#109 - Ramblings Mar2024

Last updated: Apr 13, 2024

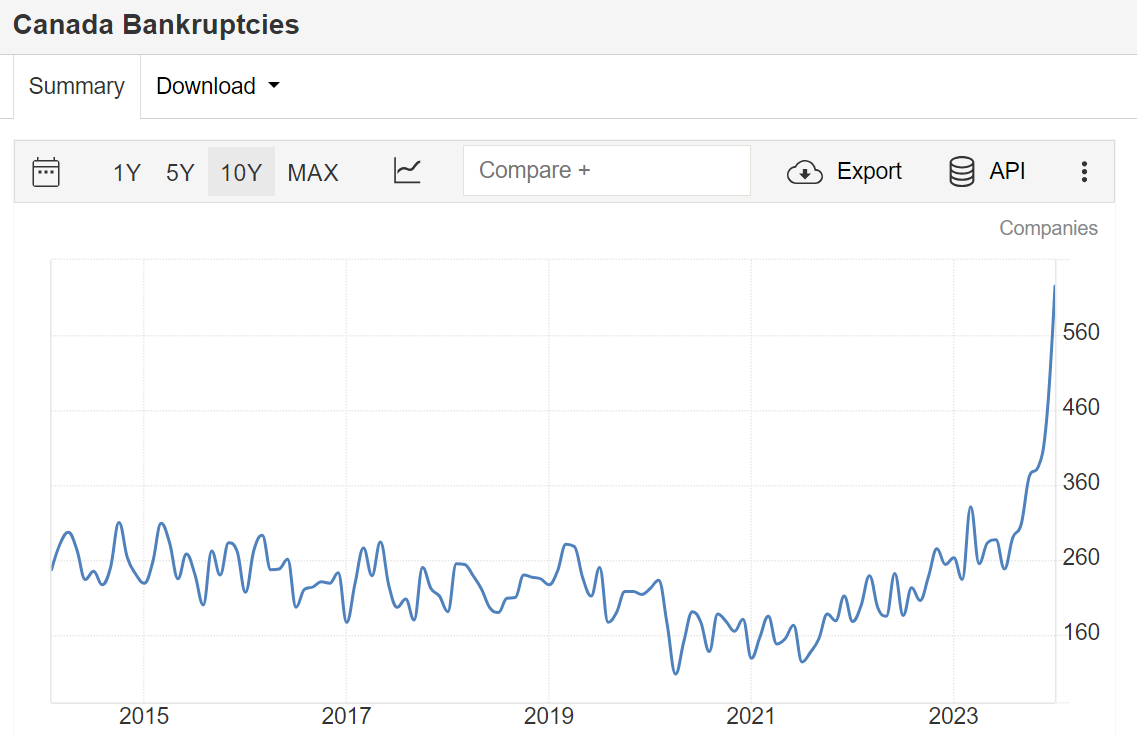

Business bankrupcies:

(source: Statistics Canada)

Article from cbc.ca:

He said that if things start to unravel, there's still room for the Bank of Canada to lower interest rates, which would help businesses repay their loans and reduce the need for job cuts.

From Insolvency now article:

Business insolvencies spiked in Q4 2023, especially in Quebec and Ontario. However, the proportion of commercial proposal vs bankruptcies decreased, suggesting potentially fewer refinancing options for businesses and that an increasing number of smaller businesses vs larger businesses are filing.

The internet is too good: link.

