#64 - Cardlytics

Last updated: Nov 1, 2022

It is wise to be rational, but unwise to expect others to be.Especially when your livelihood depends on it.

As of today, I haven’t decided to put money into Cardlytics yet, and I want to explain why - in case I want to look back at it later.

But before I get to Cardlytics, I want to make a quick detour through Carvana and Cliff Sosin - because that’s how I got introduced to the name.

Carvana

Carvana’s $CVNA stock price has doubled since its recent low of July 2022 and it made me wonder whether I missed an opportunity.

The first time I heard about Carvana as a serious investment candidate was through Rob Vinal. He talks about it here. I think he wrote about it too.

The second time was through this interview with Cliff Sosin:

Cliff struck me as a poised and intelligent guy.

The third time was through Jason Rothman, also known as the After Dinner Investor, here.

So the point is I heard about Carvana multiple times. I also was aware that the stock price had been cratering (from above $300 to $20ish):

But I’ve never put any effort into understanding the company because of two reasons:

-

I never liked the business model - buying and selling cars. Seems capital intensive and sensitive to economic fluctuations.

-

The CEO and his father don’t have a squeaky clean reputation. I don’t know whether that is deserved or not.

On point 1., the reality is that Carvana is also in the auto lending business. Maybe that’s a good thing, maybe that makes it even worse. I don’t know.

On point 2., my gold standard is people like Warren Buffett or Leonard Cohen. Go ahead and try finding something bad said about them or their actions anywhere. Good luck.

So I thought I had good reason to dismiss this investing “opportunity”. And after thinking about it some more, I still do. It’s just not for me. I don’t understand this business well enough and I don’t have a high enough interest to understand it.

Cardlytics

Then I listened to another interview of Cliff Sosin, about Cardlytics $CDLX this time:

How amazingly well-spoken Cliff is! I wanted to buy the stock on the spot after listening to him.

Now, this is a business I can understand. In fact, I don’t think there’s ever been a business I could understand better (disclosure: it’s related to my work experience).

The gist of it is like this:

-

Cardlytics receives anonymized customer bank transactions (including description, date, and amount) from their FI partners. Whenever possible/relevant, they map each transaction to the merchant and merchant category it belongs to.

-

Cardyltics probably also receives something like zip code and age group of the customer.

-

A marketer wants to target a specific segment, defined by their purchasing characteristics. E.g. the segment that buys at least $25 worth of pizza a month, within a specific zip code.

-

Cardyltics can tell the marketer how large a population they can reach based on these segment characteristics, through their bank partners.

-

The marketer launches the campaign. Cardlytics shows the ads to the qualifying customers. A percentage of them activate the offers and later redeem them by buying the marketer’s products with their bank card.

-

Cardlytics instructs their bank partner to credit cash back (or points or whatever) to the customer. The loop is closed.

It’s a win-win-win:

-

the user is happy because they got a discount

-

the bank is happy because they provide interesting and relevant offers to their users

-

the marketer is happy because they increased their topline

From the marketer’s point of view, this is a really good type of advertising, because they only pay for conversion.

Roughly speaking, what the marketer pays is split evenly between the customer (as a discount), the bank, and Cardlytics.

OK, so that’s the business (I obviously skipped a lot of details, including product-level advertising, but that’s what they are in my opinion - details).

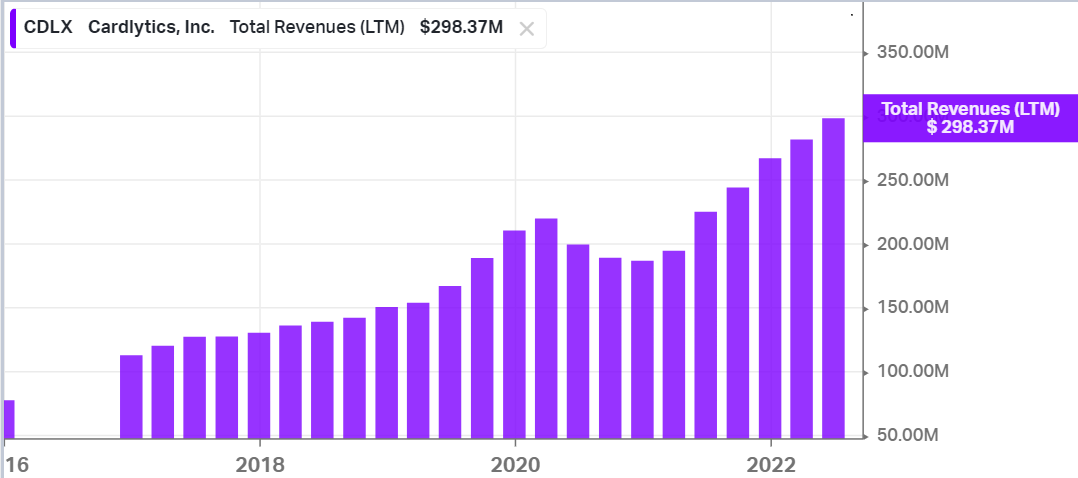

And it’s growing nicely:

But is it a GREAT business? This question has been nagging me for the past few days. I’ve had a lot of back and forth with Austin Swanson on Twitter. He’s probably the most knowledgeable and enthusiastic shareholder I’ve ever interacted with.

The business certainly looks great: network effects, economies of scale, first-mover advantage, and huge switching costs (for the banks).

So why am I hesitating?

Again, what’s the gold standard when it comes to business quality? Probably Alphabet and Apple are up there.

What is it about those businesses that make them fantastic?

Well, to put it simply: Alphabet owns google.com, and Apple owns the iPhone. That’s it. That’s the thesis.

Now what does Cardlytics own?

They own the relationships with the banks (and their trust). That’s very valuable and probably hard to replicate.

They own the engine that categorizes the transactions and associates them with the right merchant and category. That’s a technological advantage, but not that hard to replicate in my opinion.

They own a self-serve ad server and the technology that can inject targeted advertisements directly into the bank portal. That’s valuable and probably hard to replicate.

And what is it that Cardlytics does NOT own - but is important to them?

The user’s banking transactions. Those are (at least currently) held by the bank. The bank has to agree to share them with Cardlytics.

Of course, the banks are incentivized to do so. It’s good for them (revenue) and their users (experience).

And the bigger CDLX becomes (in terms of MAUs), the more attractive it becomes to advertisers, and the less incentive a bank has to defect. Both the breadth and effectiveness of the advertising should improve proportionally to MAUs, with time.

So I understand why this is a good business. And I see the current valuation, which is pretty cheap:

But I just can’t get over the fact that their key resource (the transactional data) is not under their control.

I was tempted to say that Cardlytics is doing in the marketing world what FICO did in the underwriting/credit-scoring world.

But the key difference is this: lending is core to the banks’ business and always has been. Marketing is not.

Maybe I’m not open-minded enough, and that’s something I want to improve. And I think that the expected value of this investment is very likely to be good, especially at current prices.

But is it a no-brainer? I don’t know…

Links

Disqus comments are disabled.