You are gouging us on price, and we need more of your products!”

On globalization

All of these factors go under the heading of sudden realizations. Obliviousness in these matters is yesterday’s newspaper. Realism is advancing. But make no mistake: De-globalization is inflationary and growth-suppressive. This direction of travel is not reversing back to “normal” any time soon, if ever.

On corporate profit margins

The recession, which is said to be either to be here or on its way, will almost certainly be accompanied, on form, by a significant decline in corporate profits. Taxes are rising in a variety of formats and forums. We think interest rates will be hundreds of basis points higher in the next ten years than they were in the last ten years

Overall portfolio thoughts

When the Doppler radar is dark magenta, when stock markets are down dramatically from their highs of only nine months ago, and bond markets are down in price by similar amounts, it is far too late to be thinking about starting to take steps to preserve capital. At such junctures, the hardest part is the conundrum posed by the possibility that you may be taking such steps at the bottom, in which launching risk mitigation (hedges or partial de-risking) is absolutely the worst thing you can do for the capital under your management; while at the same time, the possibility exists that the worst is yet to come, in which case paying the expensive price for protection could be “better late than never.

On bear market rallies

Indeed, when investors think they see a path for central banks to “pivot” toward ending the rate hikes and commencing rate cuts, investors need to jump in.

Our job is the same as always: To try not to lose money no matter what — no excuses. This is a noble goal, a difficult goal, and incredibly useful as a path and guideline.We urge all investors (including ours) not to count on making a lot of money, because just avoiding losses will be tough

Top gun maverick made $1.4B worldwide gross. Say 50% goes to Studio = $700M (Paramount). For context, ttm annual revenue for Paramount (parent company) ~ $30B. So Top Gun revenue ~ 2.3% of parent company overall rev. Cost $170B to make, $130B for marketing campaign => total cost ~ $300M.

$PARA trading for about 8 p/e. Sure, it might work out. Is it gonna be life changing? I doubt it.

https://aswathdamodaran.blogspot.com/2022/10/earnings-and-cash-flows-primer-on-free.html (pdf)

https://www.bloomberg.com/news/features/2022-10-24/gopuff-layoffs-signal-instant-delivery-s-demise?leadSource=uverify%20wall (pdf)

A reminder of what a shitty business instant delivery is.

Not that Coupang is an instant delivery business (I think they’re 24h delivery), but I do wonder how they were able to outpace the competition and dig their moat. Is it just about execution excellence or is there more to it?

https://www.woodlockhousefamilycapital.com/post/a-safe-place-to-hide (pdf)

The appeal of the coffee can is you protect yourself against your worst instincts. You can’t sell when things are going badly. It’s like Odysseus, when he had his crew tie him to his mast to resist the sirens’ calls. He still heard them, but he couldn’t do anything. (His crew stuffed beeswax in their ears).

Chris Mayer’s template:

If investing is part psychology, you want to create a portfolio where you won’t get shaken out. I often think a key reason to get to know a business well is not that I expect to learn some secret. It’s more to build up enough knowledge and confidence in what the business is doing so that I don’t panic when the next bear market rolls around. As Munger says, the first rule of compounding is not to interrupt it unnecessarily.

This could be a good one.

Testimonials and other videos: https://www.youtube.com/channel/UCHEcrzoKN2L4J5UwjVNrZ_w/videos

Over the last three years, Meta has also dramatically increased its capital expenses. To put that in perspective, excluding your large metaverse investment, Meta is investing more in capex than Apple, Tesla, Twitter, Snap, and Uber combined!

