#113 - Ramblings May2024

Last updated: Jun 30, 2024

Ben Claremon lays out the strategy here:

The idea is to use our influence and our standing as a large shareholder to encourage management and the Board to think and act longer term, to ignore the quarterly earnings and sell-side upgrade/downgrade noise, to deeply embed a return on capital framework as the company’s capital allocation North Star, and to make sure that executives’ comp is highly aligned with the key variables that are going to drive value creation for shareholders over time.

We aim to distinguish ourselves by only getting involved in situations where the goal is to keep a good-to-great management team in place and to encourage management and the Board to roll their equity in the private entity. I would even go as far as to say we will abandon any process in which we start to believe that management isn’t aligned with us or doesn’t have the requisite technical and personal skills to take the company to the next level.

As such, our current target client base consists of medium-sized family offices who are interested in seeing “deal flow.” What I have heard consistently is that almost nobody approaches these family offices to invest in a microcap take-private. They tell me they see private deals all day and all night but that there is essentially no such thing as an independent sponsor focused on the public side of lower middle market PE. The differentiation of our holistic approach is certainly not sufficient to get people to back us. But it definitely helps in getting our feet in the door.

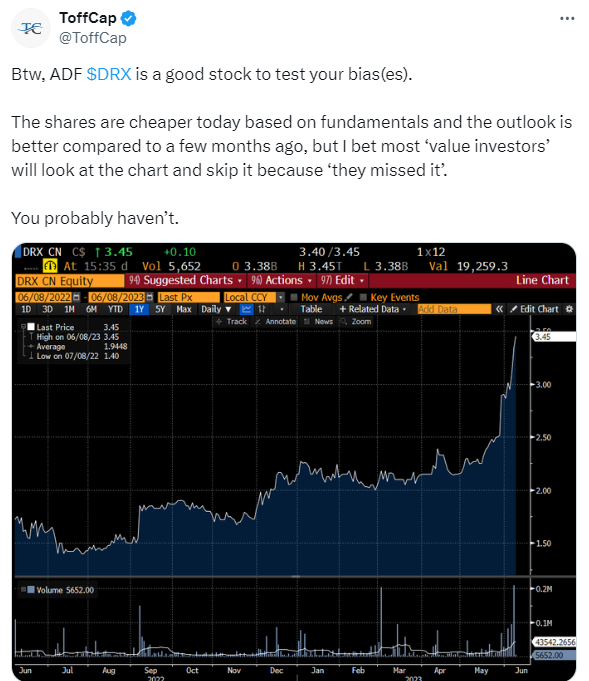

Link to: thread.

The stock has 5x’ed since.

Pdf.

Year to date, $CVNA went from to $8.96 to $121.67 today.

That’s a 13x.

I was just listening to an episode from the ValueHive podcast, there was a guy that has been an industry for a long time, a self proclaimed expert of sorts, and he was ABSOLUTELY certain that this stock was a zero.

He said to the podast host: “If it goes to $500, I will buy you that car [a Tesla], I will serve you breakfast, lunch and dinner wearing a dress, and I will shine your shoes for a month.”

Goes to show, how much “experts” know.

Now what I find interesting is how that 13x was generated.

It wasn’t from sales growth as they’ve actually decreased.

Margin has certainly improved. In fact, the company is now EBITDA positive. That being said, the EV/GP didn’t expand much.

EV/Sales did 3x.

But more interestingly, P/Sales did 11x or so.

So while EV only doubled, Marketcap pretty much did 20x.

How can that be?

Let’s look at some numbers.

Imagine a market cap of $1B, $EV of $10B (i.e. net debt of $9B), a highly leveraged situation.

EV is the amount of money an acquirer is willing to pay today to buy the entire company.

Now suppose a year later another buyer comes up and is wants to acquire the company’s full operations for $11B total, including the debt (i.e. EV value). Therefore EV has only increased by 10%. But ALL of that $1B incremental value is coming from the value of equity, hence the market cap is now 11 - 9 = $2B or twice what it was before.

So the EV has increased y 10%, but the market cap has increased by 100%, because the initial EV/Equity ratio was 10-to-1. This is financial leverage at work.

Now of course, financial leverage works both ways. If EV goes down by 10%, then in theory, the equity will be wiped out, since the EV will now be equal to the value of the debt ($9B). However in practice, I suspect that the value of the debt will not stay fixed in such a scenario, as the ability of the company to pay it back might be impaired.

Therefore I believe that these scenarios with high financial leverage can offer asymmetrical upside, as might have been the case with $CVNA.

