#75 - October Ramblings

Last updated: Dec 1, 2022

The stock surged something like 15% after their Q3 earnings release. See this article or that one.

Hamish Hodder is a young youtuber and value investor. Netflix $NFLX is his top position. He describes here how it has been a great performer for him in 2022.

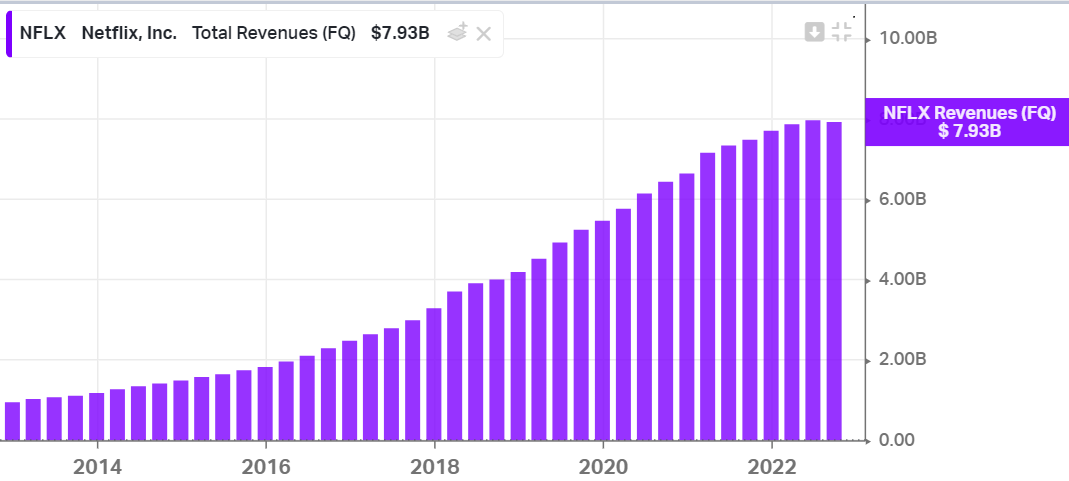

Good for him - but I have to say, why would anyone invest their individual retail money in a $120B market cap company trading at 20x EBIT with this flattening revenue profile, that is beyond me:

Now I’m not saying that Netflix is a bad company (it’s a great one and their content is amazing) or that this is a bad investment (it’ll probably turn out OK).

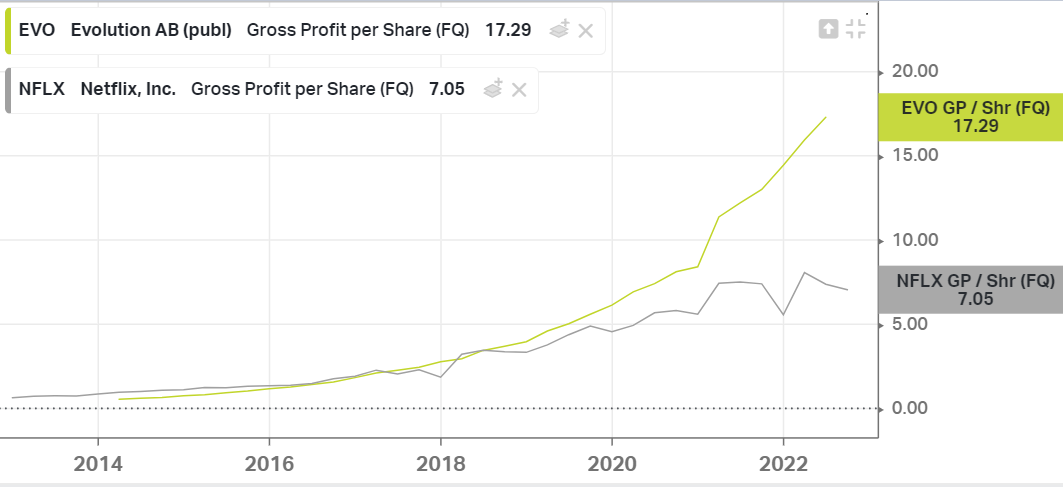

But for a similar multiple, you could be buying this:

I mean sure, we’re not making investment decisions based on ONE chart, but still…it would at least cause me to stop and think!

I very much doubt that any “deep understanding” of Netflix’s business one might achieve would be so significantly superior to what the market has figured out.

