#71 - Portfolio Update, September 2022

Last updated: Nov 1, 2022

Allright it’s that time of the month again. I’m still getting recked. Getting used to it, no need to cry over it.

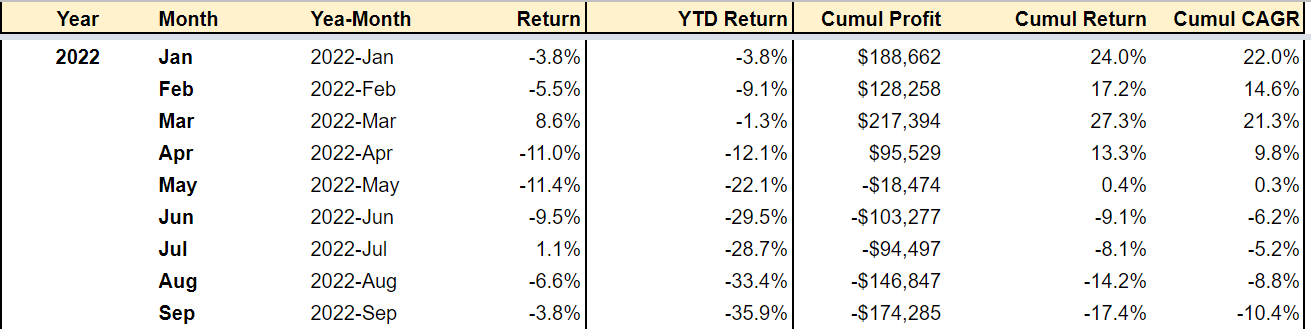

Performance update

.png)

Commentary

Biggest negative contributors:

- $EMO.V

- $MKO.V

- $GUD.TO

Biggest positive contributors:

- $CPH.TO

- $EVVTY

- $CXI.TO

I don’t mind the negative contribution from $GUD.TO. It’s a sizeable position in my portfolio, so it’s bound to appear in the top 3 positive or negative contributors every month.

$EMO.V and $MKO.V…that’s another story.

I’ve been thinking a lot about these two. Beyond admitting when a mistake was made, it’s not that easy to pinpoint what the mistake was. And we don’t want to be too short-term oriented either.

But mistakes were made all right.

On one hand, the intention was good. I did not want my portfolio to be a one-factor bet.

So I give myself 8/10 as far as avoiding the crowded hyped “growth” stocks.

But on the implementation front, I give myself 1/10. By trying to avoid the truck in front of me, I crashed my vehicle into a tree.

While this scoring is harsh, there’s good news. The error stems from a lack of knowledge and experience, which can be rectified with time.

Moves

I trimmed $EMO.V and added to $EVVTY.

I’ve also started another portfolio on another platform. It’s much smaller in size but I will be including those holdings in the reporting starting next month.

One of the stocks in that smaller portfolio is $DRM.TO. I’m still familiarizing myself with that company, but I like what I see so far. More on this later.

Outlook

Here’s my current portfolio composition, using the categories I defined in the previous month update:

.png)

In order to reach my short-term target, I need to:

- Reduce my speculative holdings

- Buy more “cheap” (value) stocks

- Buy more quality stocks

1. Reduce speculative holdings

Until very recently, I considered Mako Mining a “cheap” stock. Not anymore. I have now moved it to the “speculative” categories, for two main reasons:

-

Call me stupid, but I did not realize how awful it is to have your returns tied to the price of a commodity until said price starts moving against you, and you have NO THESIS on the long-term prospects for that commodity (note: this is not the case for oil, and I have no issue holding my oil royalty plays for a very long time)

-

The tone of Mako’s CEO, Akiba Leisman, has changed very recently. He started talking about potential acquisitions and strengthening the balance sheet to grow the company. This is at a time when the stock price has been roughly cut in half. That’s not what I signed up for. Akiba is entitled to run the company “as a business”, but that’s not all I want to hear. I want to hear that he wants to run his business “for the benefit of the shareholders”. I did not hear that part in this recent webinar.

I’m not sure how and when I’ll be able to trim this position, but it will get trimmed. No emotion about it.

I remember when I was buying this stock, I was looking up to a fellow shareholder by the handle of @BrownMarubozu. Call me arrogant, but I don’t anymore. To each his own.

2. Buy more cheap stocks

I have a few on my radar, but I’m picky. I haven’t yet found one that is a screaming buy. I guess I don’t want cigar butts either, so that seriously limits my universe.

That being said, I’ve also started looking outside the US and Canada (specifically interested in the U.K.)

3. Buy more quality stocks

This one is the easiest. I already know what companies I’d love to own, it’s just a matter of waiting for a good entry point.

Similar to what Magnus Andersson shares in this interview on Evolution, I want to buy sector leaders.

I’ve also noticed that I seem to have a particular affinity for businesses that sit in the middle of an ecosystem or in between the participants. of an ecosystem (e.g. Evolution sits in between the casino operators and the players). Many great companies fit this description.

UPDATE (2022-10-04)

On Mako: it looks like I’m not the only one being nervous.

At this price, it doesn’t make much sense to sell. So I’m kinda stuck here for the time being.

Maybe I should give Akiba the benefit of the doubt. Maybe it’ll all be fine. Or maybe I’ll just get rekt. Time will tell.

Disqus comments are disabled.