#107 - Ramblings Feb2024

Last updated: Jun 8, 2024

Tyler on the Canadian housing market and Dream Unlimited

Supply cannot increase enough. Demand will remain high. And everyone in power is searching for ways to make builders build more (mostly through ways that are making it more profitable), including ways to stop/reduce a few of the industry’s current biggest impediments and costs.

Turning Stocks

$AGF-B.TO

I found this one on Sedi.ca.

They’re buying back stock like CRAZY!

Price-to-book is low:

Yet book value has been growing over time:

![agf]bv(/images/agf-bv.png)

The free cash flow metrics look very good but I don’t know yet if I can trust them.

Divident yield is ~5%.

Here’s the business profile from Yahoo finance:

AGF Management Limited is one of Canada's premier investment management companies with offices across Canada and subsidiaries around the world. 2007 marks AGF's 50th anniversary ofproviding Canadians with innovative investment solutions across the wealth continuum. AGF's products and services include a diversified family of more than 50 mutual funds, the evolutionary AGF Elements portfolios, the Harmony asset management program, AGF Private Investment Management, Institutional Account Services and AGF Trust GICs, loans and mortgages. With approximately $53 billion in total assets under management, AGF serves more than one million investors.

So it’s an asset management shop.

Market cap = $500.6M

FCF yield is ~ 80/500 = 16%; pretty good.

They have:

- $50.4M in cash

- $22.2M + $254.9M = $277.1M in investments

- Debt of $5.8M

- Deferred income tax liabilities of $152.8M

- Other LT liabilities of $10.3

All in all, net cash and investments = $158.6M and EV = $342M

Assume UFCF = FCF then UFCF/EV yield ~ 23%.

I mean…this is pretty good.

There’s not much growth to expect from this but still, with the ~5% dividend yield AND the stock buybacks, it seems better than just getting 4.5% interest rate on WealthSimple Cash.

I’m buying.

Note: the mean historical FCF yield in the past 10 years was 12%, and one standard deviation above is pretty much where we are, around 16%. It only went above 20% at the onset of the pandemic.

$3328.T

Well I guess I should write something about Beenos now that its share price has declined by 13.5% on their 2024Q1 announcement.

Quoting myself: “Before I read his writeups, I looked at the numbers on Koyfin and - holyshit, this is looking REALLY good!”

Ya right.

Anyway, the earnings presentation is here (archive).

E-Commerce operating income was JPY 0.81B, down 18%.

Consolited operating income was…0, mainly because incubation shit the bed (vs was a big contributor in 2023).

Corporate costs: -0.28B

Other business: -0.26B

- Cash: 8.7B

- Operational investment securities: 3.7B

- Market cap: 15B

- EV: 2.6B

So trading at 9.6x annualized operating income from e-commerce minus other businesses and corporate costs.

Not looking that cheap…

That being said, 3.7B is the book value. The estimated market value as of Sep'23, from their 2023Q4 presentation, p43 (archive) was 21.7B:

The bad news is, this market value has shrinked dramatically as of December, now worth only 7.7B (see the 2024Q1 presentation, archived here):

$AEBZY

This is Anadolu Efes, pitched by Mohnish here.

They have an English IR site.

From their 2023Q3 presentation (archive), they have US$500M if net debt, compared to a market cap of US$3B, so EV is about US$3.5B.

9m FCF was ~TRY10B so annualized is about TRY13B or US$546M. So EV is about 6x FCF and I’m probably mixing up levered FCF and EV but who cares.

Given the growth profile (30%-40%), this looks quite cheap.

I also saved the 2023Q3 earnings call presentation here.

$CTT.LS

Greenwood investors has shared an update on the company, which I reproduced below, in their 2023 year end letter. I continue to be bullish.

CTT (OTCPK:CTTOF)We could say the same for CTT, which is entering its 504th year as an organization. Operating profit is set to hit a company record in about a year’s time, given the capital markets day guidance of €100-120 million in EBIT in 2025. Besides this figure being a new company record, what’s more compelling is that the majority of it will be made up by profit drivers that didn’t exist when we entered the board room in 2019.

A highlight of the year for me was in December, when a union called a strike during the busiest moment of the year. Zero employees showed up for the strike, outside of the 6 union leaders that called for it. This strike was called just as a new customer-satisfaction bonus scheme was in the early phases of being trialed. The company has been working on preparing data and processes for years to get to this point. It already has the leading position in on-time delivery in the entire market, but the company is pushing the bar even higher. While most employees feel a sense of ownership over the company and its brand, this incentive scheme will bring that commitment to a new level by continuing to prioritize the customer experience.