On the other hand, I’m sure Evolution will hit a wall at some point, just like Netflix has. But that is exactly my point! Until them, clearly, it’s enjoying better economics, while trading at a similar valuation.

In fact (according to Koyfin), on a FCF/EV yield basis, it’s much cheaper (3.87% yield vs 0.62%).

So I personally don’t see any reason to buy or hold Netflix here. There are many better opportunities out there, and $EVO is just one of them.

P.S. The gambling/igaming sector is not without risk, far from it. $EVO itself is not without risk. I’m not trying to say that it’s a no-brainer investment, I’m just comparing two ideas.

I read one of the funniest shareholder letter ever.

It starts like this:

“Imagine waking up to the realization that you are set to fight Mike Tyson and have him punch you in the face for 6.5 straight hours. Now imagine that happens every morning… Hello Q2 2022 (which was the actual twin of Q1 2022).”

It’s from a fund called 180 Capital Corp. It trades under the ticker $TURN.

I quickly looked at a couple of their holdings ($PBPB and $SCORN), didn’t see anything to get too excited about. Not my style of companies.

I also didn’t like their objective: “We are focused on individual companies that we believe have the potential to generate a return of 100% over a three-year cycle”. The reason is: 3 years is an incredibly short timeframe. I personally don’t want to anchor any investment decision over a 3-year timeframe.

On the other hand, I really enjoyed reading their study on the previous 15 recessions dating back to the Great Depression. Here are a few excerpts:

"War continues to rage in Ukraine. Inflation continues to run rampant. Gas prices are at record highs. Food prices are eating into consumers pocketbooks. Mortgage rates have skyrocketed. Gross Domestic Product fell in the first quarter of 2022. The Fed is in the midst of a major tightening cycle. When you add all of this together, it seems obvious why many believe that we are headed into a recession, defined as a drop in GDP for two successive quarters."

"On average, for the 15 recessions dating back to the Great Depression, the stock market has hit its lowest point when 40% of the recession still remains."

"If we use 12/21 as a starting point for the current downturn, then we would already be seven months into the current recession. If the current downturn ends up lasting an entire 12 months (the historic average for the length of recessions), then we are slightly over halfway through it."

"One final historical point; there is a wide disparity for how long it has taken the market to return to its pre-bear market highs. For example, in the Great Depression in the early 1930’s, it took the market 258 months to recover to its previous high, and in the 2008 recession it took 45 months. In many other periods (e.g., the 1950’s, 1991, 2020) it took less than 5 months. Much depends on the severity of the recession and the amount of leverage in the system at the time. "

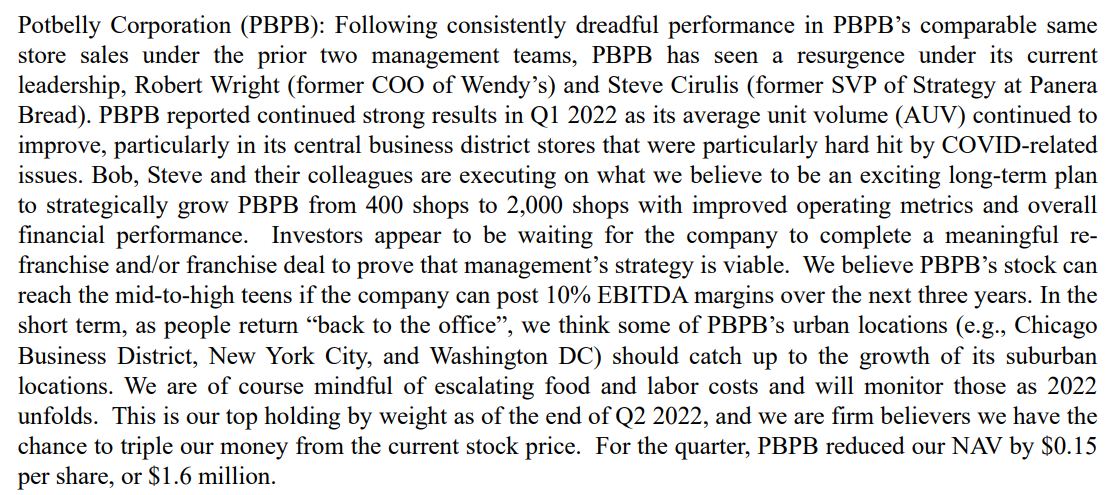

This is their comment on Potbelly Corporation $PBPB (their top holding), a franchise sandwich shop business. It’s not totally uninteresting, even from a valuation perspective, so maybe worth adding to the watchlist (but the truth is, I have so little $USD remaining to invest that my bar is fairly high):

All in all, an interesting portfolio manager. I wish the best and look forward to read their future letters.

