#55 - Aimia: too bad, so sad

Last updated: Nov 1, 2022

I wrote previously about Aimia, here and here. This is a holdco that trades at a discount. They own one business in particular (Trade X) that is growing like crazy and seems to have some unique competitive advantage.

After acquiring a starter position, I did some additional work on this stock and I have decided to dump it. I explain why below.

On April 29, 2020, Aimia announced a Corporate Transformation. A small part of this transformation was the acquisition of Mittleman Brothers LLC (“MB”).

From the announcement:

The purchase price consists of US$5 million in cash and 4 million shares of Aimia stock, of which 2,667,667 shares are held back for earnout and performance related targets, namely a significant increase in MIM’s assets under management and/or Aimia’s share price trading at a weighted average of C $6.00/share or higher over a consecutive 20 day trading period.

Let’s unpack that.

They paid (to themselves) CA$6.3M in cash plus 4.1M shares of Aimia, worth CA$10.6M using the share price as of end of April 2020 (CA$2.6/sh). So CA$17M in total.

What did they get in exchange?

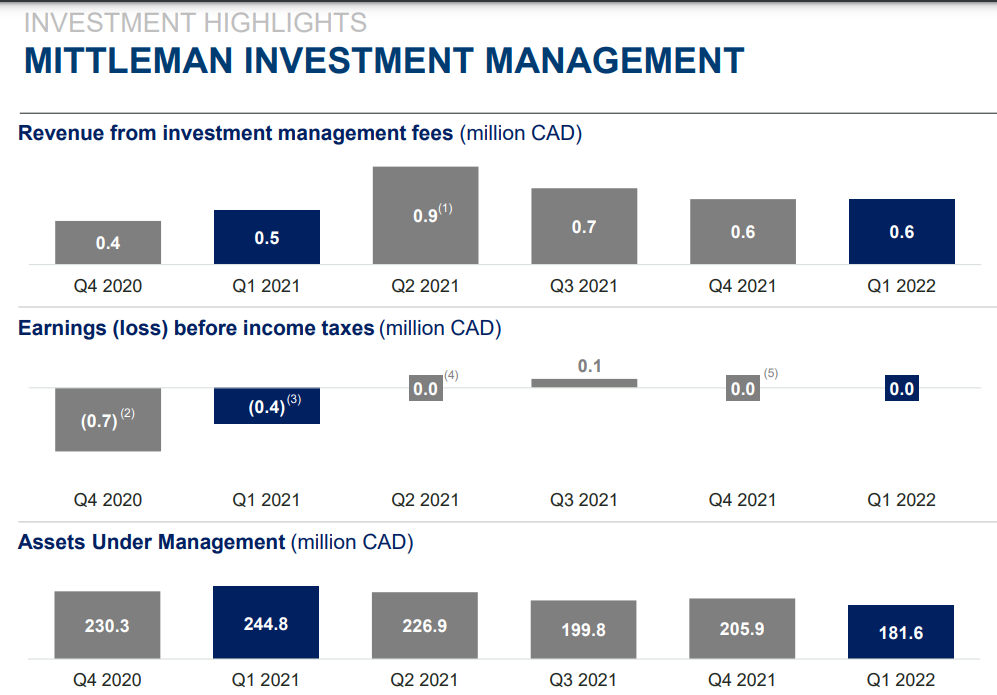

This gem (from their 2022Q1 highlights):

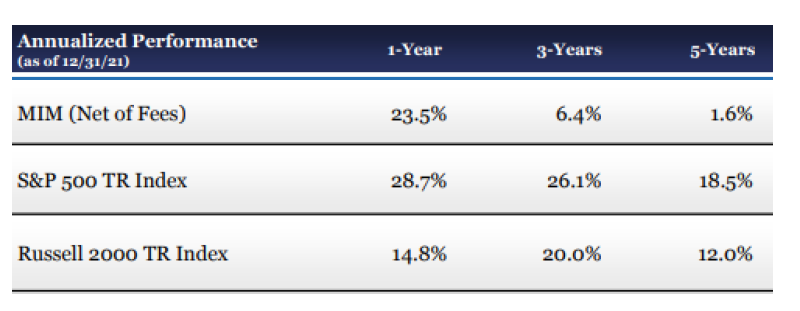

And in case you needed more color:

Just to finish off, remember that significant increase in AUM condition to unlock 2.6M shares of Aimia?

Here’s something that might help, from their 2021Q2 earnings call:

As part of the company’s continued process of investing excess capital to generate superior returns, Aimia invested $25 million in Precog Capital Partners, a private fund managed by Mittleman management using its deep value-oriented strategy.

Precog is a fund managed by MIM. This means they can increase the AUM of MIM until the condition to unlock the remaining earnout shares is met.

If you are invested here, I wish you good luck. It may end up being a great investment.

As for me, even though I was initially enticed by their stake in Trade X (which looks like a truly fabulous business), the discount to NAV, and the share buybacks, these are not people I want to give my money to.

I’m out.

Disqus comments are disabled.