#0 (old) - Data Communications Management

Last updated: Aug 4, 2023

Bottom line up front

I am not taking a position in DCM as of today. While the stock is cheap in terms of multiples, the company is in the declining printing business and they need a mini-miracle to expand out of it into digital. I do not see a clear path towards a 10 bagger in 5 years.

The cannabis labeling business represents only 5% of their revenues despite their market leader position in Canada. In the US, they have yet to score a client and they are facing established competitors.

Update (2021-06-01):

Of course, a few days after I published this, the stock runs up 16%. Great :triumph:.

DCM: Dunder Canada Mifflin?

Data Communications Management is a 60 years old commercial printing services company, with added marketing and brand management solutions. Their core business is facing obvious secular challenges and is slowly declining.

The company caters to big enterprise clients in multiple industries: banking, retail, healthcare, energy, cannabis, etc. According to the 2020 MD&A, the company provides services and products to 70 of the 100 largest corporations and government entities in Canada. Renewal rate on existing businesses was 95% as of 2021Q1.

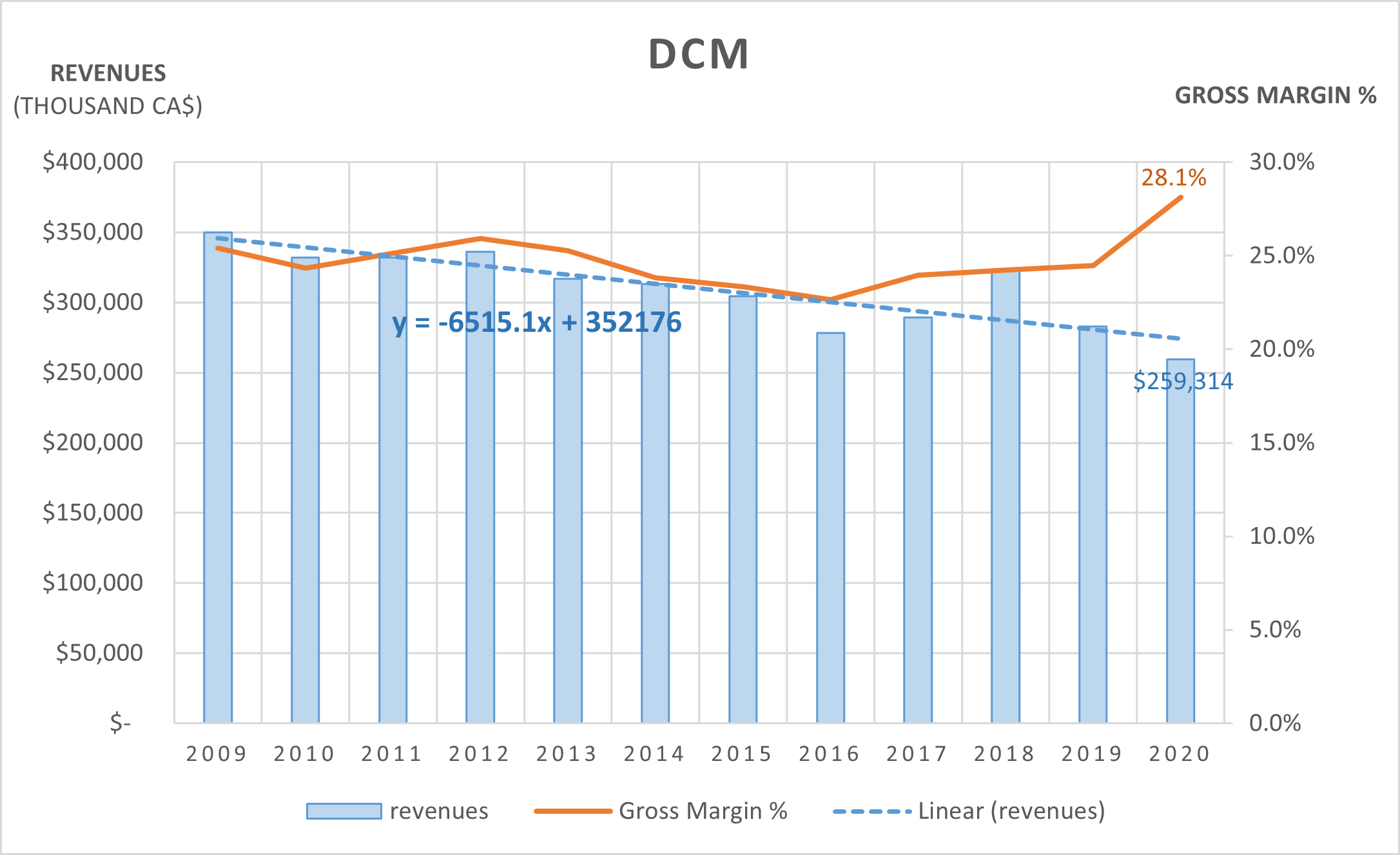

Unsurprisingly, the printing business is declining, and the company’s revenues are declining at the pace of ~$6.5M of revenues per year.

On the other hand, there was a reversal in the gross margin in 2020, as a result of better product mix, improved pricing, temporary layoffs during the pandemic and restructuring efforts started in 2019.

Recent Developments

In the summer of 2018, the company began serving an emerging new market, providing speciality label solutions to the cannabis market. DCM provides dynamic labeling services to 8 of the top 10 cannabis licensed producers, helping them keep up with the evolving Health Canada regulations and compliance requirements.

As of 2021Q1, this segment represents about 5% of the total revenues and has a higher gross margin (~35%).

During the second quarter of 2019, headcount was reduced by ~105 individuals. Restructuring expenses of $3.2M were incurred and annualized savings of $7.5M are expected. Another 30 positions were voluntarily vacated, leading to $2.5M additional savings.

In November of 2019, the direct sales force was reduced by 13 people. Restructuring costs $0.7M, annualized savings $1.4M.

In Februray of 2021, the company announced that Michael Coté, President of DCM, left the company.