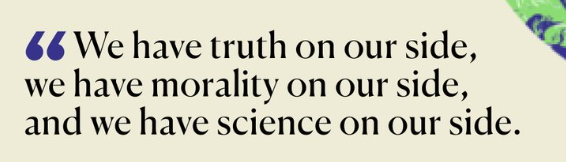

I don’t know if it’s possible to utter scarier words than these.

The full discussion is here.

Excerpts and thoughts sparked from reading this piece by Graham Duncan.

“In life the challenge is not so much to figure out how best to play the game; the challenge is to figure out what game you’re playing.”

– Kwame Anthony Appiah

I’ve come through many investment ideas lately that seemed interesting and profitable. But I passed because they’re not interesting within the game I want be playing, which is that of being a perpetual owner of amazing businesses.

I’m not that interested anymore in businesses I’ll have to sell two years later. I have some, but only if they are just ridicusouly priced, and even then, I have a quota.

This was a nice quote from the article:

Pride of authorship is an obstacle when it comes to making money.

And this one was intriguing:

An investor who uses only one game will have less sustainable returns than those who reach the next stage: putting in the time develop new games even while playing the existing one.

I’m not sure I get it. I used to think this way, just a few months ago maybe. That one has to adapt his style to the current environment.

I guess I don’t think that way anymore. Instead, I believe there is a style (call it the “Charlie Munger” style) that, if played correctly and consistently, will almost inevitably outperform in the long run. It might not outperform in every cycle or sub-cycle, but long-term, it will.

At least that is my belief now. Maybe it’ll change in the future, and I still allow myself to explore around this core belief, but I have to say, it is a belief that feels true. It makes sense to me. It also gives me equinimity, without me even trying.

This is in contrast to David Tepper’s style for example - he was able to choose and use whatever approach was appropriate for the context. I just don’t think I have that sort of mental firepower. But who knows, maybe I can learn and practice with enough mental models to make it easier to jump from one to another.

Now this, however, is very interesting:

[..] noticeable changes in their techniques, discipline, and attitude, are accomplished usually through a change in setting, e.g. working with a new coach, new friends, etc.who work at a higher level. What I have called “levels” are better described as “worlds” or “spheres.”

While I don’t have access to coaches or anything of that sort, I like everyone else have access to books and interviews from the best of the best. All we have to do is absorb.

This quote from Harvard professor Bob Kegan was also fascinating:

People with self-transforming minds are not only advancing their agenda and design. They are also making space for the modification or expansion of their agenda or design.

Wow! A “self-transforming” mind. That sounds like a good way to win the game.

The opposite of that is something I experienced way too often in my own investing adventure:

Lower level investors are sometimes surprisingly definitive in the way they describe an investment opportunity; they have a too tight grip.

The speed with which my brain crystallized an opinion on a stock was sometimes, after the fact, surprising - and disappointing. Why not keep an open mind and review the foundations, every once in a while?

Instead of cloning Warren Buffett’s value investing style, we should instead clone the flexibility of mind that allowed to transition from Graham’s net-nets to Munger’s wonderful businesses at a fair price.

And I have to say, this also resonated with me:

Level 4 investors seem, at one moment, to focus on the businesses themselves, then switch perspectives the next moment to see the business as a “stock,” then switch again to identify the moments in time when one factor is driving the entire stock market.

As I’m going through this article, the gems keep popping up:

Good investment management comes from a mindset reflecting the assumption that the manager will be investing for decades, but that investment activity is as a series of sprints and recoveries rather than one extended marathon.

Teqnion $TEQ.ST went down 14% after their earnings release for the quarter ended Sep 2022. I was curious to see what happened over there, so I headed to their investor relation website to read the CEO’s thoughts.

I think that the reaction of the market is mainly due to this:

we have not fully succeeded in compensating for the price increases we ourselves have experienced.