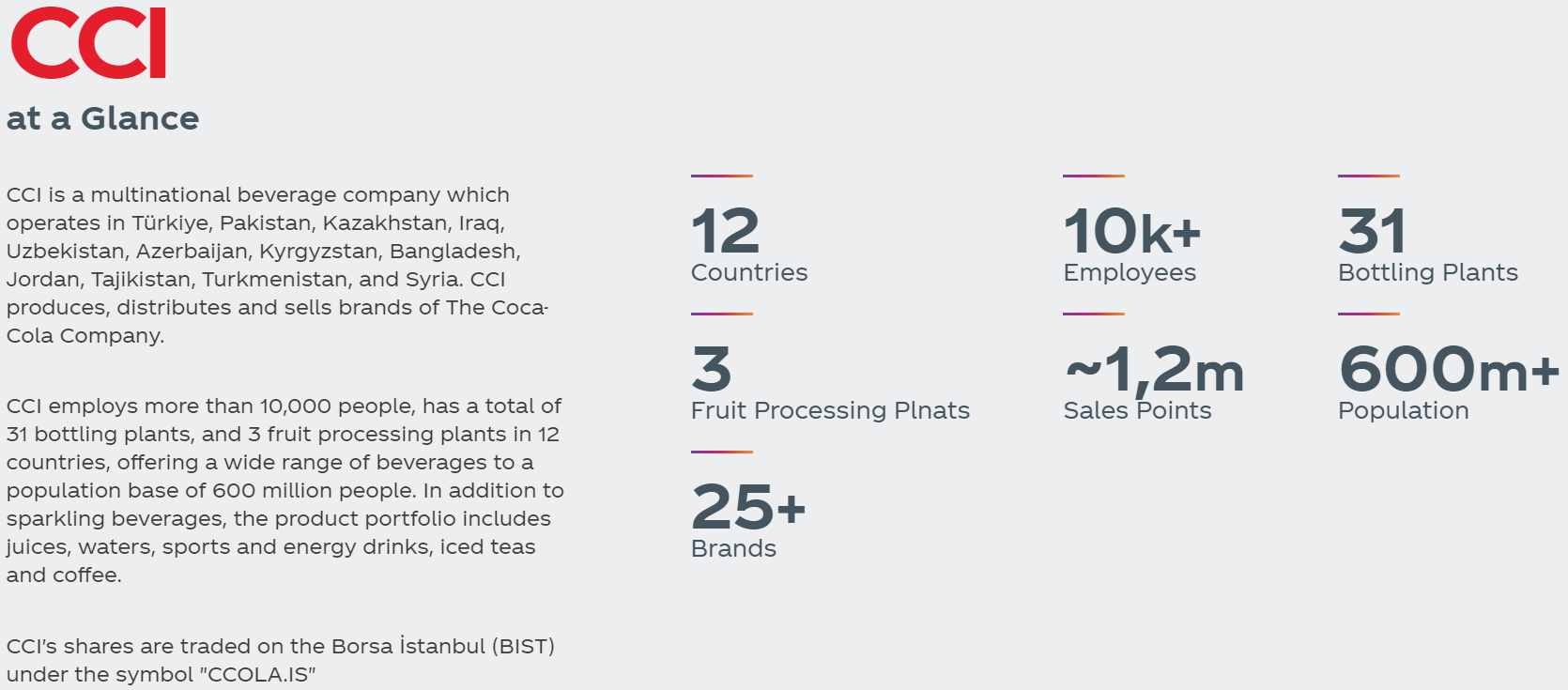

I will park here some interesting links about both Anadolu Efes and Coca-Cola İçecek.

Turkish Coca-Cola Icecek acquires Coca-Cola Bangladesh Beverage for $130m.

The CEO of CCI is Karim Yahi. He comes from the Coca-Cola Company.

In the video of Mohnish that I linked to [last month]/107-ramblings-feb2024/#aebzy, around the 20min mark, Mohnish explains how CCI bought the Coca-Cola bottler in Uzbekistan and grew the businesses 4x fold or something in a very short time span.

Switching to Anadolu Efes, a company of the Anadolu Group, which was founded in 1950 by the Özilhan and Yazıcı families and trades under the ticker $AGHOL in Istambul.

