#42 - I sold SMLR

Last updated: Nov 1, 2022

Just a few days ago, I wrote this:

[…] people tend to overcomplicate things and read too much into quarterly numbers. I don’t think the company is suddenly facing some new competition or dealing with fundamental issues.

While I haven’t changed my mind on the second part, I have changed my mind on the first part (keeping it simple).

In a nutshell, I now think that I was keeping it too simple.

My conviction about the company has changed.

As I explained in my previous post on Semler, I initially decided to trust Yen Liow’s business analysis skills and save myself the trouble.

But I ended up doing the work myself to understand the business at a deeper level (after I bought… 🤦)

I found myself going down a rabbit hole about Medicare, Medicare Advantage, and big insurance companies in the US such as UnitedHealth (which is a customer of Semler’s).

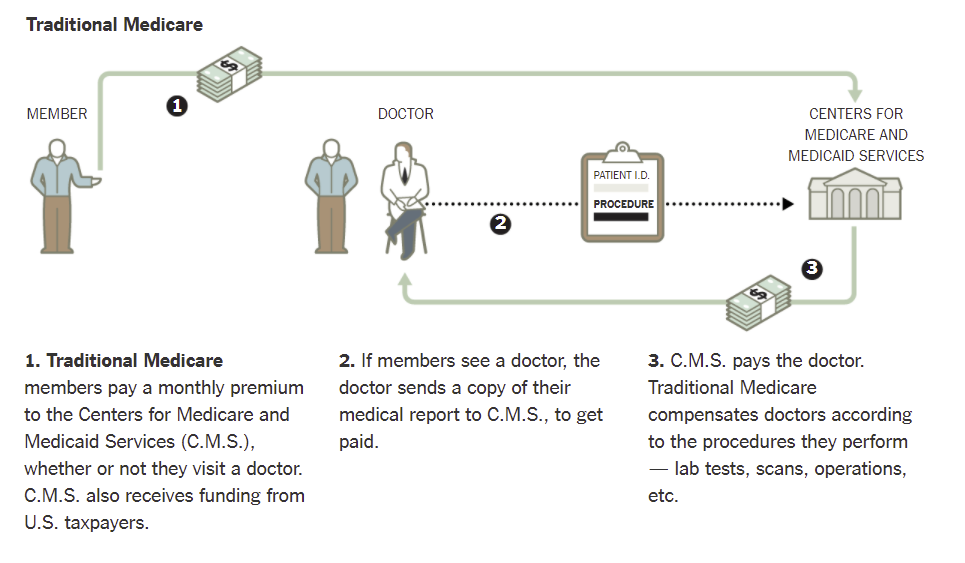

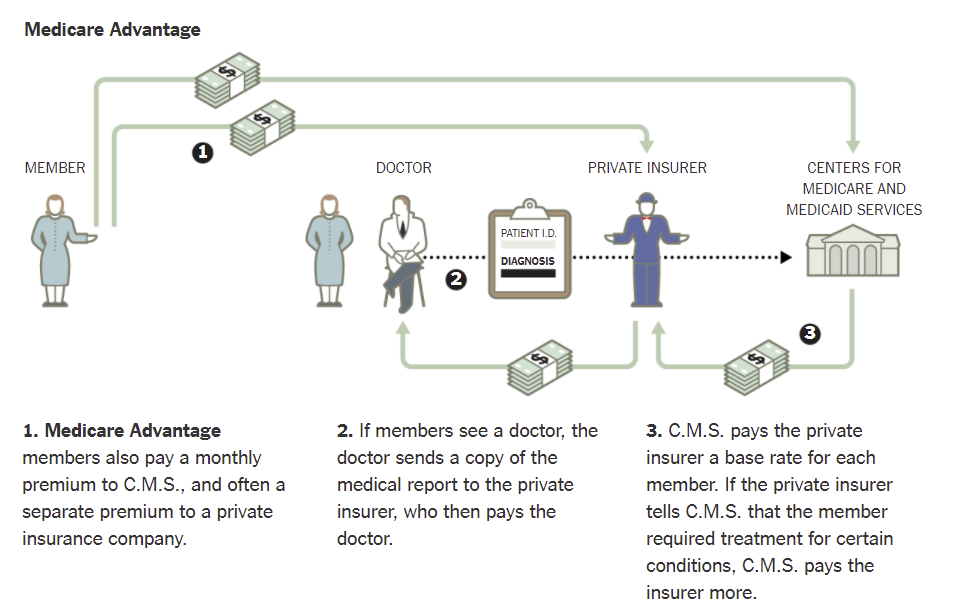

Medicare Advantage was basically created to bail the government out of a funding deficit for Medicare. They brought in the private insurers and made a deal to reimburse them based on how sick the participants are (the more ill the participants are, the higher the government reimbursements are).

Source: link

Under Medicare Advantage, the insurers are incentivized to diagnose patients with something. Anything. But they have no incentive to treat the sick patients, other than to avoid costlier treatments down the road.

There have been a few lawsuits against these insurers, launched by whistleblowers, accusing them of gaming the CDC’s (Centers for Disease Control and Prevention) risk scoring system. Some have also claimed that treatments under Medicare Advantage are harder to get than under traditional Medicare, especially for severe cases.

In any case, the insurers have a financial incentive to detect illnesses, and that’s where Semler comes in. Because it allows the diagnosis of PAD to be performed quickly and with ease, at the general physician’s office, and with good accuracy, it was a no-brainer for the insurers.

And I believe other products of Semler will be easy commercial successes as well. They’ve announced that they have commercialized a product targetting diabetes, and this is even easier as it has synergies with PAD (diabetes can cause PAD), and the insurers can get paid extra if they can prove that a patient’s PAD was caused by their diabetes.

Of course, I didn’t even mention that the insurers would probably save money by treating patients early, but that ROI is longer-term and I believe the real immediate value proposition of Semler is tightly coupled with the Medicare Advantage payment system.

Because of this tight dependency, if you were to ask me now whether Semler will exist 20 years from now, I would hesitate. And to be honest, my answer would be a not-very-confident “maybe”. Because I’m not 100% confident that Medicare Advantage is a win-win-win: I know it’s a win for insurances companies and for diagnosis providers like Semler, but whether it’s a win for the patients is unclear to me.

Finally, I was reminded of this quote from Warren Buffett: “The price is my due diligence.”

And in this case, while the price is good, it’s not good enough for me to look past my hesitancy on the fundamentals. I think I can find other investments at similar IRRs that I would have a higher conviction on.

So I sold, at a loss. Which I would have avoided if I had done the work prior instead of blindly cloning someone else. I’m OK with it though, I learned my lesson. As they say: conviction can’t be borrowed. I also learned that scaling in works better for me psychologically speaking, as opposed to buying a full position quickly.

As Buffett also says, this game is more about temperament than it is about intelligence. Unfortunately I’m not that intelligent to begin with, so I really need to work on control my temperament.

Unfortunately, it seems this market has had its toll on me. I’m being overactive, changing my mind too often, and accumulating small losses along the way.

One of the reasons I’m looking for companies with a very long expected life is so that I can coffeehhhhhhm hhj-can them and update my views on the business once a quarter or so. I just don’t have the wiring of a good trader, and I find the psychological toll too high.

P.S. I should have made it clearer: I am absolutely not worried about the stock in the short-term. I believe their 2nd product will be a hit. It’s also evident that this business is recession-proof, and once the market is reminded of that, it’ll be hot again. I’m just lookingfor something I can set and forget.

Disqus comments are disabled.