It seems like this period will force them to remain disciplined. In Johan’s words:

In good times with strong demand and cheap capital, it is all too easy to be lulled into a state where it feels permissible to slip on principles. It is fatal. Now we will be sharpened scalpel sharp again!

Johan is clearly a fighter. You can somehow feel it even through the badly translated text.

The one thing that bothers me sometimes with him is his willingness to publicly share his political stances, such as:

Support the brave women of Iran! Still applies, more than ever, Russia must get out of Ukraine!

I haven’t really made my mind on this topic. My heroes very rarely give their opinion on political or geopolitical matters, if ever (at least publicly). So I’m not sure what to think about Johan sharing his.

On the other hand, doesn’t that make him just a more transparent and relatable human being? A better leader even maybe? I haven’t made up my mind about it - and maybe it doesn’t even matter.

I’m looking into how to buy Swedish stocks at the moment. I think Teqnion can still fall a bit more. I’d love to understand what both Chris Mayer and this guy(Andrew Brown) find so attractive about it.

Maybe I should just keep it simple and look at the numbers…

When I bought a shitload of Emerita Resources $EMO.V shares, the thinking was: the value is in the land - I’m safe.

What I didn’t realize is that with a changing macro environment (in particular, with rising interest rates), that same observation could become a bear argument.

The value is in the land - and it will stay there, until…who knows when. Without a clear catalyst, why would anyone bury their money there, when they can receive 4% interest from the government, risk-free?

This is a good example of why we shouldn’t treat everything that Warren Buffett says as gospel. When he says that the macro is irrelevant because it’s unpredictable, I would retort that it is indeed irrelevant, most of the time. But in those rare occasions when it is relevant, I think one would do well to pay attention; such as, for example, when there’s rampant inflation and rates have nowhere to go but up.

I’ve been working remote from several years now - even before the pandemic started.

There was a period when I was hybrid, and actually going to the office almost everyday (by choice), and there was a period where I was fully remote, working from home, like I am now.

All I can say on the matter, from personal experience, is this: there is no way that, overall, employees are as efficient from home as they would be from the office.

Maybe there’s 15% or 20% of employees who can almost make it work. But I don’t see how fully remote can be sustainable at a time where capital is scarce and companies have to be efficient.

This is why I like Dream Unlimited $DRM.TO. They’ve been increasing their stake in Dream Office.

I don’t think humanity is ready to move on from offices. And I think we’ll see many companies going back to their old secular habits - at best, promoting hybrid work; but I don’t see full remote as a long-term sweeping trend.

Is it possible that the woke virus that spread from the West Coast is just a manifestation of a deep feeling of guilt from being so arbitrarily lucky?

EVERY TECH COMPANY CAN REDUCE HEADCOUNT BY 20% pic.twitter.com/6ujcVOrDul

— Q-Cap (@qcapital2020) October 25, 2022

TL;DR: Despite being a trucking business, this is a capital-light growth story. I see a 10% IRR in the bear case based on very conservative assumptions, on top of the 3.4% dividend yield. The current valuation is not demanding and leaves room for multiple expansion.

Disclaimer: I do NOT own shares in $TTNM.

I stumbled upon this writeup from Aug 2021 on Titanium Transporation Group $TTNM.TO from @everyonehatespoetry.

Note: There are a few mistakes in the writeup; for example, TTNM is in the truckload business, not LTL).

The author has two other writeups, one on $HALL (which had a catastrophic outcome), the other on $TBRD.V, which hasn’t panned out yet - and is too complicated for me.

The thesis on Titanium Transportation Group, on the other hand, is simple enough. There are two segments in the business: Trucking and Logistics. Trucking has been a mediocre to average business so far. Logistics on the other hand seems to be a hidden gem. I’m not sure what’s going on over there, but the numbers are impressive.

TTNM has opened 5 truckload brokerage offices so far in the US. The expansion into US logistics only started in 2019 and they’re up to five offices now. Logistics revenue increased 6x in the last three years, from $12M in 2019Q1 to $75M in 2022Q2. In 2022Q2 alone, the logistics segment generated CA$8.4M of EBITDA. Depreciation is negligible, so for all pratical intents, EBITDA = operating income.

The company EV is $190M, or 5.6x the annualized EBIT of Logistics alone, for a business that can double in 5 years with very little capital; and we get the trucking business for free.