From [twitter]](https://twitter.com/themattharbaugh/status/1786389085512245396):

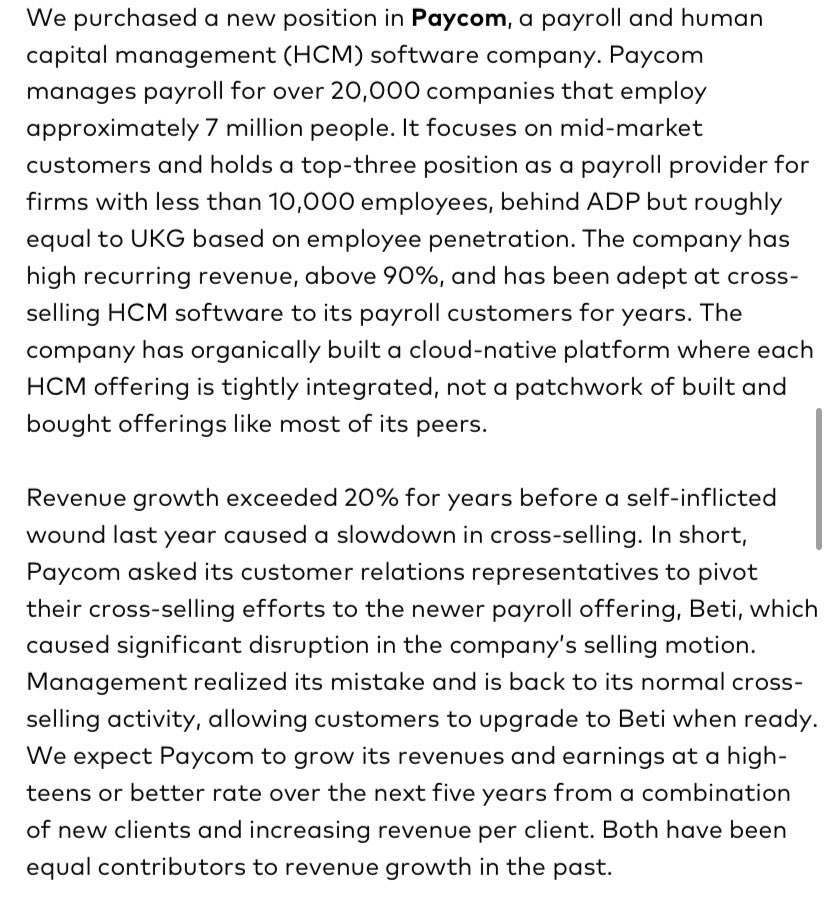

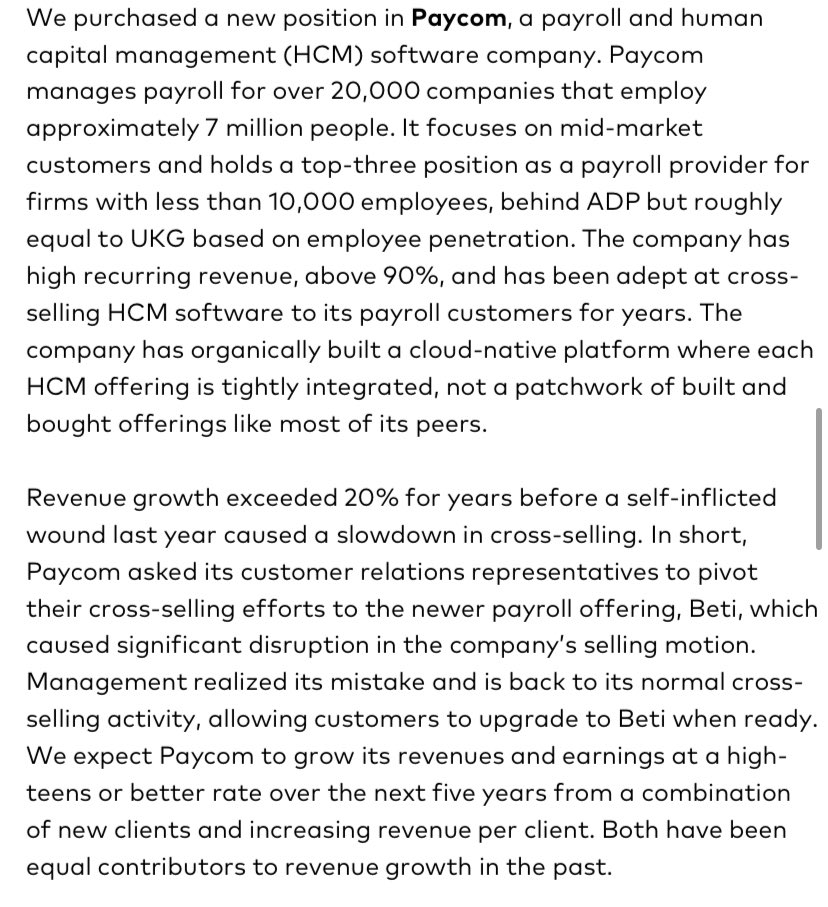

Paycom Software $PAYC is a cloud-based SAAS HCM provider. Paycom helps businesses with payroll, hiring, timesheets, etc, to serve as an all-in-one HCM offering. The main problem they are trying to solve is that legacy providers lack integration with different offerings. For example, businesses may use ADP for payroll but use a third party for scheduling and time tracking. This creates complexity for the business. With Paycom's solution, the business can simplify its HR. They sell their HCM solution to a diversified range of businesses directly through their 55 sales offices. HCM is an essential service to businesses because of the regulatory tax filings that businesses need to file each year.98% of revenues are recurring. The majority of revenue comes from payroll, which every client has to use. There are two ways Paycom generates revenue (1) fixed amounts charged per billing period plus a fee per-employee/transaction and (2) fixed amount per billing period. When interest rates are high, Paycom earns interest income on client funds they hold, thus providing a hedge in higher interest-rate environments, when the labor market may be unstable. Paycom earns higher revenues in Q1 and Q4 because of tax filings (1099), ACA filings, and end-of-year bonuses. Paycom has held a>90% client retention rate. The major KPIs to track are; the number of clients, annual revenue retention rate (ARRR), unemployment rate, and interest rates. Paycom’s success depends on the labor market as a whole (the more people are employed, the more they can charge per employee).

Management discusses 4 areas of growth; 1) increase sales teams in current markets 2) expand into additional markets (currently 28 states and 4 international countries) 3) increase product mix and enlarge customer relationships, and 4) target higher clients. In 2023, management focused on areas 2, 3, and 4. Implementing Beti, which has reduced payroll time to 90 minutes instead of days, shows Paycom’s efforts to increase value to clients, thus increasing the probability that clients stay with Paycom and not churn. Paycom’s main competitors are ADP, Paychex, and Paylocity.

Paycom’s business model allows them to scale more easily which improves operating leverage.

Paycom provides an essential service to businesses, and operates on a capital-light business model which allows for scale and operating leverage

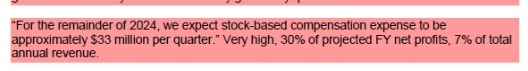

On the other hand, SBC is very high (almost a third of net income):

I think I’m gonna pass for now.

Paycom Stock Plunge: Hidden Trouble or Golden Opportunity?.

A couple of things I like here:

This YouTube video from Cameron Stewart gives a great overview of the financial metrics.

With assumptions of 5% growth and 4% exit yield on FCFE (or 14x EV/EBITDA) 10 years out, Cameron get to a an annual IRR of ~12%. Good, not great.