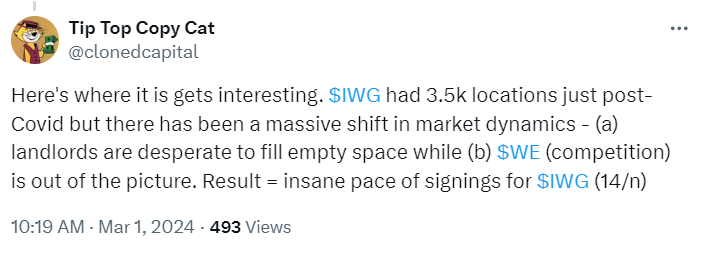

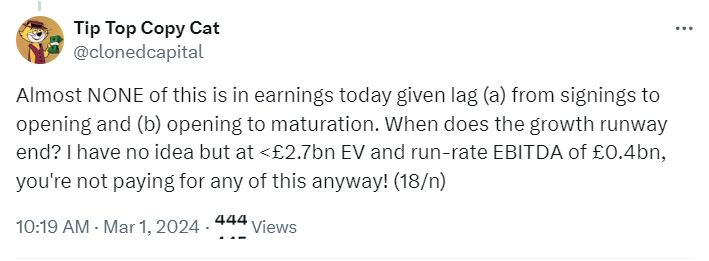

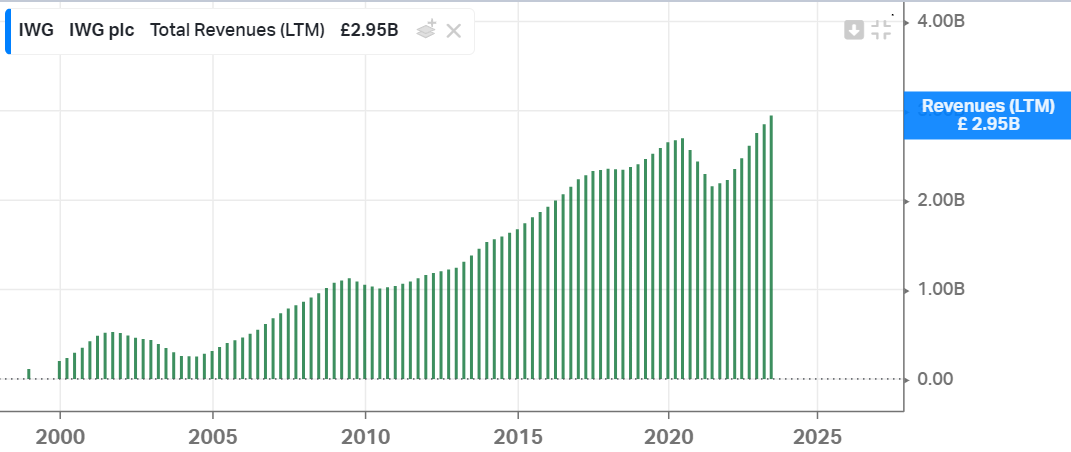

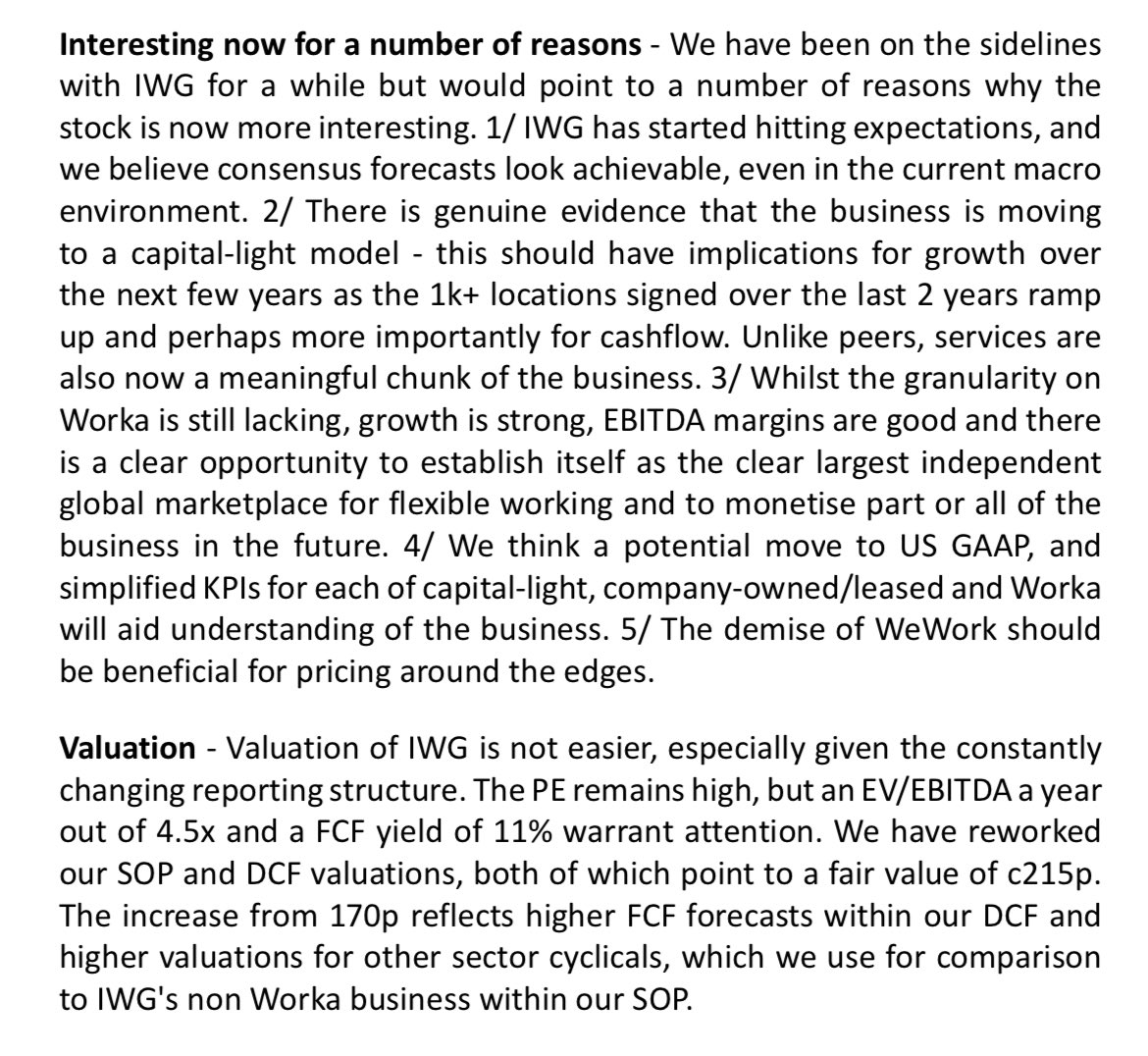

The largest flex space operator in the world. The owner of Regus!

From this thread:

3 segments - Traditional (co. owned), Capital Light (management/franchise) and Worka (digital tools & services).

