#130 - Portfolio Update Feb2025

It’s going well but I don’t really know why.

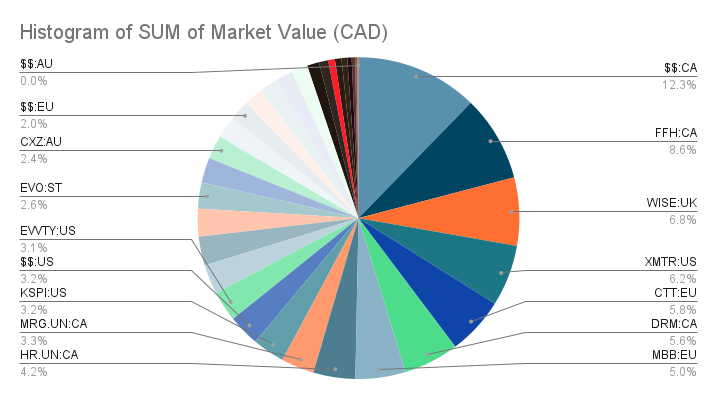

Funny how I have not touched $FFH.TO in years!

$WISE.L is maintaining itself in the top-3, but I had to help $XMTR quite a bit as the stock tumbled (I don’t see any issues with the business). When it was around EV/GP ~ 10, I almost sold. This is gonna be my threshold going forward. Above it is too expensive.

$CTT.LS did well, it’s been a while I haven’t checked on the business. All my REITs have been total duds, but I still like $DRM.TO and $HR-UN.TO. Maybe not so much $MRG-UN.TO, this one is on the chopping block.

I got lucky with the sale of $CTS.TO (although I was timid in my sizing once again).

I also booked the sale of tinybuild $TBLD.L $8Z3.F, taking advantage of a price bump as I was tired of waiting for a miracle. I should never have been in that stock to begin with.

Couple of other sales as well.

I bought a bunch more of $EVO.ST $EVVTY as the price tanked. I also added to $XMTR for the same reason.

I sold out of many stocks:

- $TBLD.L as mentioned above

- $7974 Nintendo - price stretched too high

- $TVK.TO - also in the very expensive territory

- $CPNG - mabe not very expensive…but expensive

- $PRKA, $PCSV - nothing extraordinarily appealing about these

I have been inexcusably distracted away from stocks this month. I need to get my focus back.

Not good. Lots of uncertainty. Lots of foolishness (especially out of the European dwarves).

I am looking to sell $MRG-UN.TO very soon.

And I am back on the hunt for a quality business on sale.