In March of 2021, the company announced the departures of 4 seniors managers:

-

Chris Lund, who joined in 2018 as Chief Innovation Officer, in connection with DCM’s acquisition of Perennial

-

Kevin Lund, Chief Brand Officer, also coming from Perennial

-

Ralph Misale, Chief Operations Officer, who joined DCM following the acquisition of Eclipse

-

Edwina Fund, SVP Finance

All of these departures were probably not voluntary.

On June 3 2019, DCM launched a new ERP system across its core DCM business. DCM experienced numerous operational challenges in connection with the implementation of the ERP system, which led to a decline in production levels (and, as a result, lower revenue recognized) and shipments, and negatively impacted the processing of accurate and timely billings to customers. The lag in the issuance of invoices resulted in constraints on DCM’s working capital and financial liquidity. These challenges also required DCM to obtain from its senior lenders a number of waivers, amendments and related consents under the terms of its existing credit facilities.

During the 3rd quarter of 2019, DCM continued to experience challenges with issuing accurate billings to its customers which in turn has increased its accounts receivable by nearly double its normal levels. DCM has leveraged its Bank Credit Facility during the third quarter, in addition to obtaining additional financing from Crown to enable it to continue to meet its commitments to its valued suppliers until billings and collections issues are resolved with its customers.

In the 1st quarter of 2020, DCM started changing its legacy practice of “bill-as-released”, or BAR, where they incurred the costs of producing finished goods for their clients, warehoused these products for a period of time, and didn’t invoice clients until product was ultimately shipped. At the end of March 2020, they initiated a project to convert their top 15 clients (2/3 of the BAR products) to a more practical “produce, bill and hold” model where the client is billed as the product and produced, and charged while the product sits in the warehouse.

Converting clients to the new billing model has generated $12.3M of working capital, and is expected to generate an additional $5M in 2021.

The company paid down more than $31M of senior debt between the end of 2019 and the end of 2020.

As of 2021Q1, the total debt, including credit facilities and promissory notes, amounted to $40M, down from $47M a quarter before, and $82M a year before.