-

Traditional is similar to WeWork (enters a long-term lease for a large space and re-leases them as smaller spaces on a short-term basis).

-

Capital Light model. Here, $IWG signs a management agreement (a la Hilton) with a landlord to operate their flex space (end-to-end from design input to daily operation). $IWG’s explicit stated aim is to focus almost exclusively on Capital Light now.

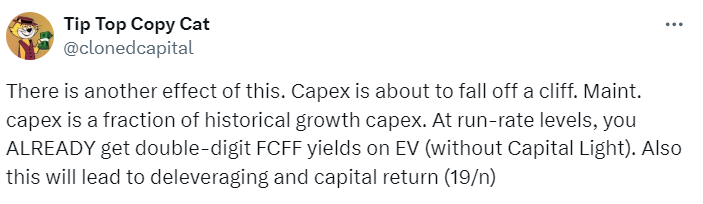

From teir H1 2023 release:

- Annualized EBITDA of £400m (bfr application of IFRS16)

- Using cash to reduce debt

- Net financial debt: £658m

Current market cap: £1.89B -> EV: £2.5B

EV/EBITDA ~ 2.5/0.4 = 6.25x

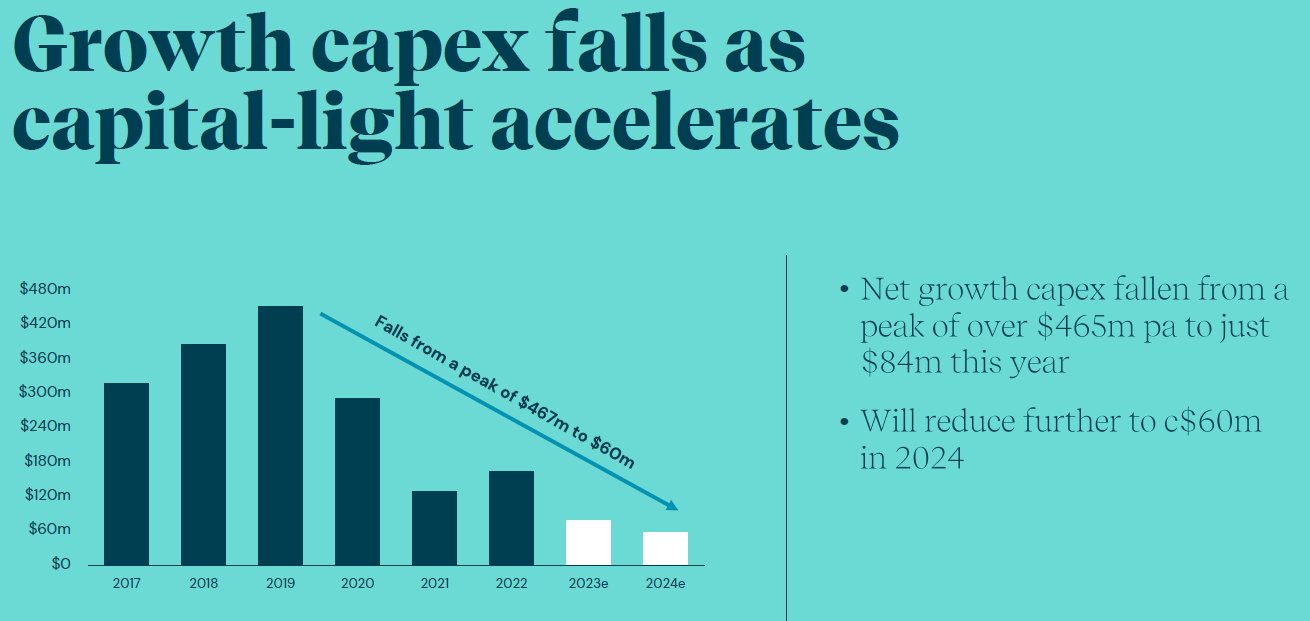

For more context, here are the historical revenues:

(link)

Greenhaven Road Capital also disclosed that they have a new position in $IWG.L in their 2023Q4 letter.

RBC with an upgrade:

IWG CEO Mark Dixon On Tertiary Markets: Instant offices’ are now IWG’s fastest-growing niche, Dixon says

An interview on PunchCard investing with Andrew Marshall of Capital Mindset.

Their 2023 investor day presentations can be found here.

Another (through) writeup by Itai Partners: link.

Have some spare JPY to reallocate.

Altay Cap wrote this one up here (archive).

Key Metrics:

Revenue CAGR 10yr: 2.75% Revenue CAGR 5yr: 5.64% Tangible Book Value CAGR 10yr: 6.52% Net Income CAGR 10yr: 14.49% P/E (LTM): 4.5x EV/EBITDA (LTM): 2.1x Dividend Yield: 3.76% P/TBV: 0.5x

Same as above.