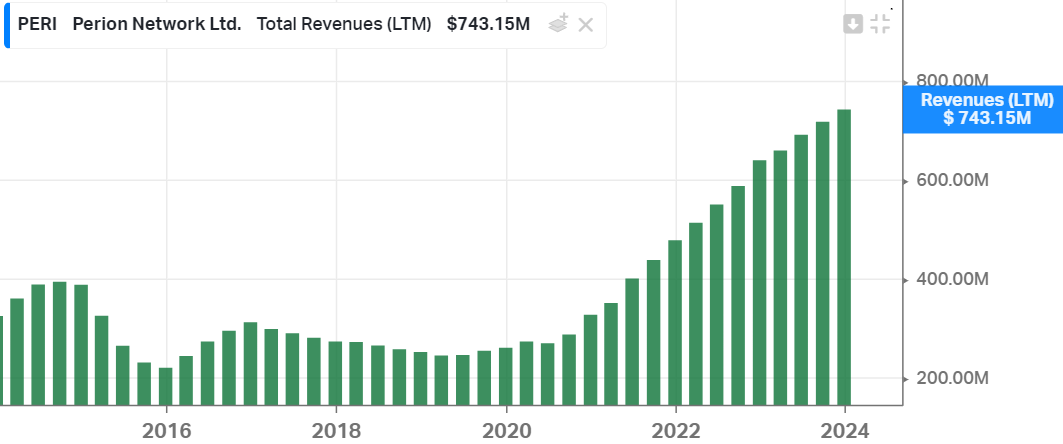

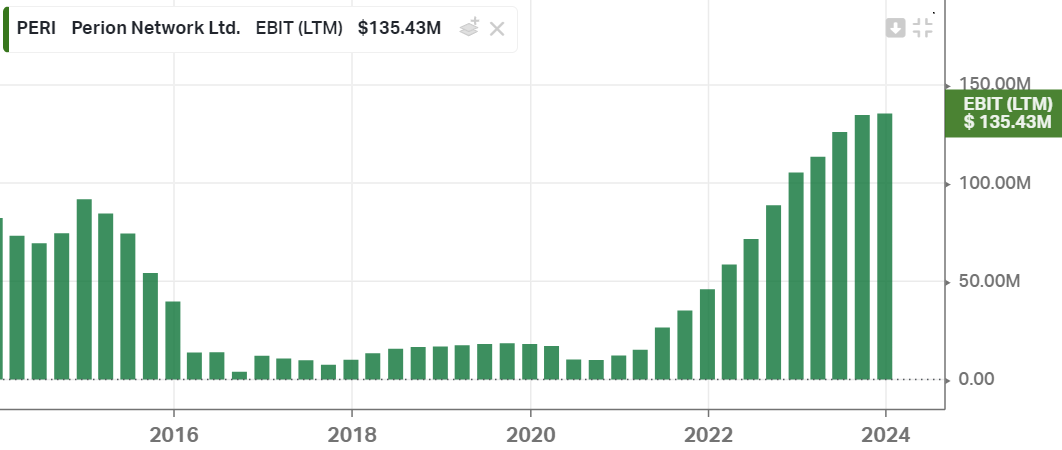

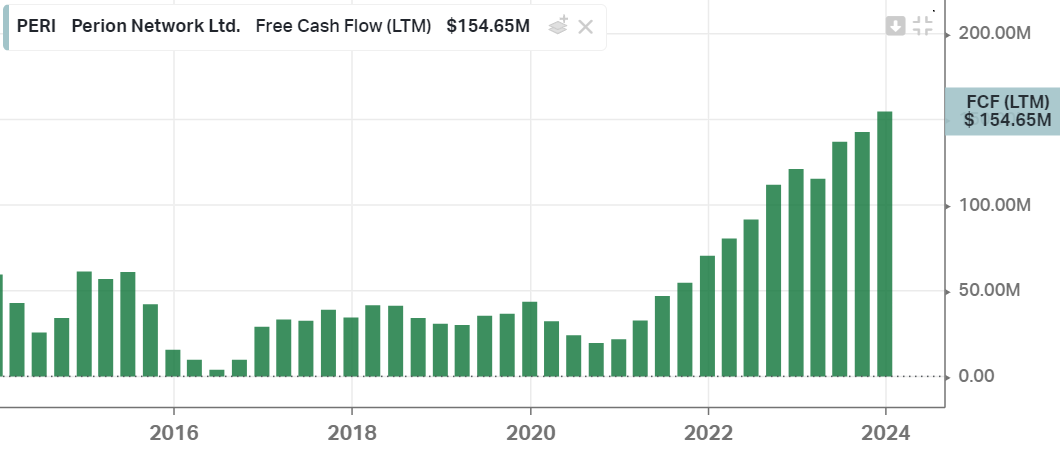

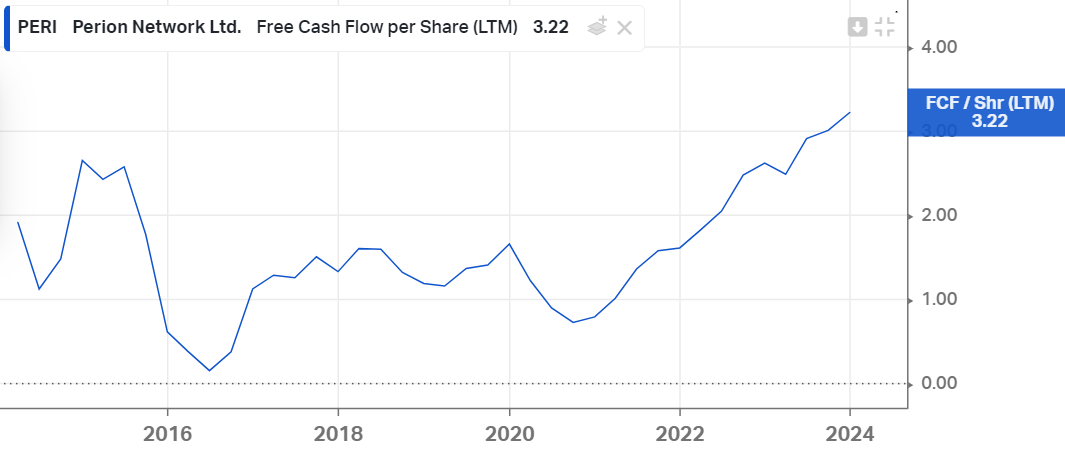

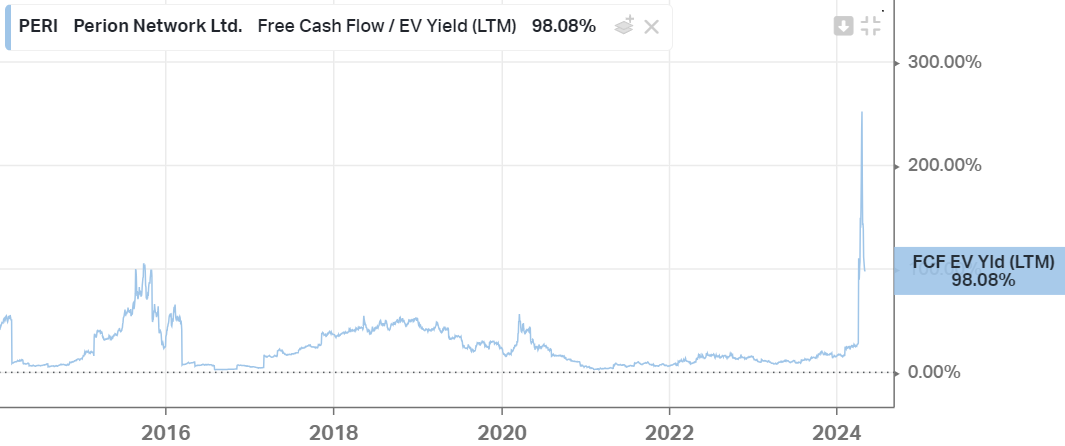