The Thesis

2021 revenue should tick higher because of the pandemic ending and the reopening of businesses, although that is not guarantee. The linear trend shows expected revenues around $280M (vs $260M in 2020) and a $6.5M yearly decrease in revenues.

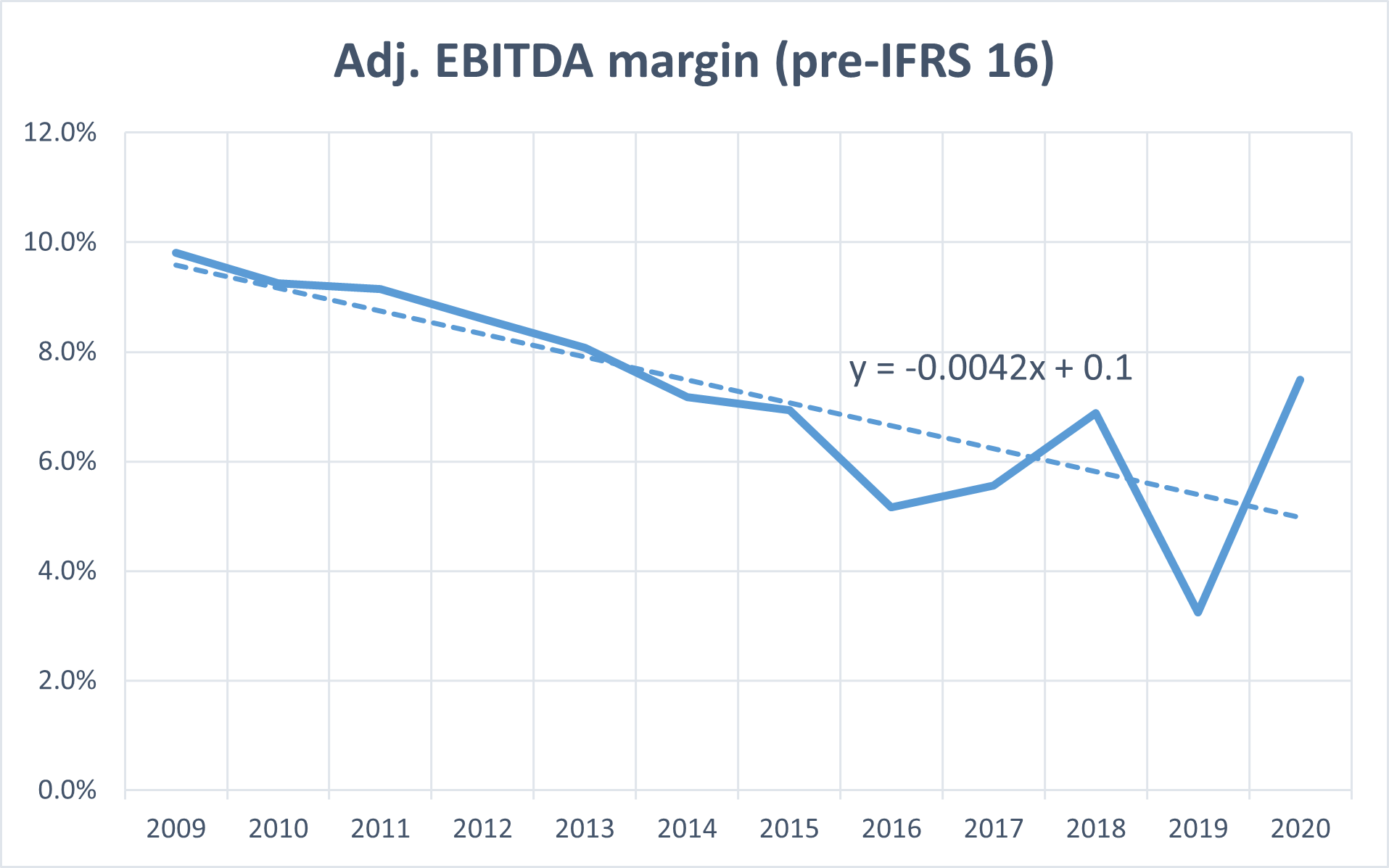

In 2020, the company achieved Adjusted EBITDA (excluding pandemic-related government grant and restructuring costs) of $19M, or $14M after tax, representing 7.5% of revenues. This is the pre IFRS-16 figure, i.e. after deduction of the lease payments. This is much higher than the previous years average, and according to management, is the result of a better mix of products, improved pricing, temporary layoffs and restructuring efforts started in 2019.