This also is starkly contrasted to competitors that are owned by venture, government or short-term oriented investors. A great example of this was in 2021-2022, when VC-funded Paack, government-funded Correos, and Royal Mail-owned GLS were attacking the Iberian market with price points that carried with them deeply negative gross margins. All three were fighting to “dress up” short-term results through unsustainable price points.

As Royal Mail pulled the GLS IPO, Correos posted a negative result for its sole profitable segment of Express & Parcels, and Paack’s venture-funding has evaporated, so has the sustainability of these competitors. As CTT held price and reinvested in quality of service throughout the heat of the moment, it has re-accelerated its market share conquest on the Iberian Peninsula. E-commerce ordering frequency in Iberia is still fractions of where it has hit in other developed markets, meaning the profit drivers from this core division are sustainable and secular in nature.

Thus, the accelerated revenue growth rate demonstrated in recent results has sustainable profit drivers underpinning it. Furthermore, according to consensus estimates, EBITDA from 2023 will hit a new company record when its reports full year financials. The stock remains 65% below its levels when it last reported a smaller number in 2016. The story is far from being over, and our suspicion is that the new record will not be the peak, as the company’s medium-term guidance promises more by 2025.

The EBIT guidance of €100-120 million would support a market capitalization of €1.0-1.2 billion at peer valuations. These peers are not growing nearly as fast as CTT, so this is even conservative. The only question that remains is how many shares the company can retire between now and then, from the current 138.9 million left outstanding. Every day that goes by with it trading for less than half of fair value means the share count will likely be considerably less.

$MSFT

Microsoft’s EV/EBITDA was ~40x in 2000 and 12x in 2020.

EV/GP was ~30x in 2000, down to 6x in 2010.

EBITDA margin was very healthy above 50% in 2000, down to 40-ish% in 2010.

EBITDA was ~$12B in 2000 and $24B in 2010.

The stock price declined by ~50% in those 10 years.

I was looking at $MSFT because I wonder if I’m overpaying for Coupang.

According to Koyfin, $CPNG is trading at EV/EBITDA ~ 21x (Note: this is wrong - see below).

$CPNG

From their 2023Q3 earnings release, Coupang had:

- $4.8B in cash

- $1B in debt and severance benefits (excluding lease liabities)

Current market cap is $25.85B, i.e. EV ~ $27B.

Adjusted EBITDA for the trailing twelve months was $991 million with a margin of 4.3%.

EV/EBITDA ~ 27x

It might be too expensive for me.

Oh and equity-based compensation was $310M out of those $991M. Yeah I don’t like it anymore.

$HR-UN.TO

I’ve been surprisingly active on REITs as of late. This is another one that caught my eye, shared by @alphafortuna10.

Here are the details of the Bow option:

The 100 Wynford option is not as significant.

I think this REIT trades at a 10% AFFO yield.

However the residential portion of the business is only in the US.

