#1 - Texas Pacific Land Corp

TPL

I just listened to a fascinating interview of Steven Bregman, President and co-founder of Horizon Kinetics. Here’s a short description of this firm: “dedicated to long-horizon, creative approaches to investing, away from mass-market, asset allocation driven orthodoxy”. Pretty cool, huh!

The interview was mainly about the index investing bubble. Steven did a great job explaining the mechanics of that bubble. You can watch the interview here.

Towards the end, Steven talks about one of his main holdings: Texas Land Corporation, $TPL. He goes in detail about the business model and why it’s an attractive one, especially in a long-term inflationary environment, which he thinks we are in.

Chris Mayer, author of the 100 Baggers book, is also a shareholder. And let’s just say, Chris is a guy that knows a thing or two about long-term investing. He recommended $TPL back in 2020, here for example. The stock has doubled since, so part of me wonders if the valuation is a bit streched at the moment (41x P/E (ttm)).

Several reasons can justify this multiple. Of course, a fruther rise in oil price is one of them. But the more obvious one is that $TPL is currently exploiting only about 10% of their land package.

Funny enough, I had purchased $TPL a few months ago as a blind clone of Chris Mayer, but not knowing what I was holding and finding it optically expensive, I quickly chickened out and sold it back.

I am interested again, but this time, I want to understand the business.

Worth mentioning, there seems to be some shareholder discontent with the board: see this tweet, that one, and yet another. Something to look into.

Interesting write-ups:

PSK.TO

Then, I found out about this other oil royalty play, this time in Canada: PrairieSky Royalty Ltd, PSK. They seem to have a similar business model, and they look slightly cheaper on a multiple basis at 32x P/E (ttm), so I want to take a look at them too.

Here’s a short interview of the CEO Andre Phillips. And here, Eric Nuttall (who is basically an oil investing sensei) shared what he thought of this play, back in 2020; in a nutshell, that it is a low risk one, albeit with less torque comapred to other more leveraged, higher beta ones. But for me, at this juncture, exposure to energy with low balance sheet and operating risk is exactly what I’m looking for.

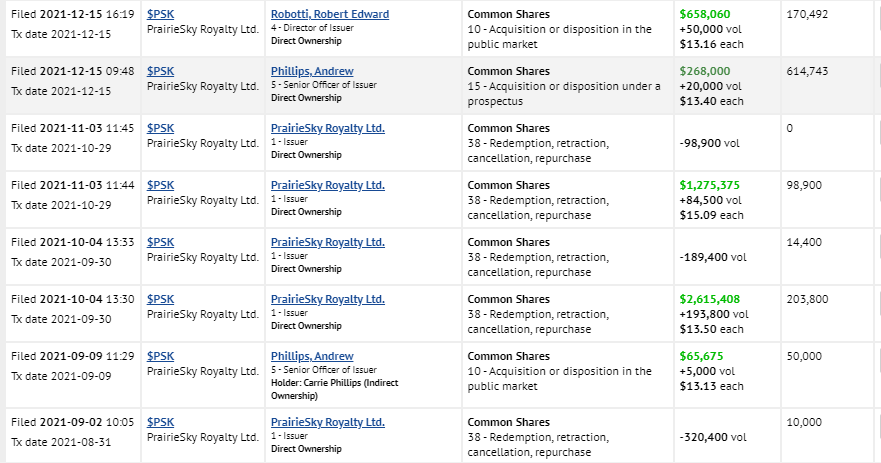

Incidentally, I see that both the company and insiders have been buying shares:

Because the multiple is fairly high, I’m not yet pulling the trigger on PSK either. I need to understand what their growth potential is first.

Update (2021-01-06):

Researching $PSK.TO, I found Freehold Royalties, another (slightly cheaper) oil royalty play. I’m not sure where the price differential comes from. Something to look into.