To some degree, it almost seems too easy to be true. Why are they able to do this? Fankly, I don’t know.

In reality though, the company has surely been over-earning lately. The entire sector has benefitted from strong pricing power, which seems to be receding now.

Maybe the normalized EBITDA/office figure is only $2M/year. With 10 offices and an 8x multiple, that’s $160M of EV.

As for the trucking segment, let’s assume a conservative EBITDA margin of 10% and 50% conversion from EBITDA to FCF. Let’s also use revenues of 2019 to be extra safe (CA$113M). That gives us $5.65M of FCF. At 10% yield, this should be worth $57M of EV.

In total, we get $217M of EV (rounded down), or $127M of market cap in 3 years, versus $100M today. That’s an 8.3% IIR. Substract 2% due to share dilution, we get 6.3% IRR in the bear case. The dividend yield of 3.4% completes the downside protection.

That covers the bear case, where I’ve been conservative on EBITDA/office, EBITDA to FCF conversion, and the pace of expansion.

Still, the big known unknown is: what if the entire expansion into the US was only made possible because of how tight the supply chain was in 2020/2021? In other words, the real risk here is to see NO incremental and profitable brokerage office being open in the next few years, or to see the expansion continue but with much lower EBITDA/office.

The upside, in broad strokes, stems from the fragmented nature of this industry and the fact that most small trucking operations will have a hard time surviving the down cycle coupled with sustained inflation, therefore high operating costs, leading to destruction of capacity and/or interesting acquisition opportunities.

Some more color:

Historically, return on equity has been cyclical, averaging around 10% - not amazing. BUT the ROE profile has spiked up to 20% recently. Obviously because of the logistics segment.

Return on capital is not great either, around 4% average historically, and recently up to 7%. Compare these metrics to $ODFL, and you’ll see the difference.

Two comparable trucking companies in Canada are $MTL.TO and $TFII.TO and they are both more expensive. These companies mostly do LTL though on the trucking side (vs truckload for $TTNM).

$TFII.TO has generated better returns on capital historicall, while $MTL.TO have a similar profile to $TTNM.TO on that front.

The asset-light logistics segment is now about 60% of the top-line, versus 30% three years ago.

This is an founder-led business, and management has skin in the game. They did a large acquisition in the past and it was not a resounding success. Hopefully it makes it less likely they repeat the same mistake.

Net debt to EBITDA is ~ 2.1 - no issue there.

Share count has been stable to slightly increasing after the big acquisition in 2021, and this is despite a renewed NCIB. On the other hand, dividend yield is about 3.4%.

The company emphasizes their technological focus as a competitive advantage. I don’t understand what’s special about their tech stack.

TTM EBITDA is $34M. Management has guided for $45M for 2022 => 4.2x EV/EBITDA.

This investment is easy to track: two US logistics brokerage office per year at ~$20M of revenue per office and 10% EBITDA margin.

My take:

After mulling over it for a few days, I decided not to invest here.

The main reason is not that I don’t know where spot rates for longhaul trucking are going (I think everyone agrees they’re going down), but rather what will the impact on the bottom line be.

After going through all the 10Ks and all the earnings calls, I couldn’t come up with a clear conclusion. Moreover, this business and management does not strike me as spectacular.

Zooming out a bit, it seems to me that generally speaking winners keep finding ways of winning, whereas average people keep finding ways of tripping up. With that in mind, for an average business, I require a much higher hurdle rate than for an extraordinary one.

Therefore, I’m passing for now.

Down to 20% in a day, to $100. Just insane.

Here are a just few reactions to Meta’s earnings.

Same investors who were preaching not to buy cyclicals at 1x EBITDA, loaded up $META “because 12x PE” but not realizing it’s also 0% FCF yield 😏 pic.twitter.com/v3ArHxoDgn

— Le Shrub🌳🔥🇺🇦 (@agnostoxxx) October 27, 2022

$META investors are learning a lesson experienced microcap investors know well.

— Jason Hirschman (@EightTrack180) October 27, 2022

A substantial founder-manager does not mean he is aligned with your priorities. It means you are aligned with his priorities - whatever they may be.

