#5 - Oil and Gas

This post will be slightly more philosophical in nature and a bit longer than usual. To make up for that, I promise some concrete take-aways and action items.

Two concepts I’d like to explore:

-

the concept of “circle of competence”, its implications and misuses

-

why opportunities exist

Buffett has popularized the importance of staying within our circle of competence when it comes to investing. If you look closely at his own investment record, excluding Apple, he never got it wrong when he invested in financials or insurance companies. On the other hand, he made plenty of mistakes elsewhere (airlines and retail furniture for example).

But funny enough, Apple, a technology stock, was the best investment of his life. Was Apple within his circle of competence?

You could argue that Buffett is a life-long learning machine and that he relentlessly kept pushing the boundaries of his circle until it included something like Apple. While that is probably true, I think the simpler explanation is that he understood the moat of Apple; how the business was making money and fending off competition. And at some point, Apple’s stock price fell low enough for him to consider it cheap and scoop it up.

Here’s another, more personal, example.

I’ve had a hard time investing in energy stocks, because I’m not very familiar with that sector and am not sure how to value those companies. As a result, and even though it seemed the entire sector would do well post-covid, I stayed away - because it was “too far from my circle of competence”.

I have now changed my definition of what the concept means. Here’s my updated definition:

Something is within my circle of competence if I can predict with adequate accuracy whether, why, and for how long it will make money.

I wish I could say that this definition brings the oil and gas companies within my circle of competence, but unfortunately, it doesn’t. Valuing those companies is hard, and I would say without a few years following and studying the field, don’t even bother.

However, what is within my circle of competence is to understand the fundamental macro trends that have led these companies to be undervalued.

And those trends seem to indicate we might be headed towards an energy crisis and higher oil prices. Here’s a beautiful quote from John Polomny:

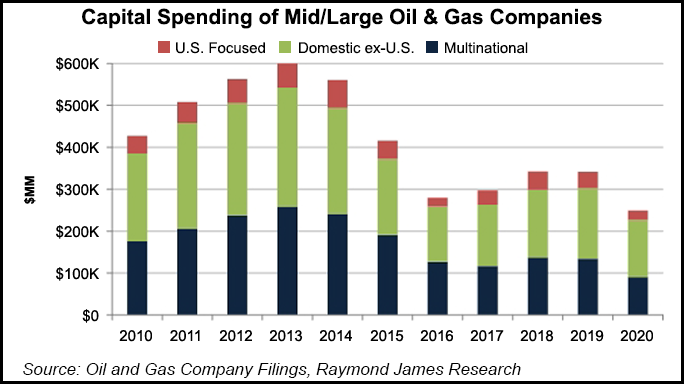

We simply have not made the necessary investments to find the requisite amount of hydrocarbons that are required to run the world.

Take a look, it’s pretty drastic:

My goal here is not to go over these macro trends, it would take way too much time, and I’m not qualified anyway. Smarter people have expressed their thoughts on the matter, see Kuppy’s here for example.

Let’s just assume that oil & gas stocks are likely to be undervalued. I’m still no expert though; therefore I need help choosing which ones to bet on.

I see three reasonable options. Here they are,. from least to most risky.

1] The safest approach would be to buy an ETF with energy exposure, such as the Horizons Crude Oil ETF, the BMO S&P/TSX Equal Weight Oil and Gas ETF or the Horizons S&P/TSX Capped Energy Index ETF. That’s a totally fine idea.

2] Another way to do it, and maybe the one with the best risk/reward profile, is to figure out who is an expert on this sector and allocate some money with them (let them manage the bets).

When it comes to energy, I have identified a few individuals that know what they’re talking about. They’re not that hard to spot. Three of these (but there are more) are:

-

Eric Nuttall, portfolio manager of the Ninepoint Energy Fund

-

Josh Young, managing partner & founder of Bison Interests

-

Shubham Garg, CEO & Founder of White Tundra Investments

3] We can also try cloning the experts. We live in an era where information is exchanged freely and openly at an unbelievable rate. All we have to do is pay attention.

We could simply check their top holdings and buy a diversified basket from these. Which is what I’ve decided to do.