Still from Altay Cap:

Sanyu (TYO 5697)

Market Cap: $21m USD

Net Current Assets (Net of Total Liabilities): $30m

Investment Securities: $4m

Net Current Assets + Investment Securities: $34m

P/TBV: ~0.3

P/E: 5.6

Sanyu is another dirt cheap listed subsidiary of Nippon Steel (they own 35.1%) which the market values at -$13m. While it’s not as cheap as Nichia, it offers a much higher dividend yield of 6.3%. It operates a largely undifferntiated business that manufactures and markets cold-finished bars and cold-heading wire.Sanyu has only ever really lost money twice. Once during the great financial crisis in 2009 and again during the covid cash in 2020. Revenue has grown steadily over the last 20 years as well. The company has not repurchased shares recently.

Thesis: Same as Nichia. Dirt cheap, good dividend, cheap on both P/E and P/B basis.

The post-mortem:

I missed a double because I kept tweeting about it and nobody cared.

I was looking for validation. I was looking for support.

I hope this is lesson learned.

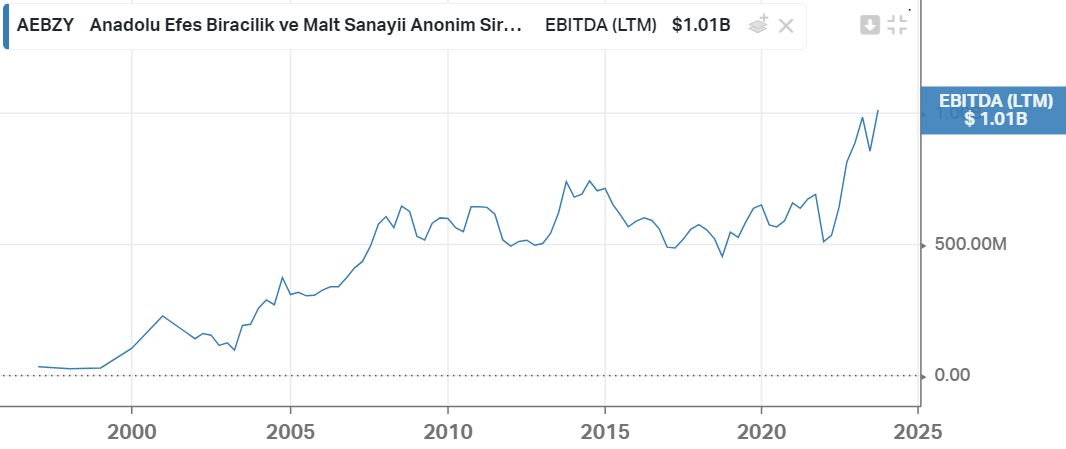

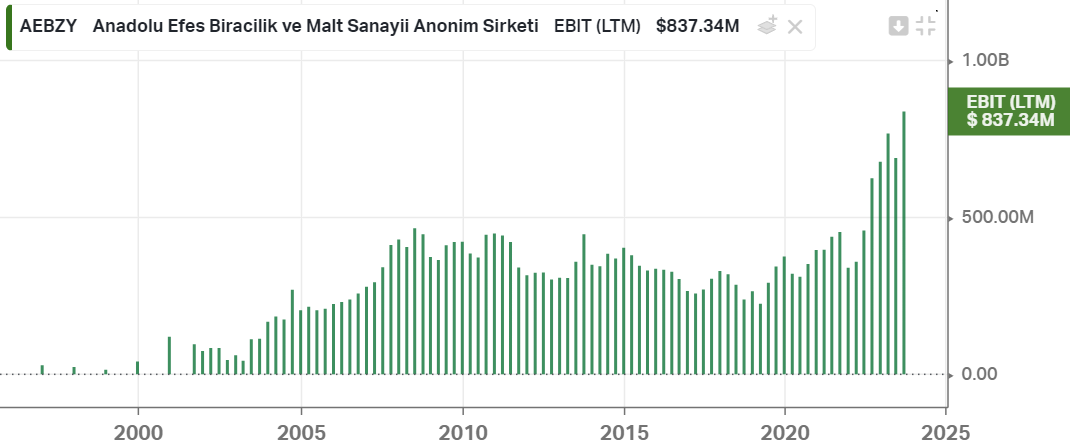

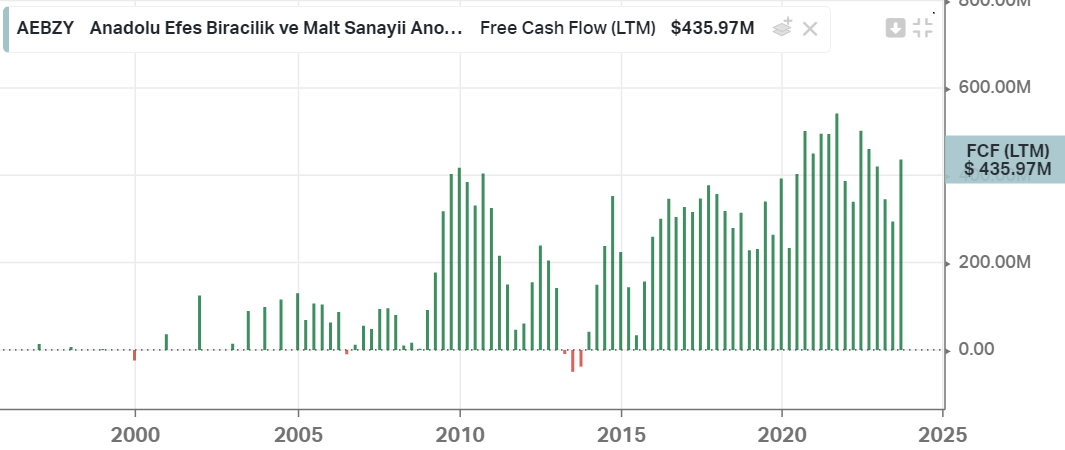

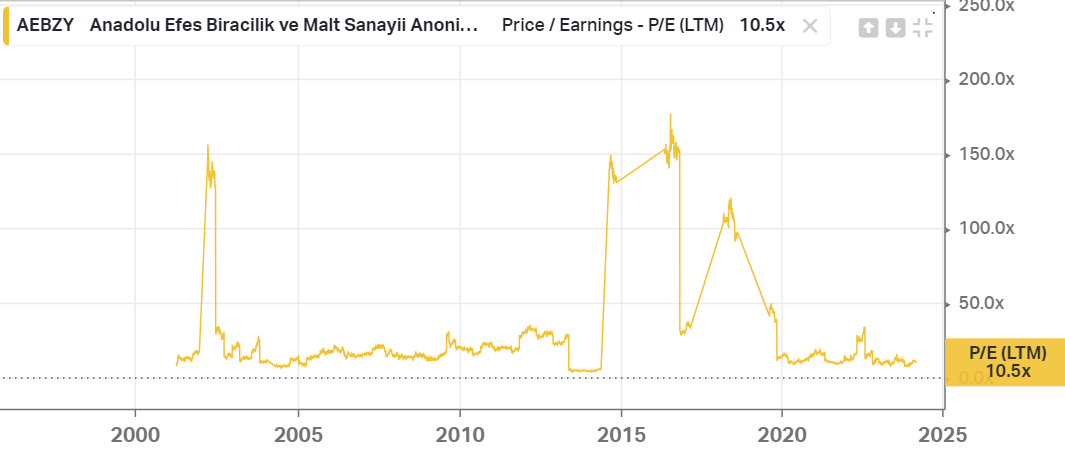

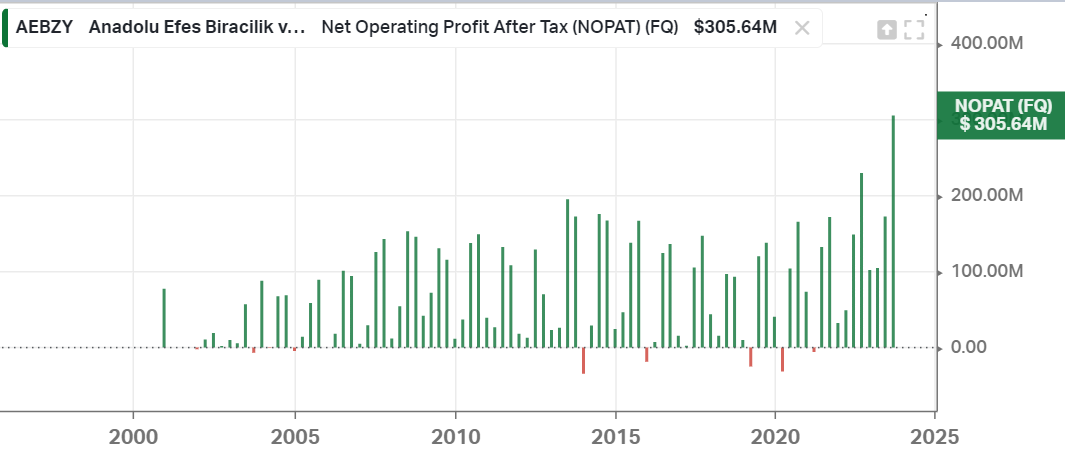

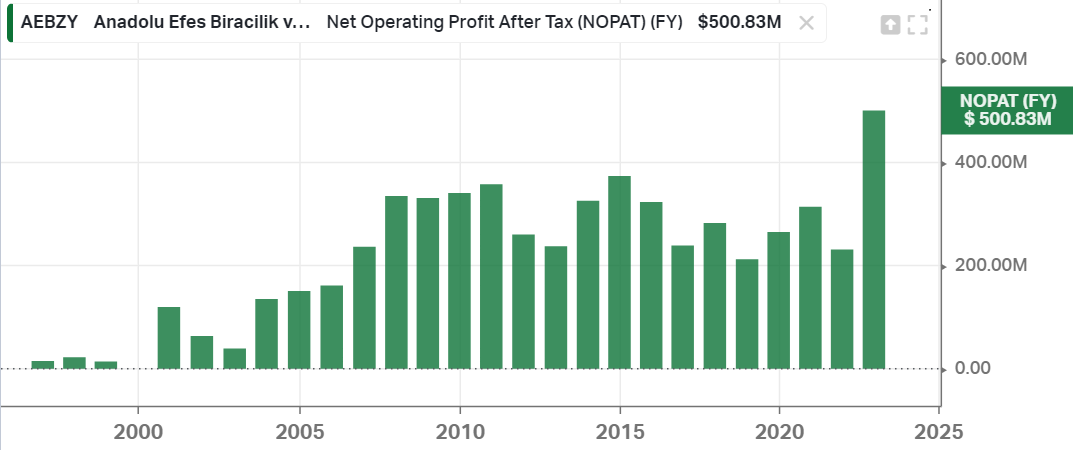

A few charts (all $ figures in USD):

Market cap is around $3B, net debt around $400M.

Consolidated FCF is about US$450M (TL$10.8B in last 9mo = TL$14.4B annualized = US$450M).

FCF/MC ~ 15%