Morgan Stanley on $META - the structurally higher capital intensity is "thesis changing" pic.twitter.com/o2LUkaG0rx

— crypto analyst (@punchcardinvest) October 27, 2022

$META Flaming dumpster fire 🔥 miss, guide even worse. Rev DOWN 4% yet costs up 19% 😵! Users flat, but average ad price -18% y/y. 🤮 Not Inflation! Capex 2x+. Added 19k employees +28% y/y 😱. Zero cost control. Expects costs to grow from ~$85bn ‘22 up to $101bn in ‘23. 🤯 #RIP pic.twitter.com/bKbZzxF1RR

— Wasteland Capital (@ecommerceshares) October 26, 2022

The $META pain is self-inflicted. It's artificial FCF destruction.

— Supreme Bagholder (@supremebagholder on Threads) (@SupBagholder) October 27, 2022

The top line and core engagement metrics are doing well. I love seeing fintwit gurus making it sound like the business is in terminal decline

Facts are $META has no discipline. They burn everything they make.

When you get into a crowded trade pic.twitter.com/oEJqPA62VZ

— Commonstock (@JoinCommonstock) October 27, 2022

I disagree with the market. This is the first time that I’m saying this, but I believe the market is short-sighted.

-

Opex: if Zuck truly believes in the Metaverse, why would he slow down spending now?

-

Capex: they’re investing in data centers and servers for AI. Nothing wrong with that - why would you not want to have the best AI in the future?

-

Family of apps is doing OK. Reels are doing great. Whatsap for business is just getting started.

-

The market thinks Zuck is stubborn and out of control. The jury is still out on that until 2024.

The most rational and balanced take I’ve found was from the Unrivaled Investing YouTube channel here.

I’m not saying $META is a screaming buy here. The distribution of outcomes, due to the Metaverse bet, is too wide to get any degree of certainty. But the core business is certainly not doing as bad as some of the comments above make it seem.

Summary of the story here.

Interestingly, no one is accusing him of saying things that aren’t true. But irrelevant of whether they’re true or not, certain things must not be said.

See what I mean in this interview with Lex.

In fact, there’s an even better segment of the interview where Lex says point blank: “The reason you don’t say it, is because the world is much bigger than […] the narrow little world you exist in. Your impact stretches way past these little boardroom meetings over contracts.”

Implicitely: the reason you don’t say these things is not because they’re untrue. It’s because you don’t want to draw hate. While Kanye’s point is: why am I not allowed to even point to them, draw attention to them? Why do I get instantly shut down? Doesn’t that prove my point?

This reminds me of a story I sometimes read to my kids, called: “The dragon that doesn’t exist”. It’s the story of a dragon that keeps getting bigger inside the house because the mom refuses to acknowledge that dragons exist.

I’ve always thought Kanye was an arrogant fool. Now I just think he’s arrogant.

All quotes below from the pod.

Alex Morris quoting Geoff Gannon: “If I buy something, there’s zero percent chance I’m selling it within 5 years.”

It’s a seemlingly small change that impacts everything when you change the lense from thinking about stuff in terms of where’s my best IRR over whatever select period of time that you choose, to finding great businesses - and in my mind management teams and businesses are somewhat indistinguishable over a long enough period of time.

Sometimes you actually need a few years to see whether or not the business is breaking. It’s very hard.

(Quoting Charlie Munger) If you own a hanful of good well-run business throughout the country and you paid seemingly reasonable prices, that’s plenty of diversification.

It’s harder when I stray outside of that framework. Arb situations, for example - these things can all be perfectly sound ideas, but I find myself more comfotable with the conclusion of: it’s great for other people to do those things, but I can not care - I don’t have to do these other things.

One of the best pitches I’ve listened to lately was given by Joe Boskovich on Microcap Club, about WildBrain $WILD.TO.

WilBrain is a great business and I’ve been in and out of the stock before.

Just listening to Joe pitch it again made want to jump back in!

But put simply, I doesn’t strike me as an incredible opportunity investing-wise.

See, from their investor day presentation in October 2021, the company is targeting around CA$125M of EBITDA in 2024, which Joe seemed to imply that at a 10x multiple, would yield a double from here.

The problem is: the company has CA$573M of net debt!!

So 10x of CA$125M EBITDA is CA$1.25B EV…not very far from the current EV of CA$1.19B…

I mean sure, we could argue that the business should be worth more…maybe it is, maybe it isn’t - who am I to say?

I just thought it was interesting that a great pitch turned out to NOT be a fat pitch, based on the numbers.

Disqus comments are disabled.