#65 - Mako Mining 2022Q2

Last updated: Nov 1, 2022

2022Q2 results are out (link).

FCF breakdown: 7.5 [mine OCF] - 1.0 [royalties & taxes] - 1.9 [capex] = US$4.6M or CA$5.9M.

The stock price has taken a beating as of late, currently sitting at CA$0.23. Market cap = $151.4M.

Debt is still around US$16M or CA$20.5M

=> EV = CA$171.9M

=> run-rate unlevered FCF yield = 13.7%

It’s possible I buy a bit more in the coming days.

Note:

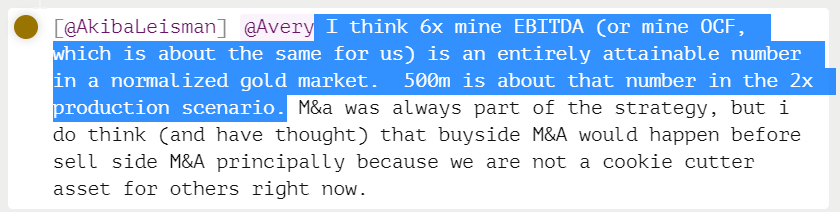

The CEO left this comment on ceo.ca which I found interesting:

The current run-rate OCF is ~US30M.

x6 => fair price at the current production (500tpd) is ~US$180M or CA$234M.

So according to the CEO, the current EV of CA$172M represents a 26% discount.

And if/when production doubles, let’s say yielding OCF of US$70M (after synergies), we should be able to get a market cap of US$420M or CA$545M. With 657M shares outstanding, that’s a stock price of CA$0.83 or 3.6x from here.

Just to be clear, this is the opinion of the CEO so take it with a grain of salt, and it relies on doubling the production capacity as well as a proven long-enough mine life.

Disqus comments are disabled.