Using an exponential regression for the historical trend for EBITDA margin, we will assume a decay factor of 94% in EBITDA margin.

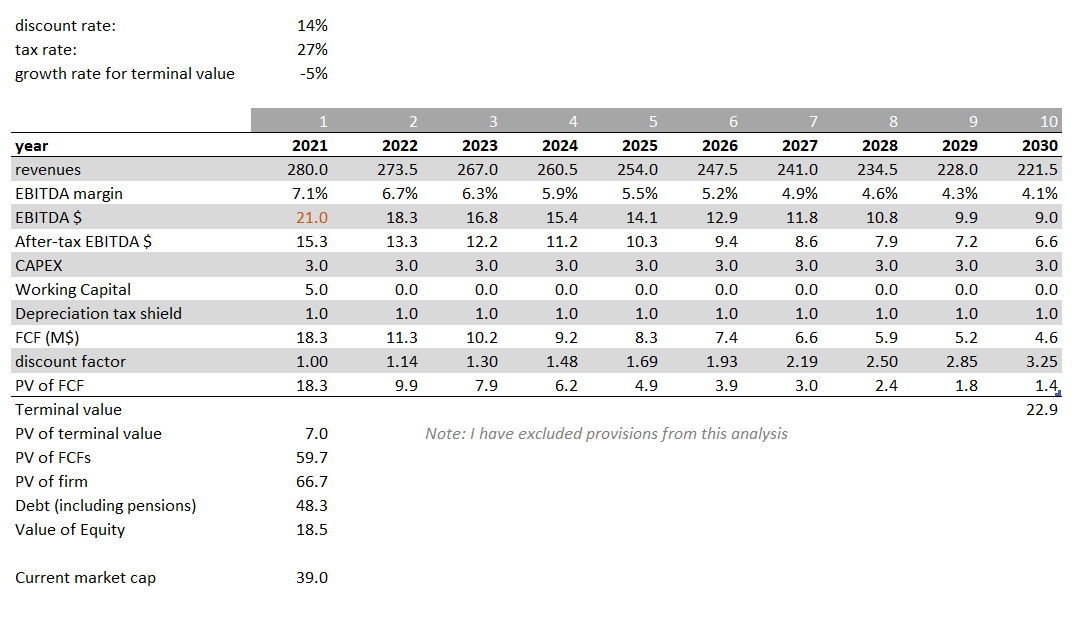

We will give the company credit for the efforts to improve EBITDA margin and start our model at an initial margin of 7.1%. The recent cuts in upper management should add at least $1M to EBITDA in 2021, yeilding base EBITDA of $21M in 2021.

For 2021, CAPEX is expected to be around $3M ($1.5M for plant maintenance and $1.5M to improve the digital platform). The CAPEX outflows have varied historically between $0 and $3M for the plants and equipments alone. It seems reasonable to assume a total CAPEX (physical and digital) of $3M going forward.

Working capital improvements should add about $5M to cash flow in 2021, but we will assume neutral impact after that.

Finally, the depreciation tax shield should yield another $1M to free cash flow per year.

All in all, we can expect free cash flow to the firm of ~$23M in 2021.

The current market cap is $39M.

With a WACC of 14% (estimated by the company), debt of $48.3M and a conservative 5% yearly decline in FCF starting at $23M, if the company remains in business for 10 years and exits with $22.9M terminal value (implied growth rate -5%), present value of equity is $18.5M.

Disqus comments are disabled.