#129 - Ramblings Jan2025

Last updated: Jan 12, 2025

a Danish company that designs, manufactures and markets hand-finished and contemporary jewellery to individual customers. [...] Pandora sells what it refers to as “accessible luxury” hand-finished by craftspeople from high-quality materials.

Writeup (paid) from Bebop Value here (archived).

Better Nest has been super vocal about this one. I can’t see it personally.

Here’s a discussion on it:

There’s a longer writeup here (archived).

Comparison to $TVK.TO:

A bearish stance:

This strategic pivot turns Alico into a low-risk real estate and agriculture play with significant upside potential. The company’s vast land holdings, valued at $650 million to $750 million, provide a solid margin of safety for investors. Given that Alico currently trades at a deep discount to its net present land value, the stock offers an attractive opportunity.

Source: smallcaptreasures Substack (archive).

For some reaon, I find myself attracted to @ragingbullcap’s tweets and writeups.

I already have a position in Cronos Group, a negative EV, dominant and growing cannabis company.

Here’s his first writeup on it (archived). And the second one (archived).

From eycinvesting’s substack:

Burford Capital (Ticker: BUR) is progressing on collecting from Argentina for the YPF case. As explained on the Q3 2024 earnings call, Argentina submitted appeals to the Second Circuit Court of Appeals which are now awaiting oral argument before a 3-judge panel which Burford expects to occur early this year. This panel’s decision is expected “some months” after they hear the oral arguments. Burford expects little changes to this same court’s previous decision in favor of YPF/against Argentina. After this decision, Argentina may request an additional appeal from the U.S. Supreme Court which is granted less than 5% of the time. If this appeal is granted, that would add between 12 and 18 months to the process. Meanwhile, the trial court judgement is enforceable even though it is on appeal. CEO Christopher Bogart said, “the goal of enforcement campaigns is to apply pressure and create friction so that a rational negotiation can occur… Argentina is rebuilding its economy and resuming its place on the world stage. And to do that, it needs to rejoin the capital markets and participate in the global economy. Having a large unsatisfied U.S. court judgment and ongoing enforcement proceedings around the world that also sweep in third parties is sand in the gears for that normalization process. And it should, in our view, ultimately lead to a commercial resolution. Put simply, we are a nagging problem that Argentina needs to solve.”My hopeful expectation is for roughly a 200% return over the next few years. Burford’s current market cap is ~$3 billion, and they could receive ~$3 billion (50% of their portion of the total judgment) from Argentina; meanwhile, the rest of the business could continue to grow at roughly 15-20% per year while we wait.

Caught my attention through this tweet:

Here’s a bullish thesis:

I was surprised to learn that Temu was a #1 app:

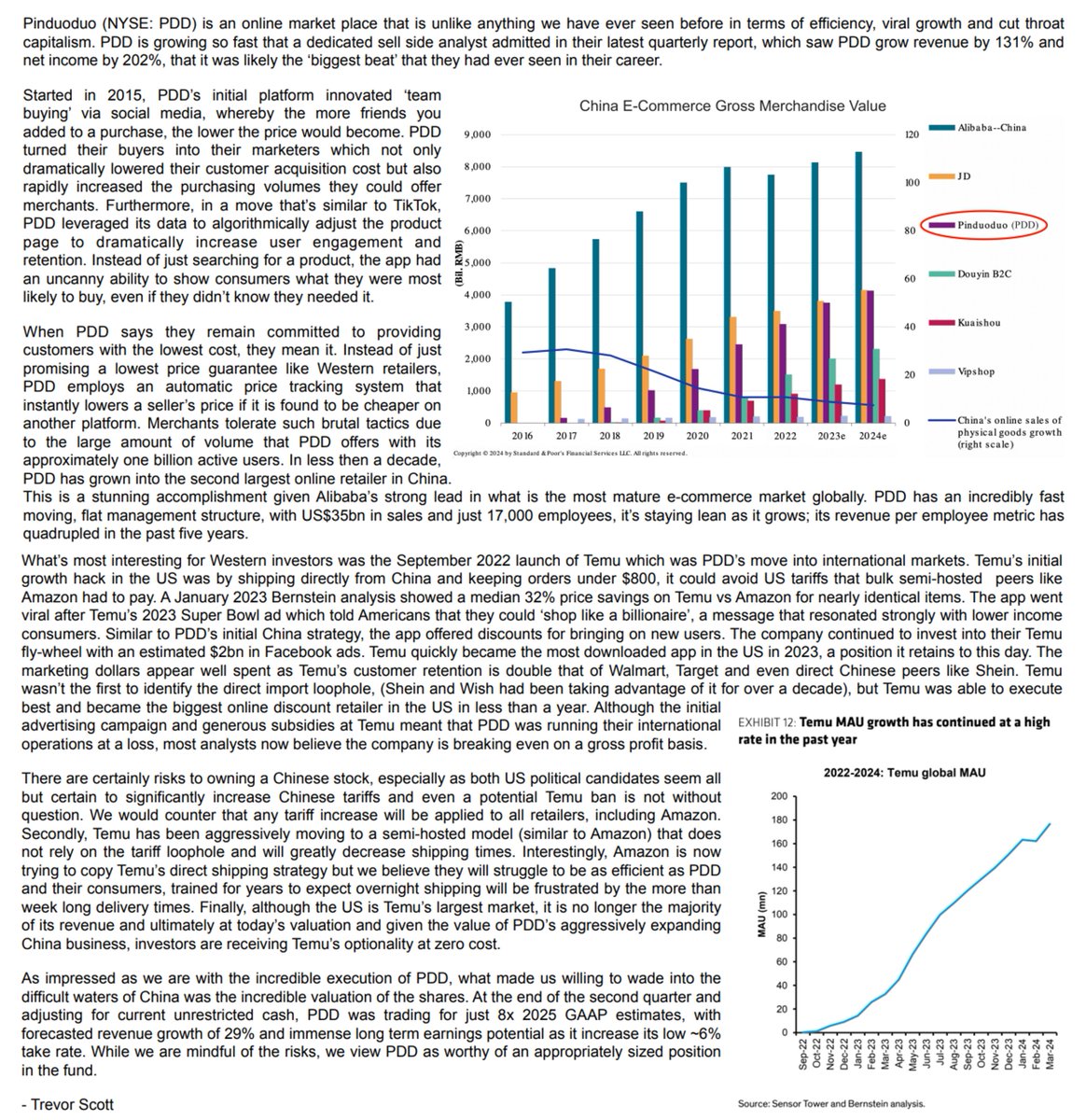

Found a long writeup by Bristlemoon Capital (archived).