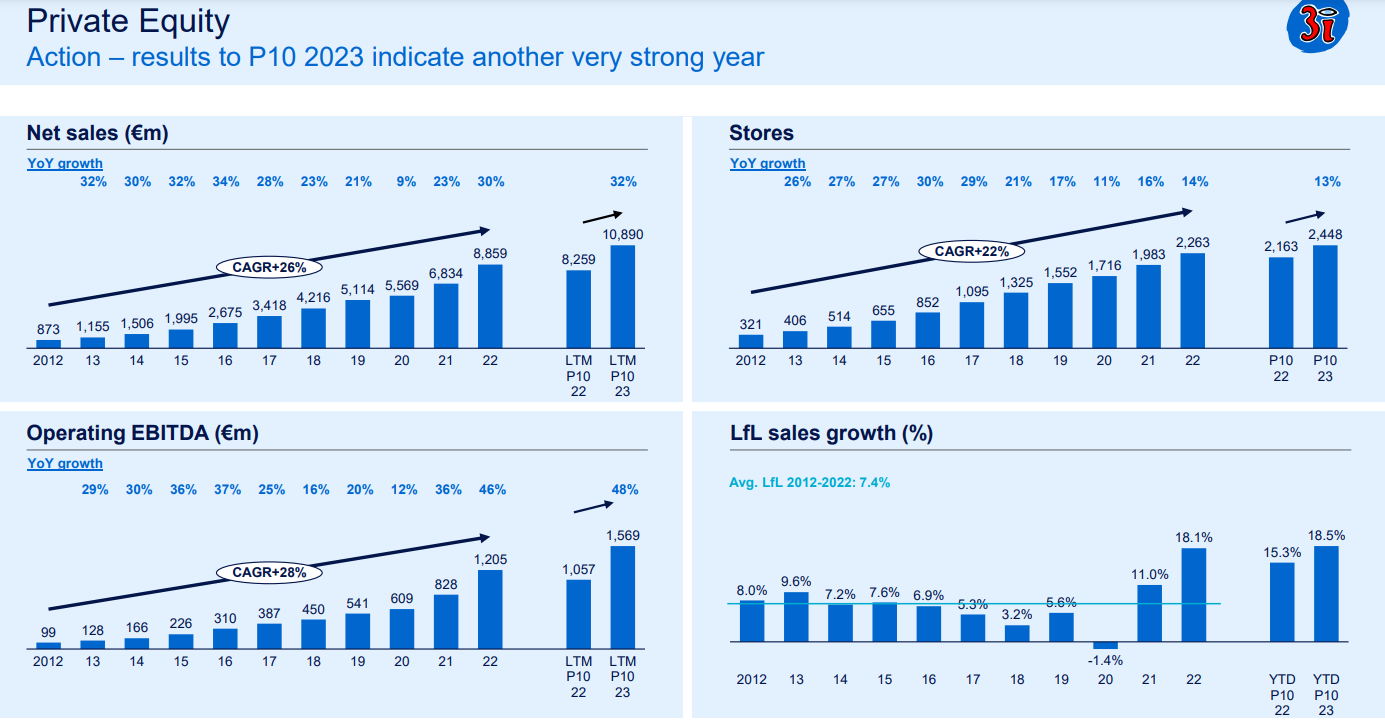

$III.L

Somebody shared this ticker with me. They own Action, a European discount store chain that is growing like crazy.

Image is from their 2023Q3 presentation.

$MPCT-UN.TO

Koneko Research published a thorough piece on Dream Unlimited here (archive).

It made me realize that while I’m sure Dream Impact will at some point be worth more than the current market cap, I just don’t like this business or this management. They fudged it and I don’t know how long it’ll take them to unfudge it.

I am a bit tired and didn’t sleep very well so I might just be shaken out of a good opportunity but still, this is not a situation I understand well.