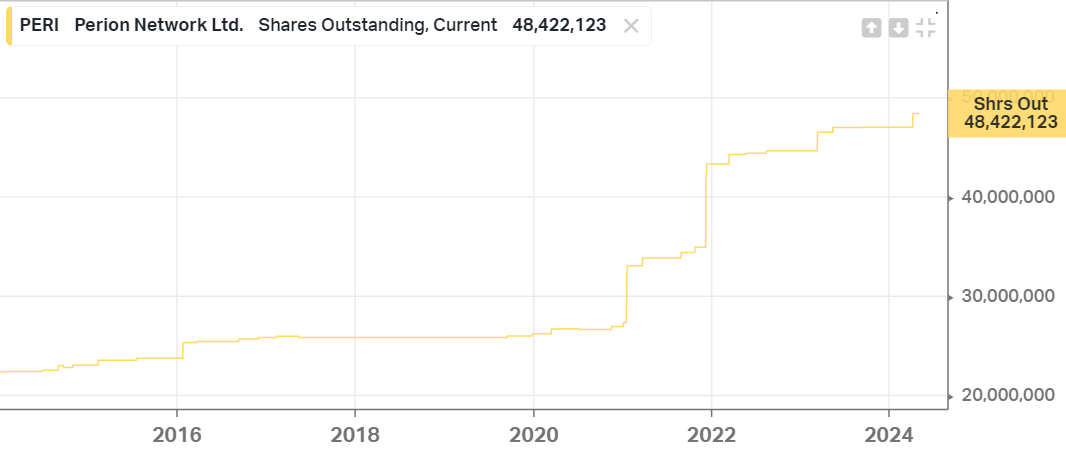

This is why the price has gone south: (PERI) Faces Investor Class Action for Allegedly Concealing Decline in Search Advertising Business.

Unfortunately, still too expensive despite the drop.

