#63 - Portfolio Update, July 2022

Last updated: Nov 1, 2022

.png)

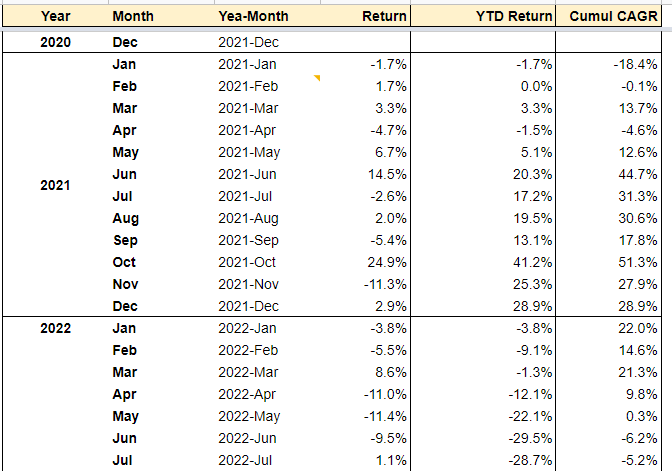

Note: I wrote my commentary on the morning of Friday the 29th, expecting a loss for the month. But Mr market was in a good mood that day (especially with Emerita up 9%) and brought my monthly return back into the green.

This is my fourth consecutive month of negative returns.

Three explanations are possible:

- I’m getting beat up with the market

- I’ve been unlucky

- I have no clue what I’m doing

Intuitively, I would weigh these 3 explanations 35%, 5%, and 60% respectively. I can only do something about 3. so it’s good that it has the largest weight.

In this Lex Fridman podcast about genetic differences in average IQ between races, the guest mentioned that it would be a GOOD THING if the observed average differences had a biological source (as opposed to societal), because biology is a rational science. When we think rationally, we can solve problems and make concrete progress.

Similarly, I do believe that my future self will be less clueless than I am right now. While the changes might take some time to manifest themselves into my investing performance, that is bound to happen ultimately.

Maybe that’s why I’m not feeling so bad about my current underperformance. Weirdly, I’m almost feeling bad about not feeling bad.

I’m reminded of the manga I was reading when I was much younger, Dragonball Z.

I didn’t explicitly understand why I liked that manga so much and in particular Sangoku, the main protagonist. But it’s clear to me now.

He just loved the fighting game. No matter whether he was winning or losing, fighting itself filled him with joy. He was looking forward to tougher fights.

As Buffett once said:

We enjoy the process more than the proceeds.

The second weird thing about Sangoku is that whenever he got beat up, he systematically came out stronger from it. The manga even made it a physiological characteristic of his race, as if it was trying to tell us: “The best fighters out there are wired in a way that they become stronger after a beating.”

And I do agree that you’re either wired that way or you’re not. It’s probably a mix of ambition, love for the game, curiosity, and humility.

While I’m no Sangoku, I’ve enjoyed a good beating recently. It has forced me to think about my decisions and what was driving them.

Longer-term, I’ve also been thinking a lot about style (see here).

And on that subject, it looks like I have a lot of overlap with Geoff Gannon, from https://focusedcompounding.com/, which I couldn’t be more proud about.

They recently released a fantastic episode where Geoff talks about the importance of knowing our style, as maybe the most important thing we must do as investors.

Here’s the Spotify link and the YouTube clip:

Not too many moves this month.

I bought some shares of Vermillion Energy $VET.TO for the exposure to natural gas, and some of Cipher Pharmaceuticals $CPH.TO (1.8x EV/EBIT ttm).

I completely sold out of $AEP.V. It’s a good business and maybe it’ll do fantastically, but I’ve been turned off by a few subtle things here and there.

Suppose you have one decision left to make before you die.

One purchase; one business. Whatever you buy will be coffee-canned and passed on to your children, but they’ll only be told many years from now when they’re 21.

What do you buy?

(backup link)

Disqus comments are disabled.