#39 - Portfolio Update - Feb 2022

Last updated: Nov 1, 2022

- It doesn’t matter whether you’re right or wrong. It matters how much you win or lose when you’re right or wrong, which will be related to how much you bet, in turn dependent on your conviction, and related to the underlying torque.

Case in point:

Jan - Feb 2021 was life-changing.

— Shubham Garg (@WhiteTundraSG) February 27, 2022

Jan - Feb 2022 built generational wealth.

The oil industry has given me everything I have and is responsible for people enjoying a higher quality of life and getting out of poverty all across the world. For that, I will always be grateful. 🛢💰 pic.twitter.com/LildK7oHGz

-

The money is created when you buy: buy low. Don’t chase ANY particular stock. Be extremely patient and detached, wait for the price to come to you. And then get out of the way and let the money compound.

-

While it’s OK to binge on famous super-investors’ content about general investing principles, DO NOT overxpose yourself to any particular opinons about stocks or groups of stocks (I made the mistake of listening to too many energy-related twitter Spaces, which turned me bearish too son).

-

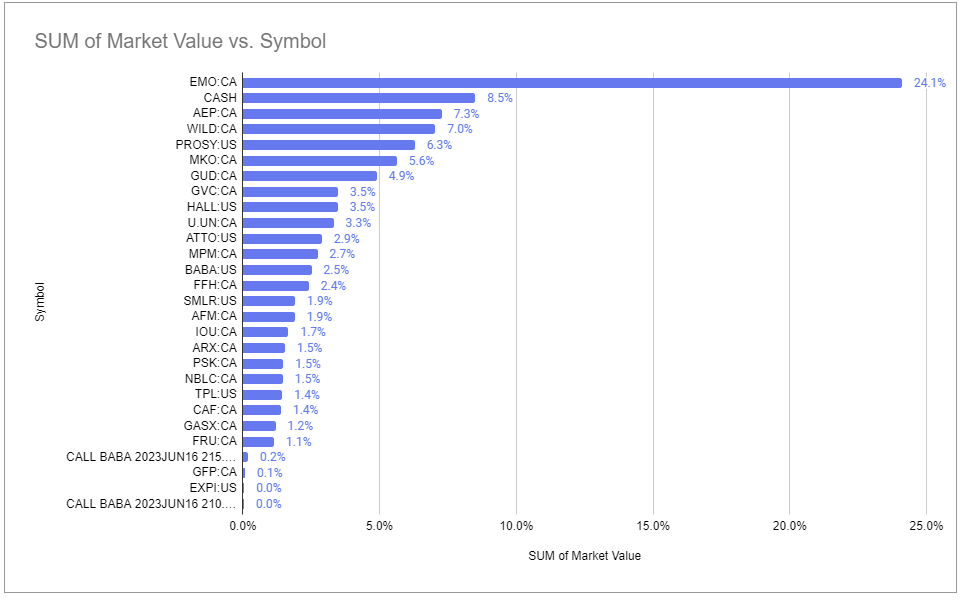

Oil stocks: unfortunate early sells (kept ripping)

-

$JAKK [JAKKS Pacific]: unfortunate early sell (kept ripping)

-

$XX.V [Avante Logixx]: Sold following announcement of acquisition, don’t trust the new company

-

$GFP.TO [GreenFirst Forest Products]: small position; price of lumber is still extremely (and surprisingly) high

-

$BABA: Added on weakness

-

$PROSY [Prosus]: Added on weakness

-

$SMLR [Semler Scientific]: new position following earning miss

Disqus comments are disabled.