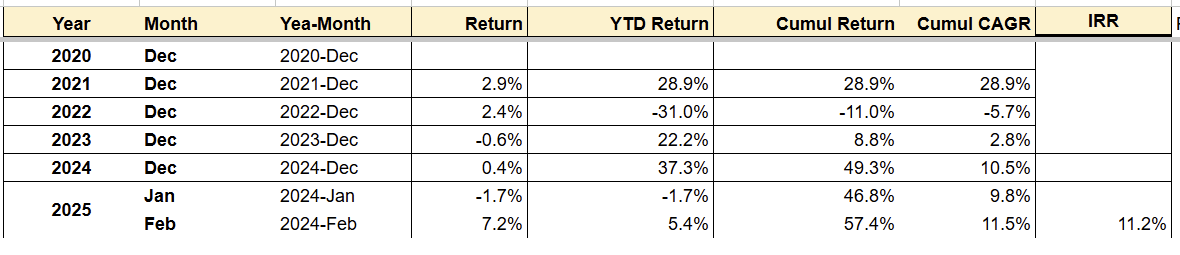

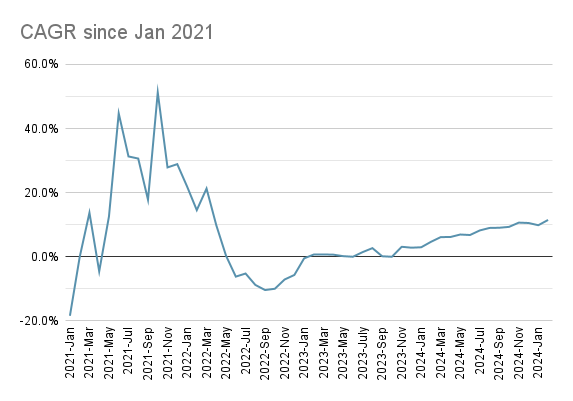

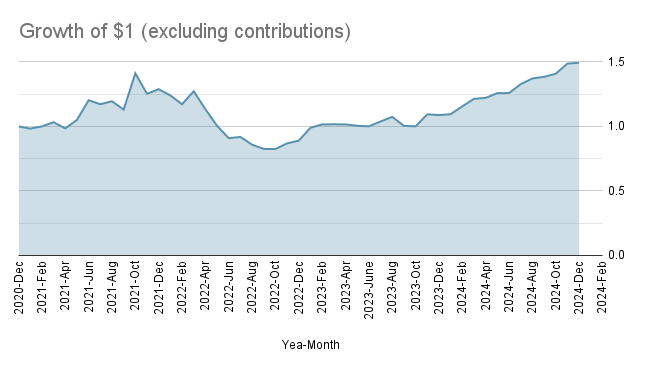

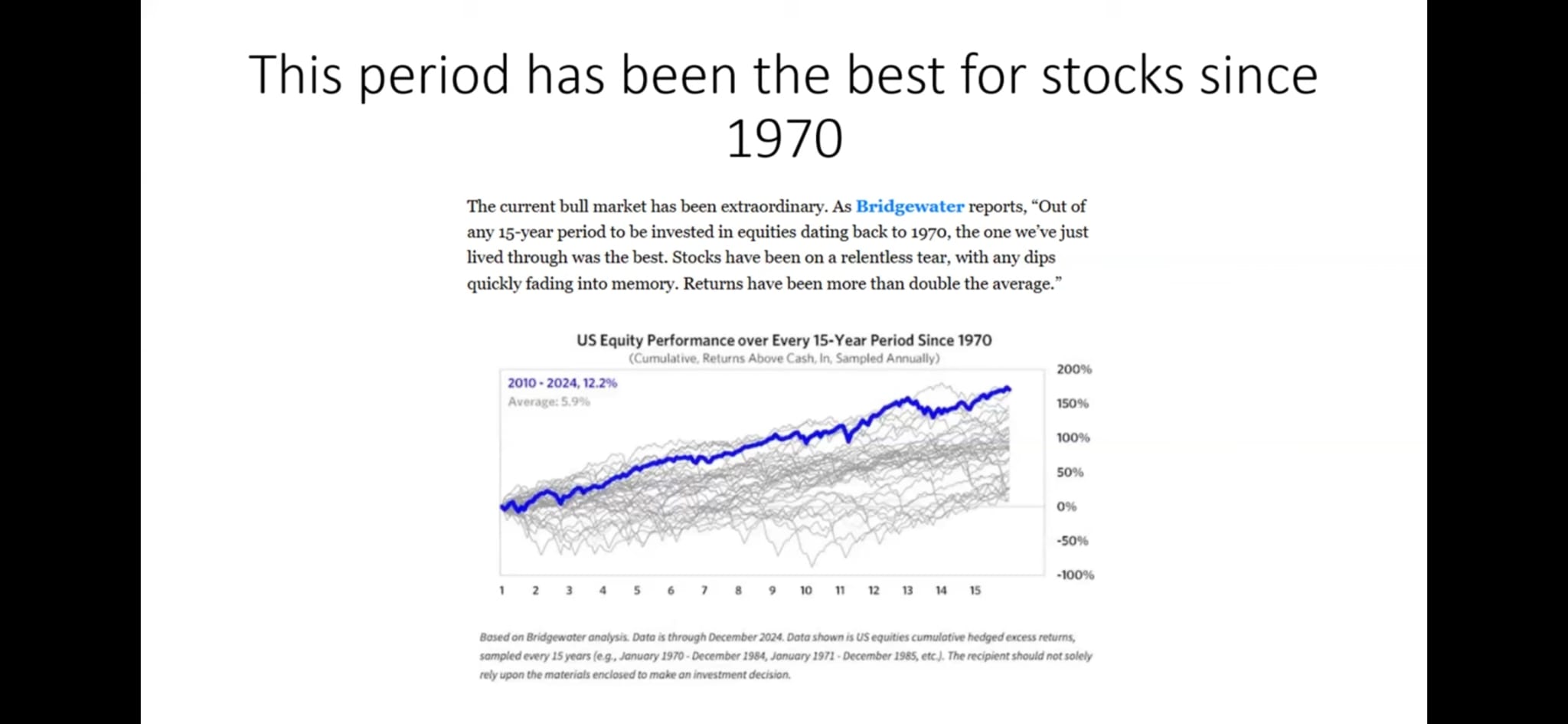

My 4-year performance (11% CAGR) has been rather pitiful and I’m looking to have a better performance in the next 4-years, without the recklessness of 2021-2022.

Disqus comments are disabled.