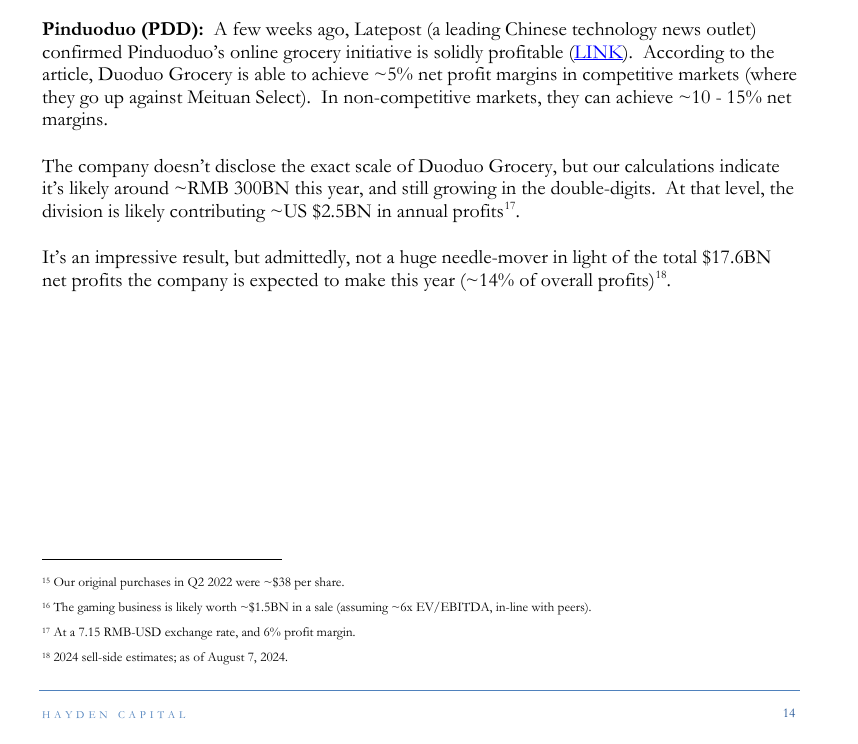

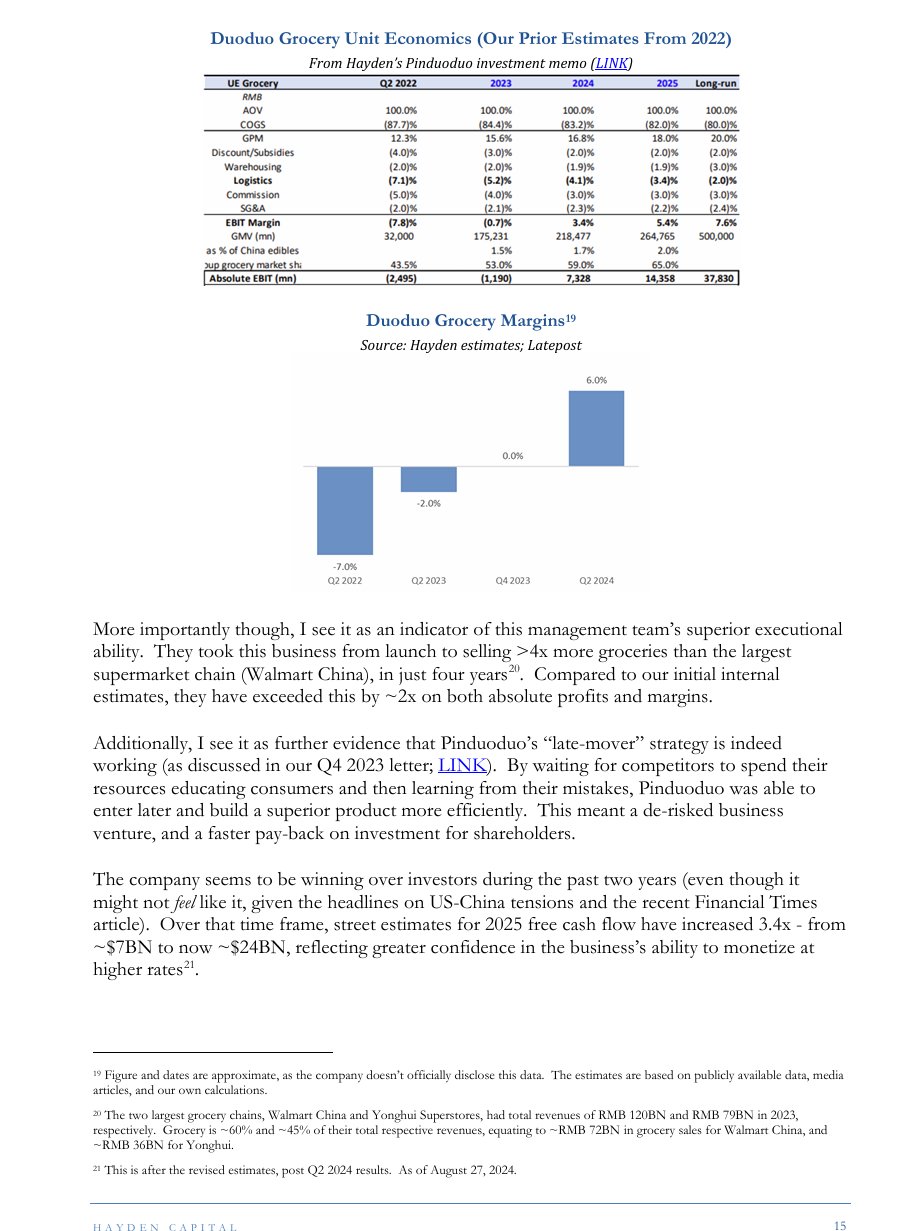

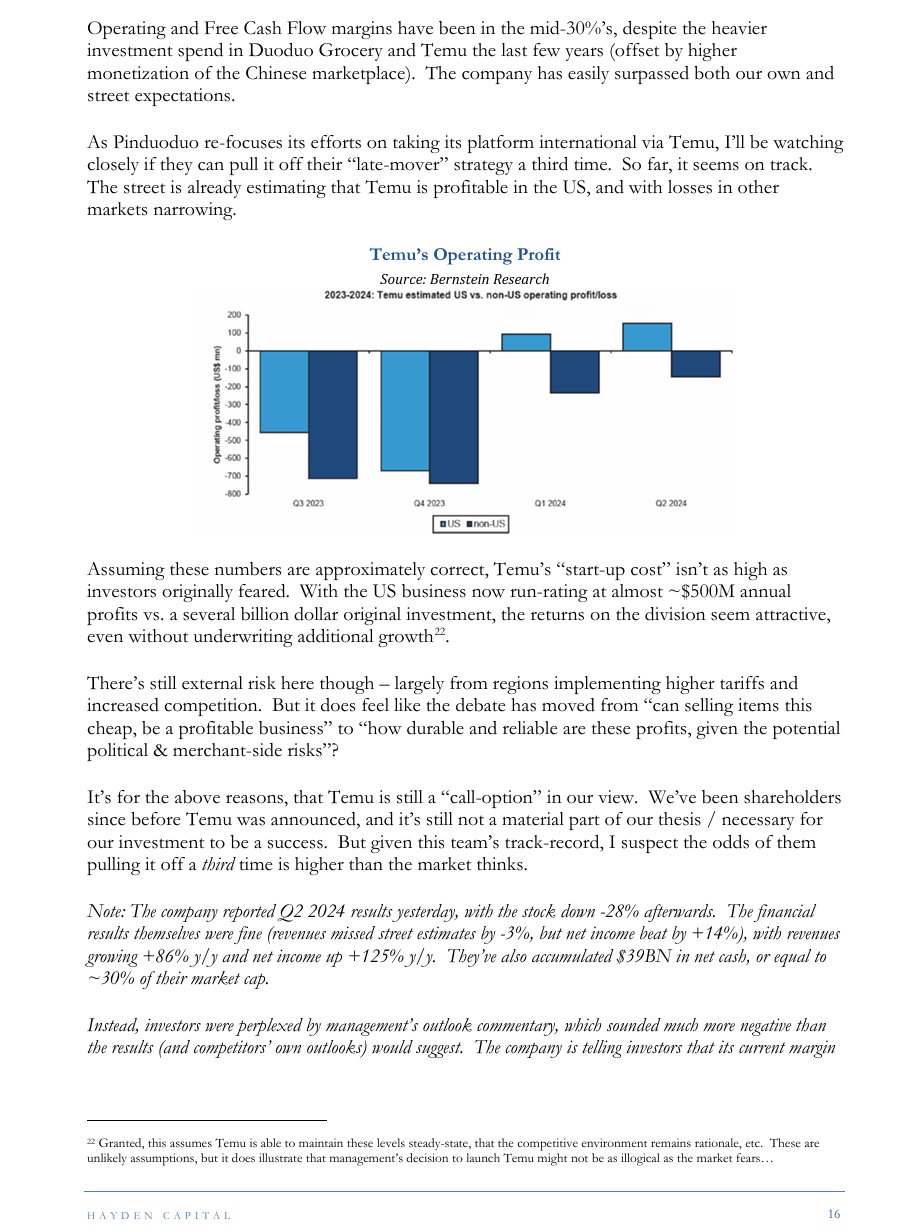

Yet another writeup by Hayden Capital shared in their Q2 2024 letter:

It gets better. Someone shared PDD’s CEO shareholder letters here (archived).

Some quick-fire comments here. Some more comments here (paywalled):

I find it interesting that ToffCap has also been looking into this stock:

Longriver Partners Fund on Pinduoduo:

Baron on PDD Holdings $PDD:

(last two both shared by @StockCompil)

Two more articles:

- How Temu’s team was built (archived)

- Why am I pessimistic about Amazon’s low price attempt (archived)

Allright last one from Greenwood investors:

#Evo, $Evo, @Evo - Goldman Sachs raised Evolutions target share price with a buy to 1 670 SEK, on 26 April 2024 and the other day they lowered it to 1 000 SEK due to lowered growth than expected.More loose speculation seem to be behind adjusting their recommendation to current share price conditions than a quality based analysis with conclusions regarding future slower growth potential.

What is really new except a couple of temporary challenges:

Workforce and studio limitations - temporary slowing growth - has nothing to due with slowed demand

Hackerattacks in Asia - normal problems to be handled if you have business on the internet - has nothing to due with slowed demand - just yet to be quantified and officially mitigated.

Uncertainties with revision of license in UK- not material, out of the 3 % revenue from UK more than 95 % are coming from licensed operators. - Not a material problem and it has no bearing on other authorities. Evo is blocking illegal traffic and those players will likely find their way back to Evo through other licensed operators. There is of course no reason for a gambling commission to revoke a license and make 95 % of Evos legal players illegal or incitamentized to be illegal in that market. You just need to block a behavior that doesn’t support channelization and ultimately don’t provide the government with taxes.

Conclusion: The lower growth than expected is in no way related to weaker demand its mainly related to limitations in the available workforce in Georgia due to strikes and in some part hacker attacks in Asia.

The effects has also materialized in the report with fewer reported game rounds, but still the company has been able to increase revenues since Evo focused their service to the more profitable customers in certain affected markets.