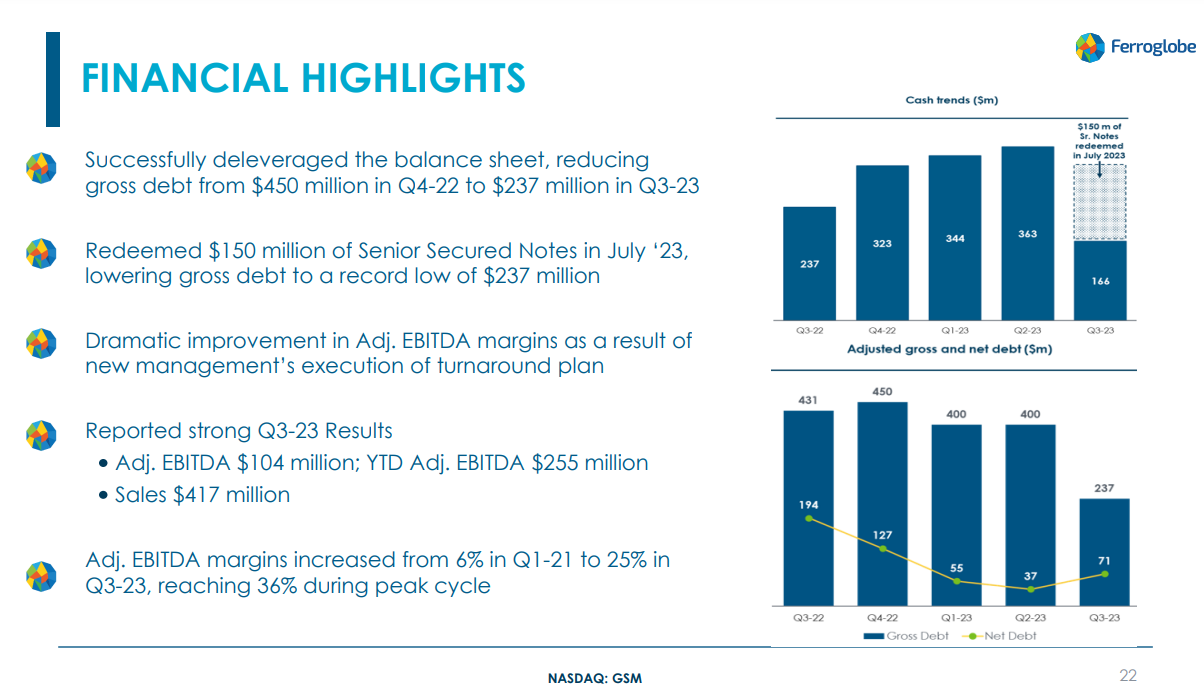

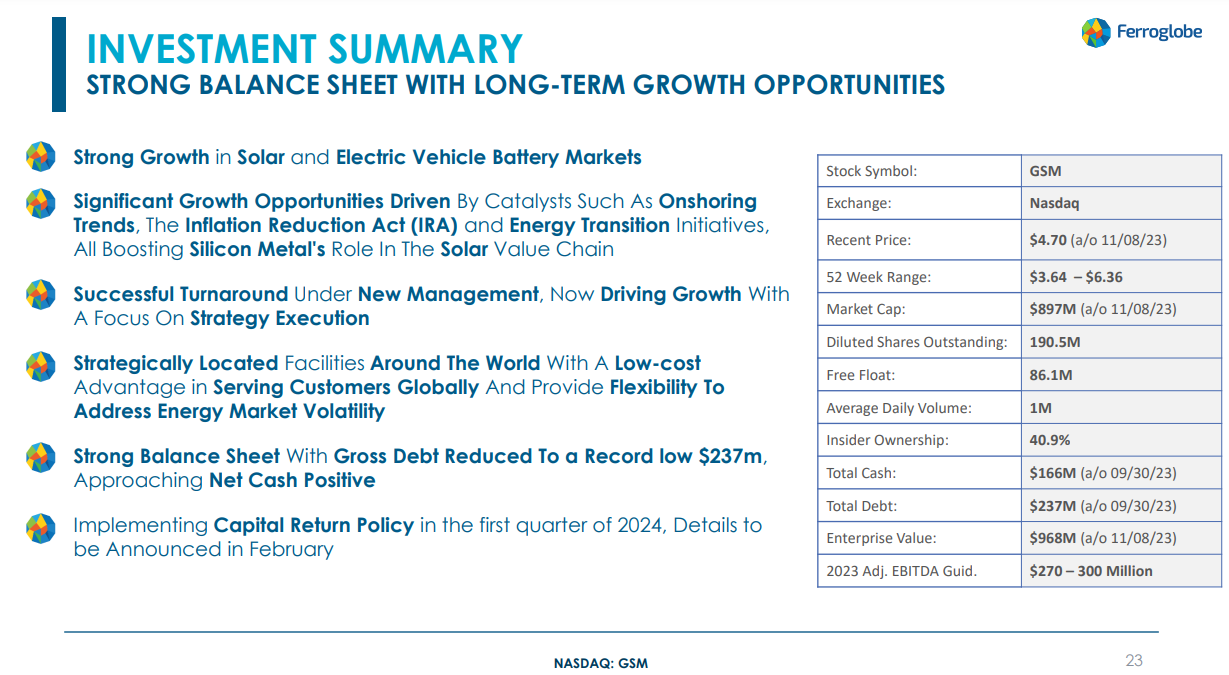

$GSM

Ferroglobe: heard about it on an episode of the Forward Guidance podcast: Secrets of Small Cap Value Investing with Kyle Mowery from GrizzlyRock Capital.

The November investor presentation is here.

Some highlights:

Current EV/Adj.EBITDA is ~ 3.6x

Not that SBC was not deduced from Adj. EBITDA (good).

The 2023Q3 earnings call presentation is here.

