#21 - Weekly Recap

Oil

This week, I increased my oil exposure.

Despite being a generalist bozo, I decided to increase my sizing as the price of WTI kept creeping higher, although there was a surprise retracement on the last day of the week.

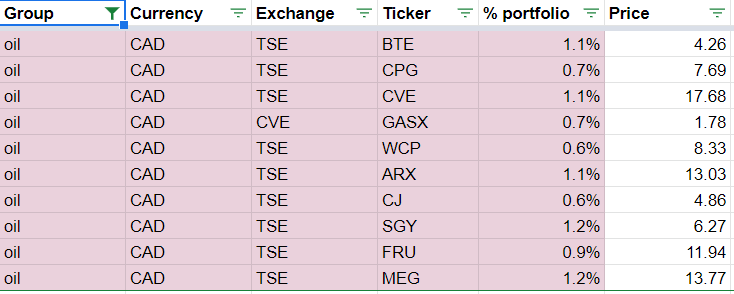

Here are my current holdings and corresponding percentage of my total portfolio:

I’m currently at 9.2% of total portfolio in oil. My maximum psychological threshold is probably around 15%. If we get other dips in the short term, I’m willing to get closer to that percentage, but I’;; probably be careful as I do want to increase my cash position as well.

On a more psychological note, while I am attracted to the energy space because it is fundamental to life, the number of visible and hidden variables that seem to drive this market is overwhelming. I don’t see myself staying invested in this sector too long, just because of the effort it would take to stay on top of it.

For 2022 and beyond, I really want to find a compounder with a solid moat that I can understand at a deep level and track with just a few key variables.

New position

I have a new position in Fairfax Financial Holdings Limited ($FFH.TO). It is led by Prem Watsa and seems cheap. Many smart people I follow are bullish on Prem, despite his lackluster track record in the past decade.

It’s a small position (2.2%) and probably my last non-oil investment for a little while, until the dust settles.

Exited $GFP.V

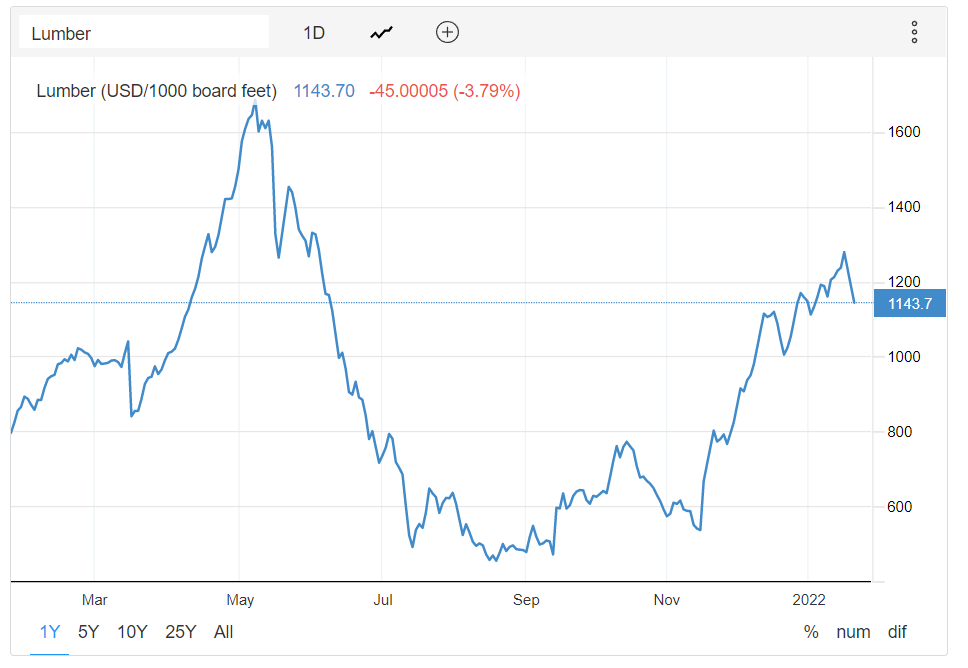

Lumber is doing its thing again:

I felt like this round 2 of lumber-mania was not driven by fundamental supply issues like in early 2021, and I had a decent (but not spectacular) run with $GFP.V, so I decided to get out for now.

I might jump back in later.

Short-term plan

My cash position is 6.4% at the moment, which is much lower than I’d like. I’m looking for any short-term rallies to unload a bit.