In the Q3 report in 2023 the market was also disappointed but only one quarter later Evolution showed the market it had capability of quickly ramping up their workforce and initiating new studios resulting in a quick ramp up of workforce between Q3 2023 and Q4 2023. Analysts like Goldman where happy and quickly increased their share price targets…

Is there any reason why they shouldn´t be able to mitigate the same challenge again, they already done it one time - repetition is not the hardest thing to accomplish.

Is there really any likely fundamentals that motivates Goldman going back and forth in their opinion of the future - especially since its pretty obvious they are not reading it correctly - I say history will most likely repeat itself both when it comes to Evos coming ramp up of both workforce and products and that will again affect Goldman with revised valuations and target prices.

In the Q/A after the Q3 2024 the CEO of Evolution was very clear with the fact that Evolution was investing heavily in their growth and still had great margins which he by the way didn´s see any structural changes in going forward - I guess Goldman wasn´t on the call.

Also this on Jan 9th:

$Evo, #Evo, @Evo - It should be known that the profitability in the gaming sector is higher in the I-gaming segment than in the sportsbetting segment.In Europe which is probably to be the most mature and thoroughly regulated market I-gaming is providing higher revenues than the online betting market.

Despite who’s gaining marketshare or who is dominating the competitive landscape - all the operators have one thing in common - if they want to be competitive in the live-casino segment - they have to provide world leading Evolutions products/services.

Despite Evos unquestionable position and the automatic effect that Evolution growth path goes hand in hand with the dominating market developments -meaning general growth pace - Evo is being valued at a substantial discount to market leading operators - even though its not affected of who’s winning the marketing wars in different markets - it should be the other way around.

Goldman Sachs has a buy on Flutter and Draft Kings, both of with balance sheets that would dream on being in Evolutions cash position - at the same time we can expect a costly marketing war in Brazil - a war that doesn´t effect Evolutions output in any other ways than the harder the competition (the higher the market spend) the faster Evo will grow there. A fact that is true for all markets, not at least the US that still has most to come considering the I-gaming (read live casino) segment. Currently just accessible in a few states.

Evolutions profits outmatches all of the operators with a landslide and still the leading operators are having way higher valuations and much weaker balance sheets. Looking at growth over time is more than competitive.

The situation bears no logic - Especially since Evos challenges due to labour problems in Georgia during 2024 and hackers in Asia has (likely temporary) has disrupted Evolutions growth story…. Making it just great but not as super great as we are used to.

Maybe the market need to understand that the growth story at Evolution will of course be intact as long as the growth story is intact at the leading operators - unless somebody else will outmatch Evolutions productoffering - there is just no signs of that.

It´s apparent that Goldman is looking at the latest Evo challenges and growth affects like it would be equal to the promises of the future - why would that be - given that management has taken actions against challenges in Georgia and Asia.

The market seem to forget that Evo has had steady sequential high double digit growth even when delivery conditions been challenging - and the market seems to forget that the challenges has never been related to a slower demand, just temporary problems.

The past does not equal the future - my guess is that Q4 revenues and game rounds will show the market this.

On Thursday, Goldman Sachs adjusted its stance on Evolution Gaming Group (ST:EVOG) AB (EVO:SS) (OTC: EVGGF), downgrading the company’s stock rating from Buy to Neutral and lowering the price target to SEK 1,000 from the previous SEK 1,420. The move follows a period of slowed growth for the leading online live casino provider and a series of missed expectations in recent quarters. Evolution Gaming has been recognized as a primary benefactor of the online live casino industry’s long-term growth, boasting a compound annual growth rate (CAGR) of 43% in live casino revenue from 2019 to 2023. The company has historically outperformed expectations and maintained an attractive financial profile, with approximately 70% EBITDA margins and a return on invested capital (ROIC) exceeding 70%. Despite this strong performance, the company’s growth has decelerated compared to its historical trajectory, failing to meet Goldman Sachs’ forecasts in the last two quarters. This underperformance has prompted the firm to revise its projections, which now sit below market consensus. Compounding the issue are emerging challenges, such as cyber attacks in Asia, which obscure the potential for growth to reaccelerate. Adding to the concerns, the UK Gambling Commission has initiated a review of Evolution’s license, a development that heightens existing investor worries regarding the visibility, sustainability, and quality of the company’s future earnings. This regulatory scrutiny further complicates the outlook for Evolution Gaming, as it could impact the company’s operations in one of its key markets.

source: tweet

source: tweet

Disqus comments are disabled.