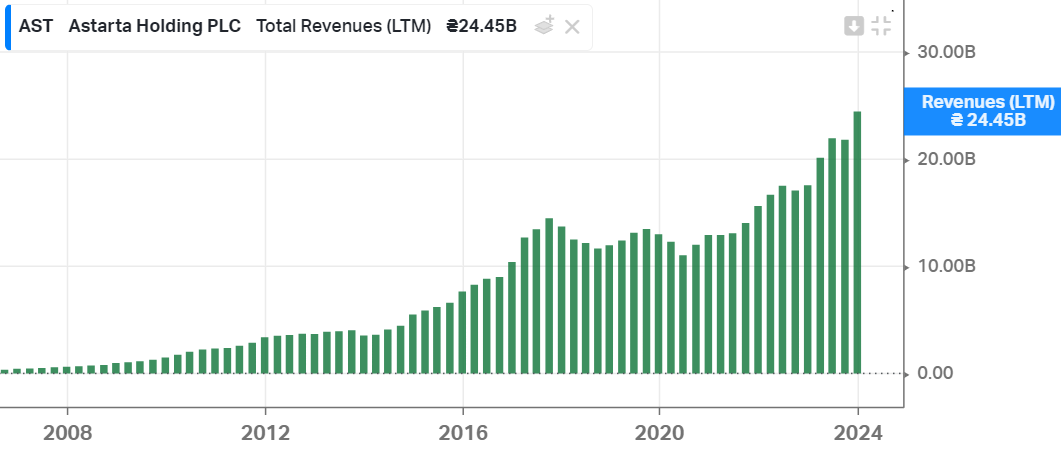

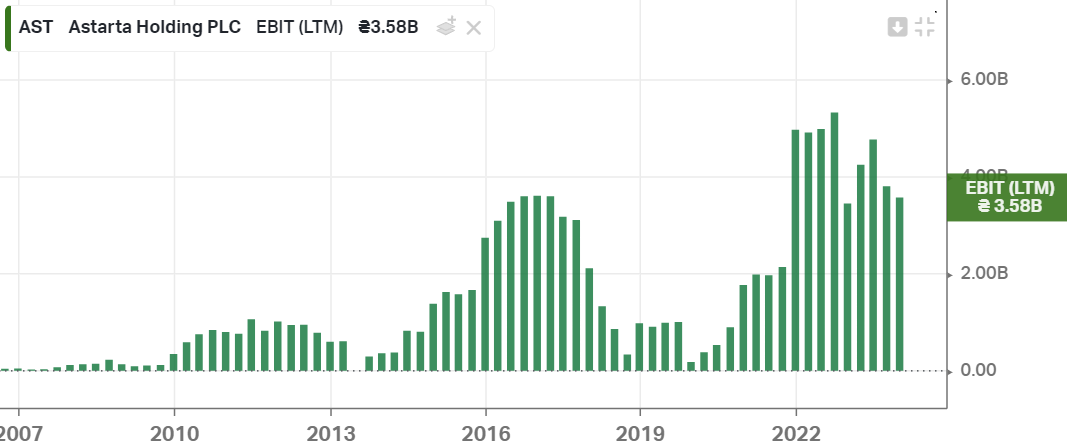

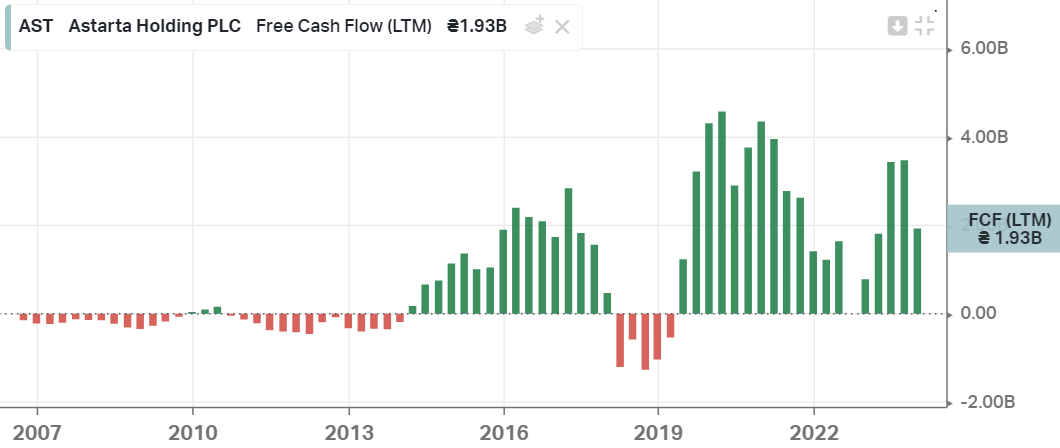

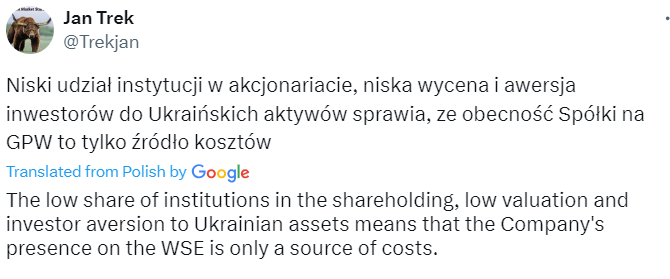

A weird post from a weird (i.e. Polish) account (seems like a good source for Polish stocks):

But the stock looks quite cheap:

Quite an interesting thesis by Pommesbuden Invest on XP Factory Plx (archive).

