#0 (revived) - Viemed

Last updated: Apr 28, 2023

I had a small position in Viemed because it’s a company with strong growth, a strong moat and a deep runway.

I decided to sell because, for one, I don’t want to be in that space anymore, i.e. selling services to dying people.

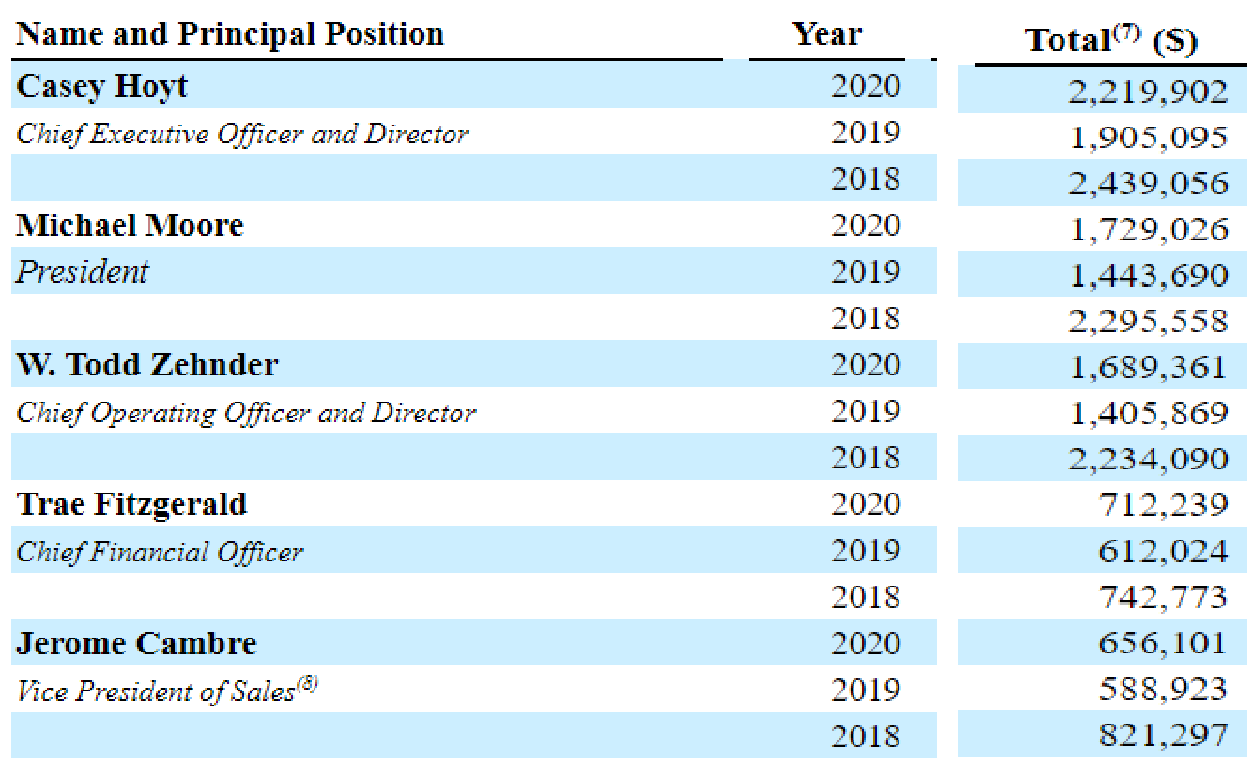

But more importantly, I initially had overlooked the compensation of top executives. Top-5 executives compensation was 7.4% of revenues in 2019. I don’t like it.

I found this commentary to be spot on (from seeking alpha).

“That said, it’s important to separate good management from good stewardship of partners’ capital. If they’re willing to issue – essentially overnight – roughly 2.4 million shares or 7% of the outstanding stock in order to (presumably) incentivize a group that already collectively owned over 9% of equity (additional motivation seems unnecessary), I’m left wondering what their actions will be when looking to incentivize incoming execs with zero shares to boot (lets not forget the power of envy/jealousy).”

Yet another comment from that same page pointing in the same direction:

“Good analysis. I would add that, when looking at VMD’s fully-diluted equity capitalization, it’s clear that management isn’t as shareholder-friendly as might first seem, and as such, the stock isn’t as cheap as could be. The trend of issuance isn’t very encouraging either. […] What’s particularly devious is that, because Option Tranche 3 (2.2M shares) is way under water and is expiring in mere months, FOMO/deprival reaction tendency led them – as is indicative of a management which considers it an earned right to have its bread “buttered differently” from shareholders – to issuance of another 1.67M RSUs and 700,000 in-the-money options, for a total of 2.4M shares, or 7% increase in capital base in response to expiring options. That’s basically low-quality capital management.”

I don’t have to be invested in a company where I don’t like the space and the management, even if I think it’s currently undervalued. There are tons of other choices.

Disqus comments are disabled.