#67 - Cipher Pharmaceuticals $CPH.TO

Last updated: Dec 27, 2022

Every thesis out there starts by explaining why the investment is compelling, and ends with a bullet point list of potential risks.

Let me do the opposite here and start with what I think is the obvious risk here: this could be a value trap.

I say could because there are some potential avenues for growth, but none of them is confirmed yet.

While I already have a small position here, I am waiting to see what management will do with their cash and for more visibility into future product launches before I deploy any more capital (if given the chance).

The captain of the ship (Craig Mull) has taken some very good decisions in the past two years or so, and has skin in the game. But two years is not a long enough timeframe to judge a man’s character, and he’s only the interim CEO.

Finally, the nature of the business itself is unpredictable. Who knows which drug will be successful and for how long. I don’t see this as a “set-and-forget” type of holding.

With that out of the way, here’s some context about the company.

The Business

Cipher Pharmaceuticals is a very small (~ US$45M market cap) specialty pharma company that sells its products in Canada and out-licenses in the US.

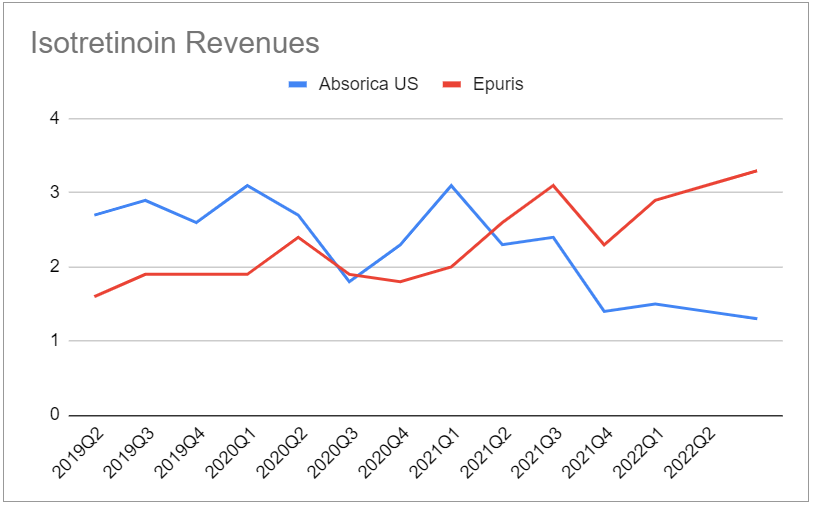

The flagship product is isotretinoin for the treatment of acnea, branded as Epuris in Canada and Absorica in the US. The competitive advantage of this product is that it doesn’t require to take food at the same time, which is most convenient for the target population (teens).

Absorica is priced higher than Epuris but is facing competition from generics, and its sales are declining.

Epuris sales in Canada are much more resilient. In fact they’re growing.

In the US, the company also licenses Lipofen, a product for the treatment of high cholesterol.

In Canada, the company sells a bunch of other products, but they don’t amount to much revenue-wise.

Why it’s interesting: the price

The company has US$24M in cash, no debt.

TTM revenue is $21M, TTM Net income is $8M.

Backing out the cash from market cap gives a P/E of ~2.6.

The company also has a tax loss asset from a previous acquisition, probably worth around ~$6M. So it’s not paying taxes right now, even though those taxes are still getting accrued on its financial statements and reducing the accounting net income.

Revenue quality

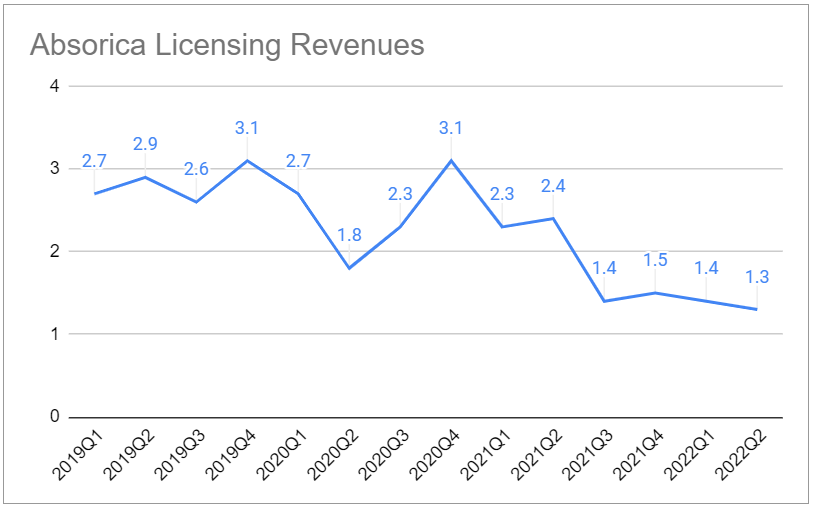

The revenues from the main product (Absorica) are declining due to competition from generics (introduced in 2021Q2):

On the other hand, revenues from the Canadian version are surpsingly strong and make up for the decline of Absorica:

The only other product worth mentioning is Lipofen (TTM revenue $3.2M).