I need to listen to some earnings call and learn more about the CEO, since he has very minimal ownership.

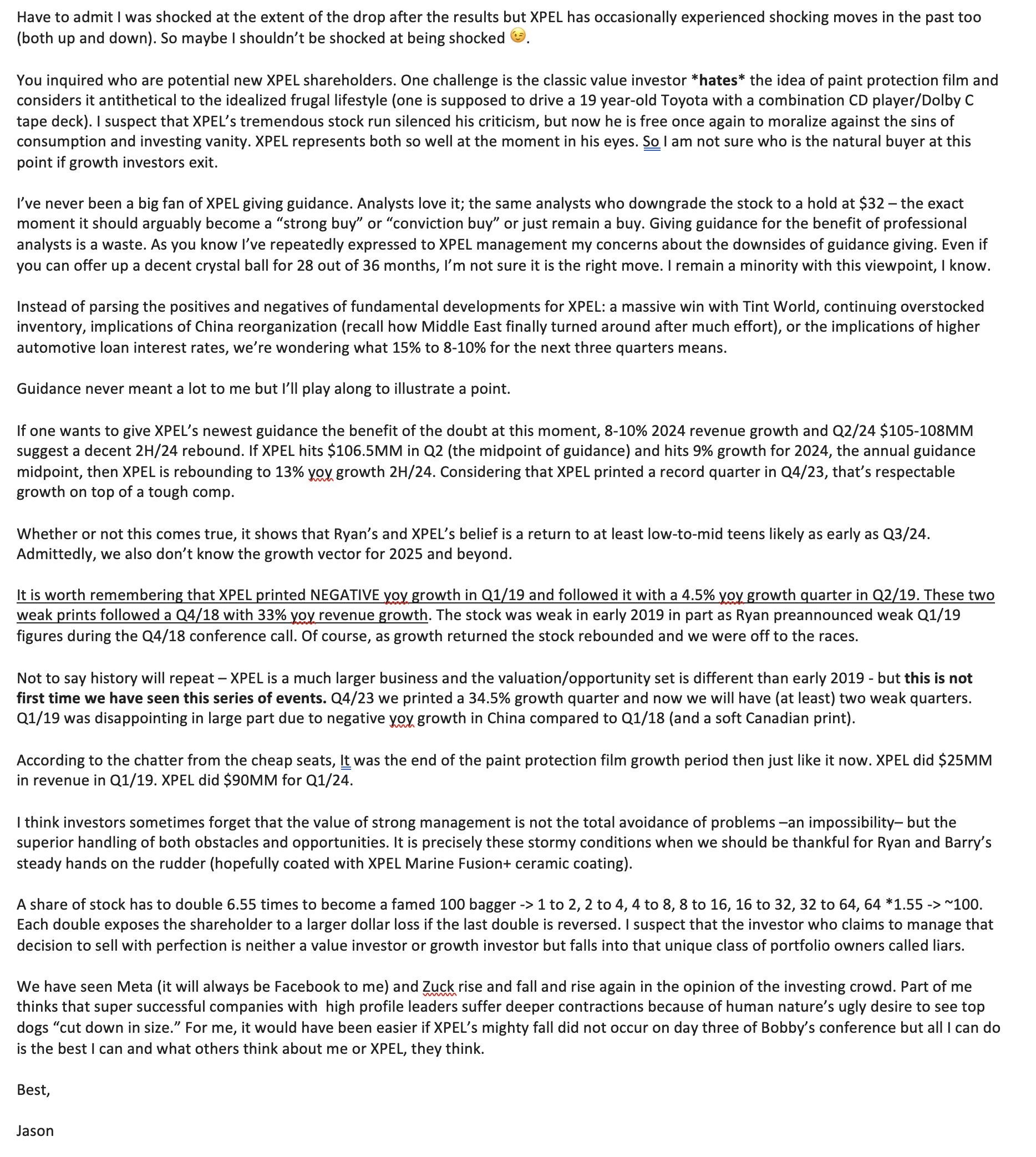

Yet another writeup on this battleground stock (archive), shared by Javen.

Here’s a more bearish perspective:

A summary of the business outlook: thread.