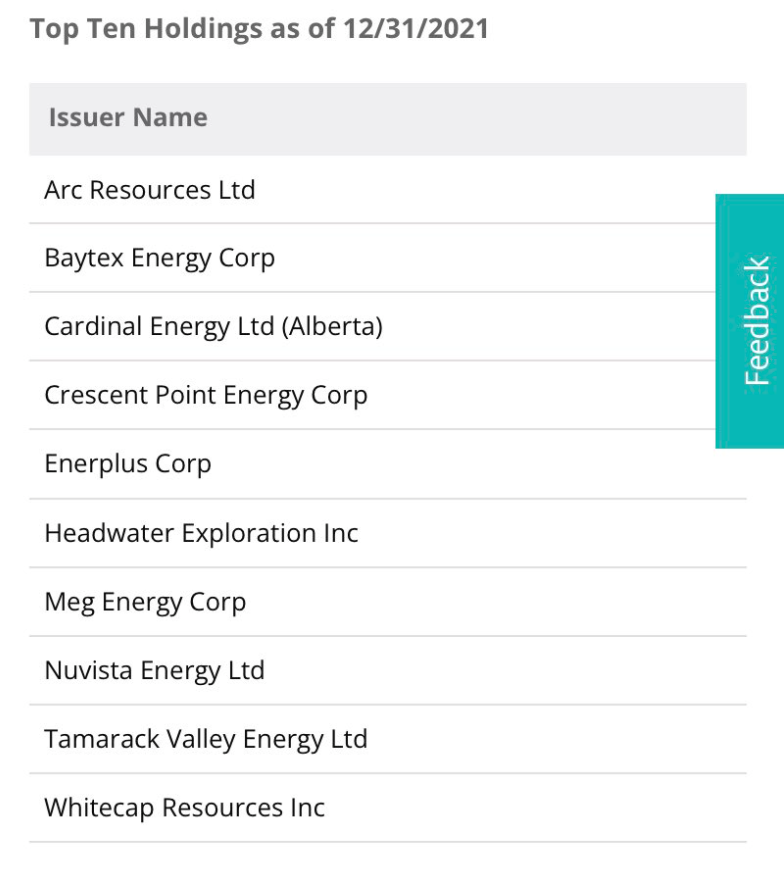

Just as an example, here the top holdings of the Ninepoint Energy Fund - not investing advice, I think it’s pretty obvious by now I’m not qualified for that :)

To wrap up these musings on circle of competence, I would add a final caution. The buying part is easy. Knowing when or why to sell, as non-experts, is trickier. Because the experts will tell you when to buy but if they see trouble brewing (and by definition, they’ll see it way before you do) they won’t necessarily have an incentive to alert you immediately. Keep this in mind and act accordingly.

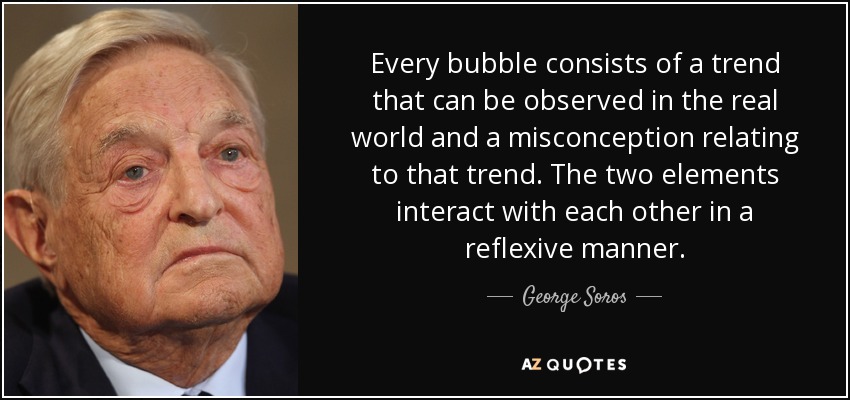

Why is it that oil and gas companies are cheap currently, despite the obvious supply problems and the short-term cashflow prospects in this sector?

To me, the answer is a mix of herd behavior and psychological rigidity, on the part of a huge mass of regular people who are making erroneous financial decisions. Those are the ESG people (God bless their souls). They have the best intentions, but they have embraced these intentions to the point of idelogy and dogma, refusing to see reality and instead sticking with their mental models.

The mental models say: renewable energy is preferable to fossil fuels, and we should make the transition as quickly as possible.

The reality is: things take time. And renewables are just not efficient enough, yet. As Warren Buffett (him again!) said:

You can’t produce a baby in one month by getting nine women pregnant.

The opportunity stems from the discrepancy between the dominant mental models and reality.

You might ask: “Why don’t they just change their mental models?”

It’s hard, and not just on a psychological level. These models have been translated into rules, procedures and performance metrics. They are incentivized to stay in denial.

Opportunities such as these exist because some people are constrained in ways that you’re not.

If you want to explore this topic further, check out this amazing ValueHive podcast episode with Dan McMurtie, PM at Tyro Partners.

So what is the take-away for us, simple mortal investors?

Be flexible.

Avoid dogma.

Keep an open-mind, and keep learning.

I don’t know if he’s the one who said it, but John Maynard Keynes is often credited with one of the best quotes of all times:

When the facts change, I change my mind. What do you do, sir?

The best time to bet on oil and gas was in 2020, when oil went into negative territory.

Now, in early 2022, it seems like a good bet still. In some ways, on a risk-adjusted basis, the bet might be just as good.

But I have to acknowledge: more and more people are aware of it. Part of me wonders: am I too late to the party?

I just read a Revue issue from Bill Brewster, and he had this quote from a Howard Marks’ talk on MOI Global:

You make the most money in investments that have undiscovered merits. You lose the most money in investments who’s merits are overstated.

The next caveat I would give is: oil and gas are cyclical commodities, driven by global supply and demand. The stocks go up and down, these are not (for me at least) life long investments.

Third, I like to think that I’m making an intelligent probabilistic macro bet, but could it be that I’m just following the momentum? Yep, that’s a real possibility.

And finally, there two known unknowns in this story: 1) US shale oil coming back online thanks to higher prices, and 2) OPEC spare inventory. These two alone can shift the story dramatically.

I will leave you with one final quote, from a guy I don’t necessarily admire, but one whose financial success and trading chops are undeniable:

-

White Tundra Investments (so much knowledge there, and Shubham Garg is both extremely competent and generous)