$STLC.TO

I saw some people praise the CEO of Stelco, Alan Kestenbaum, on X.com:

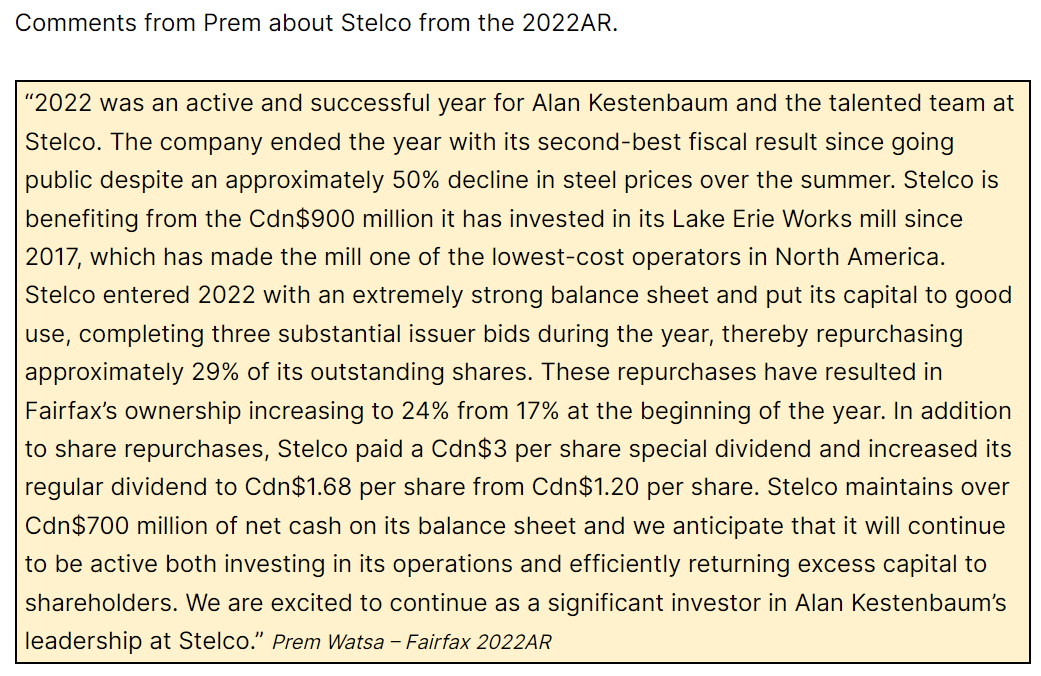

Then found these reported comments from Prem Watsa on Stelco, on thecobf:

Here’s the original deal where Bedrock bought Stelco: Bedrock gets steelmaker for less than $500 million (archive).

And here’s their 2023Q3 earnings call presentation (archive).

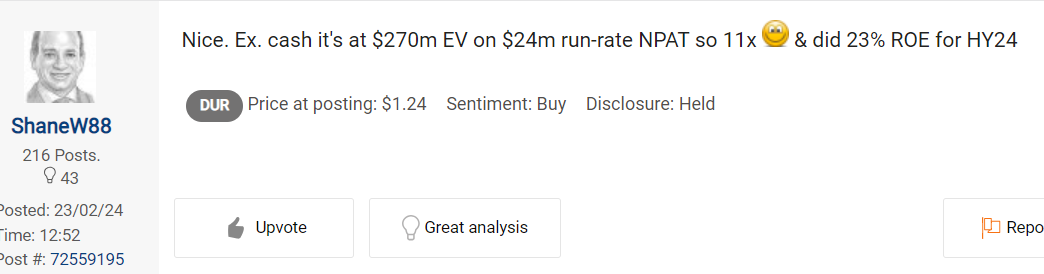

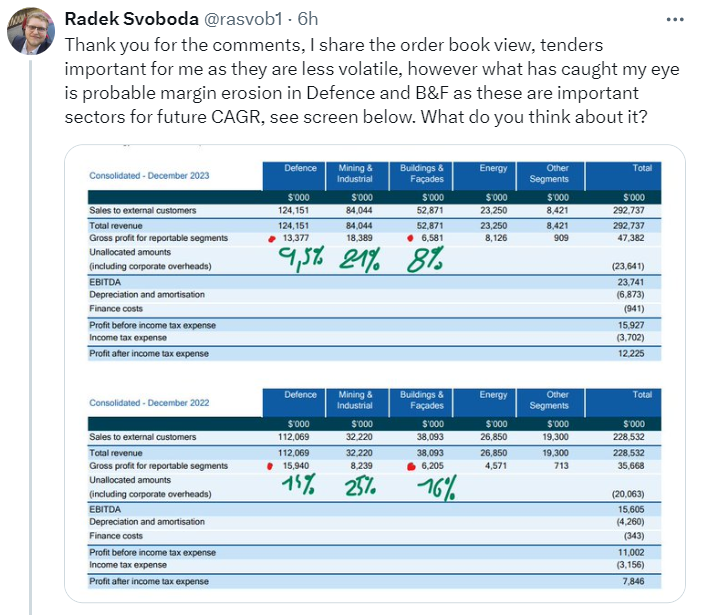

$DUR.AX

Sold out today. Apparently their order book was weaker than expected.