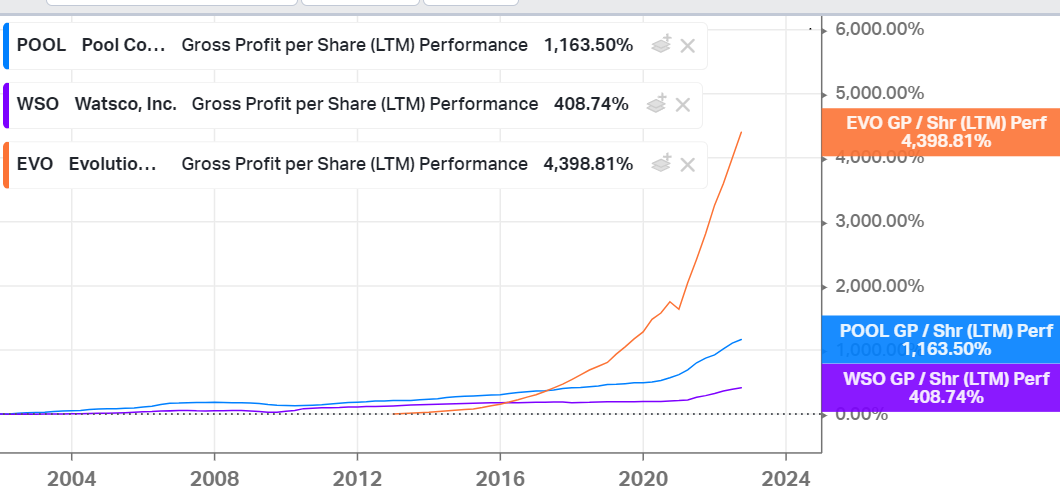

The name of the game now is to find the 5-years-ago $EVO!

Yielded:

- $APPS Digital Turbine 7% FCF/EV yield, 13.7 EV/EBIT, 6x GP/sh growth since 2020.

- $EXPI Unloved, facing tough times (housing), 15% FCF/EV yield.

- $STNE FCF/EV 16%, explosive growth, $3.4B MktCap.

- $LIO Liontrust Asset Management plc. Big FCF/EV yield, but recent surge in OCF.

From this tweet:

https://twitter.com/agnostoxxx/status/1590675005415002112

Archived Bloomberg article.

This September, American Airlines ceased flying to Ithaca and Islip’s MacArthur Airport in New York — as well as Toledo, Ohio, and Dubuque, Iowa — bringing the total number of airports where it has canceled service to 15. The airline says it has 100 regional jets parked because of a lack of pilots.

Smaller airports lost “a dramatically higher percentage” of their flights than larger airports, Faye Malarkey Black, chief executive of the association, wrote in an email. Those airports lost an average of 34 percent of their flight traffic while larger airports’ schedules shrank an average of 16 percent.

Why fly a 50-seat plane into a small town when you can deploy those same resources such as pilots, flight attendants and ground crew for a plane that carries three times more passengers and earns more revenue?

The loss of air service “is of tremendous concern and a huge challenge,” because it makes it harder for companies to meet with business partners, to transport their staff and to attract investment and employees.

Archived NY Times article.

Youtube clip.

A wonderful business is very well protected against the vicissitudes of the economy over time and competition.

Three of those will be better than a hundred average businesses. And they will be safer, incidentally.

From this tweet.

https://www.youtube.com/watch?v=wMvcp3qZCHw

https://www.youtube.com/watch?v=0O9m-pToNTQ

IT Services market in Germany: €50B. $D6H.DE revenues: ~€500M (vs €26M in 2006, north of 15% CAGR).

~20 to 25 new customers per year, through a tender process.

Their advantage is what they call CORBOX, which is a transparent and structured way of packaging, selling, and delivering their IT services.

They have a central department that takes care of the actual service and product offering, as well as regional customer-facing market units, all in Germany. So it’s a mix of scale and flexibility.

Cloud services is their main offering.

Heads-up: this bit is self-centered and personal.

$EMO.V just lost 30% in one day.

Here are the 5-days, 1-month, 1-year, and 5-year charts for EMO.V.

I wanted to show how many chances I had to get out of this mess. I’m now down more than 60% on it, after doubling up my money in just a few months. Somehow, that wasn’t enough for me.

That’s part of the problem. I’ll get back to it.

But before I do, here’s something I wrote just a few weeks back:

I just want to continue to hold a sizeable $EMO.V position. If I start trying to flip for pennies I’ll definitely miss out on when AZN court date is announced and we fly.

Since the start, I purchased $EMO.V as a one-way ticket to the moon. It’s not the first time I do this either.

That was the first mistake. The desire to get rich quickly leads to a dark path.

Or rather, to a dark flow. This concept was introduced by a psychology professor at the University of Waterloo in a study titled: Dark Flow, Depression and Multiline Slot Machine Play.

From the abstract:

Multiline slot machines allow for a unique outcome type referred to as a loss disguised as a win (LDW). An LDW occurs when a player gains credits on a spin, but fewer credits than their original wager (e.g. 15-cent gain on a 20-cent wager). These outcomes alter the gambler’s play experience by providing frequent, albeit smaller, credit gains throughout a playing session that are in fact net losses. Despite this negative overall value, research has shown that players physiologically respond to LDWs as if they are wins, not losses.

These outcomes also create a “smoother” experience for the player that seems to promote a highly absorbing, flow-like state that we have called “dark flow”.