Their 2023Q3 earnings release is here.

Ended the year with $1.1B of adjusted EBITDA, excluding $326M of SBC, so about $0.8B of “real” adjusted EBITDA.

EV is ~$30B.

This is too expensive for me. No regrets.

A succint and to-the-point thesis from Artko Capital, mentioning the 5% buy-back: pdf.

Cake Box could be interesting but they have a healthy dividend yield, which I don’t need.

Amadeus Fire also seems to be performing well, but I don’t like the industry (staffing).

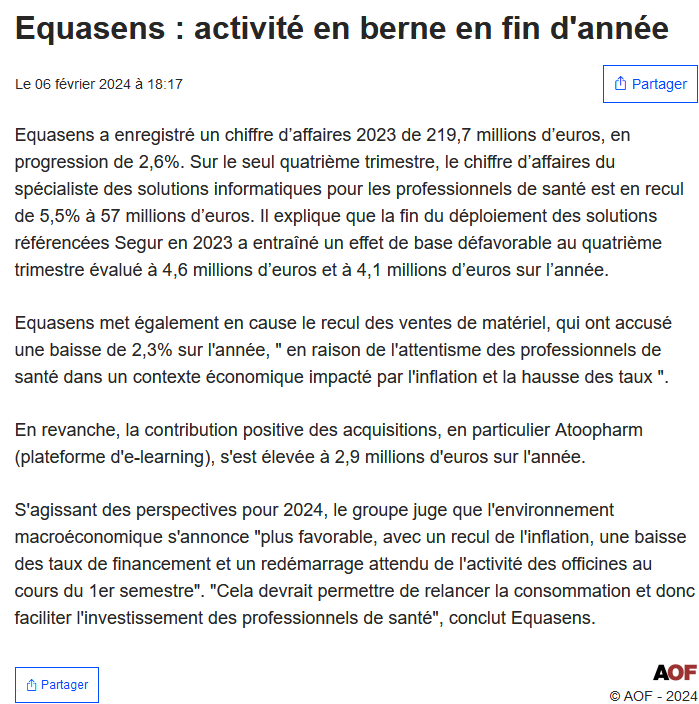

From Yahoo Finance: “Equasens Société anonyme provides healthcare IT solutions in Europe”.

(thread)

A pretty straightforward valuation by @jenslin_:

Levered offshore rigs: a writeup (archive)

Another one is Valaris $VAL.