From their latest 10Q:

Georgia Capital currently has the following portfolio businesses: (1) a retail (pharmacy) business, (2) a hospitals business, (3) an insurance business (P&C and medical insurance); (4) a renewable energy business (hydro and wind assets) and (5) an education business; and (6) a clinics and diagnostics business.

Georgia Capital also holds other small private businesses across different industries in Georgia; a 20.0% equity stake in the water utility business and a 19.7% equity stake (at 31-Mar-24) in LSE premium-listed Bank of Georgia Group PLC (“BoG”), a leading universal bank in Georgia.

As of 2024-05-17, $CGEO’s market cap is GBP 432M. Net debt of GBP 93M, so EV is GBP 525M.

The stake in $BGEO.L alone is worth GBp 369M.

525M - 369M = 156M.

The water utility business can be ignored.

The assessed equity values of the private businesses are as follows.

Large portfolio companies:

- Retail pharmacy: GBP 200M (30M LTM EBITDA, 91.5M Net debt, EV/EBITDA ~ 9.7x)

- Hospitals: GBP 90M (12.5M LTM EBITDA, 74.2M Net debt, EV/EBITDA ~ 13.8x)

- Insurance: GBP 108M (8.7M LTM pretax income, P/E ~ 12.4)

If we sum the total for the large portfolio companies, we get GBP 398M.

Even if we take a margin of safety of 50%, this gets us to 199M.

199M + 369M (BGEO’s value) = GBP 568M.

In English: the current company’s EV is worth less than the value of its BGEO stake and half of the value of its large portfolio companies.

One could argue that the equity value of these companies, as reported by CGEO, is inflated. In that case, the remaining margin of safety would be from the value of the investment stage portfolio companies (renewable energy, education, clinics).

These are assessed as follows:

- Renewable energy: GBP 76.2M (EV/EBITDA ~ 12.4x)

- Education: GBP 58M (EV/EBITDA ~ 16.2x)

- Clinics: GBP 34.5M (EV/EBITDA ~ 10.6x)

- Other businesses: GBP 83M

Total = GBP 251.7M

Let’s be aggressively conservative and shaveoff two thirds of this value, leaving us with: GBP 84M.

All in all, the total value would be: 568M + 84M = GBP 652M.

Substracting the net debt (93M) = GBP 559M.

Current market cap: 432M.

Margin of safety = 1 - 432/559 = 23%. Good, not great.

To bet heavily on this, we’d need an informed opinion on the sub-businesses (and probably on the geopolitics too).

A good summary thesis here from @ChapTwelveCap:

Cineplex $CGX.toMgmt thinks they can match pre-covid EBITDAaL of $200 million at 80% of 2019 attendance.

In 2023, attendance was at 72% of 2019 levels with a slate still impacted by covid/strikes. EBITDAaL was $157 million in 2023.

Box office/patron up 18% since ’19 to $12.53 and concession/patron up 32% vs. ’19 to $8.90. Lease expense down 6% vs. ’19 to $166 million.

Over next 12 months, Cineplex should enjoy a clean movie slate (ie. unimpacted by covid/strikes) for the first time since 2019.

I think theaters are gaining leverage vs. studios/streamers as pendulum swings away from growing subs at all costs to profitability.

Protecting/enhancing the theatrical window will enhance streamer profitability. Will subs churn if they have to wait an extra few months for new films?

Cineplex balance sheet is cleaned up with sale of P1AG and recent refinancing. Only debt is $575 million notes due 2029 and $215 million 2030 convert that equitizes at $10.29 (+19% vs. current share price).

Excluding convert, leverage is at 3.7x vs. management target of 2.5-3.0x.

Management plans to restart capital return in early 2025. Likely a combination of dividend and buyback.

Cineplex should have relatively good leverage over their landlords given the uniqueness of theaters. Management expects further declines in lease expense.

Management spending $80 million on capex this year, half of which is for new Rec Room/Playdiums and one new theater. Depreciation is about $80 million but because of the long life of the buildings, maintenance capex is only about $30 million.

The company has $150 million of deferred tax assets from pandemic losses.

Interest on debt is about $60 million (or $45 million excluding convert).

If EBITDAaL reaches $200 million, Cineplex could be generating $110 million+ of FCF excluding growth capex with the tax shields good for five or more years.

Excluding convert interest, this rises to $125 million on a $729 million fully diluted market cap (17% yield).

This is with an attendance recovery to 80% of 2019 levels.

Risks – I am wrong about theaters gaining leverage vs. streamers, attendance continues to fall, Canadian consumer weakness drives a pullback in spending at the movies in a business with high operating leverage.

Disqus comments are disabled.