And the final punch:

Past research has indicated that there may be a relationship between problem gambling status and dark flow, as well as between dark flow, depression, and gambling expectancies.

I’m finally able to understand the process by which I found myself in the $EMO.V quicksand and why I was never able to free myself from it, even when given the chance.

My initial purchase of the stock was 100% emotional, driven by the remnant of a depression hidden deep within and a desire to finally “break free”.

That’s why I didn’t sell when my position doubled, as unreasonable as it seems now. No other stock could give me the same adrenaline-charged hope of becoming a multi-millionaire - fast! At least that’s what I thought.

At the same time, I entered a dark flow: a state of slow but constant punishment, interrupted by random periods of dopamine-inducing stock rallies.

I became an addict. Numb to the punishment, as long as I could get some kind of (LDW) reward later. The expectation of a possible reward became a positive experience in itself, and the deeper the stock price sunk, the more power this potential reward had on me.

Likes a prisoner who has been beaten down repeatedly by his kidnapper, day after day, with increasing brutality; until he gives up on everything except the random little acts of “kindness” from his demented captor. The beatings become an accepted part of the routine, because sooner or later, they’ll be followed by a reward.

The slot players are prisoners of their slot machines. I used to look down on those old people in a state of trance pushing on them buttons like there’s no tomorrow…and here I am now, an old man addicted to my own slot machine.

These devices are only attractive to those that do not expect anything positive from life. So they hook themselves to the machine, where they can recreate the constant shittiness of life, BUT with random positive rewards from time to time.

A random positive reward within a constant stream of negativity is perceived as better than small, repeated positive rewards.

Why is that?

Could it be that the players are just unable to see life as a stream of positive rewards? Maybe they’ve been beaten down so much that they’ve simply given up all hope. And they don’t even have the energy anymore to imagine a life where they don’t get constantly beaten down?

The desire to get rich quickly is the desire to find a way out; or rather a way up from the depth of the dark sea where the pressure is unbearable. It’s the desire to find air when we feel that we can’t breathe.

OK, enough of this drivel. What’s to be done? Let’s get practical.

(I’m writing these as directives to myself)

First things first: I need to get out of this mess.

Yes, I’m aware, I might be selling at the bottom. But this stock has been a drag on my portfolio, and my life overall. Management has misled and disappointed me repeatedly. I should have dumped this turd much sooner. So I’ve sold everything from my taxed account and kept only a minimal position in my untaxed ones.

Looking forward, here’s my advice to my future self:

-

Make sure that you’re breathing well. Meaning that you’re happy with your life as it is right now. Genuinely happy, energized, and joyful. Taking care of your body, mind, and soul - through exercise, self-care (e.g. massages), social activities, music, reading, etc. Take time to be in the present, engaged, mindful and empowered. Constantly push yourself towards the light by being in movement, seeking opportunities, and acting on them. You don’t need any one stock ticker to pull you up.

-

Be wary of investments that require a specific event or set of events taking place to be successful, and that might flounder otherwise. Ideally, avoid them altogether. If you have very strong reasons not to - write them. Also write very precisely what needs to happen by when for you to stay invested, as well as any triggers to sell (including stock price).

-

Mohsnish Pabrai doesn’t exceed 10% for his initial positions (cost basis). You’re not smarter than him. In fact, you’re significantly less smart. Therefore, add exponential resistance to adding more to a position once it reaches the 4% to 5% range.

-

Don’t clone blindly. Do your own work. Develop your own thesis.

-

Know what game you’re playing. It’s OK to ride a wave. But don’t crash on the rocks. Don’t trust the crowd, but respect its momentum.

I can’t be sure that I learned my lesson for good. I did my best to use the pain to grow, but only time will tell.

Now here’s the funny part.

While everything above might be true, the reality could be much simpler. It could simply be that I did not understand what I owned, and I got shaken out by the market volatility.

So I’m adding the most important piece of advice:

- KNOW WHAT YOU FUCKING OWN!!!

Funny how I keep rediscovering Buffett’s advice…

Anyhow, now more than ever, I want to find strong businesses that I understand and that will reward me slowly, for a very long time.

Example of what not to do (from Twitter):

Link to the memo, and archived pdf here.

Howard Marks basically just spanked my ass. I did everything he said NOT to do, i.e.

Most people buy stocks with the goal of selling them at a higher price, thinking they’re for trading, not for owning.

But then he described what to do: think long-term. Buy businesses you want to own for years to come. It’s the only way (edit: there might be other ways, but this one I know will work for me, while the others haven’t).

Just a fantastic memo.

Disqus comments are disabled.