#0 (old) - Alibaba

Last updated: Aug 4, 2023

Final version (LOL):

Listen. I’m not gonna pretend I understand Alibaba’s business and the risks involved. I don’t. But here’s how I think about it. If someone I consider a true master says this is a good move, and from a price perspective, the move only gets MORE attractive, then I have no problem putting some money here. If it turns out that it was not a good move, I honestly will have no bad feelings about it; for the simple reason that if the master got it wrong, then anybody else would have as well.

Updated version:

The cloud. 50% growth. Population just coming online. Businesses will go straight to the cloud (no on-premise). Invisible in the earnings as of today. High margins (AWS ~ 30% operating margin).

Previous version:

Charlie Munger bought some (19% of The Daily Journal’s portfolio). The last time he bought something was in 2014. Mohnish Pabrai is partaking. The current price is lower than when either of them bought. Sentiment on the stock is probably near peak pessimism (EDIT: I was wrong on this; pessimism deepened afterwards). Valuation is cheap. Growth, optionality, FCF and balance sheet are very strong.

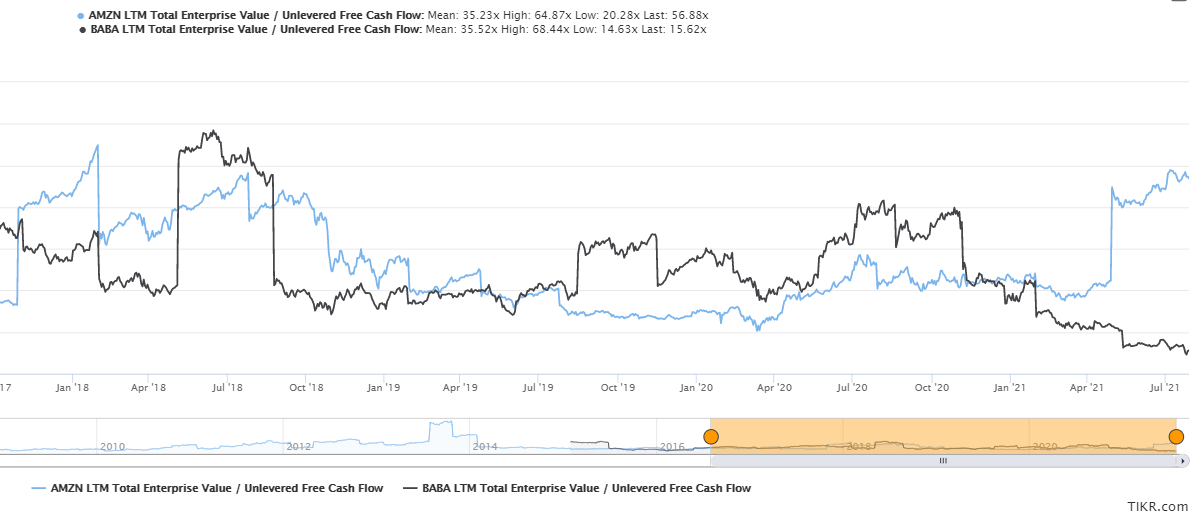

$BABA is growing at ~30% YoY and trading at near all-time lows of:

- ~28 EV/EBITDA(ltm)

- ~40 EV/EBIT(ltm)

- ~17 EV/FCF(ltm)

Compare to AMZN (similar growth) trading at:

- ~30 EV/EBITDA(ltm)

- ~58 EV/EBIT(ltm)

- ~53 EV/FCF(ltm)

The discrepancy between the comparisons of EBITDA on one hand and EBIT or FCF on the other reflects the asset-light nature of Alibaba’s business.

The company has positive $46B net cash.

I use an ultra-simple DCF template to get a ballpark idea of what a company could be worth. My template has 3 phases: growth, sustain (0% growth) and decay. The length of each period is a parameter, as well as the growth rate and the discount factor. I assume the company dies at the end of the decay period.

In the case of $BABA, using a starting unlevered FCF of $27B, a growth period of 10 years at 20% growth rate, a sustain period of 20 years, a decay period of 10 years and a discount rate of 15%, I get an enterprise value of $636B. This gives me a 15% margin of safety above the current EV of $544B.

Alibaba is a cashflow monster with tremendous survivability and optionality. Daniel Zhang, Alibaba’s CEO and Chairman, explains in this video that Alibaba is in fact an infrastructure service provider (including e-commerce, logistics and cloud computing) to all their business partners who want to achieve a digital transformation. This goes back to the original mission of the company, which is to make it easy to do business anywhere. The cloud business of Alibaba in particular is just getting started and similarly to Amazon/AWS, they can use their core e-commerce business to feed and improve their cloud business.

In Alibaba’s last earnings call, the CEO said this regarding the use of future profits:

We plan to invest all of our incremental profits in this coming year into core strategic areas such as technology innovation, support programs for merchants to lower their operating costs, user acquisition and experience enhancement, merchandising and supply chain capabilities, infrastructure development, and new business initiatives.

The market didn’t seem to like this. I do.

Monish Pabrai on Alibaba (at 38:39): “If I’m buying it, I must like it.”

-

At the end of Donald Trump’s tenure, there was a lot of political tension with China. Delisting of Chinese public companies from the NYSE seemed like a serious possibility.

-

The company was recently slapped with a one-time $2.8B anti-monopoly fine (4% of revenue), not long after Jack Ma publicly criticized Chinese regulators. Ant Group’s IPO was cancelled as well. Jack Ma had momentarily forgotten the rules of the game, and the CCP reminded him.

-

The Chinese have a reputation for shady accounting standards.

-

There is a demographic cliff coming in China due to the one-child policy, which could impede GDP growth if not mitigated by higher productivity.

The stock has been hit with a quadruple-whammy: the tech sector sell-off, negative sentiment towards chinese stocks, delisting fears, and Jack Ma’s misplaced bravado.

Of the risks enumerated above, the one that bothers me the most is the delisting threat. I don’t think that my shitty Canadian broker would allow me to salvage anything if it came to materialize.

On the other hand, the biggest and most unfair advantage I see for Alibaba is that it is now entrenched in the Chinese economy in a way that few other companies are, in China or elsewhere.

I have a ~1.5% position.

Update (June 28): Between the shares and the LEAP calls, $BABA is ~5% of my portfolio.

Today I realized that I do treat the stock market (at least partly) as a game. I realized this thanks to my investment in $BABA, because what matters to me here is the quality of the decision, not the outcome. This is a case where we all have access to the same information. And I am convinced that this bet is a very profitable one, despite the fact that I’m in general much more attracted to small caps.

For this to be a bad bet, first C. Munger would have to be wrong. Possible? Yes. Unlikely. Very much. But then, M. Pabrai would have to be either wrong or lazy. Now we’re getting in the realm of infinitesimal odds. And then, there’s my perception of the american market’s perception of China and the CCP. I think they think that the Chinese government could lose their marbles and destroy the value of Alibaba in the blink of an eye, out of principle or anger. I think that’s BS. The CCP has shown their teeth and the market believed them, but I’m calling the bluff. China needs Alibaba as much as Alibaba needs China. As a shareholder, I believe the CCP is my ally, not my ennemy. They are a moat around my investment.

I’m happy to see investing partly as a game, it’s because I know that the best out there do too. I want to make optimal decisions and beautiful moves for my own inner score card.

Some quotes from Charlie Munger on China and investing (2018):

“I anticipate the China securities market and investing practices will get better and better for a long, long time.”

“You buy the best companies in China or the best companies in the United States, I think at the current prices the best companies in China are selling cheaper”.

Other perspectives:

Disqus comments are disabled.