#102 - Portfolio Update Nov2023

Last updated: Feb 29, 2024

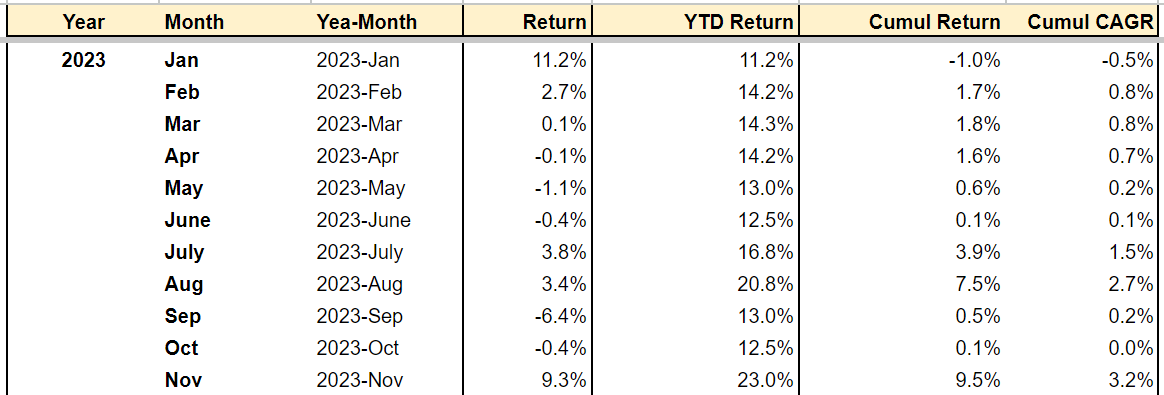

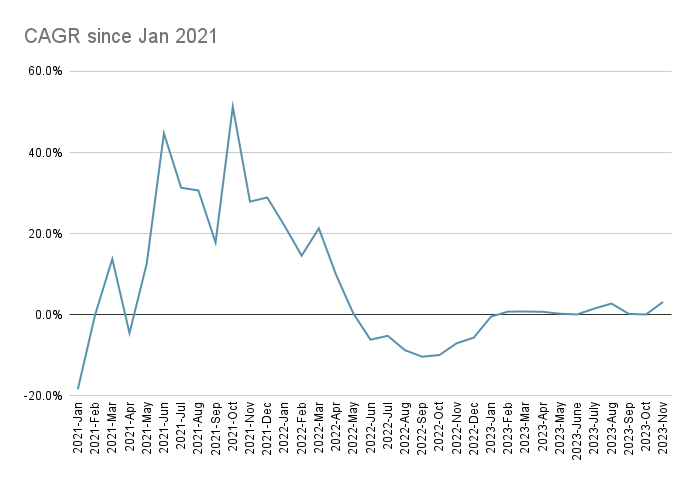

Best month of the year; 3rd best month since inception.

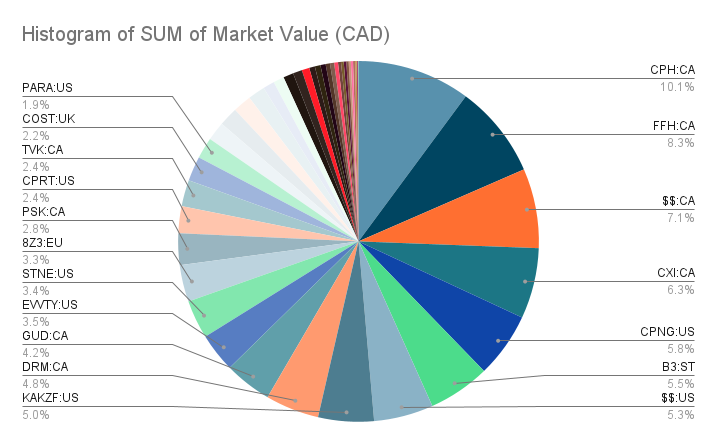

Top contributors:

- $CPH.TO: very strong performance. Solid quarter, on-going buybacks.

- $STNE: solid quarter, still growing

- $DRM.TO: just coming back from the dead

Top detractors:

- $8Z3.F: fucking killing me man…

- $CPNG: irrational drop, imo.

The elephant in the room is $TBLD $8Z3.F.

See Firm Returns update here (archive).

I personally marked the stock price at 0. It was a pretty devatating turn of events. Thank God it was only a 5% position at cost.

I remember feeling some envy at the thought that other shareholders who had a bigger allocation would make a much higher return should the stock price return to higher level. Thankfully, I didn’t cede to envy.

Some members of our discord group still believe that there was a “massive margin of safety” with this bet.

I strongly disagree. I know that hindsigh is 20/20, and I don’t want to overlearn from a single experience, butthe fact is: the margin of safety was an illusion. It relied on the willingness of the CEO to act as a capital allocator and not an operator, to cut all necessary costs and expenses if required.

It turns out, the CEO is more motivated to keep the company running and growing - even willing to underwrite a new equity raise, keeping his proportional stake while diluing minority shareholders, despite having promised just a few months ago that dilution was not in the cards.

I learned that management behavior is a huge determinant in unlocking the perceived margin of safety.

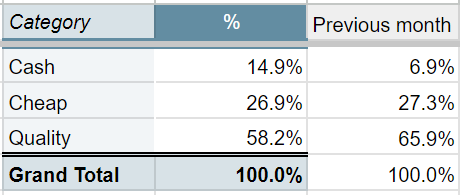

Lots of movement this month, a lot of small new positions.

- New:

- $HUMBLE.ST: seems very cheap, but I need to learn more about it. I linked to AltaFox’s writeup in my monthly notes.

- Added:

- $CXI.TO: added again while it remained cheap.

- $CPNG: I think this company has a long, long runway.

- $WBD: I added a tiny bit.

- Trimmed:

- $PARA: replaced by $WBD.

- Exited:

-

The market is not always wrong. Ask first: why is the market scared? Why is it greedy? Do I agree with it?

-

Operating leverage is a real bitch. When something looks stupid cheap, do a simulation with revenues down 10% (you might find that EBIT would go down 50%).

I have a bunch of cash now. I have existing positions that I could add to. I’m fine earning 4% while I wait for good opportunities.

Disqus comments are disabled.