#22 - Selected Letters - 2021Q4 (Part 1)

Last updated: Nov 1, 2022

- Inception Date: November 2015 (6 years ago)

- CAGR since inception: 18.68% vs 16.40% for the S&P 500

- Fund Fees: No loads; 1% gross expense ratio

While Ensemble’s investment strategy is focused on owning companies that are already deeply competitively advantaged, we know that what really matters is that our companies remain competitively advantaged in the future. Competitive moats erode over time unless they are diligently and proactively maintained. So, we focus on identifying companies that have strong competitive positioning and which we believe will maintain those advantages over time.

The fact is that investors don’t get paid for observing how the world stands today. They get paid for correctly understanding how the world will evolve over time. If a company starts off with ultra-high competitive advantages, but has them diminished to just strong competitive advantages is likely to see its stock underperform as investors assign less value to the company. On the other hand, a company that starts off with moderate competitive advantages, but works to improve their positioning so they display strong competitive advantages, is likely to see its stock outperform as investors recalibrate the valuation, they assign the company to reflect the stronger positioning.

While we talk about return on invested capital (ROIC) a lot, the fact is, it is return on incremental invested capital (ROIIC) that measures how much return a company can generate in the future and investors only get paid for what happens in the future, not what happened in the past.

But today, we want to call out our multiyear investment in Blackline and our brand-new investment in Peloton, as our current emerging moat holdings

Ouch!

- Inception: April 1995 (26 years ago)

- CAGR since inception: ???

(a) most investors trade too much, to their own detriment, and (b) the best solution for illiquidity is to build portfolios for the long term that don’t rely on liquidity for success.

…long-term investors can take advantage if illiquid assets become available for purchase at bargain prices.

When you find an investment with the potential to compound over a long period, one of the hardest things is to be patient and maintain your position as long as doing so is warranted based on the prospective return and risk.

Investors can easily be moved to sell by news, emotion, the fact that they’ve made a lot of money to date, or the excitement of a new, seemingly more promising idea.

Funny bit (but so true):

…there are two main reasons why people sell investments: because they’re up and because they’re down.

Superior investing consists largely of taking advantage of mistakes made by others.

It’s patently clear that relative considerations [opportunity cost] should play an enormous part in any decision to sell existing holdings.

- If your investment thesis seems less valid than it did previously and/or the probability that it will prove accurate has declined, selling some or all of the holding is probably appropriate.

- Likewise, if another investment comes along that appears to have more promise – to offer a superior risk-adjusted.

- Fund inception: August 1991 (20 years ago)

- CAGR since inception: 13.15% vs 10.84% for the S&P 500

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

Favorite bit:

Of course, I was asked for Oakmark’s view on cryptocurrency. As you could guess, my answer was that we won’t buy it because we have no idea how to value it. To my surprise, another panelist, a bull on crypto, said they completely agreed with me that its value can’t be defined, but that’s exactly why they own it. If a crypto coin is worth somewhere between $0 and $500,000, then they want to own it at $50,000.

While we concede that many stocks are priced close to fair value much of the time, it isn’t all stocks all the time. Most market participants are not carefully calculating the present value of all future cash flows. They act on emotions. They often aren’t thinking about next month, much less next year. As a result, stocks prices don’t always match business value. We believe we can take advantage of that by forecasting further into the future and by unemotionally pursuing opportunities where other investors have overreacted.

We will only buy a stock when it sells at a meaningful discount to our estimate of the company’s intrinsic value.

Personal note: Oakmark, just like Ensemble Capital, owns Netflix. They also own Alphabet.

…we often believe investors overreact to disruption risk. Examples include fossil fuel and internal combustion engine businesses. Current prices suggest that renewable energy and electric vehicles will be adopted at much more rapid rates than we consider likely.

Some investors put more weight and focus on the business quality and some others on the valuation. I think the best ones are those who are good at both.

But if I had to choose between the two extremes, I’d rather go for super cheap valuations and look for limited downside rather than unlimited upside.

In 2016, when Buffett started buying Apple shares, it was trading for ~8x EV/EBITDA, 10x P/EBT, and 12x P/E. Maybe the best investment of all time.

Today I stumbled on this investment thesis about a company called riwi, that I’ve never heard about.

