#28 - Letters 2021Q4 (Part 2)

Last updated: Nov 1, 2022

- Inception Date: April 2018 (almost 3 years ago)

- CAGR since inception: 71.11% (gross), 56.38% (net) vs 19.17% for the S&P 500

- Fund Fees: 1% management fee and 20% performance fee

Commentary on NRS, IDT’s most valuable business:

In the most recent quarter, NRS grew revenue 105% over the prior year. This was triple-digit growth on top of triple-digit growth in the prior year (2-year comp was 321%). That is incredible organic top-line growth. Unlike many other SAAS businesses, NRS is already EBITDA breakeven (achieved in the most recent reported quarter). Therefore, we are dealing with a “Rule of 40” in excess of 100. NRS is a 90%+ gross margin business dominating a niche with no meaningful competition, growing triple digits, and already scaling profitability.

We continue to believe that shares of IDT are likely to more than double over the next few years and that NRS itself could be worth $30 per IDT share in a few years’ time.

Comment:

Other big holdings (from previous letters):

- Inception Date: 2016 (6 years ago)

- CAGR since inception: 25.9% (net) vs 17.8% for the S&P 500

It was only four months ago when we published Part III: Apex of a Bubble. We said that the US capital markets were mired in an “everything bubble,” presaging real returns that investors would find severely disappointing – and likely negative – for many years to come. And we predicted an imminent top and a proximate cause:

We believe inflation is likely to be the catalyst that ultimately pops the everything bubble. If we are correct, eventually the Fed will have to reverse course, tightening policy and raising interest rates. When this happens, investors who have speculated in low or no-yielding assets like SPACs, high-flying growth stocks, and NFTs may find their portfolios permanently impaired.

Nonetheless, overnight interest rates remain at zero – utterly inappropriate for a high inflation, high growth, low unemployment economy. And not only has the Fed yet to begin reducing its gargantuan balance sheet, it is actively engaged in quantitative easing at this very moment. While real interest rates are up sharply – the 10 year TIPS yield has gone from -1% to -0.6% since September – they are still deeply negative. To rein in inflation, real interest rates will need to rise several multiples of their increase thus far. This tightening will be devastating to capital markets that have become dependent on easy money.

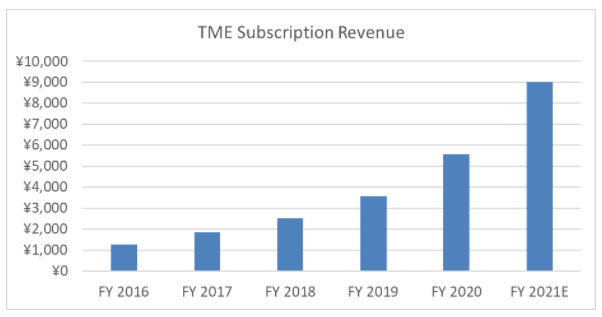

We initiated one material long position during Q4, in a Chinese company called Tencent Music (TME).

One of the largest positions of the since-imploded Archegos fund, TME has fallen from $20 in Jan 2021 to less than $7 today, implying an enterprise value (net of cash) of less than $8b. We think this is extremely cheap for the dominant online music platform in China that currently generates $5b in revenue and $570m of trailing net profits.

Comment: I own Tencent Holdings (ticker: 700: Hong Kong), the parent company of Tencent Music, through Prosus ($PROSY). Here’s a very good writeup on Tecent Music, with connections to Spotify.

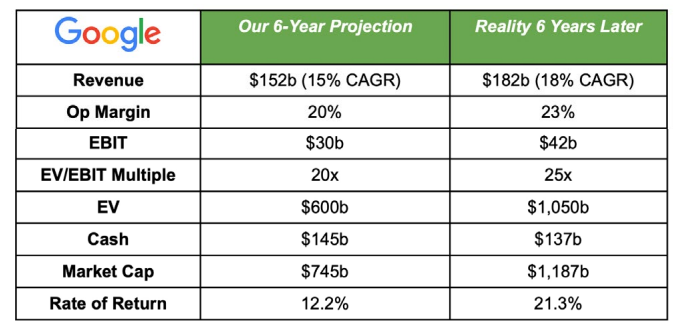

Comment: This is the difference between an OKish investment and a home run. Kinda scary…

There’s something profoundly idiotic about the whole valuation process, since it typically come with some form of multiple on slapped on some future value (be it terminal value or future earnings multiple). So we’re attaching a multiple years ahead to derive what the proper multiple should be today…

The more I think about it, the more it feels like valuation, while theoretically sound, is practically impossible to carry out in 99.9% of the cases, and the further away the cashflow is, the less useful of an exercise it is. Maybe that’s why Buffett, Greenblatt and others insist on waiting for the easy pitches.

I’m not sure what alternative framework ould allow someone to confidently bet on Google in 2015. If one exists, it probably would put way more emphasis on moat, market dominance, scale advantages, and other qualitative criteria. And it would require a good dose of faith and patience too. I doubt that there’s a way to get to a reasonably narrow range for the valuation of such companies, no matter what quantitative approach is used. Look at FB (Meta) today. Can anyone reasonably come up with a narrow range for what its intrinsic value is? I’m not sure. I think it only makes sense to hold it in a portfolio of small bets, a la venture capital.

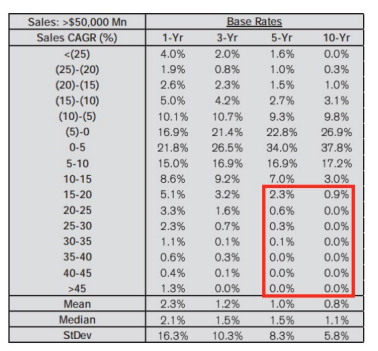

Of all the companies with sales greater than $50 billion, how many grew at a rate higher than 15% over five years and ten years? (In 2015, Google was already a big company, doing $66 billion in business)

… the onus would be on us to justify why Google had a better than 33- in-1,000 chance at defying the adage that “trees don’t grow to the sky.” Sure, Google is a remarkable business, but any organization doing more than $50 billion in sales has something cooking.

I’ll save the gory details for another letter, but the punchline is companies which invest in intangibles (like computer code at Google), have different base rate growth profiles. When it works, they can grow in ways that a “brick-and-mortar” business with tangible capital investments like factories simply can’t. Even when they’re already big.

But when it stops working, say due to technological obsolescence (think: Blackberry), the declines are equally breath-taking. So you end up with a much wider standard deviation of growth base rates. This reflects our gut intuition that it seems like technology widens the gulf between winners and losers.

Disqus comments are disabled.