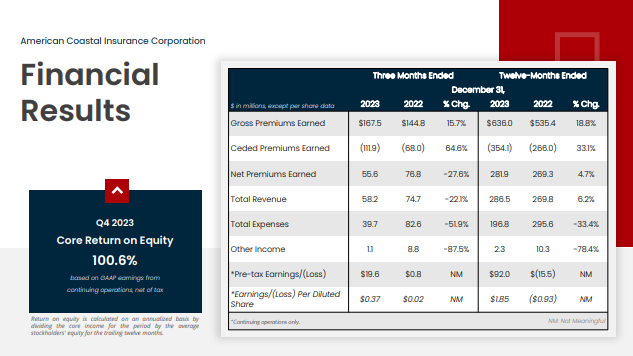

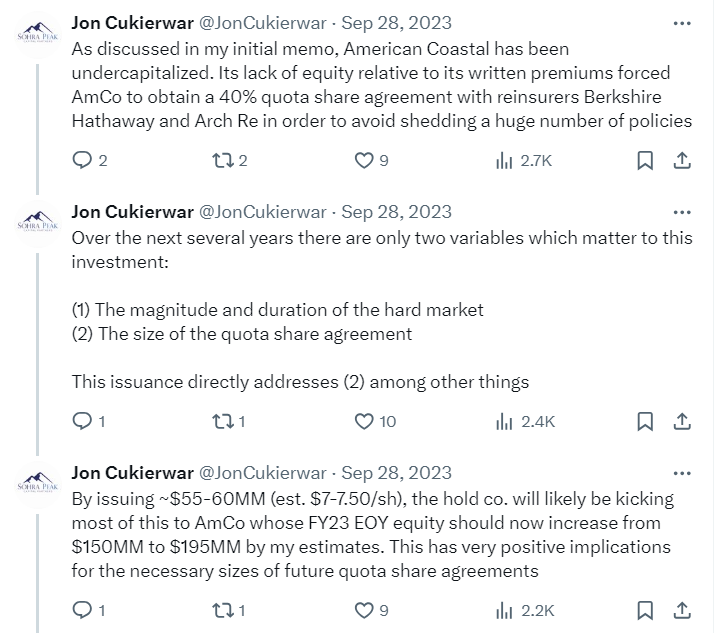

From Jon Cukierwar:

If I had to guess, from a fundamental perspective folks are concerned about Q4 GWP and Citizen's takeout announcement, the two of which are related. Q4 GWP came in a ways below Q1 and Q2 (Q3 seasonally weakest) likely due to ACIC losing some share to Citizen's. If a private insurer offers rates +20% or above the Citizen's rate, the customer has the right to go with Citizen's. In a pricing environment where some homeowners are opting to risk it and forego insurance altogether, insureds are probably price sensitive right now. With that said, as mentioned in the earnings presentation, ACIC expects TIV to inflect upward again in Q1 suggesting they will be going back on offense in accruing policies. Having spoken with them, they also view the Citizen's takeout as opportunistic and certainly not out of necessity -- in other words, if there are condos/HOAs available that they know and can price better than other private insurers, and can take these from Citizen's at a good deal, they simply view it as free money. It is understood that Citizen's takeouts have had a bad reputation as the personal lines insurers in the 2010s utilized this as an unsustainable profit mechanism for the lion's share of their profits without any core differentiation. Unclear if this difference is recognized. Despite GWP being down, for FY24 it seems clear, at least to me, that YoY GPE should be flat-to-up and reinsurance costs for various reasons should be down (before quota share consideration), resulting in increased NPE YoY which is what ultimately matters. Therefore, holding hurricane season losses & LAE constant, my view is commercial lines segment should deliver higher underwriting profit in FY24 than in FY23.From a technical perspective, there hasn’t been a sustained drawdown in the share price for quite some time. I am far from a technical analyst, so any views on impacts from profit taking, momentum, etc. are outside of my domain, though certainly possible.

Disclaimer: The above content reflects solely my opinion. The information in this thread is not intended to be and does not constitute investment or financial advice. You should not make any decision based on the information presented without conducting independent due diligence. Sohra Peak Capital Partners holds a position in the security mentioned and may change that position at any time.

Another important thread:

The OG thesis: Sohra Peak writeup (archive).

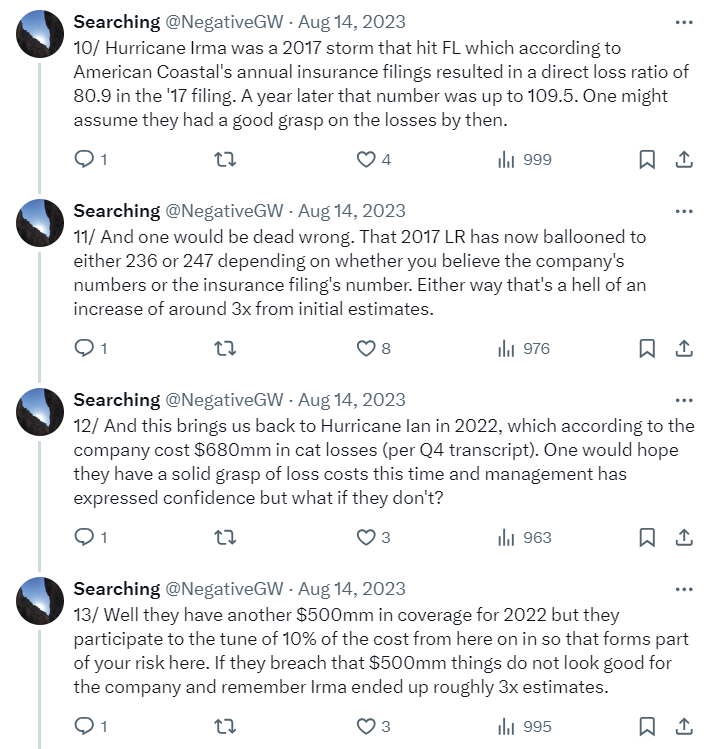

An educated bear thesis:

An explanation on the recent drop:

This is a copper play. Here’s a Value Hive podcast on copper and Ero.

A comprehensive thesis on Ero Copper from Alberto’s substack (archive).

Disqus comments are disabled.