It looks like a compounder. Koyfin says it trades around EV/EBIT ~ 12x.

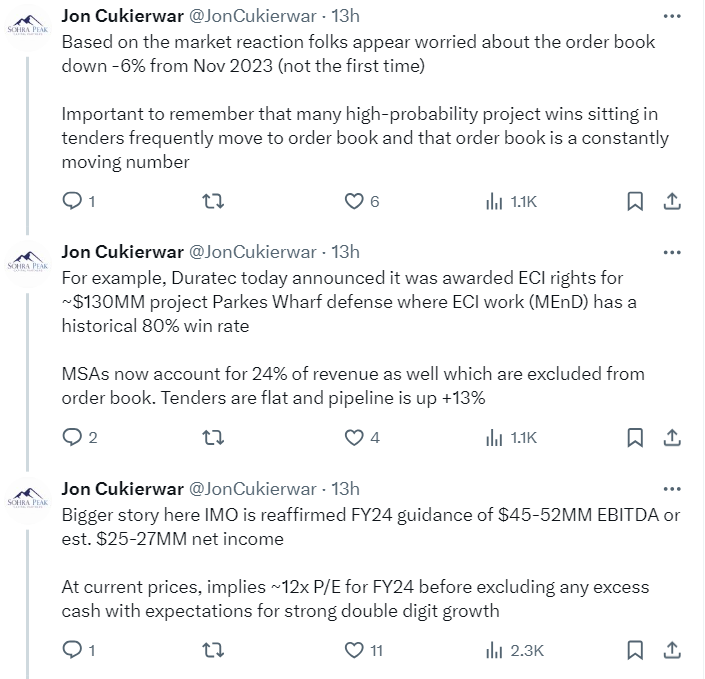

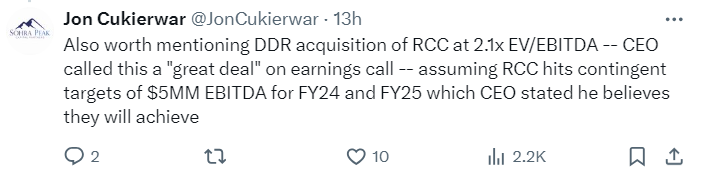

It was written up by Jon Cukierwar of Sohra Peak Capital in their 2023Q3 letter and previously in their 2023Q1 letter.

Here are some relevant and insightful comments from Jon Cukierwar on the order book decrease (thread):