The rest of the currently commercialized portfolio is not worth mentioning.

To be attractive to investors, the company needs a way to grow its revenues.The tricky part

In the last earnings call of 2022Q2, the interim CEO has emphasized that the focus of the company is to use its cash to make an acquisition soon.

The issue is…the company does NOT have a stellar track record when it comes to acquisitions. In fact, it has a shitty track record - whether it is acquiring product rights or portfolios/companies.

See for example the acquisition of the Canadian marketing rights for Eskata (link) or the acquisition of Cardiome Pharma Corp. for $25.5M, both in 2018, and both having amounted to nothing.

The current CEO is Craig Mull, the son of the founder (John Mull, MD). Craig is the interim CEO, as he has other business to attend to (a real-estate development firm for example).

Watching a recent interview on Smallcap Discoveries (link), he doesn’t strike me as a super high energy type of guy.

So why am I long?

-

I’d like to think that they have learned from their past mistakes and that their next acquisition won’t be as bad as the previous ones.

-

One of the products they’re currently testing, MOB-015 (nail fungus treatment), is interesting. It’s jointly developed with Moberg Pharma AB. Cipher has the exclusive Canadian rights. The TAM in Canada is ~$75M, dominated by on existing product. The advantage of MOB-015 is that it’s a topical treatment, as opposed to an oral pill that can cause liver problems. It is currently in a second phase 3 study in the US, after which Cipher can apply to Health Canada. The 1st phase 3 study showed safety and efficacy - it just needed reformulation to prevent nail discoloration. The product probably can’t be commercialized before 2024 though.

-

Worthy of note but slightly less exciting is CF-101, developed by Can-Fite for the treatment of psoriasis, for which Cipher also holds the Canadian distribution rights. The recent Phase 3 study showed good (but not great) results, compared to the existing product Otezla®. It seems to be slightly less efficient but safer to use.

-

I expect sales of Epuris to continue to be strong. In QC and BC, some of their competitors benefit from public reimbursement whereas Epuris does not, yet - but that might change, which would help gain even more market share. Epuris has also been approved in Mexico, and the company has a licensing arrangement in place there (and the company they’re working with also has branches in other latin american countries including Chile and Peru).

-

They’ve been aggressively buying back shares as of late, which is a sign of intelligence in my book given the depressed stock price, and they expect to renew the NCIB.

-

Insider ownership is 40%+.

-

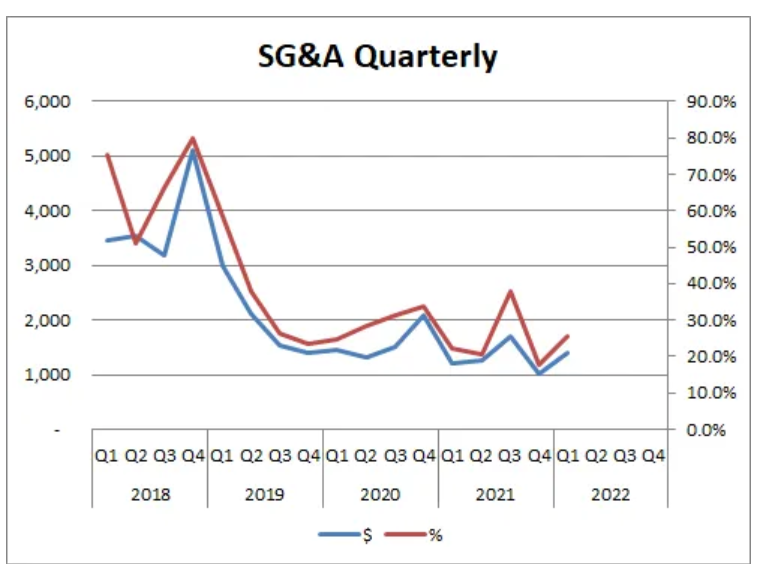

The current CEO has been quite good at slashing SG&A costs, another sign of intelligence.

Links

April 2018 - Acquisition of the Canadian marketing rights for Eskata

May 2018 - Acquisition of Cardiome Pharma Corp

Can-Fite news release on phase 3 results

Research on PASI-75 vs PASI-90

Disqus comments are disabled.