#51 - I Trimmed $AEP.V

Last updated: Feb 2, 2023

I recently praised $AEP.V as one of my top holdings that I was comfortable leaving alone, despite the bleak economic forecasts.

The reasons I like $AEP.V are neatly summarized in the tweet below: secular tailwind, strong execution, and ultra-cheap valuation.

I am gonna try to add some thoughts and facts about why $AEP.V will outperform.

— Unai Arregui (@Arregius) May 22, 2022

Numbers are starting to back up the thesis here and why margins are improving.

Atlas aims to consolidate the highly fragmented wood-housing market in canada.

Many competitors are families who… https://t.co/9bzGw3iQV1

But I did trim my position, by half.

Not because of the economy, and not because of failed execution. In fact, they just had another monster 2022Q1 quarter (financials, MDA). And I have them trading at about ~3.5x EV/[EBIT - Leases].

So what gives?

In anticipation of the quarterly earnings, I was browsing the ceo forum as I sometimes do. I was curious to see if there was any insider buying happening at these low levels.

I found the share buybacks, as expected. But I also found something else. Something that somehow slipped under my radar for several months, I’m ashamed to admit.

Here it is:

In January of this year, Dhaliwal Gurmit (the COO) was gifted ~1.5M shares. For context, the company currently has 59.2M shares outstanding, and I believe the number was 57.7M as of Dec 31, 2021. It looks like she was also granted 225,000 options and 50,000 warrants.

Either way you slice it, this person was gifted 2.5%+ of the company. And I don’t think I’ve ever seen her buy on the open market before.

This rubbed me the wrong way, to say the least.

When I buy stocks, even if I just buy one share, I consider that I just purchased a piece of a business. I am part-owner of the business.

To learn that 2.5% was GIVEN AWAY in one shot, I just can’t stomach it.

I truly believe the business will be fine long-term. But a good business is not the same thing as a good investment. When you give away 2.5% of MY investment, you might as well spit on my face, and I don’t care if it is the COO. It’s just ridiculous.

Meanwhile, both Jonathan Goodman and Samira Sakhia from Knight Therapeutics have been buying shares of $GUD.TO with their own hard earned cash.

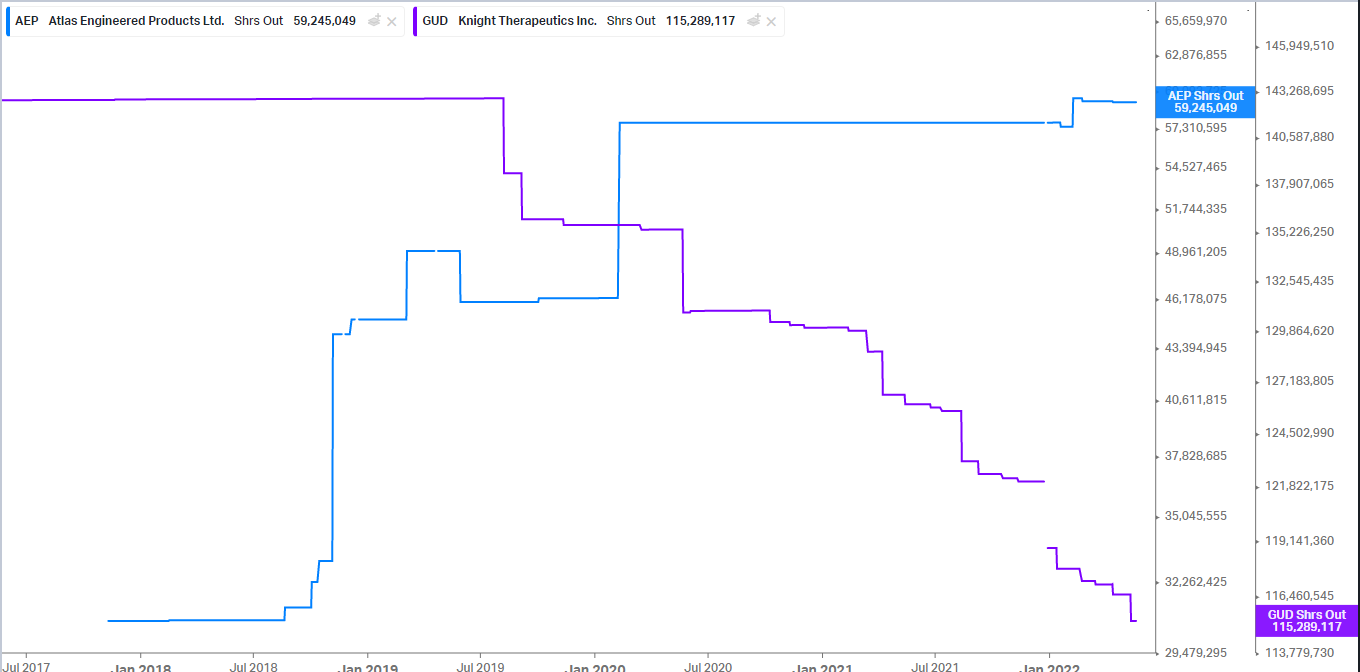

And while both businesses are buying back shares, let’s just say…not all buybacks are equal!

So I cut $AEP.V in half and put the cash into Knight.

I completely exited $AEP.V after the CEO announced he would be selling a fifth of his holdings or 2% of the outstanding. Not that he’s not allowed to, but the timing is just God awful and I’m not sure there’s enough liquidity here to support the price.

I’m out.

Disqus comments are disabled.