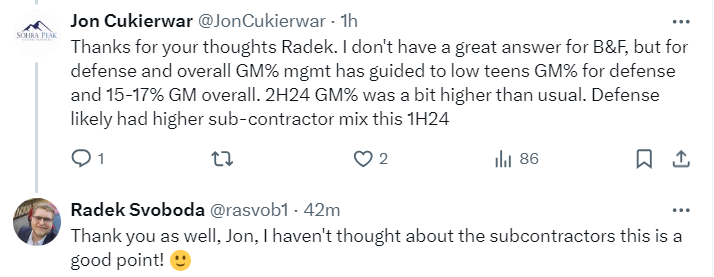

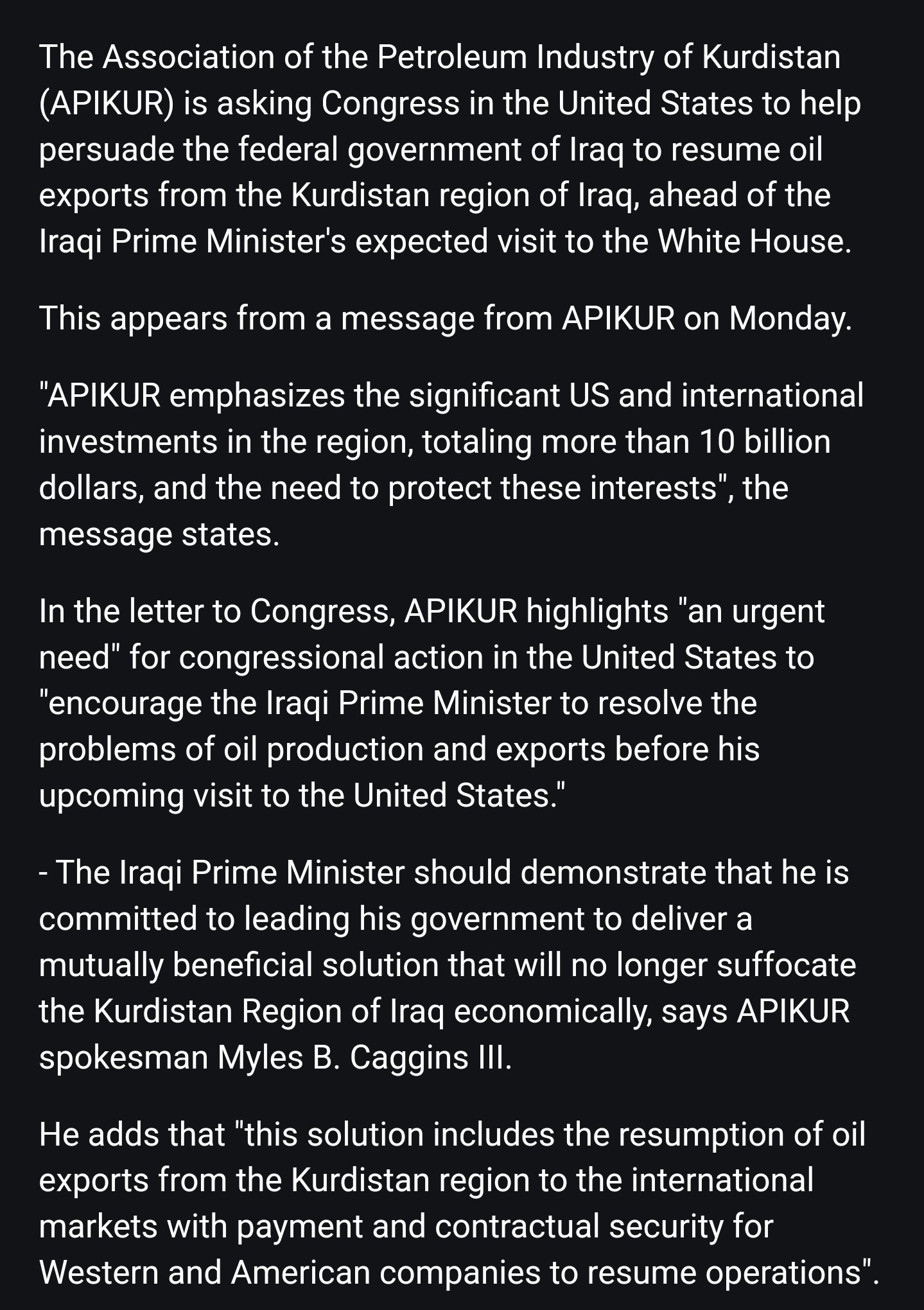

$DNO.OL

ToffCap published a bullish thesis on the company (archive).

The ticker was also pumped on X by Alexander Eliasson, see for example all the way back in November 2023.

With so much apparent certainty around the reopening of the pipeline, I cna’t help but ask: why is it not priced in already?

What’s new is:

Crude oil selling price from Iraq’s Kurdish region in focus.

Another very nice writeup here (archive) by @oilgastourist.

$EDR.MC

eDreams looks like a fantastic company at first sight.

Their 2023Q3 presentation is here (archive).

Valuation-wise, it’s seemingly a fairly simple situation.

They forecast $120M of cash EBITDA for FY2024 (year ending in March 2024), versus a current market cap of $828M and net debt of $344M, so EV = $1,172 and EV/Cash EBITDA (ttm) ~ 10x.

They also forecast 50% growth in cash EBITDA in 2025!

$BAH

Booz Allen Hamilton. A very interesting company (not stock).

$BF-B

Brown-Forman. Another amazing company. They own alcoholic beverage brands, such as Jack Daniels, Gin Mare, and many others.

Not cheap enough at the moment.

Disqus comments are disabled.