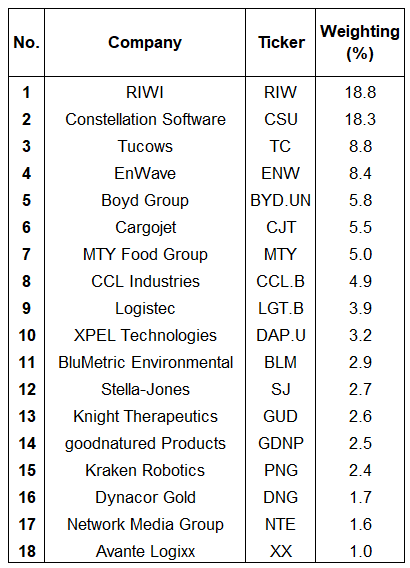

It was written in April 2019 and the author says that his conviction is so high that he made it 18.8% of his portfolio.

Looking at the rest of his portfolio, he seems to own a lot of high-quality Canadian stocks:

It also looks like he did his due diligence and reading his arguments, I’m tempted to believe that he’s a smart guy. His target price at the time was $3.40 within a year.

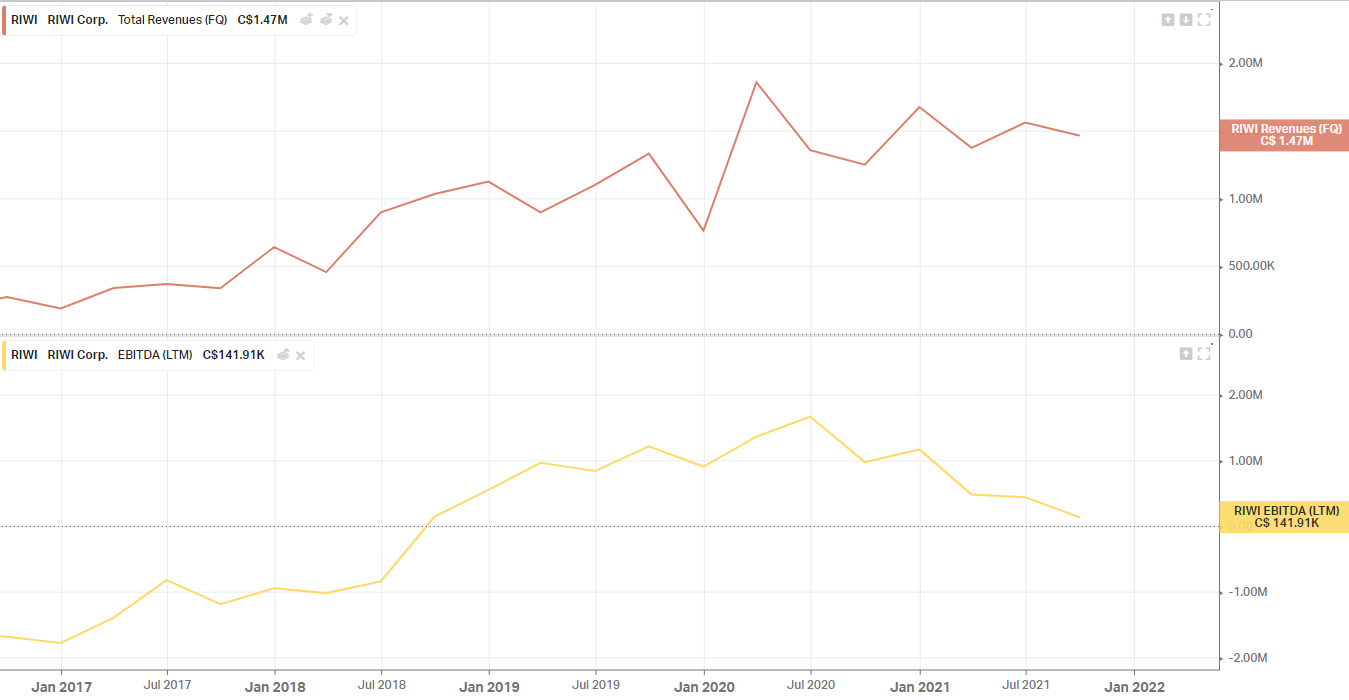

Here’s a sneak peak at the revenues and EBITDA of the company:

In April 2019, Riwi’s EV was about CA$50M, and EBITDA(LTM) was about CA$1M, so EV/EBITDA = 50.

Here’s what actually happened to the stock price:

I thought it was a good example of what can happen when you pay up and reality doesn’t go according to the plan.

Disqus comments are disabled.